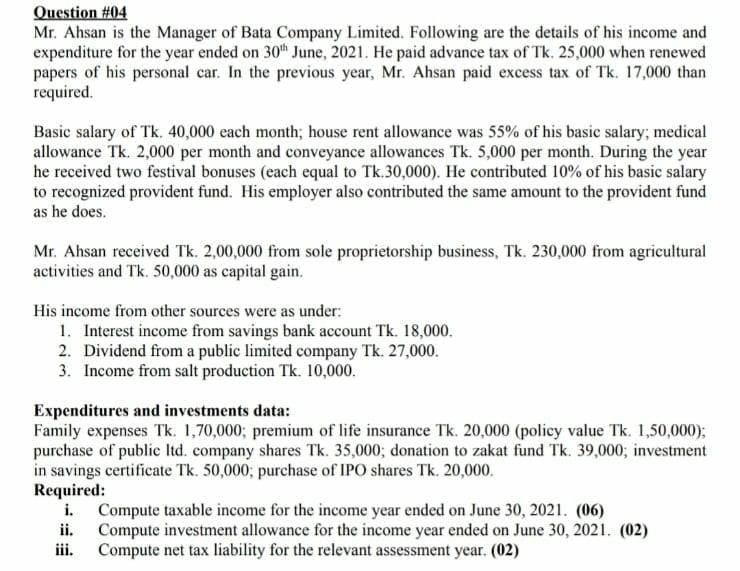

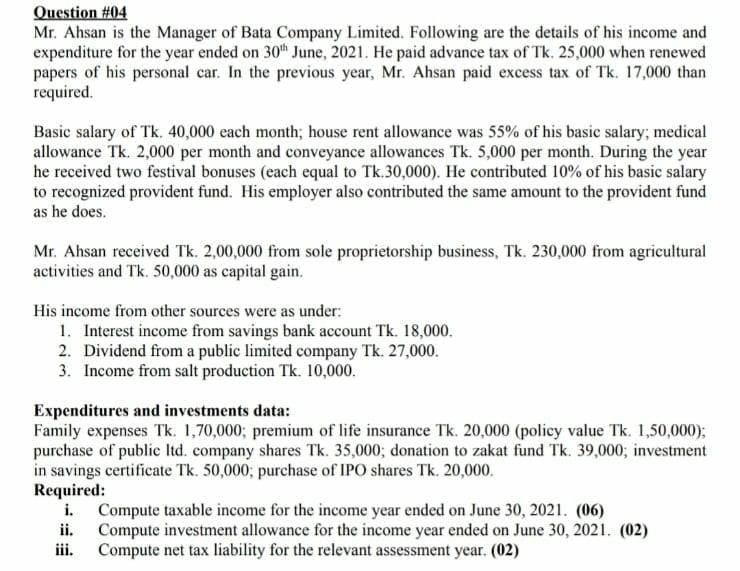

Question #04 Mr. Ahsan is the Manager of Bata Company Limited. Following are the details of his income and expenditure for the year ended on 30th June, 2021. He paid advance tax of Tk 25,000 when renewed papers of his personal car. In the previous year, Mr. Ahsan paid excess tax of Tk. 17,000 than required Basic salary of Tk. 40,000 each month; house rent allowance was 55% of his basic salary, medical allowance Tk. 2,000 per month and conveyance allowances Tk. 5,000 per month. During the year he received two festival bonuses (each equal to Tk. 30,000). He contributed 10% of his basic salary to recognized provident fund. His employer also contributed the same amount to the provident fund as he does. Mr. Ahsan received Tk. 2,00,000 from sole proprietorship business, Tk. 230,000 from agricultural activities and Tk. 50,000 as capital gain. His income from other sources were as under: 1. Interest income from savings bank account Tk. 18,000. 2. Dividend from a public limited company Tk. 27,000. 3. Income from salt production Tk. 10,000. Expenditures and investments data: Family expenses Tk. 1,70,000; premium of life insurance Tk. 20,000 (policy value Tk. 1,50,000); purchase of public Itd. company shares Tk. 35,000; donation to zakat fund Tk. 39,000; investment in savings certificate Tk. 50,000; purchase of IPO shares Tk. 20,000. Required: i. Compute taxable income for the income year ended on June 30, 2021. (06) ii. Compute investment allowance for the income year ended on June 30, 2021. (02) iii. Compute net tax liability for the relevant assessment year. (02) Question #04 Mr. Ahsan is the Manager of Bata Company Limited. Following are the details of his income and expenditure for the year ended on 30th June, 2021. He paid advance tax of Tk 25,000 when renewed papers of his personal car. In the previous year, Mr. Ahsan paid excess tax of Tk. 17,000 than required Basic salary of Tk. 40,000 each month; house rent allowance was 55% of his basic salary, medical allowance Tk. 2,000 per month and conveyance allowances Tk. 5,000 per month. During the year he received two festival bonuses (each equal to Tk. 30,000). He contributed 10% of his basic salary to recognized provident fund. His employer also contributed the same amount to the provident fund as he does. Mr. Ahsan received Tk. 2,00,000 from sole proprietorship business, Tk. 230,000 from agricultural activities and Tk. 50,000 as capital gain. His income from other sources were as under: 1. Interest income from savings bank account Tk. 18,000. 2. Dividend from a public limited company Tk. 27,000. 3. Income from salt production Tk. 10,000. Expenditures and investments data: Family expenses Tk. 1,70,000; premium of life insurance Tk. 20,000 (policy value Tk. 1,50,000); purchase of public Itd. company shares Tk. 35,000; donation to zakat fund Tk. 39,000; investment in savings certificate Tk. 50,000; purchase of IPO shares Tk. 20,000. Required: i. Compute taxable income for the income year ended on June 30, 2021. (06) ii. Compute investment allowance for the income year ended on June 30, 2021. (02) iii. Compute net tax liability for the relevant assessment year. (02)