Answered step by step

Verified Expert Solution

Question

1 Approved Answer

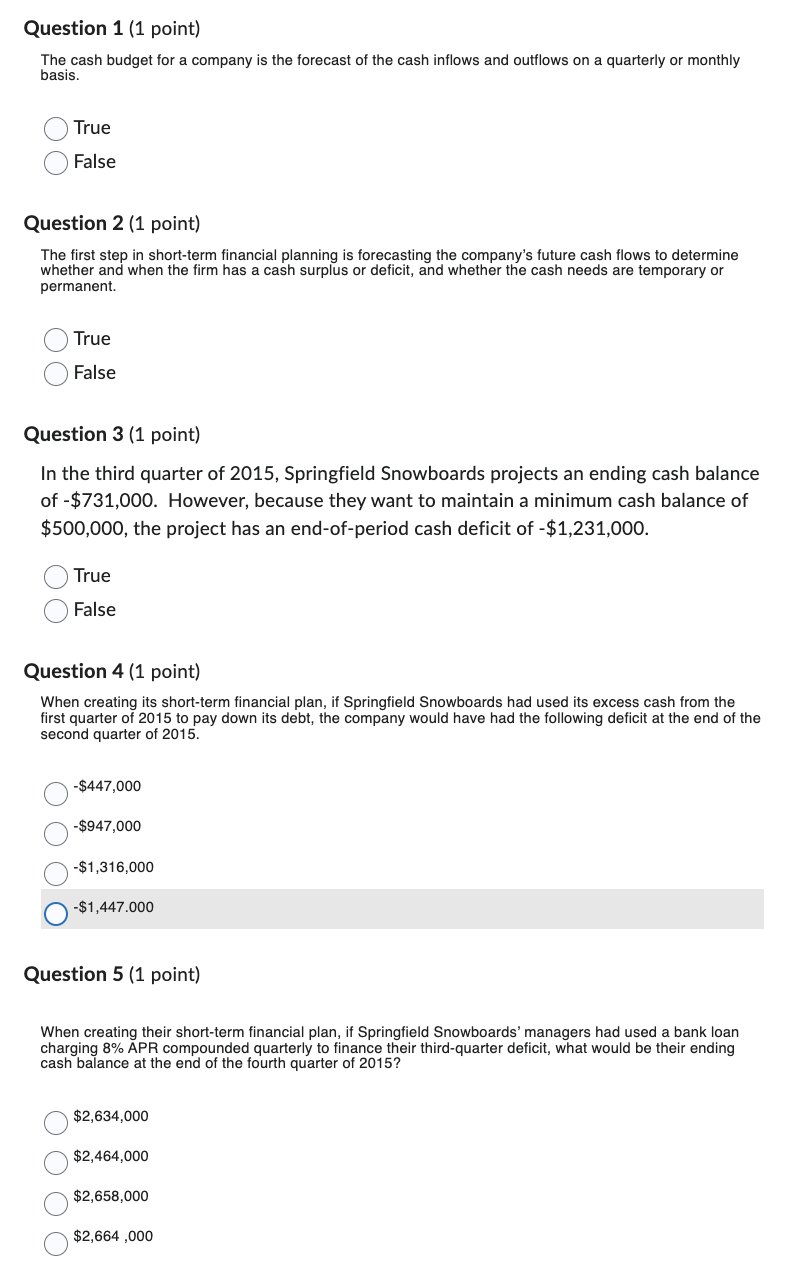

Question 1 ( 1 point ) The cash budget for a company is the forecast of the cash inflows and outflows on a quarterly or

Question point

The cash budget for a company is the forecast of the cash inflows and outflows on a quarterly or monthly

basis.

True

False

Question point

The first step in shortterm financial planning is forecasting the company's future cash flows to determine

whether and when the firm has a cash surplus or deficit, and whether the cash needs are temporary or

permanent.

True

False

Question point

In the third quarter of Springfield Snowboards projects an ending cash balance

of $ However, because they want to maintain a minimum cash balance of

$ the project has an endofperiod cash deficit of $

True

False

Question point

When creating its shortterm financial plan, if Springfield Snowboards had used its excess cash from the

first quarter of to pay down its debt, the company would have had the following deficit at the end of the

second quarter of

$

$

$

$

Question point

When creating their shortterm financial plan, if Springfield Snowboards' managers had used a bank loan

charging APR compounded quarterly to finance their thirdquarter deficit, what would be their ending

cash balance at the end of the fourth quarter of

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started