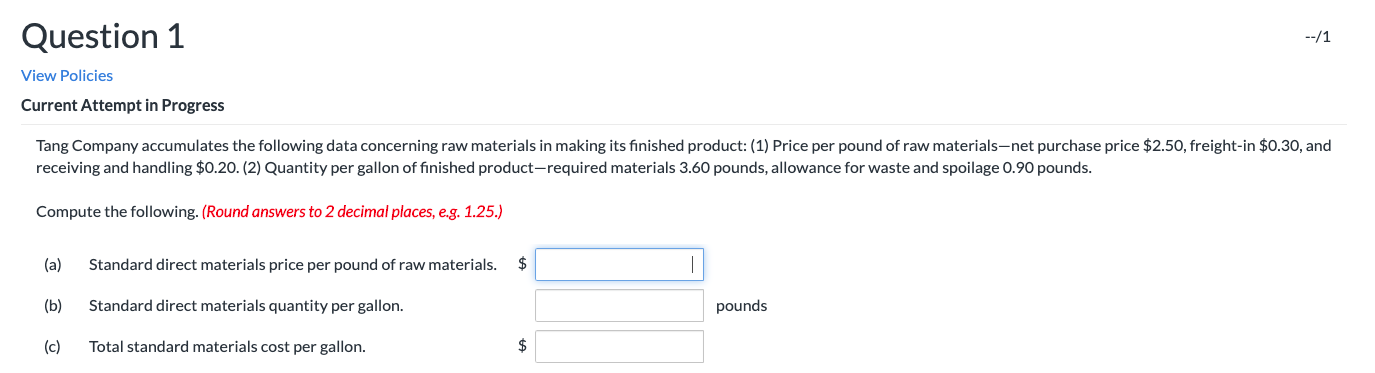

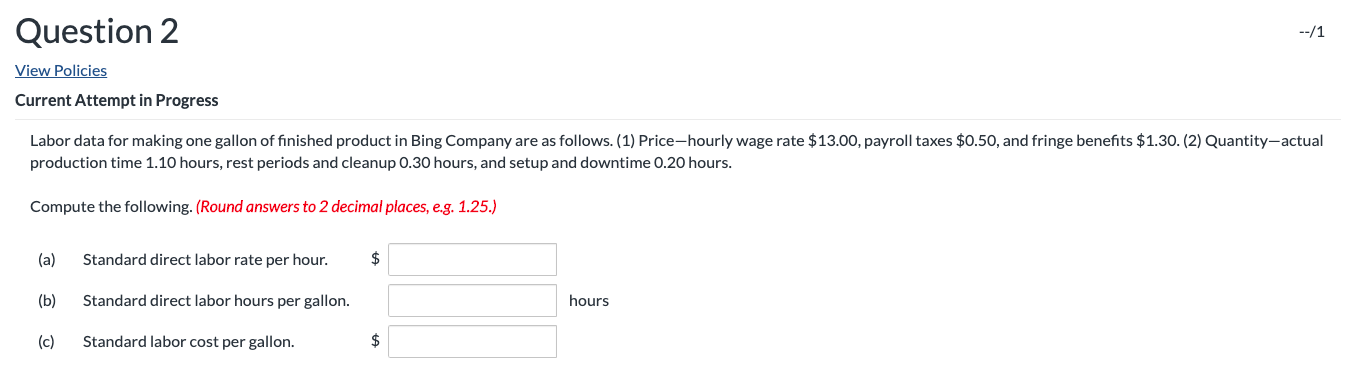

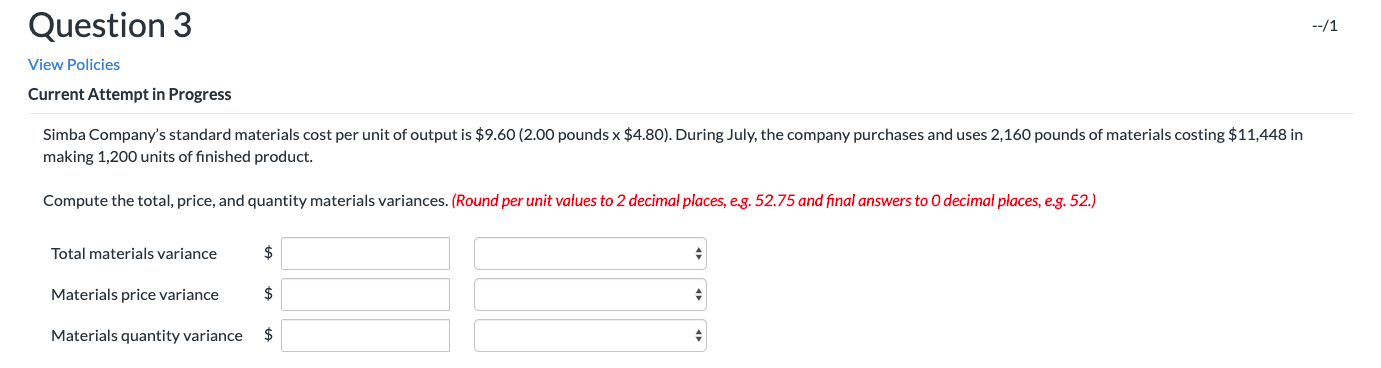

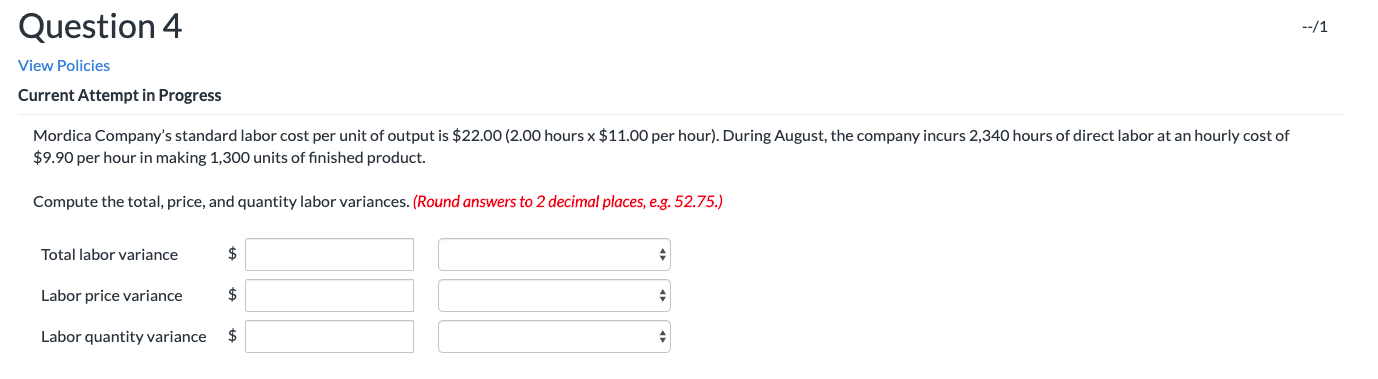

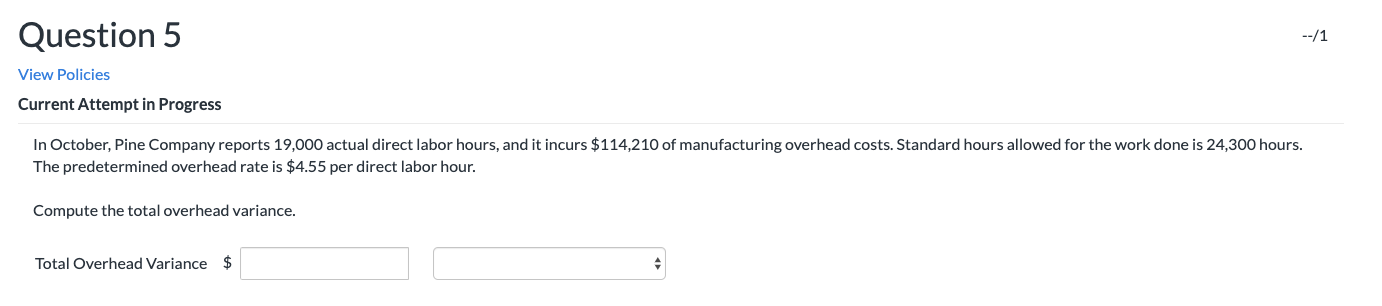

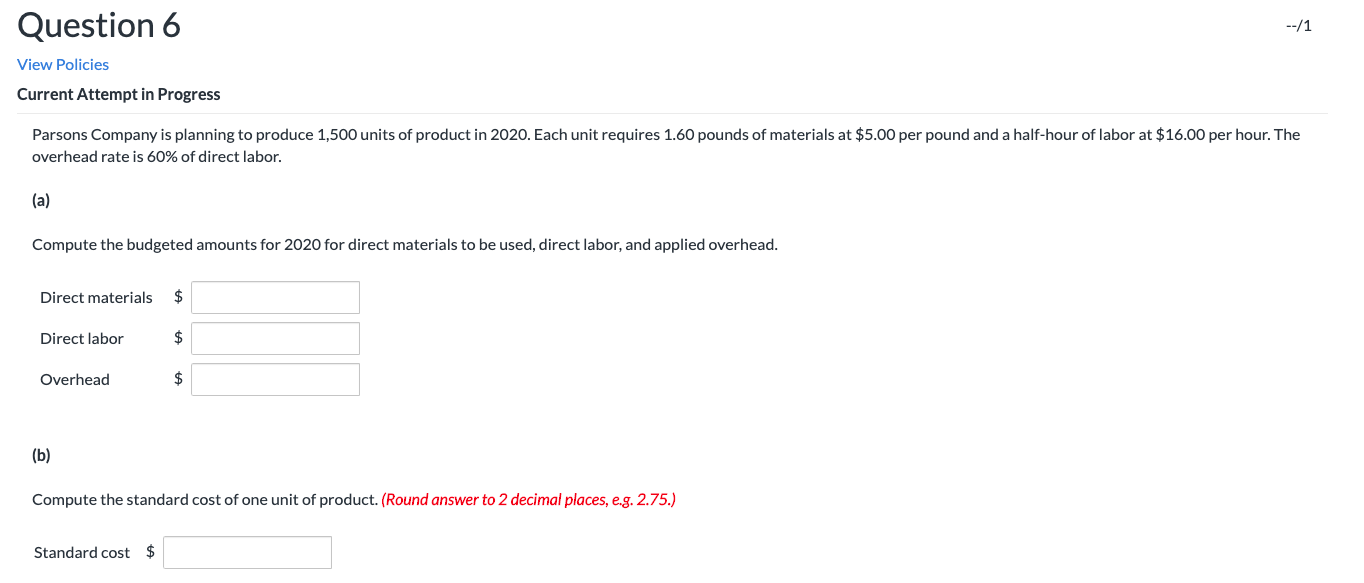

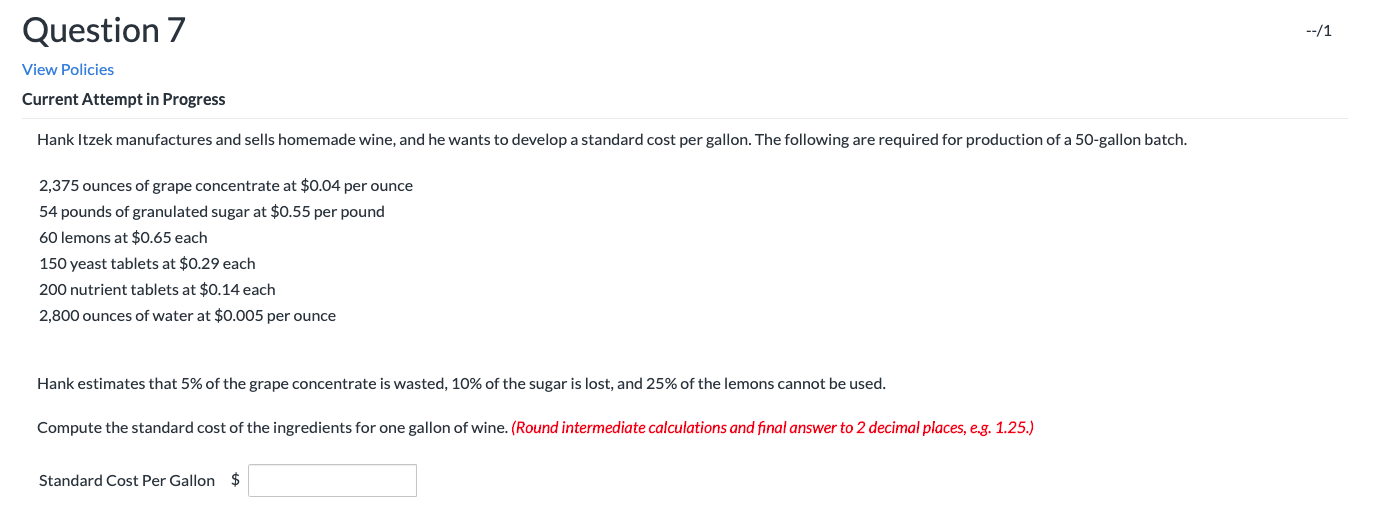

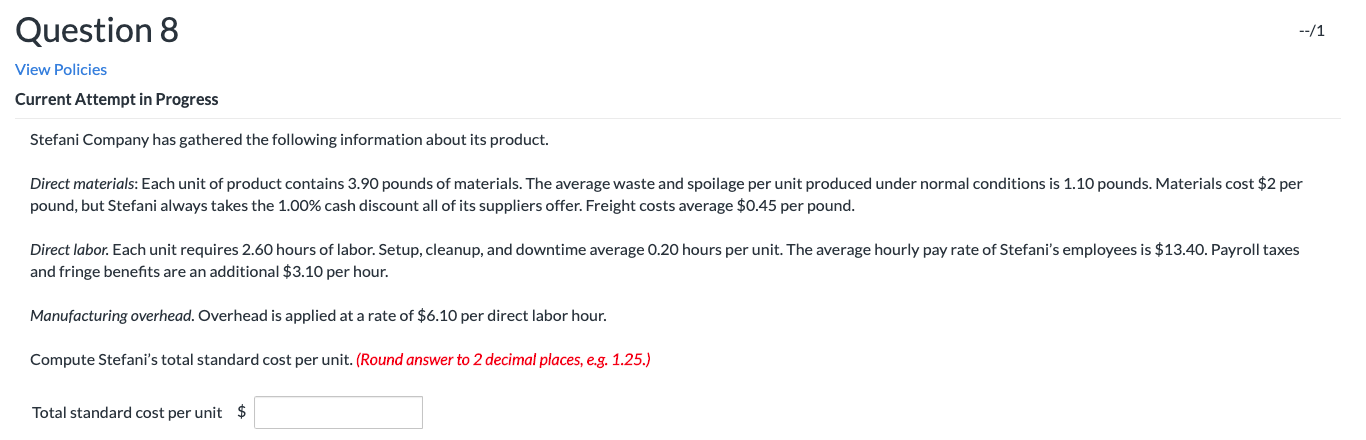

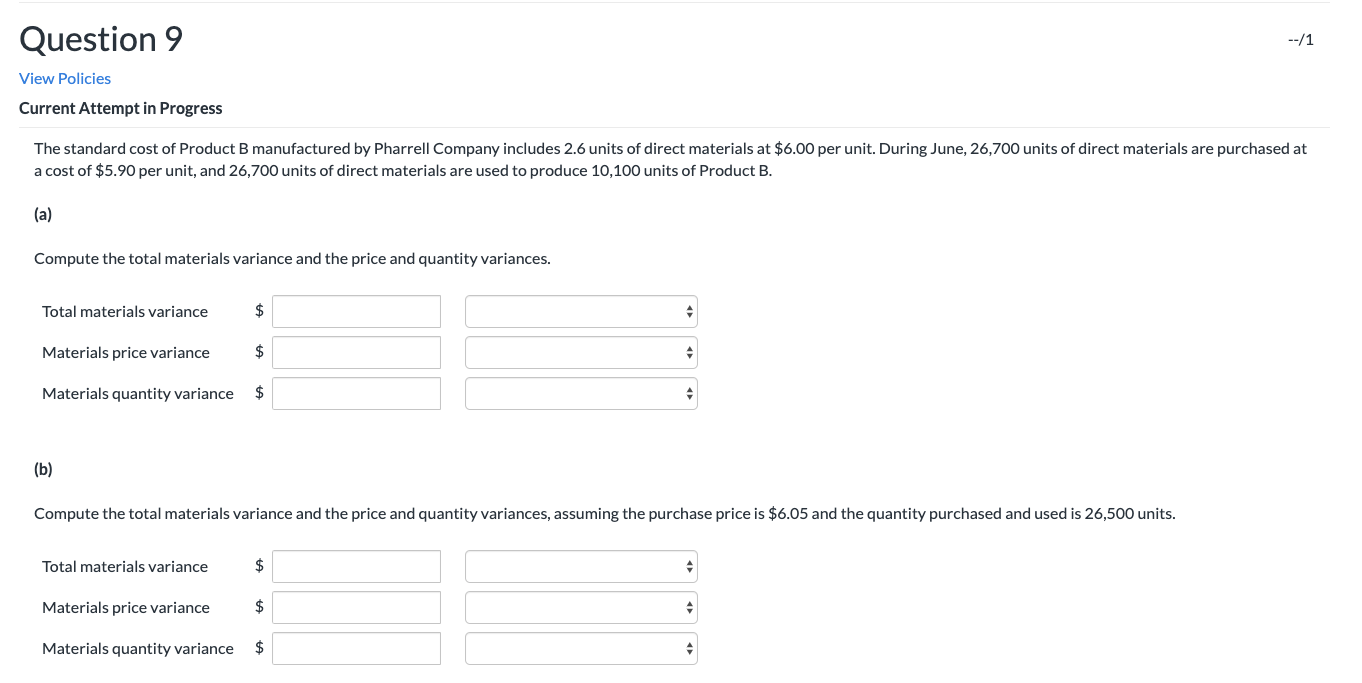

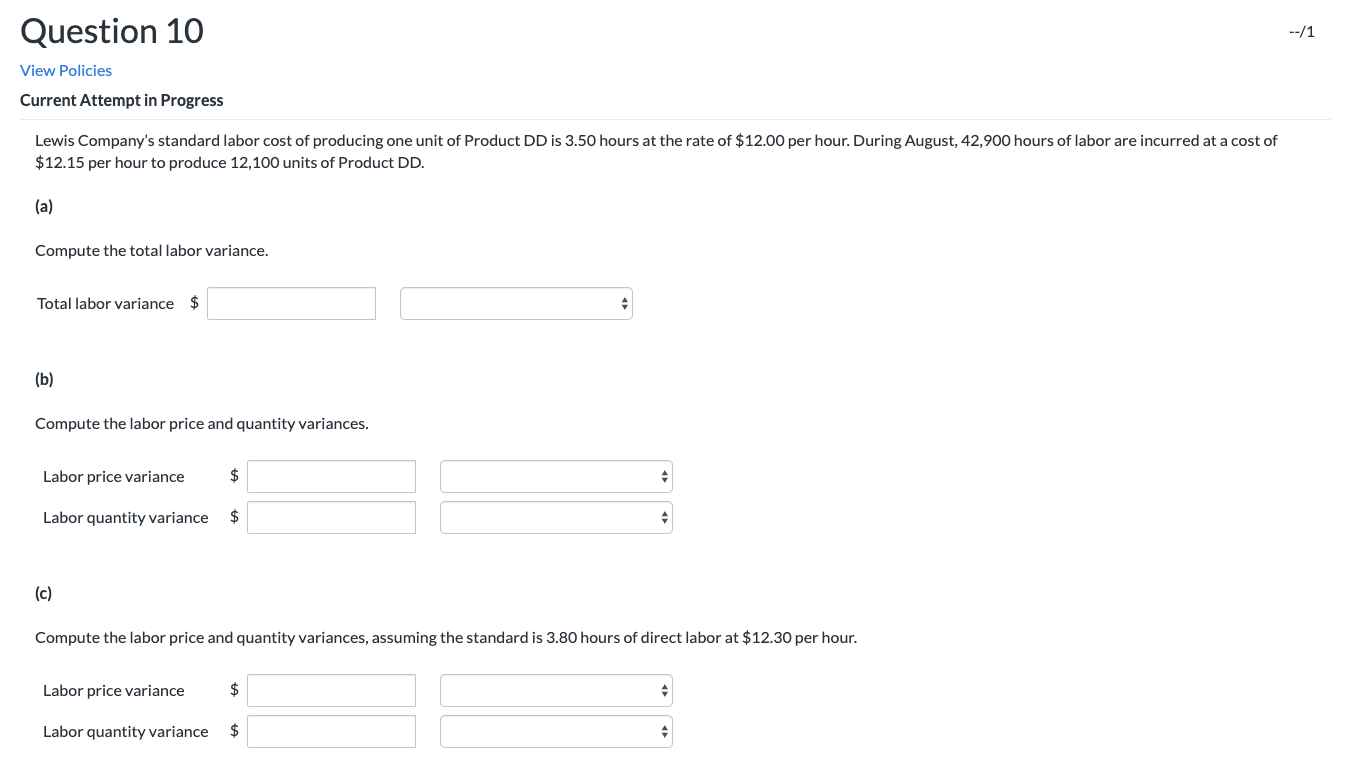

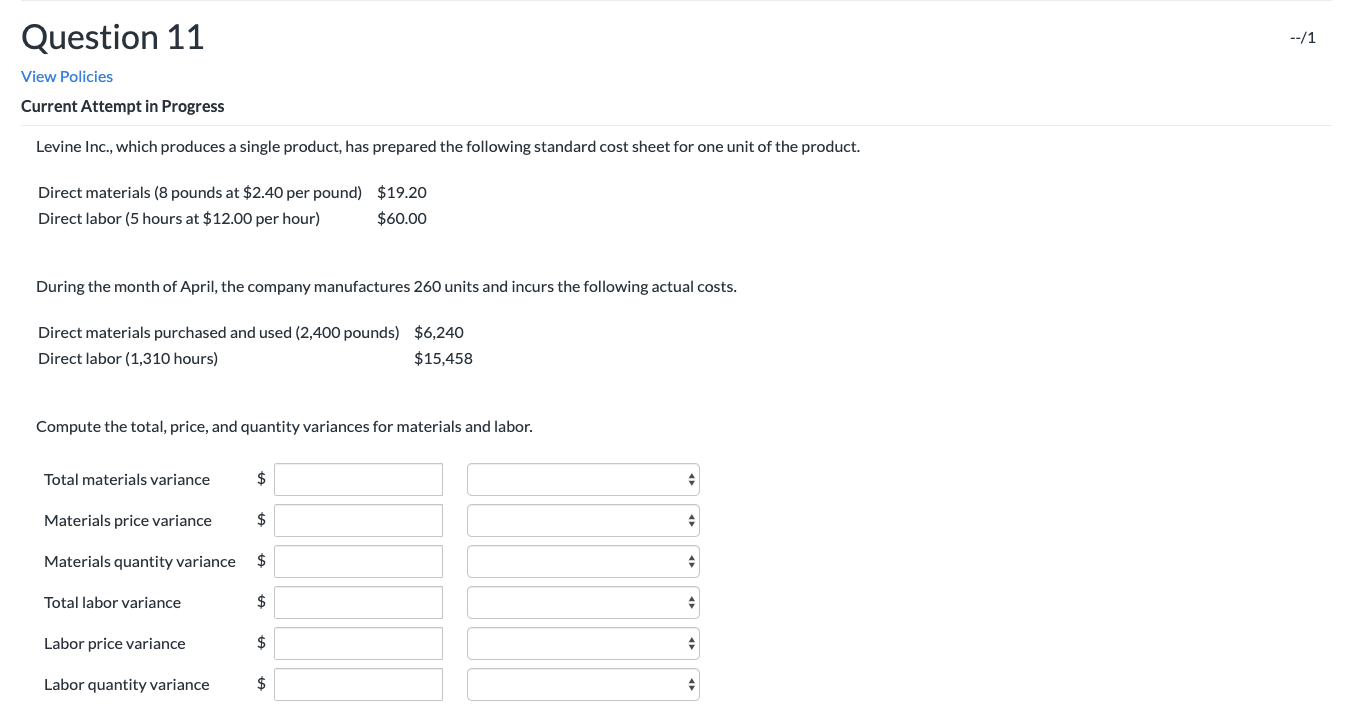

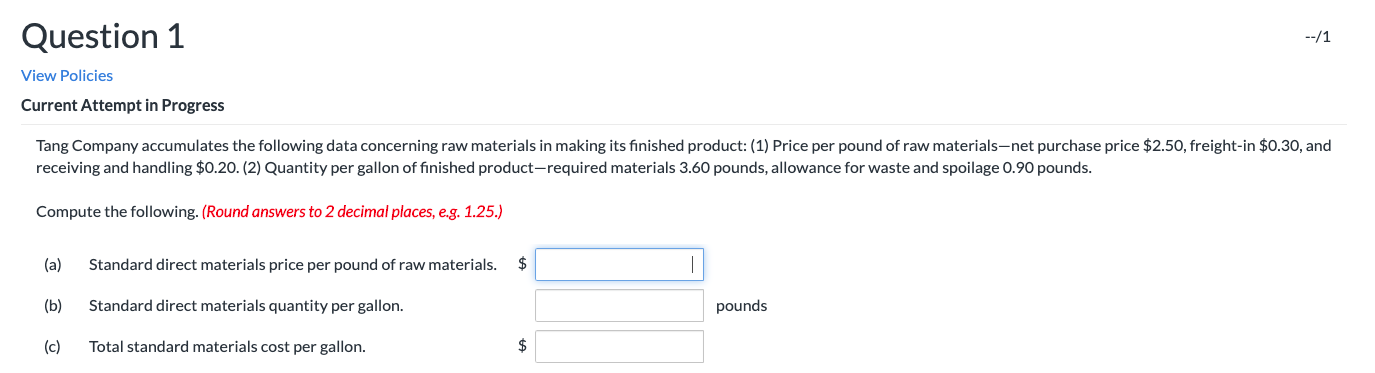

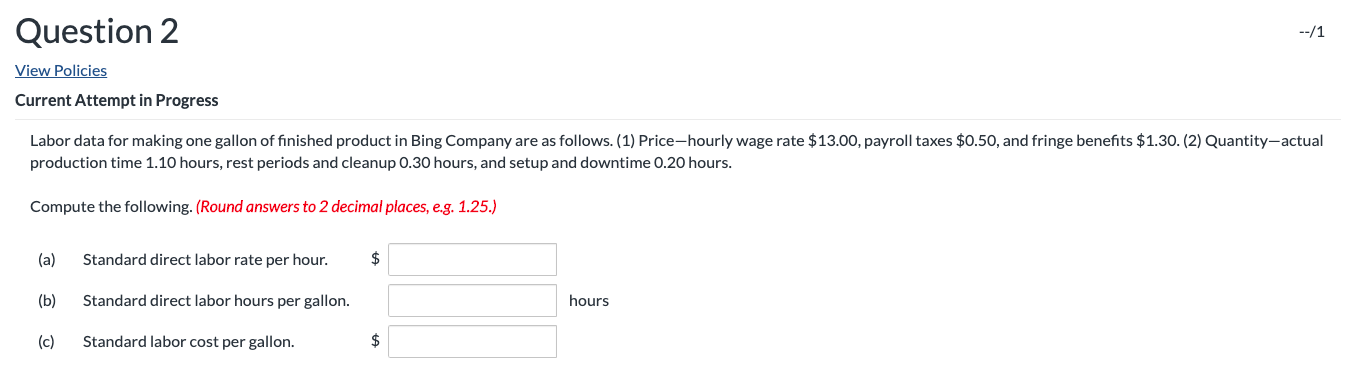

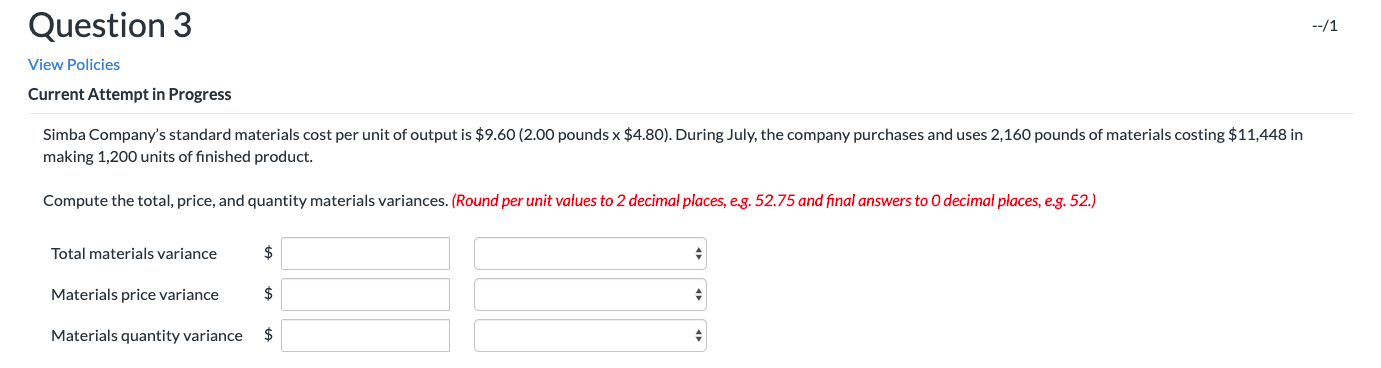

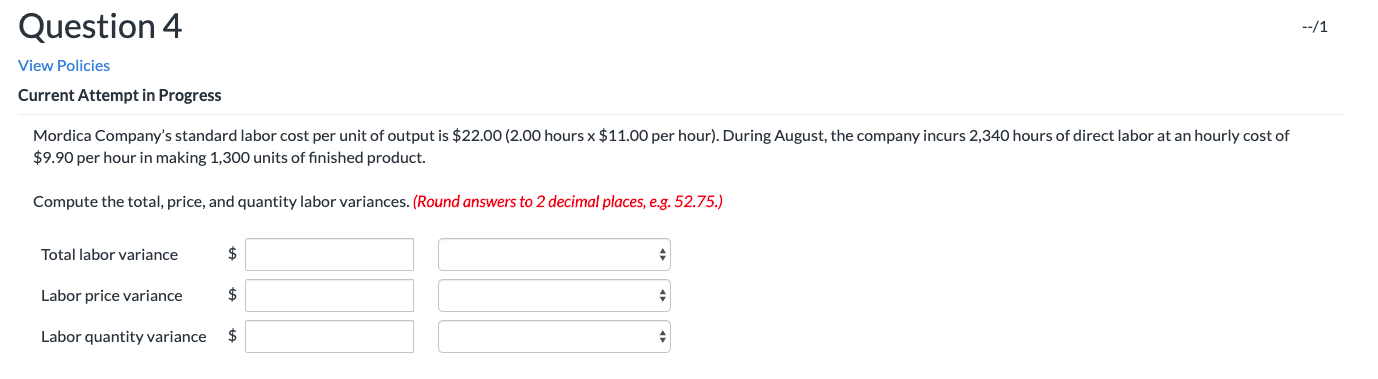

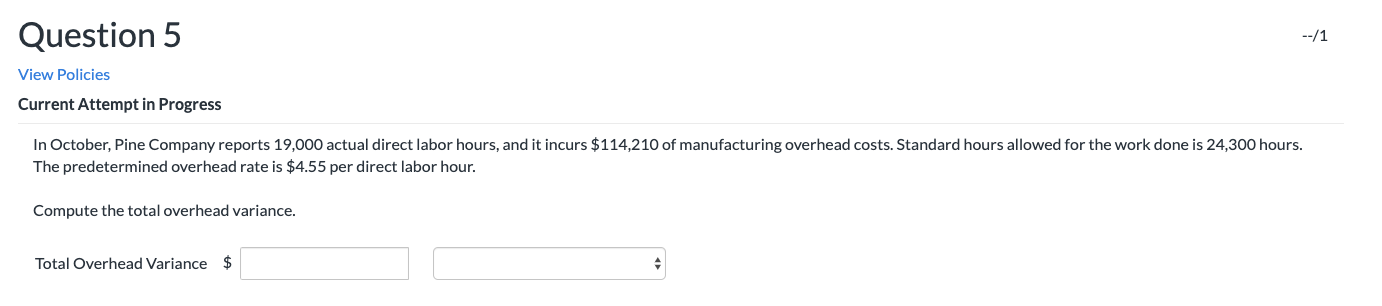

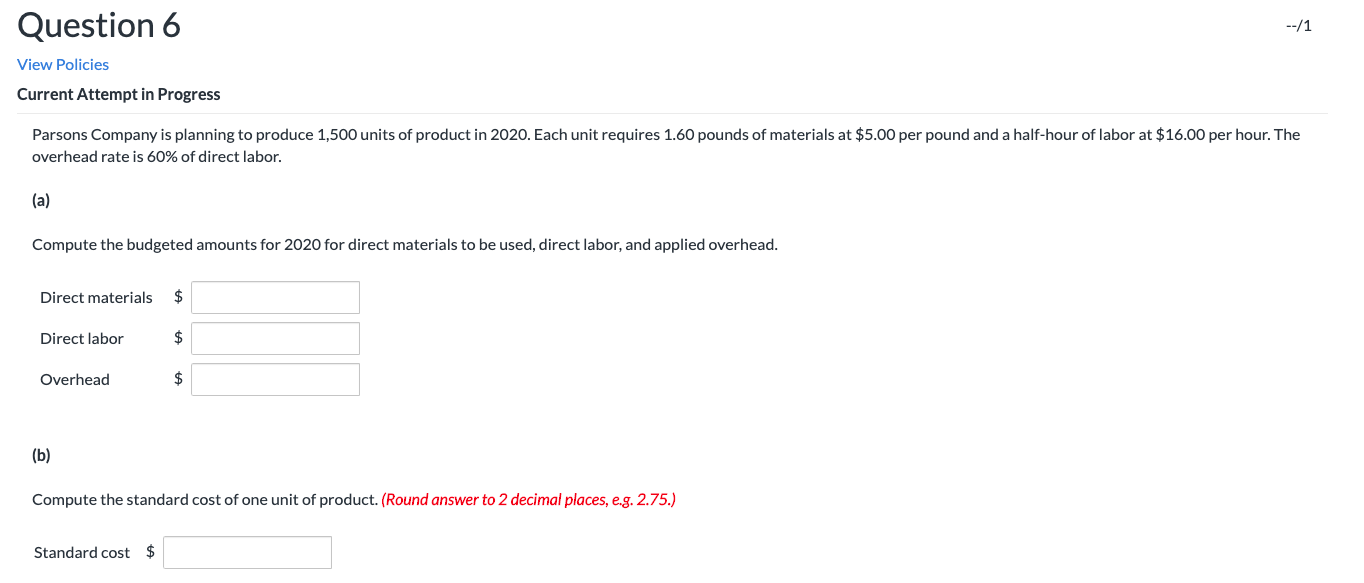

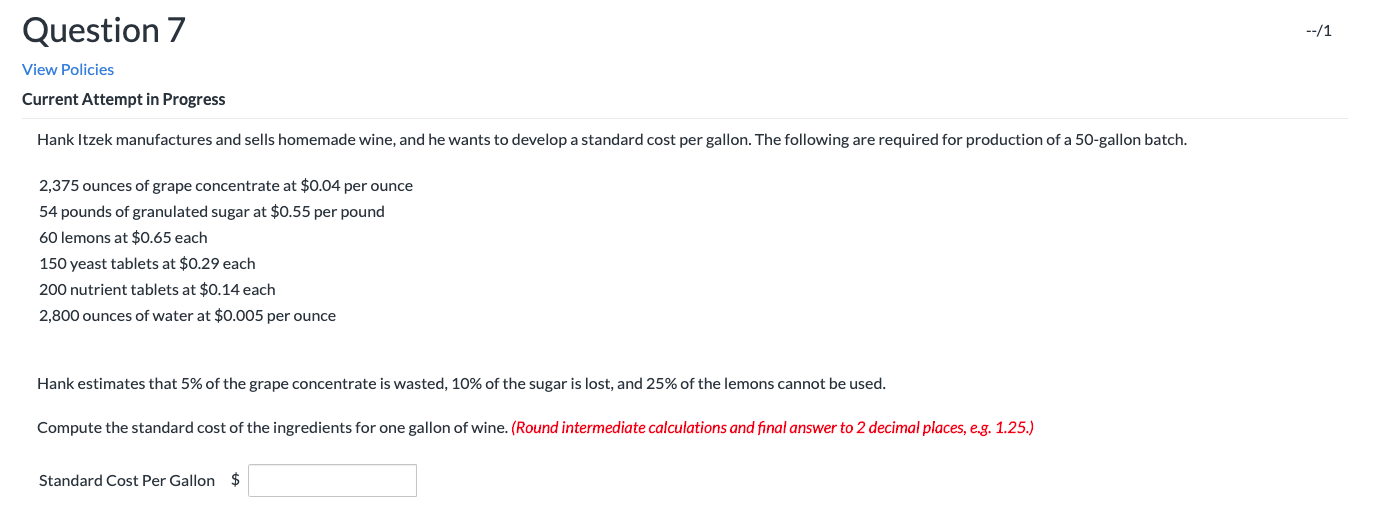

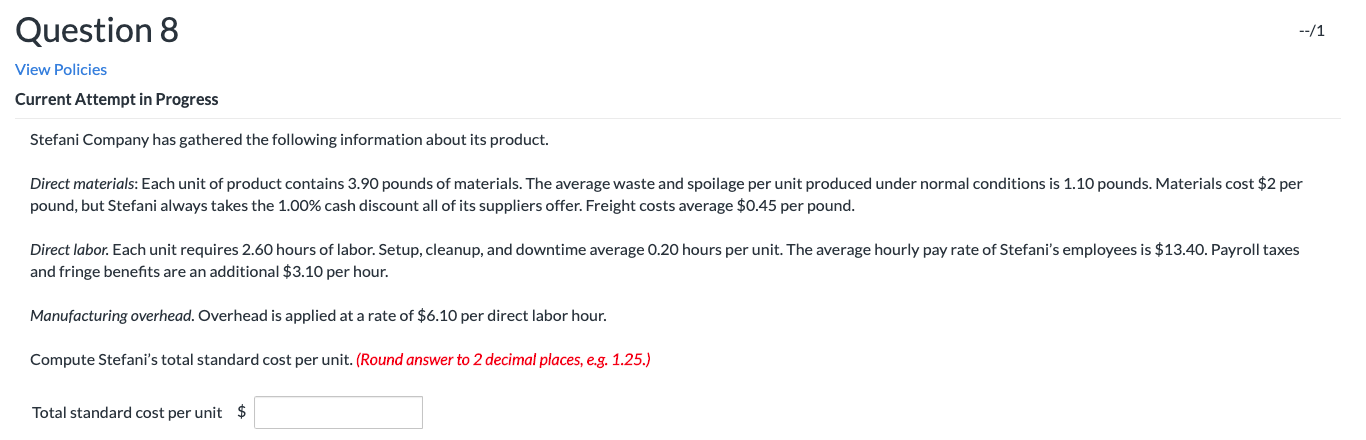

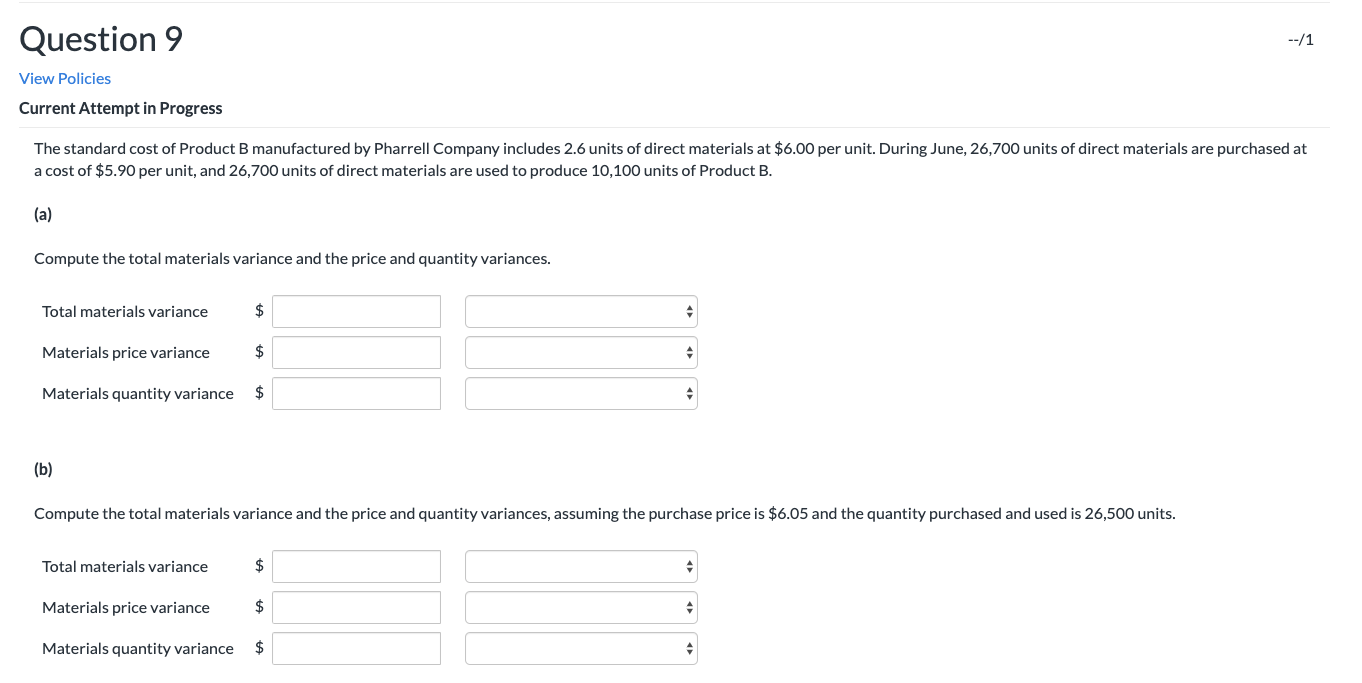

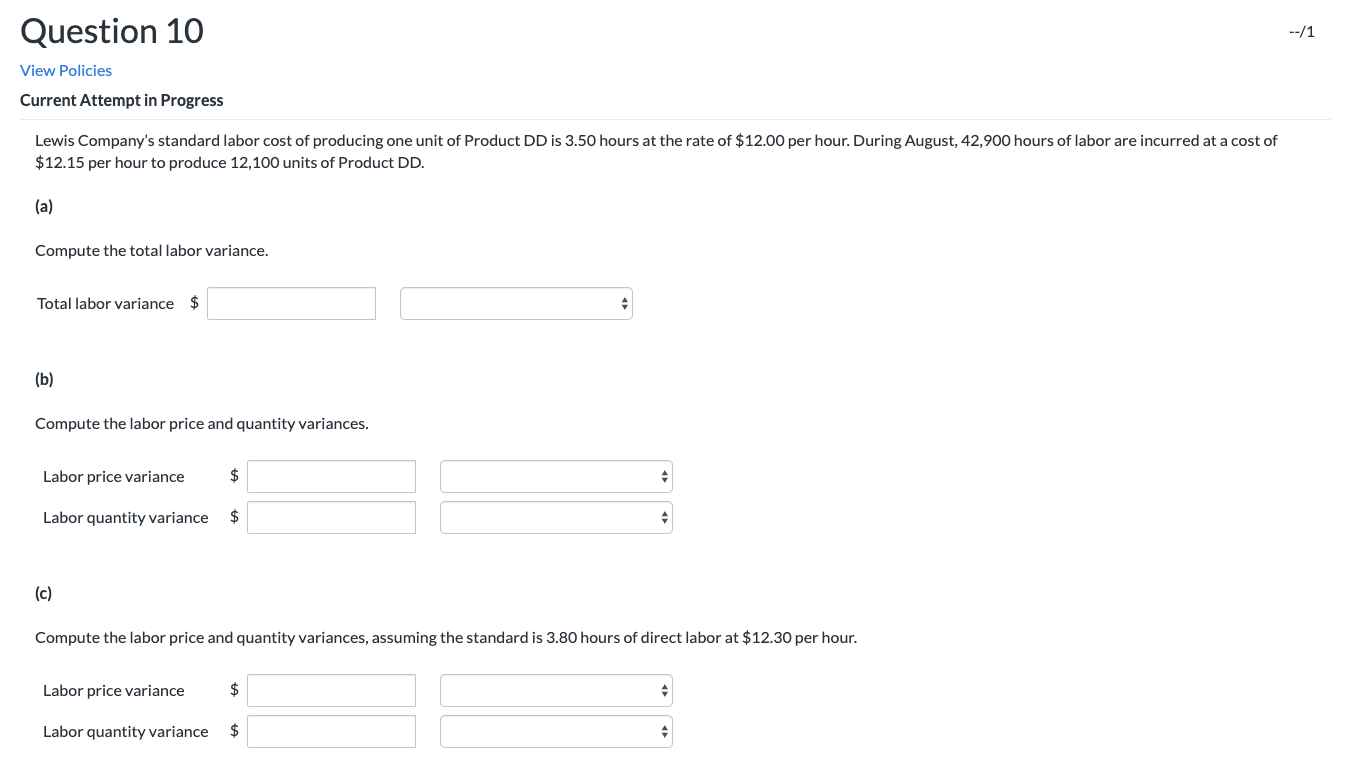

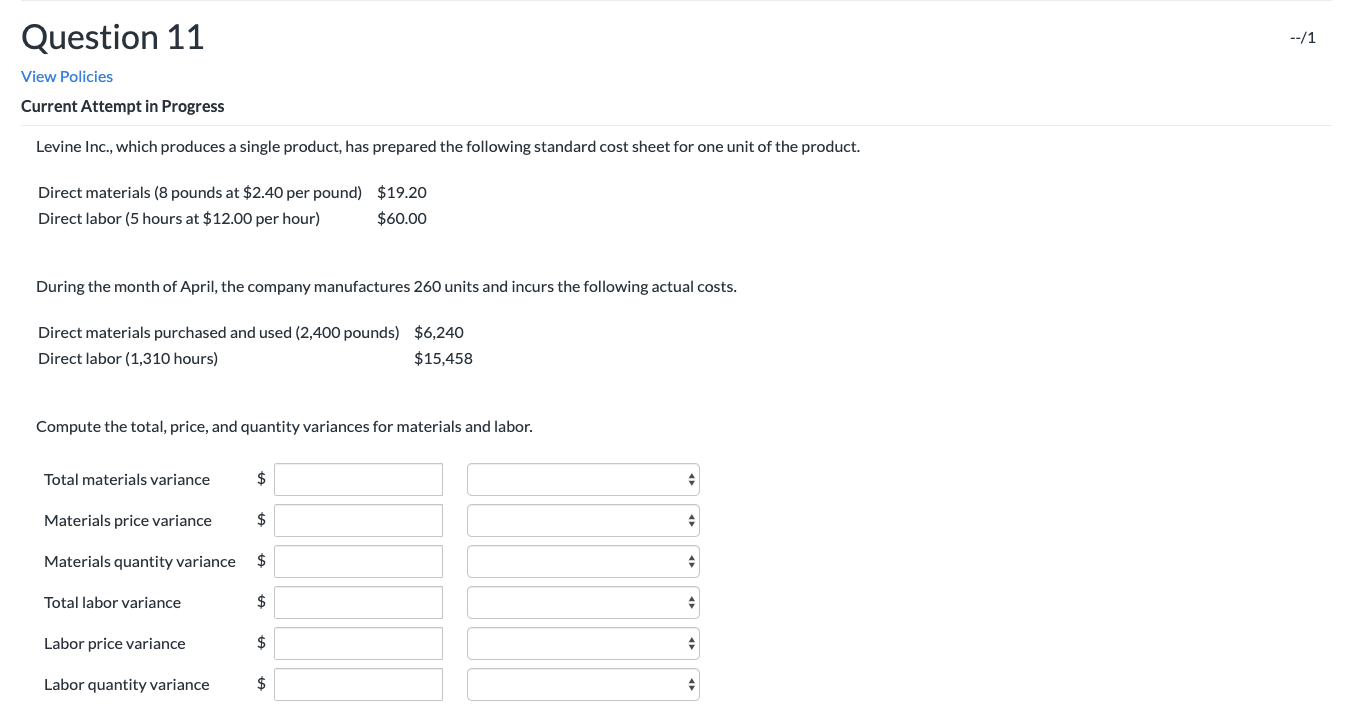

Question 1 --/1 View Policies Current Attempt in Progress Tang Company accumulates the following data concerning raw materials in making its finished product: (1) Price per pound of raw materials-net purchase price $2.50, freight-in $0.30, and receiving and handling $0.20. (2) Quantity per gallon of finished product-required materials 3.60 pounds, allowance for waste and spoilage 0.90 pounds. Compute the following. (Round answers to 2 decimal places, e.g. 1.25.) (a) Standard direct materials price per pound of raw materials. $ (b) Standard direct materials quantity per gallon. pounds (c) Total standard materials cost per gallon. $ Question 2 --/1 View Policies Current Attempt in Progress Labor data for making one gallon of finished product in Bing Company are as follows. (1) Price-hourly wage rate $13.00, payroll taxes $0.50, and fringe benefits $1.30. (2) Quantity-actual production time 1.10 hours, rest periods and cleanup 0.30 hours, and setup and downtime 0.20 hours. Compute the following. (Round answers to 2 decimal places, e.g. 1.25.) (a) Standard direct labor rate per hour. $ (b) Standard direct labor hours per gallon. hours (c) Standard labor cost per gallon. $ Question 3 --/1 View Policies Current Attempt in Progress Simba Company's standard materials cost per unit of output is $9.60 (2.00 pounds x $4.80). During July, the company purchases and uses 2,160 pounds of materials costing $11,448 in making 1,200 units of finished product. Compute the total, price, and quantity materials variances. (Round per unit values to 2 decimal places, e.g. 52.75 and final answers to O decimal places, e.g. 52.) Total materials variance $ Materials price variance $ Materials quantity variance $ > Question 4 --/1 View Policies Current Attempt in Progress Mordica Company's standard labor cost per unit of output is $22.00 (2.00 hours x $11.00 per hour). During August, the company incurs 2,340 hours of direct labor at an hourly cost of $9.90 per hour in making 1,300 units of finished product. Compute the total, price, and quantity labor variances. (Round answers to 2 decimal places, e.g. 52.75.) Total labor variance $ > Labor price variance $ Labor quantity variance $ >> Question 5 --/1 View Policies Current Attempt in Progress In October, Pine Company reports 19,000 actual direct labor hours, and it incurs $114,210 of manufacturing overhead costs. Standard hours allowed for the work done is 24,300 hours. The predetermined overhead rate is $4.55 per direct labor hour. Compute the total overhead variance. Total Overhead Variance $ Question 6 --/1 View Policies Current Attempt in Progress Parsons Company is planning to produce 1,500 units of product in 2020. Each unit requires 1.60 pounds of materials at $5.00 per pound and a half-hour of labor at $16.00 per hour. The overhead rate is 60% of direct labor. (a) Compute the budgeted amounts for 2020 for direct materials to be used, direct labor, and applied overhead. Direct materials $ Direct labor $ Overhead $ (b) Compute the standard cost of one unit of product. (Round answer to 2 decimal places, e.g. 2.75.) Standard cost $ Question 7 --/1 View Policies Current Attempt in Progress Hank Itzek manufactures and sells homemade wine, and he wants to develop a standard cost per gallon. The following are required for production of a 50-gallon batch. 2,375 ounces of grape concentrate at $0.04 per ounce 54 pounds of granulated sugar at $0.55 per pound 60 lemons at $0.65 each 150 yeast tablets at $0.29 each 200 nutrient tablets at $0.14 each 2,800 ounces of water at $0.005 per ounce Hank estimates that 5% of the grape concentrate is wasted, 10% of the sugar is lost, and 25% of the lemons cannot be used. Compute the standard cost of the ingredients for one gallon of wine. (Round intermediate calculations and final answer to 2 decimal places, e.g. 1.25.) Standard Cost Per Gallon $ Question 8 --/1 View Policies Current Attempt in Progress Stefani Company has gathered the following information about its product. Direct materials: Each unit of product contains 3.90 pounds of materials. The average waste and spoilage per unit produced under normal conditions is 1.10 pounds. Materials cost $2 per pound, but Stefani always takes the 1.00% cash discount all of its suppliers offer. Freight costs average $0.45 per pound. Direct labor. Each unit requires 2.60 hours of labor. Setup, cleanup, and downtime average 0.20 hours per unit. The average hourly pay rate of Stefani's employees is $13.40. Payroll taxes and fringe benefits are an additional $3.10 per hour. Manufacturing overhead. Overhead is applied at a rate of $6.10 per direct labor hour. Compute Stefani's total standard cost per unit. (Round answer to 2 decimal places, e.g. 1.25.) Total standard cost per unit $ Question 9 --/1 View Policies Current Attempt in Progress The standard cost of Product B manufactured by Pharrell Company includes 2.6 units of direct materials at $6.00 per unit. During June, 26,700 units of direct materials are purchased at a cost of $5.90 per unit, and 26,700 units of direct materials are used to produce 10,100 units of Product B. (a) Compute the total materials variance and the price and quantity variances. Total materials variance $ Materials price variance $ Materials quantity variance $ (b) Compute the total materials variance and the price and quantity variances, assuming the purchase price is $6.05 and the quantity purchased and used is 26,500 units. Total materials variance $ Materials price variance $ Materials quantity variance $ Question 10 --/1 View Policies Current Attempt in Progress Lewis Company's standard labor cost of producing one unit of Product DD is 3.50 hours at the rate of $12.00 per hour. During August, 42,900 hours of labor are incurred at a cost of $12.15 per hour to produce 12,100 units of Product DD. (a) Compute the total labor variance. Total labor variance $ (b) Compute the labor price and quantity variances. Labor price variance $ Labor quantity variance $ (c) Compute the labor price and quantity variances, assuming the standard is 3.80 hours of direct labor at $12.30 per hour. Labor price variance $ Labor quantity variance $ Question 11 --/1 View Policies Current Attempt in Progress Levine Inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. Direct materials (8 pounds at $2.40 per pound) $19.20 Direct labor (5 hours at $12.00 per hour) $60.00 During the month of April, the company manufactures 260 units and incurs the following actual costs. Direct materials purchased and used (2,400 pounds) $6,240 Direct labor (1,310 hours) $15,458 Compute the total, price, and quantity variances for materials and labor. Total materials variance $ Materials price variance $ Materials quantity variance $ Total labor variance $ > Labor price variance $ Labor quantity variance $