Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (1) Britech Inc., a UK-based corporation, is in the food and biotechnology businesses, with UK and Eastern European operations (composed of Poland

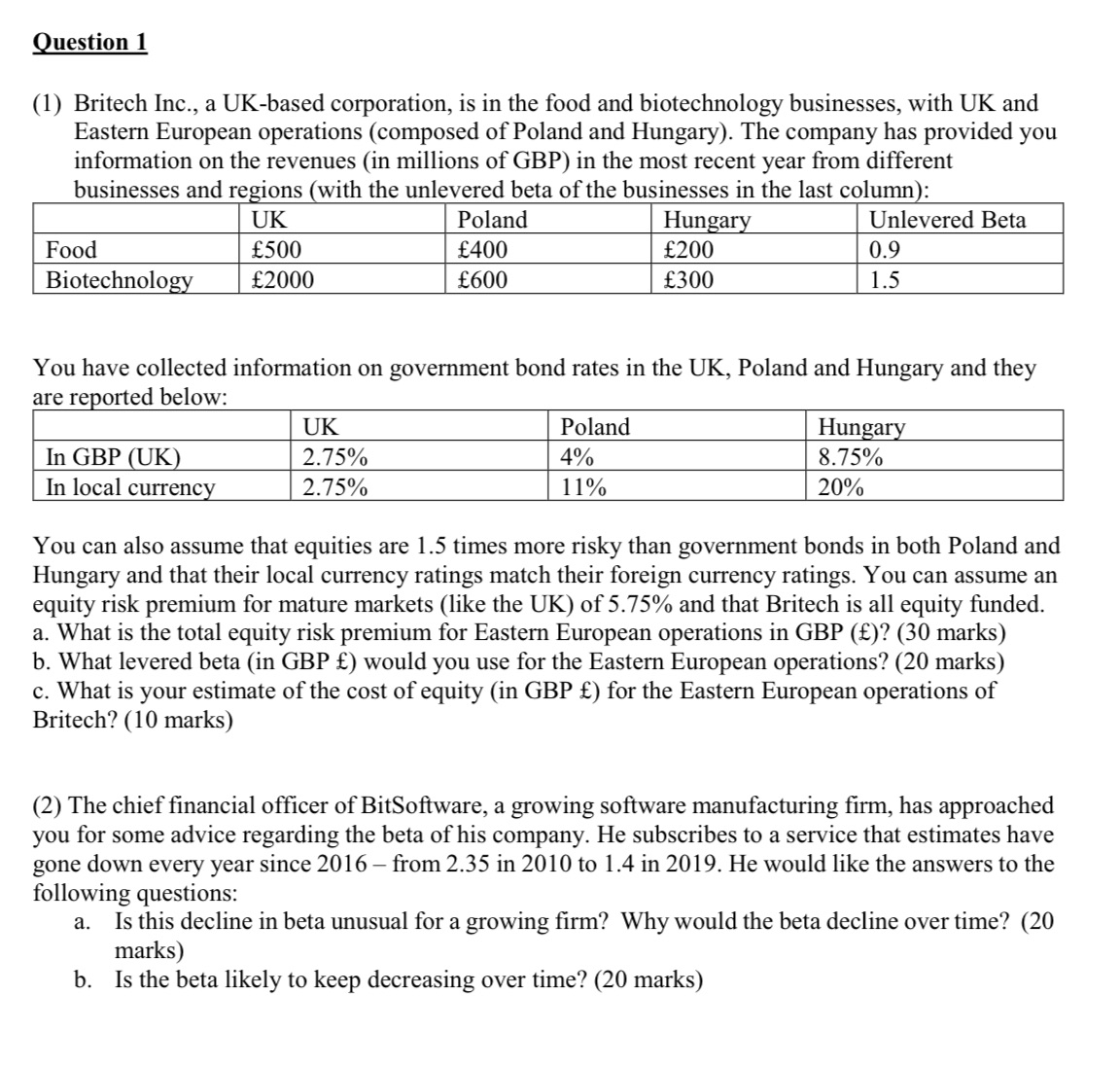

Question 1 (1) Britech Inc., a UK-based corporation, is in the food and biotechnology businesses, with UK and Eastern European operations (composed of Poland and Hungary). The company has provided you information on the revenues (in millions of GBP) in the most recent year from different businesses and regions (with the unlevered beta of the businesses in the last column): UK Unlevered Beta 500 2000 Food Biotechnology In GBP (UK) In local currency Poland 400 600 UK 2.75% 2.75% You have collected information on government bond rates in the UK, Poland and Hungary and they are reported below: Hungary 200 300 Poland 4% 11% 0.9 1.5 Hungary 8.75% 20% You can also assume that equities are 1.5 times more risky than government bonds in both Poland and Hungary and that their local currency ratings match their foreign currency ratings. You can assume an equity risk premium for mature markets (like the UK) of 5.75% and that Britech is all equity funded. a. What is the total equity risk premium for Eastern European operations in GBP ()? (30 marks) b. What levered beta (in GBP ) would you use for the Eastern European operations? (20 marks) c. What is your estimate of the cost of equity (in GBP ) for the Eastern European operations of Britech? (10 marks) (2) The chief financial officer of BitSoftware, a growing software manufacturing firm, has approached you for some advice regarding the beta of his company. He subscribes to a service that estimates have gone down every year since 2016 - from 2.35 in 2010 to 1.4 in 2019. He would like the answers to the following questions: a. Is this decline in beta unusual for a growing firm? Why would the beta decline over time? (20 marks) b. Is the beta likely to keep decreasing over time? (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The decline in beta for a growing firm is not unusual The beta of a company measures its systematic risk which is the risk that cannot be diversifie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started