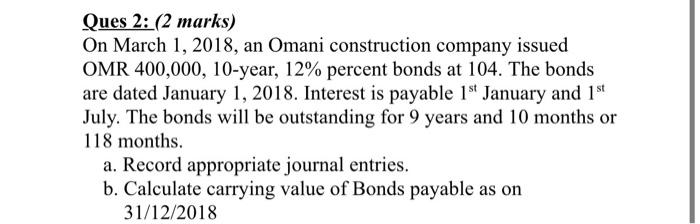

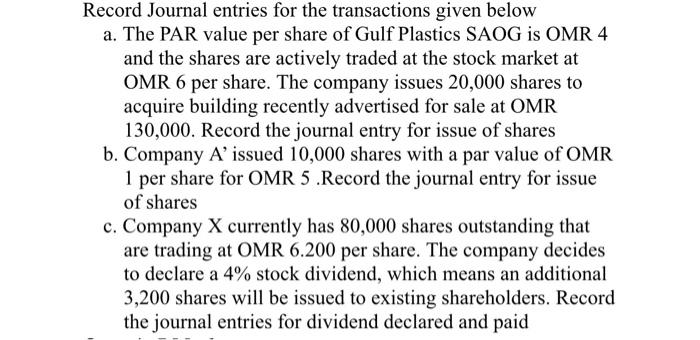

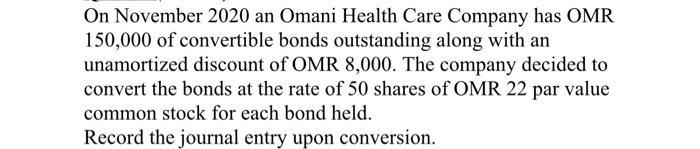

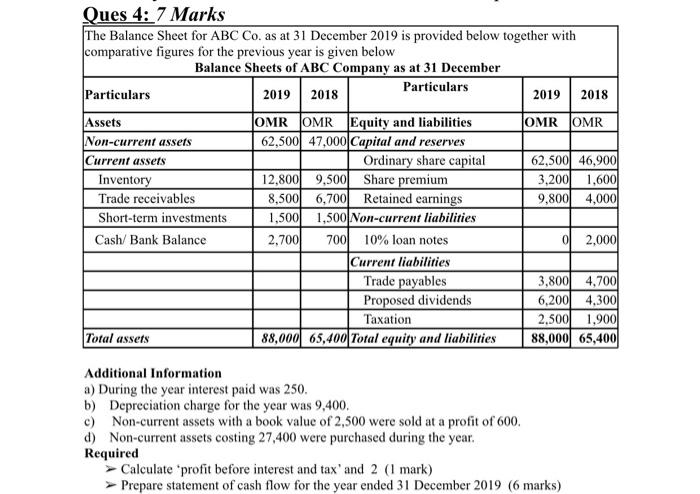

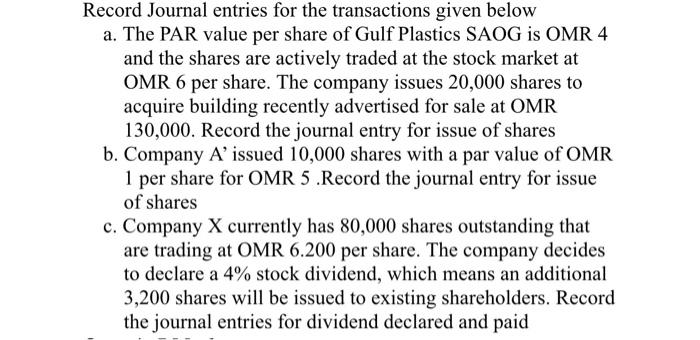

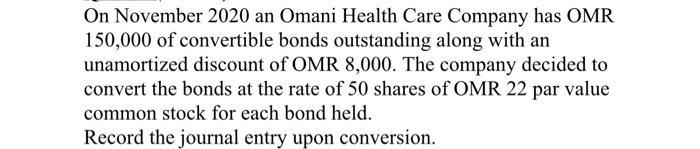

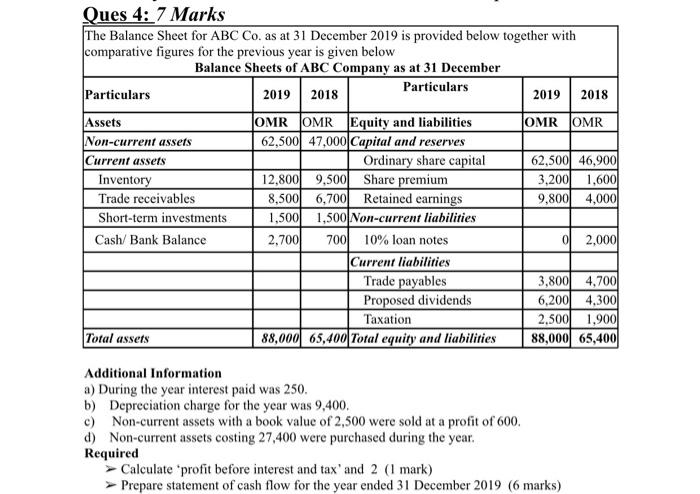

Ques 2: (2 marks) On March 1, 2018, an Omani construction company issued OMR 400,000, 10-year, 12% percent bonds at 104. The bonds are dated January 1, 2018. Interest is payable 1st January and 1st July. The bonds will be outstanding for 9 years and 10 months or 118 months. a. Record appropriate journal entries. b. Calculate carrying value of Bonds payable as on 31/12/2018 Record Journal entries for the transactions given below a. The PAR value per share of Gulf Plastics SAOG is OMR 4 and the shares are actively traded at the stock market at OMR 6 per share. The company issues 20,000 shares to acquire building recently advertised for sale at OMR 130,000. Record the journal entry for issue of shares b. Company A'issued 10,000 shares with a par value of OMR 1 per share for OMR 5 .Record the journal entry for issue of shares c. Company X currently has 80,000 shares outstanding that are trading at OMR 6.200 per share. The company decides to declare a 4% stock dividend, which means an additional 3,200 shares will be issued to existing shareholders. Record the journal entries for dividend declared and paid On November 2020 an Omani Health Care Company has OMR 150,000 of convertible bonds outstanding along with an unamortized discount of OMR 8,000. The company decided to convert the bonds at the rate of 50 shares of OMR 22 par value common stock for each bond held. Record the journal entry upon conversion. Ques 4: 7 Marks The Balance Sheet for ABC Co. as at 31 December 2019 is provided below together with comparative figures for the previous year is given below Balance Sheets of ABC Company as at 31 December Particulars 2019 2018 Particulars 2019 2018 Assets OMR OMR Equity and liabilities OMR OMR Non-current assets 62,500 47.000 Capital and reserves Current assets Ordinary share capital 62,500 46,900 Inventory 12,800 9,500 Share premium 3,200 1,600 Trade receivables 8,500 6,700 Retained earnings 9,800 4,000 Short-term investments 1,500 1,500 Non-current liabilities Cash/ Bank Balance 2,700 7001 10% loan notes 2,000 Current liabilities Trade payables 3,800 4,7001 Proposed dividends 6,200 4.300 Taxation 2.500 1,900 Total assets 88,000 65,400 Total equity and liabilities 88,000 65,400 0 Additional Information a) During the year interest paid was 250. b) Depreciation charge for the year was 9,400. c) Non-current assets with a book value of 2,500 were sold at a profit of 600. d) Non-current assets costing 27,400 were purchased during the year. Required Calculate profit before interest and tax and 2 (1 mark) Prepare statement of cash flow for the year ended 31 December 2019 (6 marks)