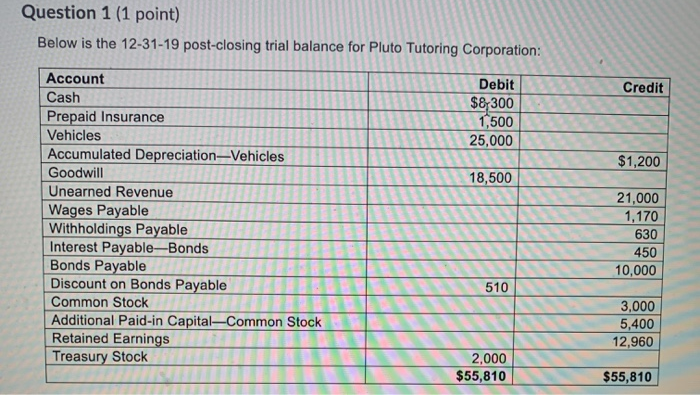

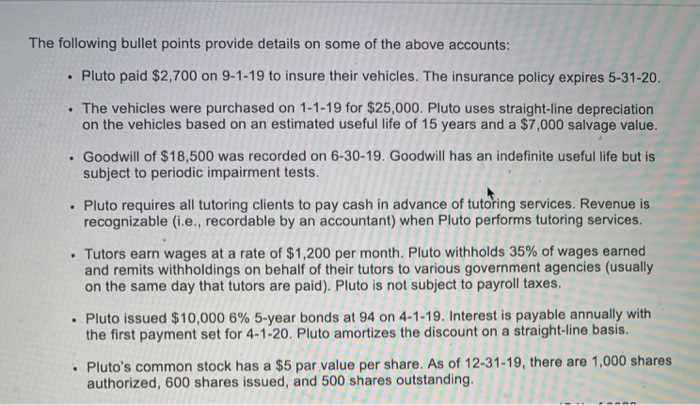

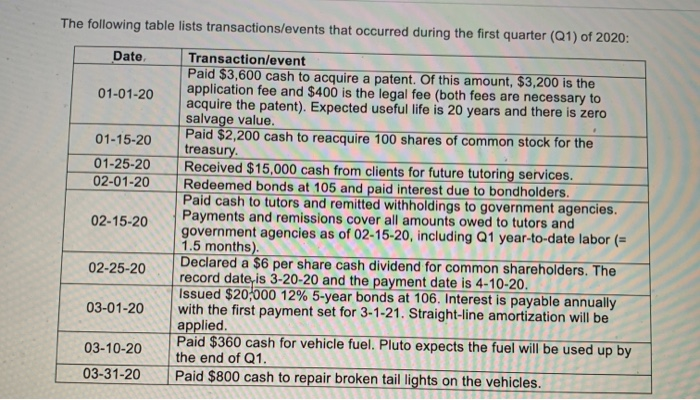

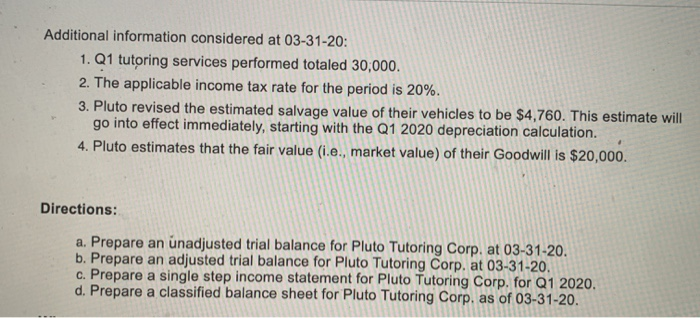

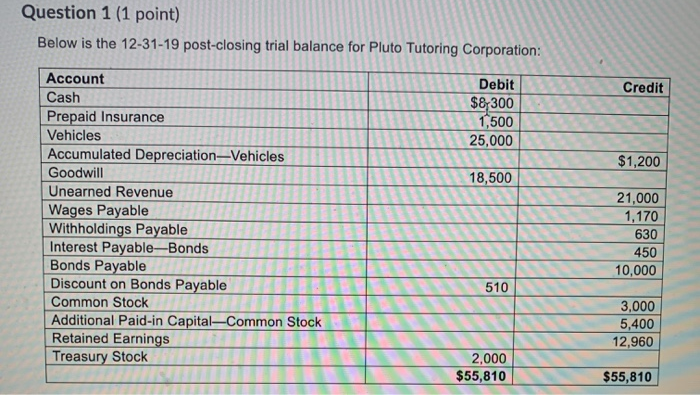

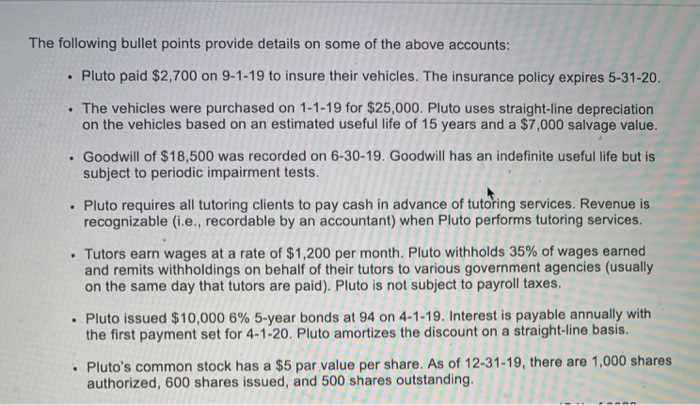

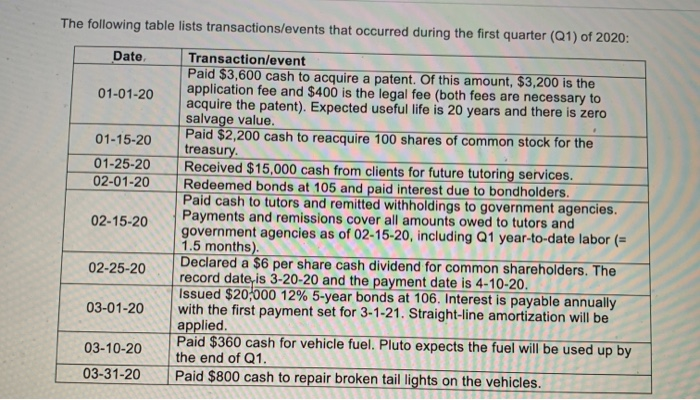

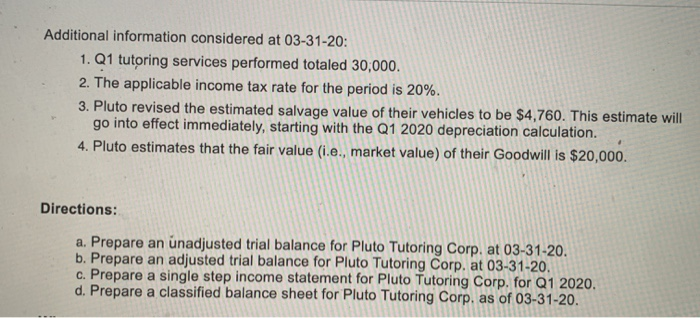

Question 1 (1 point) Below is the 12-31-19 post-closing trial balance for Pluto Tutoring Corporation: Credit * Debit $8,300 1,500 25,000 / $1,200 18,500 1 / / Account Cash Prepaid Insurance Vehicles Accumulated Depreciation-Vehic Goodwill Unearned Revenue Wages Payable Withholdings Payable Interest Payable-Bonds Bonds Payable Discount on Bonds Payable Common Stock Additional Paid-in CapitalCommon Stock Retained Earnings Treasury Stock / / 21,000 1,170 630 450 10,000 / / / / 510 1 3 ,000 5,400 12,960 2,000 $55,810 $55,810 The following bullet points provide details on some of the above accounts: Pluto paid $2,700 on 9-1-19 to insure their vehicles. The insurance policy expires 5-31-20. The vehicles were purchased on 1-1-19 for $25,000. Pluto uses straight-line depreciation on the vehicles based on an estimated useful life of 15 years and a $7,000 salvage value. Goodwill of $18,500 was recorded on 6-30-19. Goodwill has an indefinite useful life but is subject to periodic impairment tests. Pluto requires all tutoring clients to pay cash in advance of tutoring services. Revenue is recognizable (i.e., recordable by an accountant) when Pluto performs tutoring services. Tutors earn wages at a rate of $1,200 per month. Pluto withholds 35% of wages earned and remits withholdings on behalf of their tutors to various government agencies (usually on the same day that tutors are paid). Pluto is not subject to payroll taxes. Pluto issued $10,000 6% 5-year bonds at 94 on 4-1-19. Interest is payable annually with the first payment set for 4-1-20. Pluto amortizes the discount on a straight-line basis. Pluto's common stock has a $5 par value per share. As of 12-31-19, there are 1,000 shares authorized, 600 shares issued, and 500 shares outstanding The following table lists transactions/events that occurred during the first quarter (Q1) of 2020: Date 01.01.20 Transaction/event Paid $3,600 cash to acquire a patent. Of this amount, $3,200 is the application fee and $400 is the legal fee (both fees are necessary to acquire the patent). Expected useful life is 20 years and there is zero salvage value. Paid $2,200 cash to reacquire 100 shares of common stock for the treasury. 01-15-20 01-25-20 02-01-20 02-15-20 02-25-20 Received $15,000 cash from clients for future tutoring services. Redeemed bonds at 105 and paid interest due to bondholders. Paid cash to tutors and remitted withholdings to government agencies. Payments and remissions cover all amounts owed to tutors and government agencies as of 02-15-20, including Q1 year-to-date labor ( 1.5 months). Declared a $6 per share cash dividend for common shareholders. The record date is 3-20-20 and the payment date is 4-10-20. Issued $20,000 12% 5-year bonds at 106. Interest is payable annually with the first payment set for 3-1-21. Straight-line amortization will be applied. Paid $360 cash for vehicle fuel. Pluto expects the fuel will be used up by the end of Q1. Paid $800 cash to repair broken tail lights on the vehicles. 03-01-20 03-10-20 03-31-20 Additional information considered at 03-31-20: 1. Q1 tutoring services performed totaled 30,000. 2. The applicable income tax rate for the period is 20%. 3. Pluto revised the estimated salvage value of their vehicles to be $4,760. This estimate will go into effect immediately, starting with the Q1 2020 depreciation calculation. 4. Pluto estimates that the fair value (i.e., market value) of their Goodwill is $20,000. Directions: a. Prepare an unadjusted trial balance for Pluto Tutoring Corp. at 03-31-20. b. Prepare an adjusted trial balance for Pluto Tutoring Corp. at 03-31-20. c. Prepare a single step income statement for Pluto Tutoring Corp. for Q1 2020. d. Prepare a classified balance sheet for Pluto Tutoring Corp. as of 03-31-20. Question 1 (1 point) Below is the 12-31-19 post-closing trial balance for Pluto Tutoring Corporation: Credit * Debit $8,300 1,500 25,000 / $1,200 18,500 1 / / Account Cash Prepaid Insurance Vehicles Accumulated Depreciation-Vehic Goodwill Unearned Revenue Wages Payable Withholdings Payable Interest Payable-Bonds Bonds Payable Discount on Bonds Payable Common Stock Additional Paid-in CapitalCommon Stock Retained Earnings Treasury Stock / / 21,000 1,170 630 450 10,000 / / / / 510 1 3 ,000 5,400 12,960 2,000 $55,810 $55,810 The following bullet points provide details on some of the above accounts: Pluto paid $2,700 on 9-1-19 to insure their vehicles. The insurance policy expires 5-31-20. The vehicles were purchased on 1-1-19 for $25,000. Pluto uses straight-line depreciation on the vehicles based on an estimated useful life of 15 years and a $7,000 salvage value. Goodwill of $18,500 was recorded on 6-30-19. Goodwill has an indefinite useful life but is subject to periodic impairment tests. Pluto requires all tutoring clients to pay cash in advance of tutoring services. Revenue is recognizable (i.e., recordable by an accountant) when Pluto performs tutoring services. Tutors earn wages at a rate of $1,200 per month. Pluto withholds 35% of wages earned and remits withholdings on behalf of their tutors to various government agencies (usually on the same day that tutors are paid). Pluto is not subject to payroll taxes. Pluto issued $10,000 6% 5-year bonds at 94 on 4-1-19. Interest is payable annually with the first payment set for 4-1-20. Pluto amortizes the discount on a straight-line basis. Pluto's common stock has a $5 par value per share. As of 12-31-19, there are 1,000 shares authorized, 600 shares issued, and 500 shares outstanding The following table lists transactions/events that occurred during the first quarter (Q1) of 2020: Date 01.01.20 Transaction/event Paid $3,600 cash to acquire a patent. Of this amount, $3,200 is the application fee and $400 is the legal fee (both fees are necessary to acquire the patent). Expected useful life is 20 years and there is zero salvage value. Paid $2,200 cash to reacquire 100 shares of common stock for the treasury. 01-15-20 01-25-20 02-01-20 02-15-20 02-25-20 Received $15,000 cash from clients for future tutoring services. Redeemed bonds at 105 and paid interest due to bondholders. Paid cash to tutors and remitted withholdings to government agencies. Payments and remissions cover all amounts owed to tutors and government agencies as of 02-15-20, including Q1 year-to-date labor ( 1.5 months). Declared a $6 per share cash dividend for common shareholders. The record date is 3-20-20 and the payment date is 4-10-20. Issued $20,000 12% 5-year bonds at 106. Interest is payable annually with the first payment set for 3-1-21. Straight-line amortization will be applied. Paid $360 cash for vehicle fuel. Pluto expects the fuel will be used up by the end of Q1. Paid $800 cash to repair broken tail lights on the vehicles. 03-01-20 03-10-20 03-31-20 Additional information considered at 03-31-20: 1. Q1 tutoring services performed totaled 30,000. 2. The applicable income tax rate for the period is 20%. 3. Pluto revised the estimated salvage value of their vehicles to be $4,760. This estimate will go into effect immediately, starting with the Q1 2020 depreciation calculation. 4. Pluto estimates that the fair value (i.e., market value) of their Goodwill is $20,000. Directions: a. Prepare an unadjusted trial balance for Pluto Tutoring Corp. at 03-31-20. b. Prepare an adjusted trial balance for Pluto Tutoring Corp. at 03-31-20. c. Prepare a single step income statement for Pluto Tutoring Corp. for Q1 2020. d. Prepare a classified balance sheet for Pluto Tutoring Corp. as of 03-31-20