Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (10 points) Your great aunt Marie just hit the $100 million jackpot in the state lottery and took a lump sum payment. She

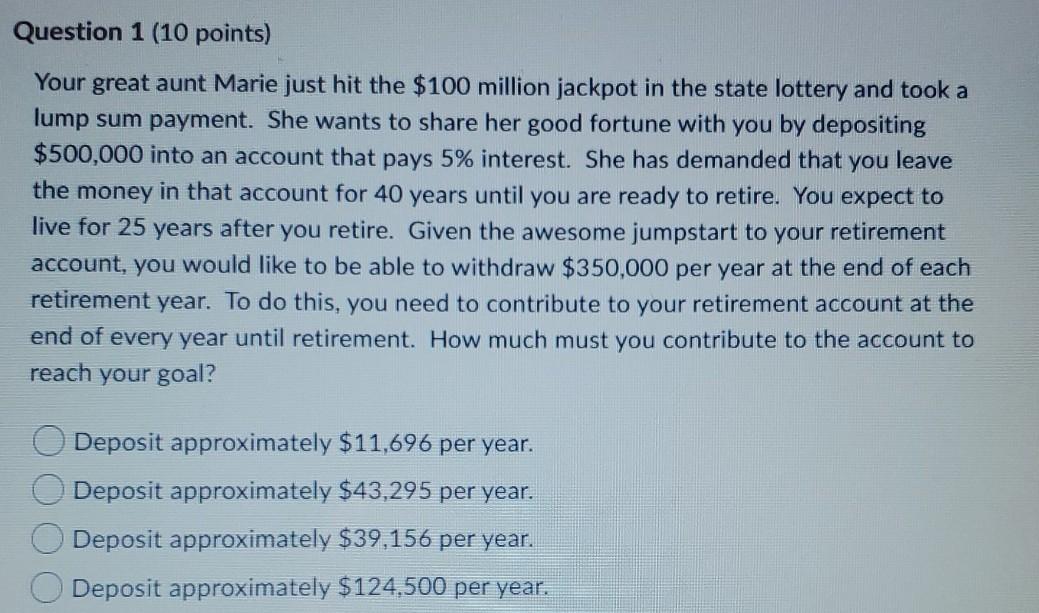

Question 1 (10 points) Your great aunt Marie just hit the $100 million jackpot in the state lottery and took a lump sum payment. She wants to share her good fortune with you by depositing $500,000 into an account that pays 5% interest. She has demanded that you leave the money in that account for 40 years until you are ready to retire. You expect to live for 25 years after you retire. Given the awesome jumpstart to your retirement account, you would like to be able to withdraw $350,000 per year at the end of each retirement year. To do this, you need to contribute to your retirement account at the end of every year until retirement. How much must you contribute to the account to reach your goal? Deposit approximately $11,696 per year. Deposit approximately $43,295 per year. Deposit approximately $39,156 per year. Deposit approximately $124,500 per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started