QUESTION 1 1.1 REQUIRED Use the following financial data to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. INFORMATION

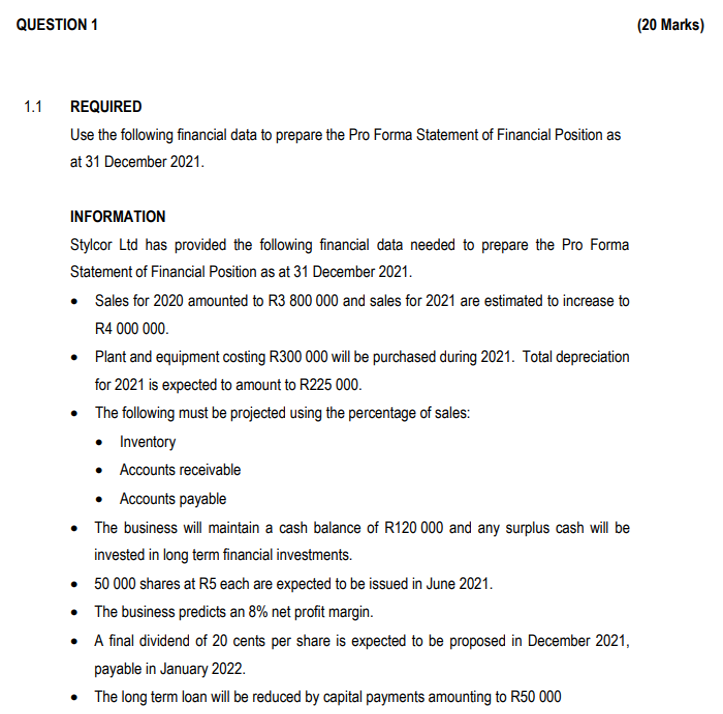

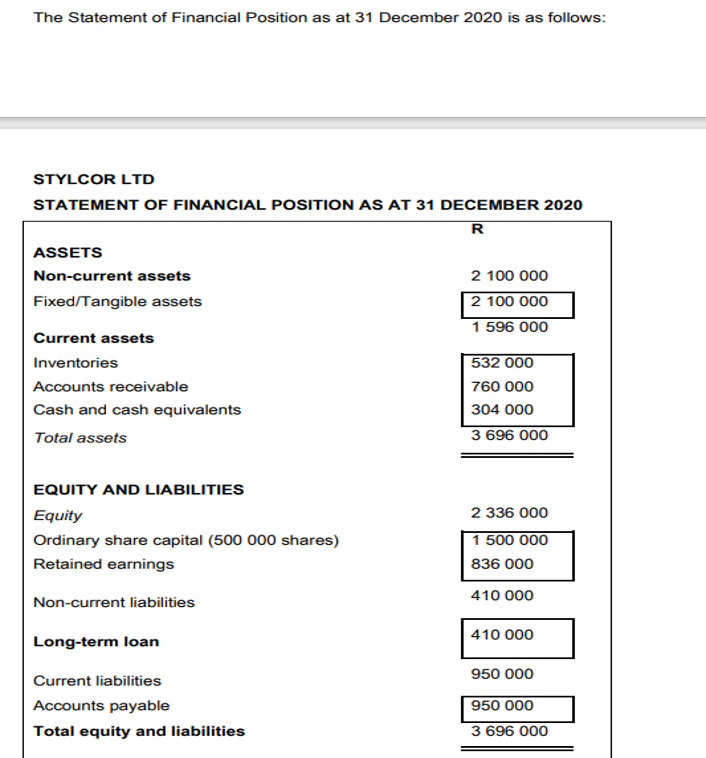

QUESTION 1 1.1 REQUIRED Use the following financial data to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. INFORMATION Stylcor Ltd has provided the following financial data needed to prepare the Pro Forma Statement of Financial Position as at 31 December 2021. Sales for 2020 amounted to R3 800 000 and sales for 2021 are estimated to increase to R4 000 000. Plant and equipment costing R300 000 will be purchased during 2021. Total depreciation for 2021 is expected to amount to R225 000. The following must be projected using the percentage of sales: Inventory Accounts receivable Accounts payable The business will maintain a cash balance of R120 000 and any surplus cash will be invested in long term financial investments. 50 000 shares at R5 each are expected to be issued in June 2021. The business predicts an 8% net profit margin. A final dividend of 20 cents per share is expected to be proposed in December 2021, payable in January 2022. The long term loan will be reduced by capital payments amounting to R50 000 (20 Marks) The Statement of Financial Position as at 31 December 2020 is as follows: STYLCOR LTD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 ASSETS Non-current assets Fixed/Tangible assets Current assets Inventories Accounts receivable Cash and cash equivalents Total assets EQUITY AND LIABILITIES R 2 100 000 2 100 000 1 596 000 532 000 760 000 304 000 3 696 000 Equity 2 336 000 Ordinary share capital (500 000 shares) 1 500 000 Retained earnings 836 000 410 000 Non-current liabilities Long-term loan 410 000 Current liabilities Accounts payable Total equity and liabilities 950 000 950 000 3 696 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started