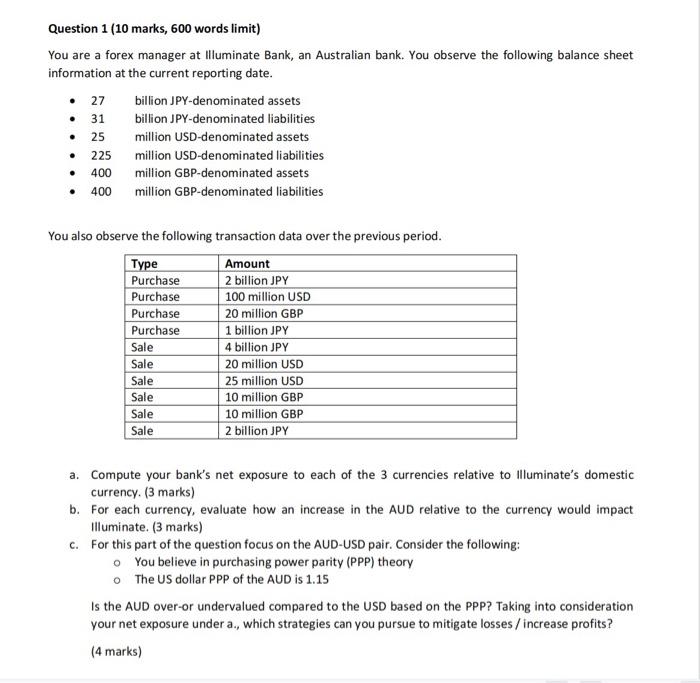

Question 1 (10 marks, 600 words limit) You are a forex manager at Illuminate Bank, an Australian bank. You observe the following balance sheet information at the current reporting date. - 27 billion JPY-denominated assets - 31 billion JPY-denominated liabilities - 25 million USD-denominated assets - 225 million USD-denominated liabilities - 400 million GBP-denominated assets - 400 million GBP-denominated liabilities You also observe the following transaction data over the previous period. a. Compute your bank's net exposure to each of the 3 currencies relative to Illuminate's domestic currency. (3 marks) b. For each currency, evaluate how an increase in the AUD relative to the currency would impact Illuminate. ( 3 marks) c. For this part of the question focus on the AUD-USD pair. Consider the following: - You believe in purchasing power parity (PPP) theory - The US dollar PPP of the AUD is 1.15 Is the AUD over-or undervalued compared to the USD based on the PPP? Taking into consideration your net exposure under a., which strategies can you pursue to mitigate losses / increase profits? (4 marks) Question 1 (10 marks, 600 words limit) You are a forex manager at Illuminate Bank, an Australian bank. You observe the following balance sheet information at the current reporting date. - 27 billion JPY-denominated assets - 31 billion JPY-denominated liabilities - 25 million USD-denominated assets - 225 million USD-denominated liabilities - 400 million GBP-denominated assets - 400 million GBP-denominated liabilities You also observe the following transaction data over the previous period. a. Compute your bank's net exposure to each of the 3 currencies relative to Illuminate's domestic currency. (3 marks) b. For each currency, evaluate how an increase in the AUD relative to the currency would impact Illuminate. ( 3 marks) c. For this part of the question focus on the AUD-USD pair. Consider the following: - You believe in purchasing power parity (PPP) theory - The US dollar PPP of the AUD is 1.15 Is the AUD over-or undervalued compared to the USD based on the PPP? Taking into consideration your net exposure under a., which strategies can you pursue to mitigate losses / increase profits? (4 marks)