Question

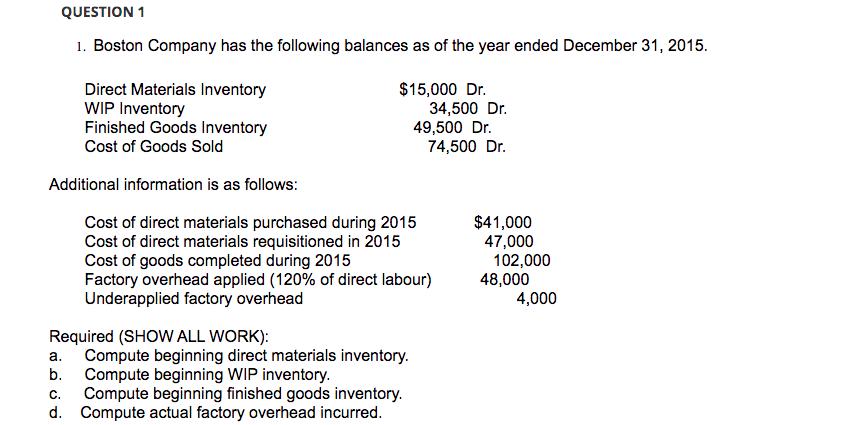

QUESTION 1 1. Boston Company has the following balances as of the year ended December 31, 2015. Direct Materials Inventory WIP Inventory Finished Goods

QUESTION 1 1. Boston Company has the following balances as of the year ended December 31, 2015. Direct Materials Inventory WIP Inventory Finished Goods Inventory Cost of Goods Sold Additional information is as follows: $15,000 Dr. 34,500 Dr. 49,500 Dr. Cost of direct materials purchased during 2015 Cost of direct materials requisitioned in 2015 Cost of goods completed during 2015 Factory overhead applied (120% of direct labour) Underapplied factory overhead Required (SHOW ALL WORK): a. Compute beginning direct materials inventory. b. Compute beginning WIP inventory. 74,500 Dr. C. Compute beginning finished goods inventory. d. Compute actual factory overhead incurred. $41,000 47,000 102,000 48,000 4,000

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Beginning direct material inventory 470...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App