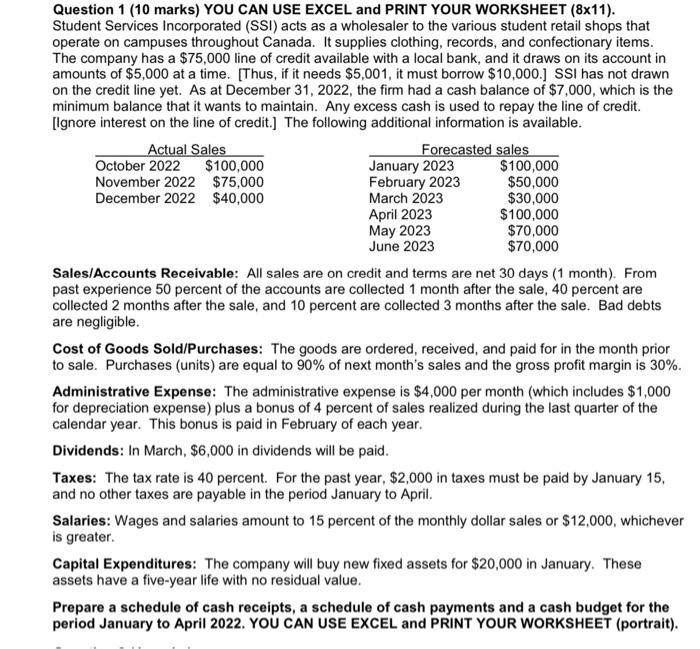

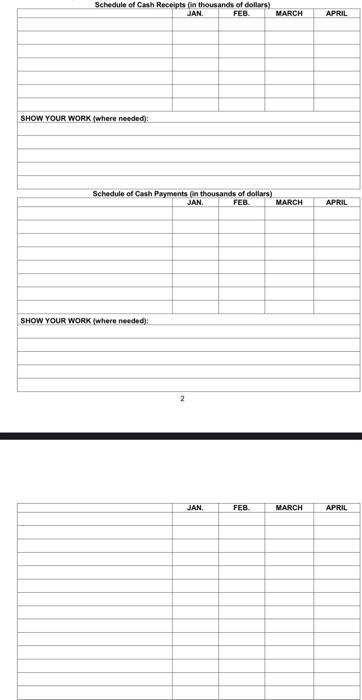

Question 1 (10 marks) YOU CAN USE EXCEL and PRINT YOUR WORKSHEET ( 811). Student Services Incorporated (SSI) acts as a wholesaler to the various student retail shops that operate on campuses throughout Canada. It supplies clothing, records, and confectionary items. The company has a $75,000 line of credit available with a local bank, and it draws on its account in amounts of $5,000 at a time. [Thus, if it needs $5,001, it must borrow $10,000.] SSI has not drawn on the credit line yet. As at December 31,2022 , the firm had a cash balance of $7,000, which is the minimum balance that it wants to maintain. Any excess cash is used to repay the line of credit. [lgnore interest on the line of credit.] The following additional information is available. Sales/Accounts Receivable: All sales are on credit and terms are net 30 days (1 month). From past experience 50 percent of the accounts are collected 1 month after the sale, 40 percent are collected 2 months after the sale, and 10 percent are collected 3 months after the sale. Bad debts are negligible. Cost of Goods Sold/Purchases: The goods are ordered, received, and paid for in the month prior to sale. Purchases (units) are equal to 90% of next month's sales and the gross profit margin is 30%. Administrative Expense: The administrative expense is $4,000 per month (which includes $1,000 for depreciation expense) plus a bonus of 4 percent of sales realized during the last quarter of the calendar year. This bonus is paid in February of each year. Dividends: In March, $6,000 in dividends will be paid. Taxes: The tax rate is 40 percent. For the past year, $2,000 in taxes must be paid by January 15 , and no other taxes are payable in the period January to April. Salaries: Wages and salaries amount to 15 percent of the monthly dollar sales or $12,000, whichever is greater. Capital Expenditures: The company will buy new fixed assets for $20,000 in January. These assets have a five-year life with no residual value. Prepare a schedule of cash receipts, a schedule of cash payments and a cash budget for the period January to April 2022. YOU CAN USE EXCEL and PRINT YOUR WORKSHEET (portrait). Sehedule of Cash Receipts (in thousands of dollars) \begin{tabular}{|l|l|l|l|l|} \hline & JAN. & FER. & MARCH & APRIL \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline \end{tabular} SHOW YOUR WORK (where needed: SHOW YOUR WORK (where needed): \begin{tabular}{|l|l|l|l|l|} \hline & JAN. & FEB. & MARCH & APRIL \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular}