Answered step by step

Verified Expert Solution

Question

1 Approved Answer

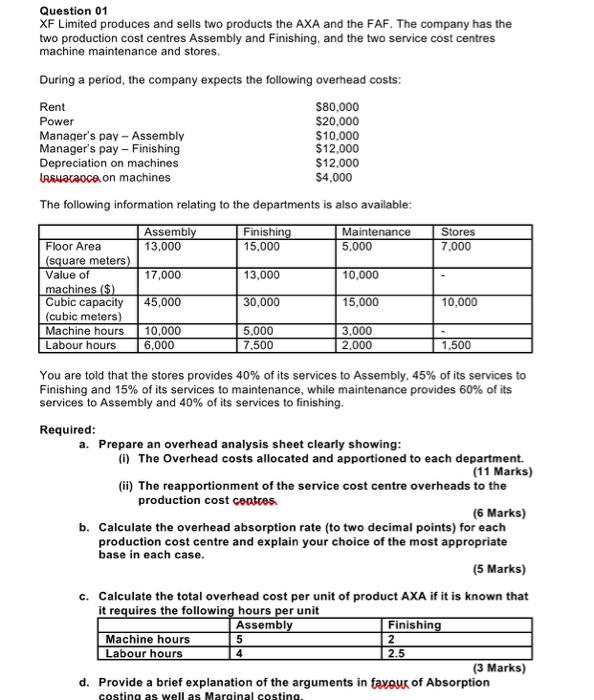

Question 01 XF Limited produces and sells two products the AXA and the FAF. The company has the two production cost centres Assembly and

Question 01 XF Limited produces and sells two products the AXA and the FAF. The company has the two production cost centres Assembly and Finishing, and the two service cost centres machine maintenance and stores. During a period, the company expects the following overhead costs: $80,000 Rent Power $20,000 $10,000 Manager's pay - Assembly Manager's pay - Finishing Depreciation on machines $12,000 $12,000 Insuataoce on machines $4,000 The following information relating to the departments is also available: Floor Area (square meters) Value of machines ($) Cubic capacity (cubic meters) Machine hours Labour hours Assembly 13,000 Required: 17,000 45,000 10,000 6,000 Finishing 15,000 13,000 30,000 5,000 7,500 Maintenance 5,000 10,000 15,000 Machine hours Labour hours 3,000 2,000 Stores 7,000 You are told that the stores provides 40% of its services to Assembly, 45% of its services to Finishing and 15% of its services to maintenance, while maintenance provides 60% of its services to Assembly and 40% of its services to finishing. 10,000 5 4 1,500 a. Prepare an overhead analysis sheet clearly showing: (i) The Overhead costs allocated and apportioned to each department. (11 Marks) (ii) The reapportionment of the service cost centre overheads to the production cost centres. (6 Marks) b. Calculate the overhead absorption rate (to two decimal points) for each production cost centre and explain your choice of the most appropriate base in each case. (5 Marks) c. Calculate the total overhead cost per unit of product AXA if it is known that it requires the following hours per unit Assembly Finishing 2 2.5 (3 Marks) d. Provide a brief explanation of the arguments in favour of Absorption costing as well as Marginal costing.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Allocated and apportioned overhead costs Rent 80000 Power 20000 Managers pay Assembly 10000 Managers pay Finishing 12000 Depreciation on machines 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started