Answered step by step

Verified Expert Solution

Question

1 Approved Answer

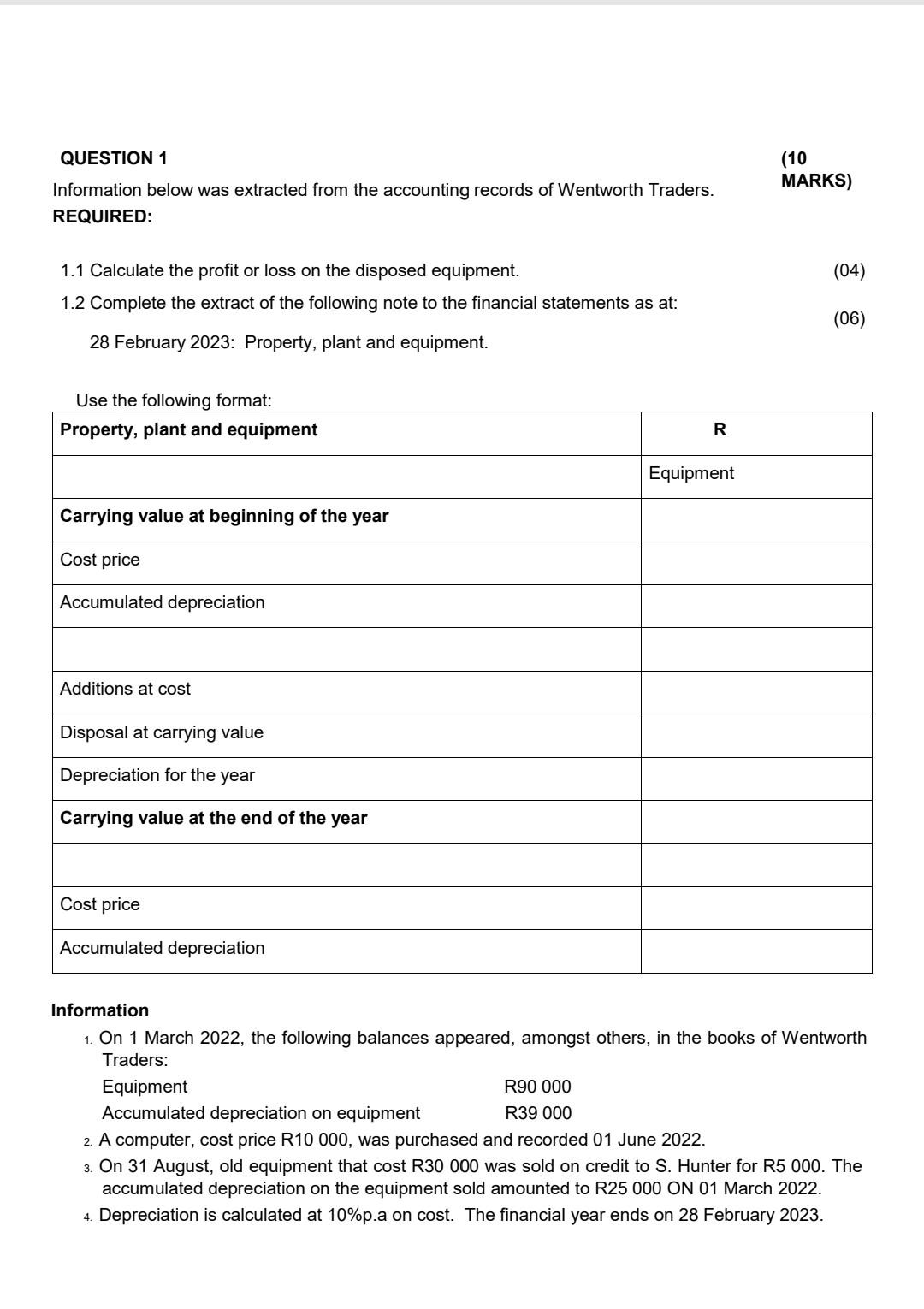

QUESTION 1 (10 Information below was extracted from the accounting records of Wentworth Traders. MARKS) REQUIRED: 1.1 Calculate the profit or loss on the disposed

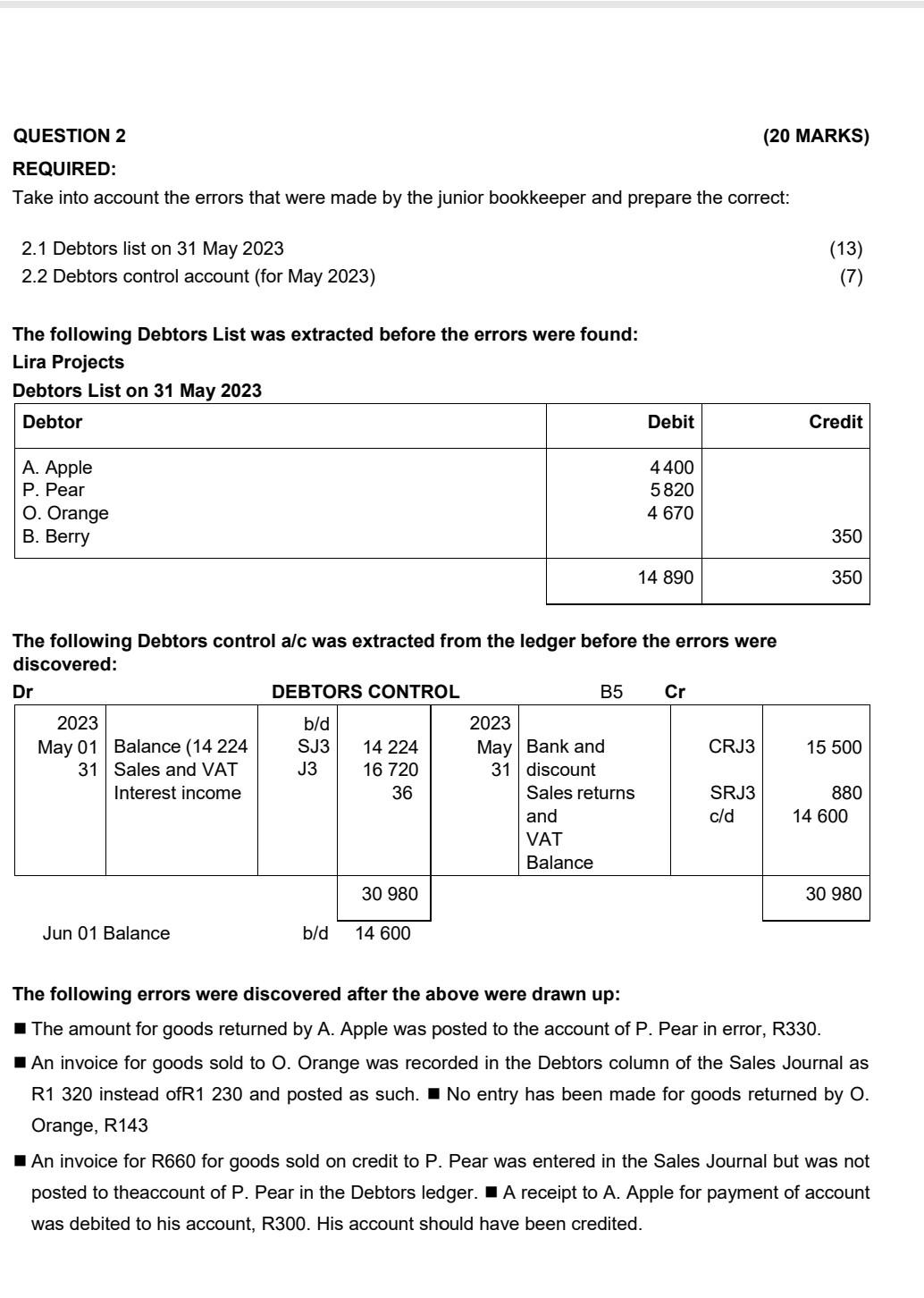

QUESTION 1 (10 Information below was extracted from the accounting records of Wentworth Traders. MARKS) REQUIRED: 1.1 Calculate the profit or loss on the disposed equipment. (04) 1.2 Complete the extract of the following note to the financial statements as at: 28 February 2023: Property, plant and equipment. (06) Information 1. On 1 March 2022, the following balances appeared, amongst others, in the books of Wentworth Traders: Equipment R90 000 Accumulated depreciation on equipment R39 000 2. A computer, cost price R10 000, was purchased and recorded 01 June 2022. 3. On 31 August, old equipment that cost R30 000 was sold on credit to S. Hunter for R5 000 . The accumulated depreciation on the equipment sold amounted to R25000 ON 01 March 2022. 4. Depreciation is calculated at 10% p.a on cost. The financial year ends on 28 February 2023. QUESTION 2 (20 MARKS) REQUIRED: Take into account the errors that were made by the junior bookkeeper and prepare the correct: 2.1 Debtors list on 31 May 2023 2.2 Debtors control account (for May 2023) The following Debtors List was extracted before the errors were found: The following Debtors control a/c was extracted from the ledger before the errors were discovered: The following errors were discovered after the above were drawn up: The amount for goods returned by A. Apple was posted to the account of P. Pear in error, R330. - An invoice for goods sold to O. Orange was recorded in the Debtors column of the Sales Journal as R1 320 instead ofR1 230 and posted as such. N No entry has been made for goods returned by O. Orange, R143 - An invoice for R660 for goods sold on credit to P. Pear was entered in the Sales Journal but was not posted to theaccount of P. Pear in the Debtors ledger. A receipt to A. Apple for payment of account was debited to his account, R300. His account should have been credited. QUESTION 1 (10 Information below was extracted from the accounting records of Wentworth Traders. MARKS) REQUIRED: 1.1 Calculate the profit or loss on the disposed equipment. (04) 1.2 Complete the extract of the following note to the financial statements as at: 28 February 2023: Property, plant and equipment. (06) Information 1. On 1 March 2022, the following balances appeared, amongst others, in the books of Wentworth Traders: Equipment R90 000 Accumulated depreciation on equipment R39 000 2. A computer, cost price R10 000, was purchased and recorded 01 June 2022. 3. On 31 August, old equipment that cost R30 000 was sold on credit to S. Hunter for R5 000 . The accumulated depreciation on the equipment sold amounted to R25000 ON 01 March 2022. 4. Depreciation is calculated at 10% p.a on cost. The financial year ends on 28 February 2023. QUESTION 2 (20 MARKS) REQUIRED: Take into account the errors that were made by the junior bookkeeper and prepare the correct: 2.1 Debtors list on 31 May 2023 2.2 Debtors control account (for May 2023) The following Debtors List was extracted before the errors were found: The following Debtors control a/c was extracted from the ledger before the errors were discovered: The following errors were discovered after the above were drawn up: The amount for goods returned by A. Apple was posted to the account of P. Pear in error, R330. - An invoice for goods sold to O. Orange was recorded in the Debtors column of the Sales Journal as R1 320 instead ofR1 230 and posted as such. N No entry has been made for goods returned by O. Orange, R143 - An invoice for R660 for goods sold on credit to P. Pear was entered in the Sales Journal but was not posted to theaccount of P. Pear in the Debtors ledger. A receipt to A. Apple for payment of account was debited to his account, R300. His account should have been credited

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started