Answered step by step

Verified Expert Solution

Question

1 Approved Answer

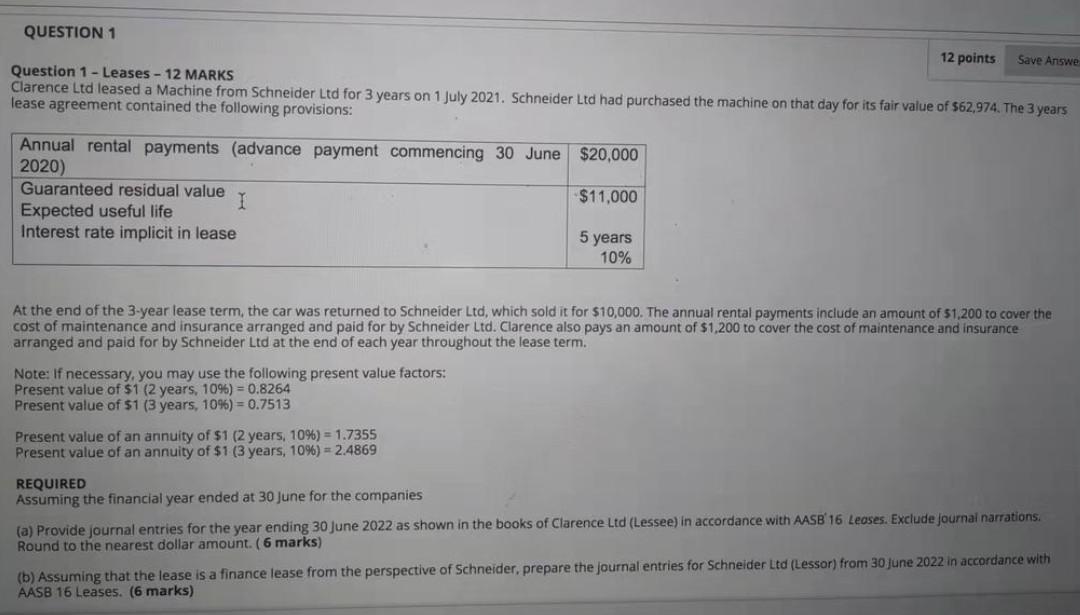

QUESTION 1 12 points Save Answe Question 1 - Leases - 12 MARKS Clarence Ltd leased a Machine from Schneider Ltd for 3 years on

QUESTION 1 12 points Save Answe Question 1 - Leases - 12 MARKS Clarence Ltd leased a Machine from Schneider Ltd for 3 years on 1 July 2021. Schneider Ltd had purchased the machine on that day for its fair value of $62,974. The 3 years lease agreement contained the following provisions: Annual rental payments (advance payment commencing 30 June $20,000 2020) Guaranteed residual value 1 $11,000 Expected useful life Interest rate implicit in lease 10% 5 years At the end of the 3-year lease term, the car was returned to Schneider Ltd, which sold it for $10,000. The annual rental payments include an amount of 51,200 to cover the cost of maintenance and insurance arranged and paid for by Schneider Ltd. Clarence also pays an amount of $1,200 to cover the cost of maintenance and insurance arranged and paid for by Schneider Ltd at the end of each year throughout the lease term. Note: If necessary, you may use the following present value factors: Present value of $1 (2 years, 1096) = 0.8264 Present value of $1 (3 years, 1096) = 0.7513 Present value of an annuity of $1 (2 years, 10%) = 1.7355 Present value of an annuity of $1 (3 years, 10%) = 2.4869 REQUIRED Assuming the financial year ended at 30 June for the companies (a) Provide journal entries for the year ending 30 June 2022 as shown in the books of Clarence Ltd (Lessee) in accordance with AASB'16 Leases. Exclude journal narrations. Round to the nearest dollar amount. (6 marks) (b) Assuming that the lease is a finance lease from the perspective of Schneider, prepare the journal entries for Schneider Ltd (Lessor) from 30 June 2022 in accordance with AASB 16 Leases. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started