Answered step by step

Verified Expert Solution

Question

1 Approved Answer

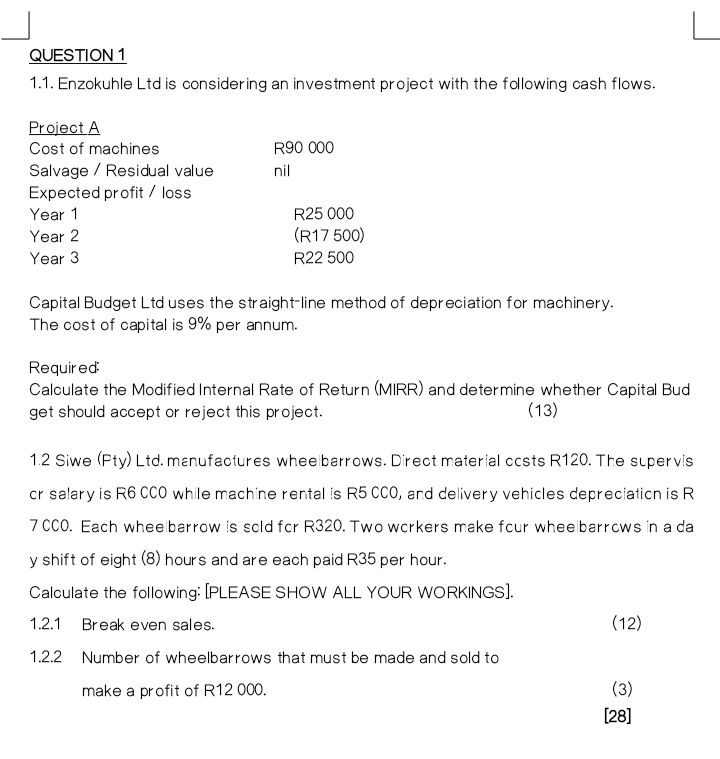

QUESTION 1 1.1. Enzokuhle Ltd is considering an investment project with the following cash flows. Capital Budget Ltd uses the straight-line method of depreciation for

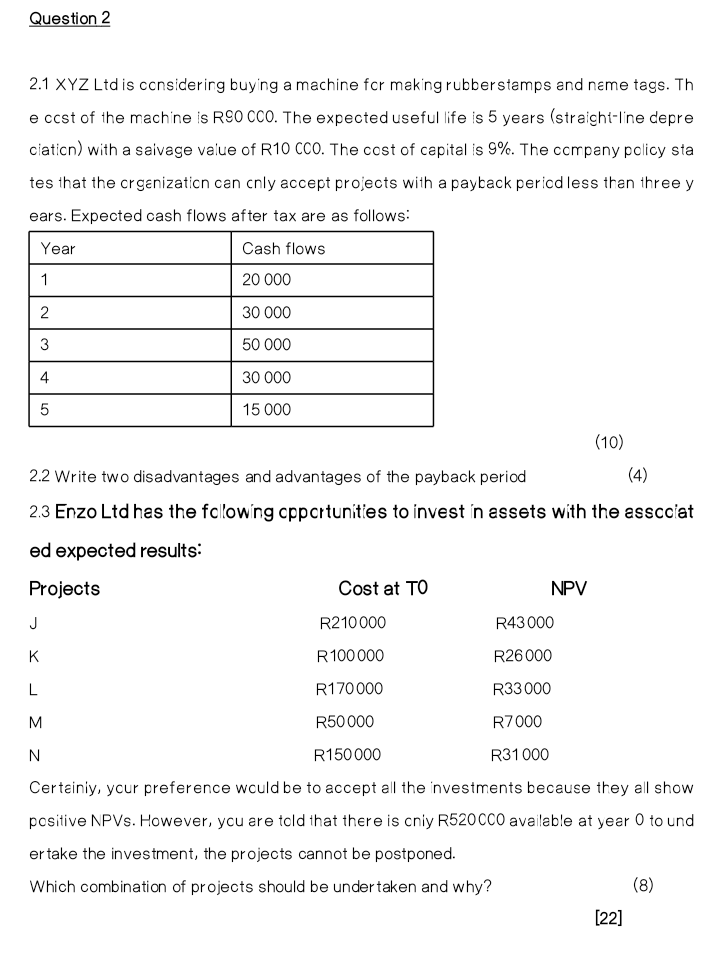

QUESTION 1 1.1. Enzokuhle Ltd is considering an investment project with the following cash flows. Capital Budget Ltd uses the straight-line method of depreciation for machinery. The cost of capital is 9% per annum. Required: Calculate the Modified Internal Rate of Return (MIRR) and determine whether Capital Bud get should accept or reject this project. (13) 1.2 Siwe (Fty) Ltd. menufactures whee barrows. Drect material ccsts R120. The supervis or salary is R6 CCO while machine rental is R5CCO, and delivery vehicles depreciation is R 7 CC0. Each whee barrow is sold for R320. Two workers make four whee barrows in a da y shift of eight (8) hours and are each paid R35 per hour. Calculate the following: [PLEASE SHOW ALL YOUR WORKINGS]. 1.2.1 Break even sales. 1.2.2 Number of wheelbarrows that must be made and sold to make a profit of R12000. [28] 2.1YZ Ltd is considering buying a machine for making rubberstamps and neme tags. Th e ccst of the machine is RSO CCO. The expected useful life is 5 years (straight-line depre ciation) with a saivage value of R10 CCO. The cost of capital is 9%. The company policy sta tes that the crgenization can cnly accept projects with a payback pericd less than three y ears. Expected cash flows after tax are as follows: (10) 2.2 Write two disadvantages and advantages of the payback period 2.3 Enzo Ltd has the fclowing cppcrtunities to invest in assets with the asscciat ed expected results: Certainiy, your preference would be to accept all the nuestments because they all show positive NPVs. However, you are told that there is cniy R520CC0 avallable at year 0 to und er take the investment, the projects cannot be postponed. Which combination of projects should be under taken and why? (8) [22]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started