Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 1 p t s A 5 - year bond with 1 0 % coupon rate and $ 1 0 0 0 face value

Question

year bond with coupon rate and $ face value selling for $ Rounded the nearest dollar. Calculate the yield maturity the bond assuming annual interest payments.

Group answer choices

None the above

Flag question: Question

Question

year bond with coupon rate and $ Question

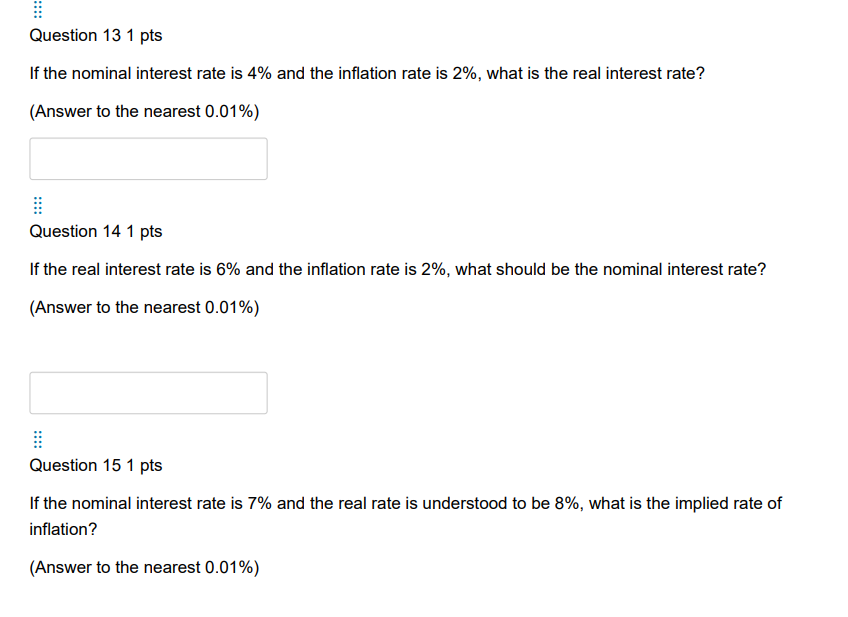

the nominal interest rate and the inflation rate and the inflation rate and the real rate understood Question

year semiannual couponpaying bond has a face value $ a coupon rate and trades

a price $ What can said about the bond? Choose the most complete answer from the

options below.

Bond trades a premium and has a yieldmaturity below

Bond trades a discount

Bond trades a premium.

Bond has a yieldmaturity below

Bond has a yieldmaturity above

Bond trades a discount and has a yieldmaturity above

Bond trades a premium and has a yieldmaturity above

Question

year semiannual coupon bond trades a price $ has a coupon rate and a face

value $ What the yieldmaturity this bond?

None the others Question

Given a series semiannual couponpaying bonds, all having a coupon rate and a face value

$

When the yieldmaturity increases from which one the following bonds will exhibit the

largest decrease price?

Bond with years maturity

Bond with years maturity

Bond with years maturity

Bond with years maturity

Question

year annual coupon bond trades a price $ has a coupon rate and a face value

$ What the yieldmaturity this bond?

None the others What the yieldmaturity year zerocoupon bond with $ face value that sells for

a market price $ $

and a yieldmaturity $ a face value

$ and a yieldmaturity $ a face value

$ and a yieldmaturity $ Question

Which the following statements about the relationship between interest rates and bond prices true?

coupon rate and face value $ the yield maturity the bond

calculate the price the bond assuming that the bond makes semiannual coupon interest

payments.

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started