Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 1 Perez & Perez ( P&P ) , based in a country currently without any taxes, has an annual operating income ( EBIT

Question

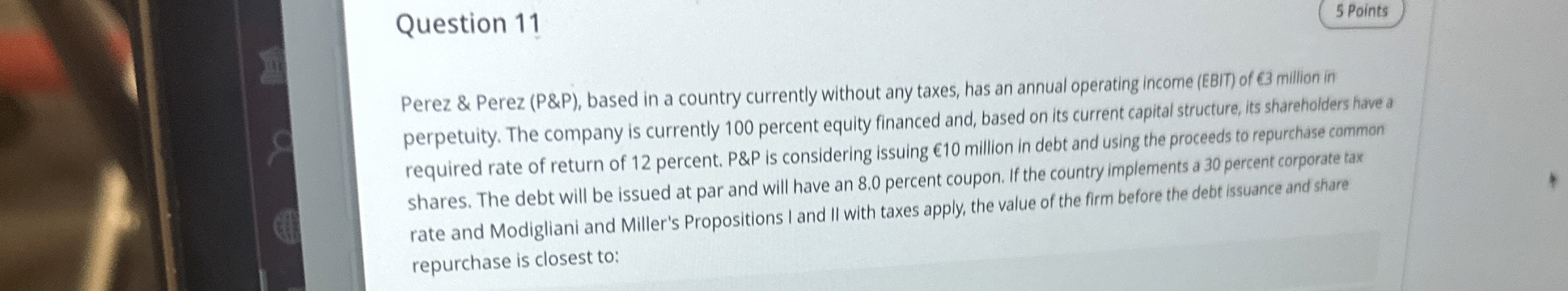

Perez & Perez P&P based in a country currently without any taxes, has an annual operating income EBIT of million in

perpetuity. The company is currently percent equity financed and, based on its current capital structure, its shareholders have a

required rate of return of percent. & is considering issuing million in debt and using the proceeds to repurchase common

shares. The debt will be issued at par and will have an percent coupon. If the country implements a percent corporate tax

rate and Modigliani and Miller's Propositions I and II with taxes apply, the value of the firm before the debt issuance and share

repurchase is closest to:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started