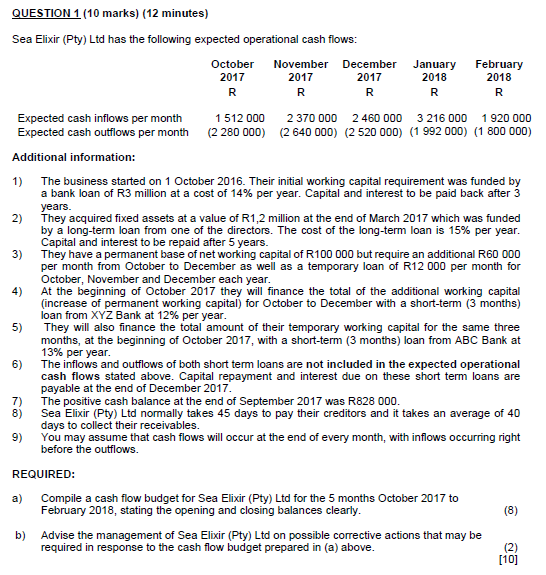

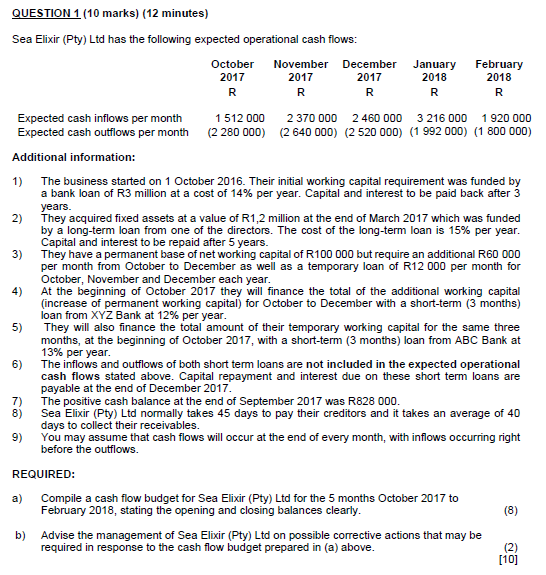

QUESTION 1 (10 marks) (12 minutes) Sea Elixir (Pty) Ltd has the following expected operational cash flows: October November December January February 2017 2017 2017 2018 2018 R R R R R Expected cash inflows per month 1 512 000 2 370 000 2 460 000 3 216 000 1 920 000 Expected cash outflows per month (2 280 000) (2 640 000) (2 520 000) (1 992 000) (1 800 000) Additional information: 1) The business started on 1 October 2016. Their initial working capital requirement was funded by a bank loan of R3 million at a cost of 14% per year. Capital and interest to be paid back after 3 years. 2) They acquired fixed assets at a value of R1,2 million at the end of March 2017 which was funded by a long-term loan from one of the directors. The cost of the long-term loan is 15% per year. Capital and interest to be repaid after 5 years. 3) They have a permanent base of net working capital of R100 000 but require an additional R60 000 per month from October to December as well as a temporary loan of R12 000 per month for October, November and December each year. 4) At the beginning of October 2017 they will finance the total of the additional working capital (increase of permanent working capital) for October to December with a short-term (3 months) loan from XYZ Bank at 12% per year. 5) They will also finance the total amount of their temporary working capital for the same three months, at the beginning of October 2017, with a short-term (3 months) loan from ABC Bank at 13% per year. 6) The inflows and outflows of both short term loans are not included in the expected operational cash flows stated above. Capital repayment and interest due on these short term loans are payable at the end of December 2017 7) The positive cash balance at the end of September 2017 was R828 000. 8) Sea Elixir (Pty) Ltd normally takes 45 days to pay their creditors and it takes an average of 40 days to collect their receivables. 9) You may assume that cash flows will occur at the end of every month, with inflows occurring right before the outflows. REQUIRED: (8) Compile a cash flow budget for Sea Elixir (Pty) Ltd for the 5 months October 2017 to February 2018, stating the opening and closing balances clearly. Advise the management of Sea Elixir (Pty) Ltd on possible corrective actions that may be required in response to the cash flow budget prepared in (a) above. b) (2 [10] QUESTION 1 (10 marks) (12 minutes) Sea Elixir (Pty) Ltd has the following expected operational cash flows: October November December January February 2017 2017 2017 2018 2018 R R R R R Expected cash inflows per month 1 512 000 2 370 000 2 460 000 3 216 000 1 920 000 Expected cash outflows per month (2 280 000) (2 640 000) (2 520 000) (1 992 000) (1 800 000) Additional information: 1) The business started on 1 October 2016. Their initial working capital requirement was funded by a bank loan of R3 million at a cost of 14% per year. Capital and interest to be paid back after 3 years. 2) They acquired fixed assets at a value of R1,2 million at the end of March 2017 which was funded by a long-term loan from one of the directors. The cost of the long-term loan is 15% per year. Capital and interest to be repaid after 5 years. 3) They have a permanent base of net working capital of R100 000 but require an additional R60 000 per month from October to December as well as a temporary loan of R12 000 per month for October, November and December each year. 4) At the beginning of October 2017 they will finance the total of the additional working capital (increase of permanent working capital) for October to December with a short-term (3 months) loan from XYZ Bank at 12% per year. 5) They will also finance the total amount of their temporary working capital for the same three months, at the beginning of October 2017, with a short-term (3 months) loan from ABC Bank at 13% per year. 6) The inflows and outflows of both short term loans are not included in the expected operational cash flows stated above. Capital repayment and interest due on these short term loans are payable at the end of December 2017 7) The positive cash balance at the end of September 2017 was R828 000. 8) Sea Elixir (Pty) Ltd normally takes 45 days to pay their creditors and it takes an average of 40 days to collect their receivables. 9) You may assume that cash flows will occur at the end of every month, with inflows occurring right before the outflows. REQUIRED: (8) Compile a cash flow budget for Sea Elixir (Pty) Ltd for the 5 months October 2017 to February 2018, stating the opening and closing balances clearly. Advise the management of Sea Elixir (Pty) Ltd on possible corrective actions that may be required in response to the cash flow budget prepared in (a) above. b) (2 [10]