Question

2. Art Grunnion wants to start a company which would build open-ocean speedboats of the highest possible quality. He would put $1 million into

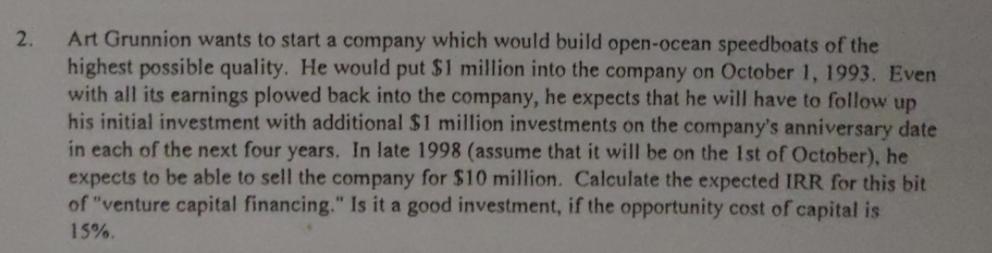

2. Art Grunnion wants to start a company which would build open-ocean speedboats of the highest possible quality. He would put $1 million into the company on October 1, 1993. Even with all its earnings plowed back into the company, he expects that he will have to follow up his initial investment with additional $1 million investments on the company's anniversary date in each of the next four years. In late 1998 (assume that it will be on the 1st of October), he expects to be able to sell the company for $10 million. Calculate the expected IRR for this bit of "venture capital financing." Is it a good investment, if the opportunity cost of capital is 15%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Internal Rate of Return IRR for this venture capital investment we need to find the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Concepts of Database Management

Authors: Philip J. Pratt, Joseph J. Adamski

7th edition

978-1111825911, 1111825912, 978-1133684374, 1133684378, 978-111182591

Students also viewed these Databases questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App