Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Everglades Ltd provides its workforce of 90 employees with 15 days paid sick leave each year. For 30 of Everglade's employees, the sick leave

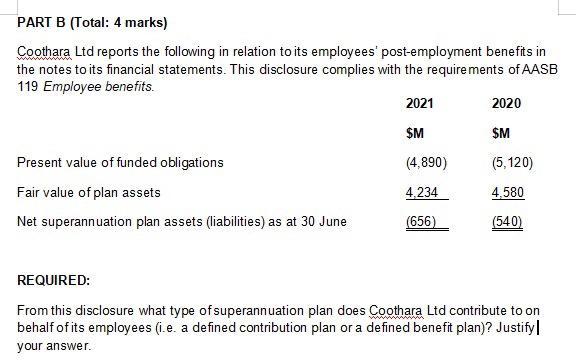

Everglades Ltd provides its workforce of 90 employees with 15 days paid sick leave each year. For 30 of Everglade's employees, the sick leave is vesting and for the remaining 60 employees it is non-vesting and cumulative. The following information is available in relation to sick leave for Everglade for the year ended 30 June, 2021. For the 30 employees with vesting sick leave, the amount ofunused sick leave entitlements totals $9,500 and the weekly payroll for these 30 employees is $364,000. For the 60 employees with non-vesting, cumulative sick leave from past experience Everglades expects that: 50% will take their full sick leave, 40% will take 10 days of sick leave and 10% will take no sick leave. The weekly payroll for these 60 employees is $900,000. REQUIRED: What is the balance of the provision for sick leave reported in Everglades Ltd's Balance Sheet as at 30 June 2021 in accordance with the requirements of AASB 119 Employee ww Benefits'? PART B (Total: 4 marks) Coothara Ltd reports the following in relation to its employees' post-employment benefits in the notes to its financial statements. This disclosure complies with the requirements of AASB 119 Employee benefits. 2021 2020 SM $M Present value of funded obligations (4,890) (5, 120) Fair value of plan assets 4.234 4.580 Net superannuation plan assets (liabilities) as at 30 June (656) (540) REQUIRED: From this disclosure what type of superannuation plan does Coothara Ltd contribute to on behalf of its employees (i.e. a defined contribution plan or a defined benefit plan)? Justify your answer.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

PART A PART B Defined contribution PlanDCB DCB is a postemployment benefit plan under which an entit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started