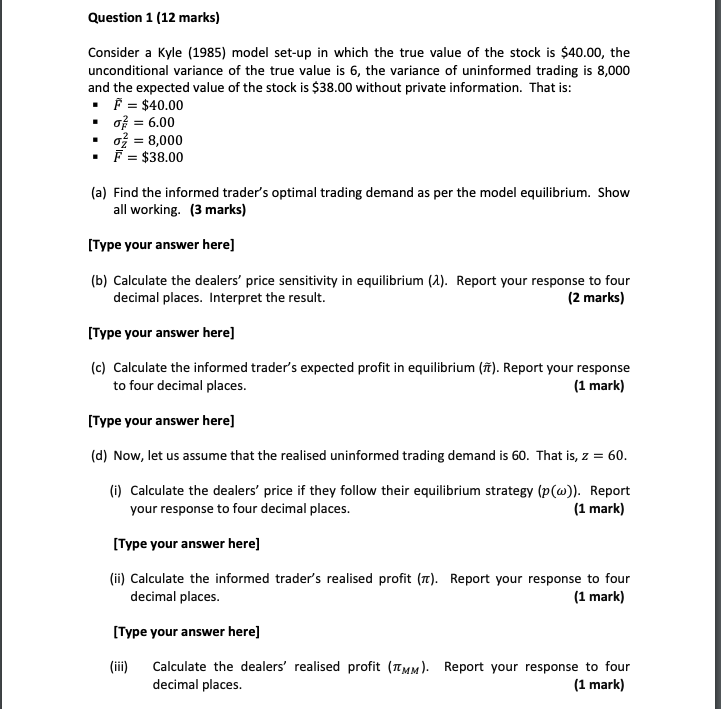

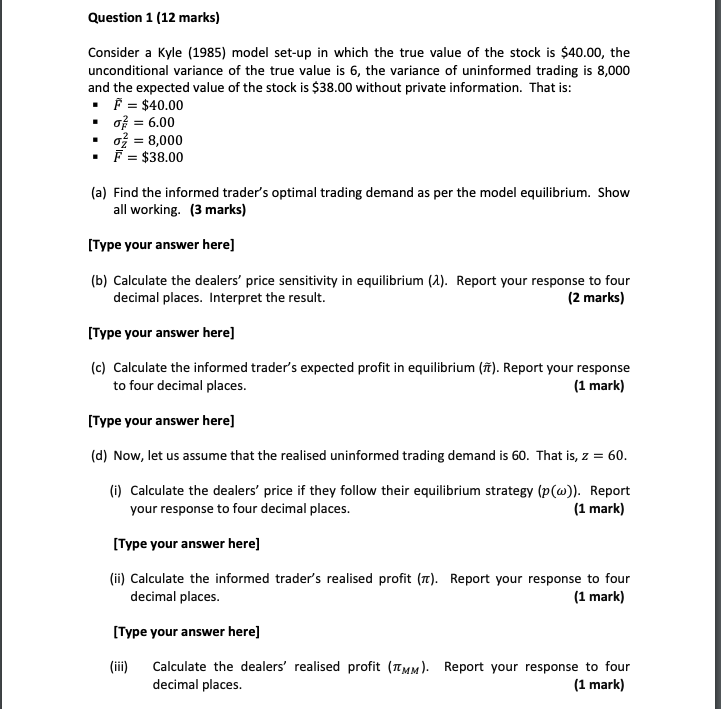

Question 1 (12 marks) Consider a Kyle (1985) model set-up in which the true value of the stock is $40.00, the unconditional variance of the true value is 6, the variance of uninformed trading is 8,000 and the expected value of the stock is $38.00 without private information. That is: . F = $40.00 o = 6.00 . o = 8,000 + = $38.00 (a) Find the informed trader's optimal trading demand as per the model equilibrium. Show all working. (3 marks) [Type your answer here) (b) Calculate the dealers' price sensitivity in equilibrium (1). Report your response to four decimal places. Interpret the result. (2 marks) [Type your answer here) (c) Calculate the informed trader's expected profit in equilibrium (). Report your response to four decimal places. (1 mark) [Type your answer here] (d) Now, let us assume that the realised uninformed trading demand is 60. That is, z = 60. (i) Calculate the dealers' price if they follow their equilibrium strategy (p(w)). Report your response to four decimal places. (1 mark) [Type your answer here) (ii) Calculate the informed trader's realised profit (Tt). Report your response to four decimal places. (1 mark) [Type your answer here) (iii) Calculate the dealers' realised profit (TTMM). Report your response to four decimal places. (1 mark) Question 1 (12 marks) Consider a Kyle (1985) model set-up in which the true value of the stock is $40.00, the unconditional variance of the true value is 6, the variance of uninformed trading is 8,000 and the expected value of the stock is $38.00 without private information. That is: . F = $40.00 o = 6.00 . o = 8,000 + = $38.00 (a) Find the informed trader's optimal trading demand as per the model equilibrium. Show all working. (3 marks) [Type your answer here) (b) Calculate the dealers' price sensitivity in equilibrium (1). Report your response to four decimal places. Interpret the result. (2 marks) [Type your answer here) (c) Calculate the informed trader's expected profit in equilibrium (). Report your response to four decimal places. (1 mark) [Type your answer here] (d) Now, let us assume that the realised uninformed trading demand is 60. That is, z = 60. (i) Calculate the dealers' price if they follow their equilibrium strategy (p(w)). Report your response to four decimal places. (1 mark) [Type your answer here) (ii) Calculate the informed trader's realised profit (Tt). Report your response to four decimal places. (1 mark) [Type your answer here) (iii) Calculate the dealers' realised profit (TTMM). Report your response to four decimal places. (1 mark)