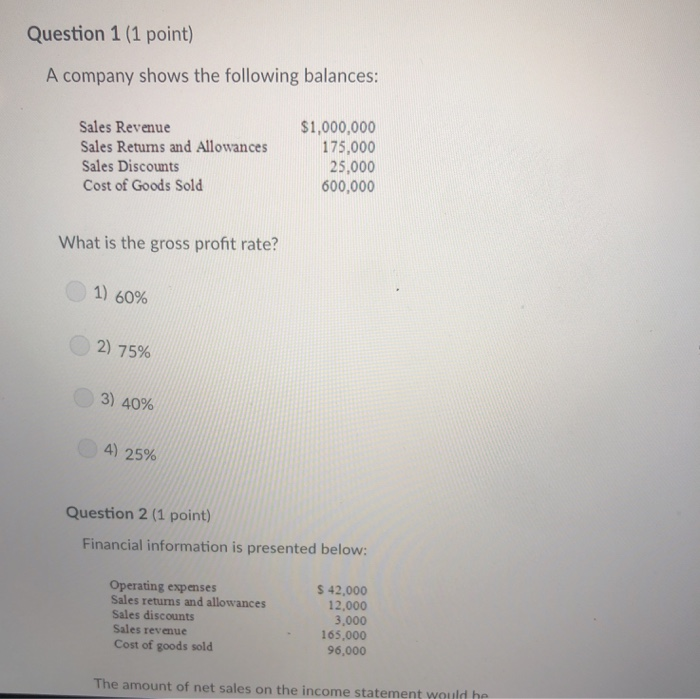

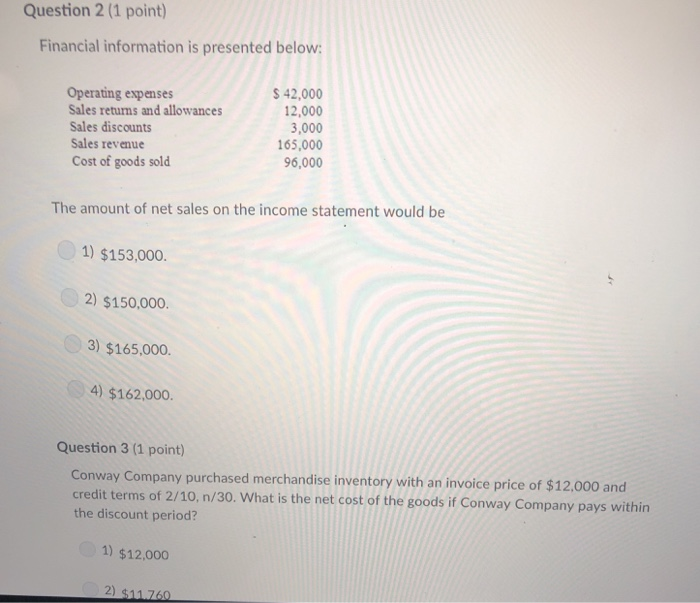

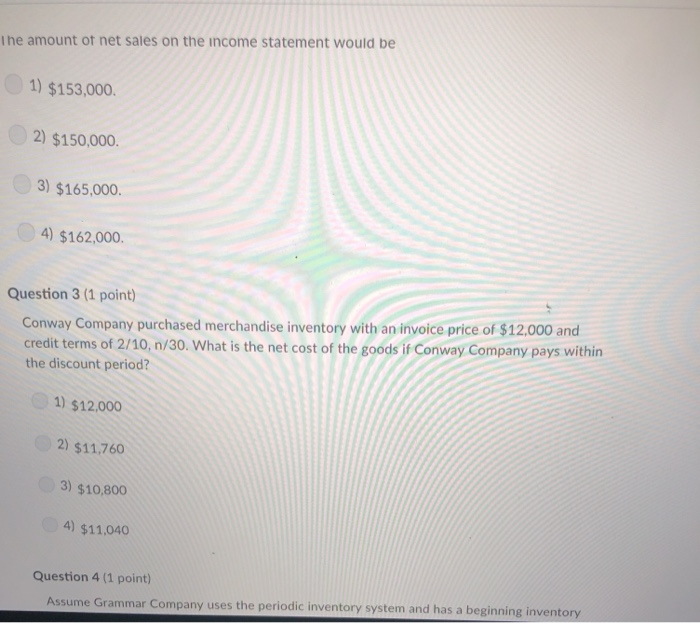

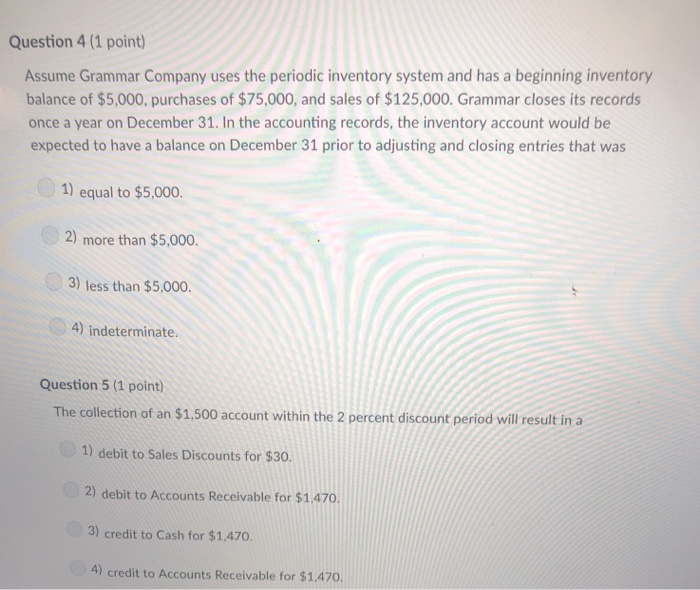

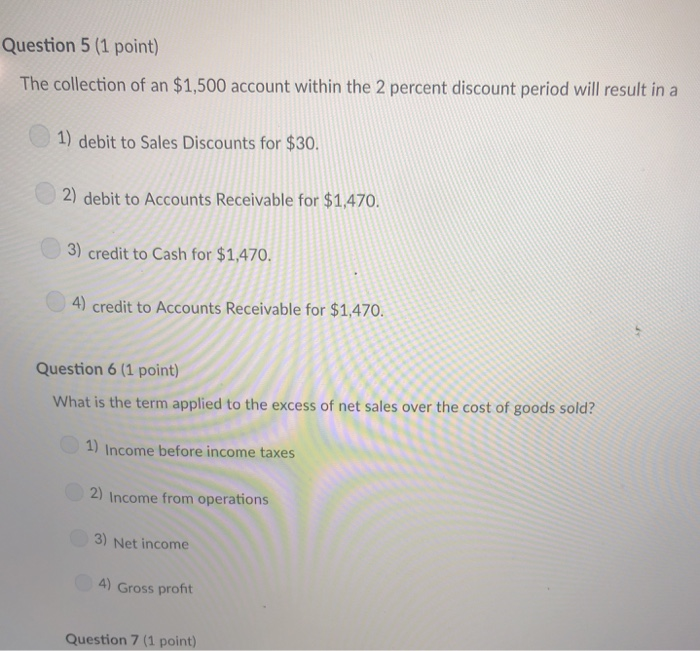

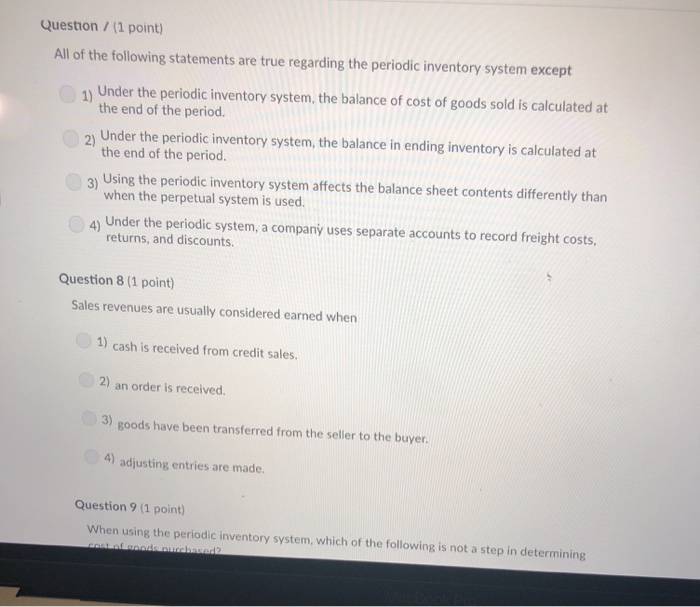

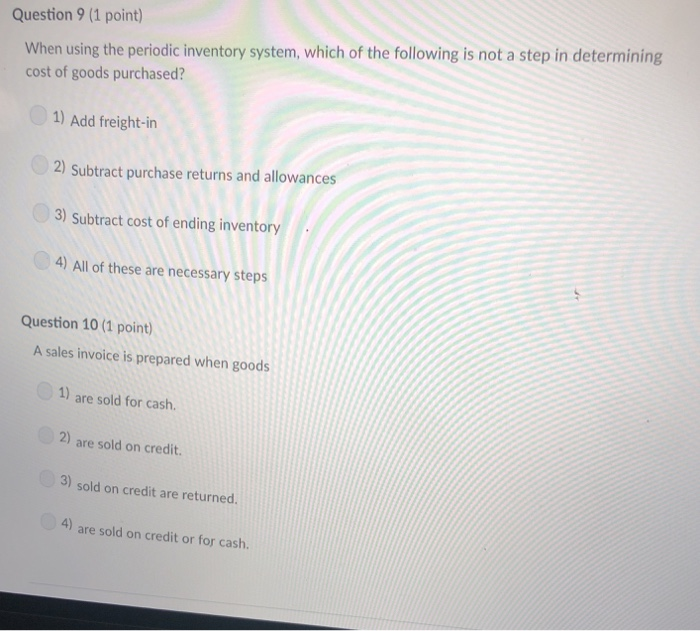

Question 1 (1 point) A company shows the following balances: Sales Revenue Sales Returms and Allowances Sales Discounts Cost of Goods Sold $1,000,000 175,000 25,000 600,000 What is the gross profit rate? 1) 60% 2) 75% 3) 40% 4) 25% Question 2 (1 point) Financial information is presented below: Operating expenses Sales returns and allowances Sales discounts Sales revenue Cost of goods sold s 42,000 12,000 3,000 165,000 96,000 The amount of net sales on the income statement would h Question 2 (1 point) Financial information is presented below Operating expenses Sales returms and allowances Sales discounts Sales revenue Cost of goods sold S 42,000 12,000 3,000 65,000 96,000 The amount of net sales on the income statement would be 1) $153,000. 2) $150,000. 3) $165,000. 4) $162,000 Question 3 (1 point) Conway Company purchased merchandise inventory with an invoice price of $12,000 and credit terms of 2/10, n/30. What is the net cost of the goods if Conway Company pays within the discount period? 1) $12,000 I he amount ot net sales on the income statement would be 1) $153,000. 2) $150,000. 3) $165,000. 4) $162,000. Question 3 (1 point) Conway Company purchased merchandise inventory with an invoice price of $12.000 and credit terms of 2/10, n/30. what is the net cost of the goods if Conway Company pays within the discount period? 1) $12,000 2) $11,760 3) $10,800 4) $11,040 Question 4 (1 point) Assume Grammar Com pany uses the periodic inventory system and has a beginning inventory Question 4 (1 point) Assume Grammar Company uses the periodic inventory system and has a beginning inventory balance of $5,000, purchases of $75,000, and sales of $125,000. Grammar closes its records once a year on December 31. In the accounting records, the inventory account would be expected to have a balance on December 31 prior to adjusting and closing entries that was 1) equal to $5,000. 2) more than $5,000 3) less than $5,000 4) indeterminate Question 5 (1 point) The collection of an $1,500 account within the 2 percent discount period will result in a 1) debit to Sales Discounts for $30 2) debit to Accounts Receivable for $1.470 3) credit to Cash for $1,470. 4) credit to Accounts Receivable for $1.470. Question 5 (1 point) The collection of an $1,500 account within the 2 percent discount period will result in a 1) debit to Sales Discounts for $30. 2) debit to Accounts Receivable for $1.470. 3) credit to Cash for $1,470. 4) credit to Accounts Receivable for $1,470 Question 6 (1 point) What is the term applied to the excess of net sales over the cost of goods sold? 1) Income before income taxes 2) Income from operations 3) Net income 4) Gross profit Question 7 (1 point) Question /(1 point) All of the following statements are true regarding the periodic inventory system except 1) Under the periodic inventory system, the balance of cost of goods sold is calculated at the end of the period. 2) Under the periodic inventory system, the balance in ending inventory is calculated at the end of the period. 3) Using the periodic inventory system affects the balance sheet contents differently than when the perpetual system is used. 4) Under the periodic system, a company uses separate accounts to record freight costs, returns, and discounts. Question 8 (1 point) Sales revenues are usually considered earned when 1) cash is received from credit sales. 2) an order is received. 3) goods have been transferred from the seller to the buyer. 4) adjusting entries are made Question 9 (1 point) When using the periodic inventory system, which of the following is not a step in determining Question 9 (1 point) When using the periodic inventory system, which of the following is not a step in determining cost of goods purchased? 1) Add freight-in 2) Subtract purchase returns and allowances 3) Subtract cost of ending inventory 4) All of these are necessary steps Question 10 (1 point) A sales invoice is prepared when goods 1) are sold for cash. 2) are sold on credit 3) sold on credit are returned. 4) are sold on credit or for cash