Answered step by step

Verified Expert Solution

Question

1 Approved Answer

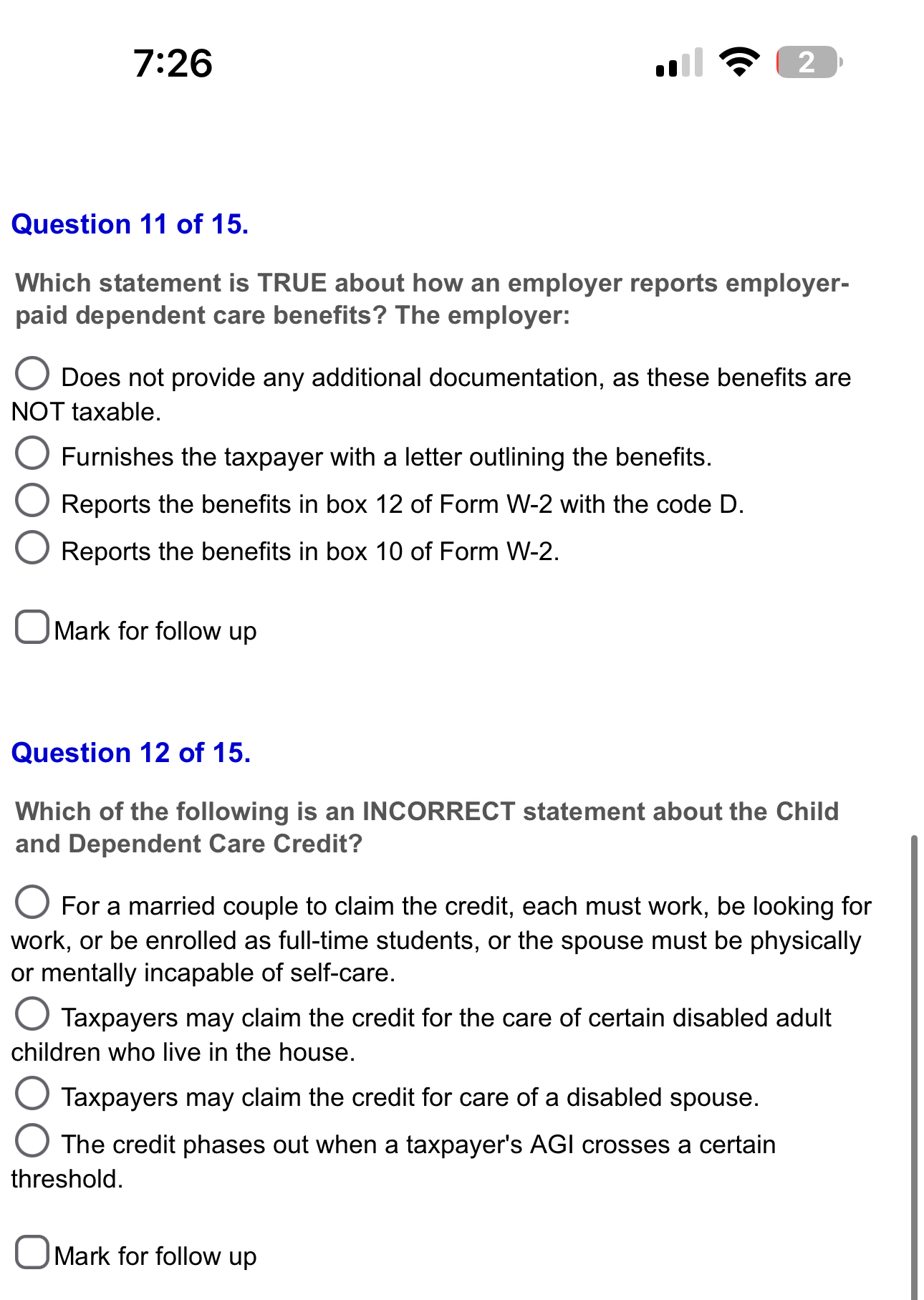

Question 1 1 of 1 5 . Which statement is TRUE about how an employer reports employer - paid dependent care benefits? The employer: Does

Question of

Which statement is TRUE about how an employer reports employer

paid dependent care benefits? The employer:

Does not provide any additional documentation, as these benefits are

NOT taxable.

Furnishes the taxpayer with a letter outlining the benefits.

Reports the benefits in box of Form W with the code D

Reports the benefits in box of Form W

Mark for follow up

Question of

Which of the following is an INCORRECT statement about the Child

and Dependent Care Credit?

For a married couple to claim the credit, each must work, be looking for

work, or be enrolled as fulltime students, or the spouse must be physically

or mentally incapable of selfcare.

Taxpayers may claim the credit for the care of certain disabled adult

children who live in the house.

Taxpayers may claim the credit for care of a disabled spouse.

The credit phases out when a taxpayer's AGI crosses a certain

threshold.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started