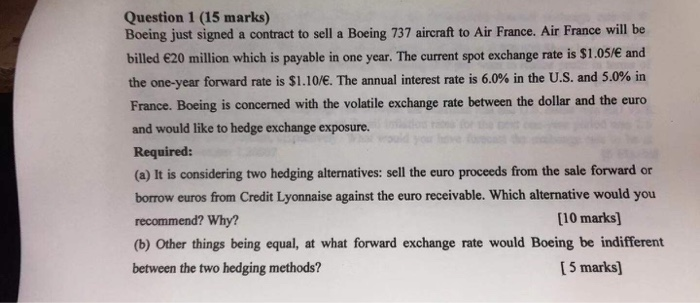

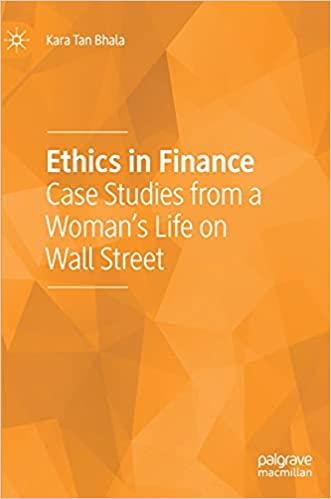

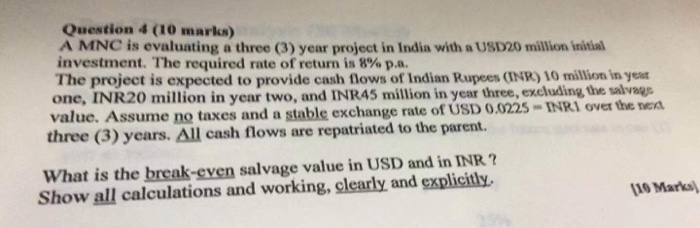

Question 1 (15 marks) Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million which is payable in one year. The current spot exchange rate is $1.05/ and the one-year forward rate is $1.10/. The annual interest rate is 6.0% in the U.S. and 5.0% in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. Required: (a) It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Credit Lyonnaise against the euro receivable. Which alternative would you recommend? Why? [10 marks] (b) Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods? [ 5 marks) Question 4 (10 marks) A MNC is evaluating a three (3) year project in India with a USD20 million initial investment. The required rate of return is 8% pa The project is expected to provide cash flows of Indian Rupees (INR) 10 million in your one, INR20 million in year two, and INR45 million in year three, excluding the salvage value. Assume no taxes and a stable exchange rate of USD 0.0225 - INRI over the sea three (3) years. All cash flows are repatriated to the parent. What is the break-even salvage value in USD and in INR? Show all calculations and working, clearly and explicitly. 110 Marka Question 1 (15 marks) Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million which is payable in one year. The current spot exchange rate is $1.05/ and the one-year forward rate is $1.10/. The annual interest rate is 6.0% in the U.S. and 5.0% in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. Required: (a) It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Credit Lyonnaise against the euro receivable. Which alternative would you recommend? Why? [10 marks] (b) Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods? [ 5 marks) Question 4 (10 marks) A MNC is evaluating a three (3) year project in India with a USD20 million initial investment. The required rate of return is 8% pa The project is expected to provide cash flows of Indian Rupees (INR) 10 million in your one, INR20 million in year two, and INR45 million in year three, excluding the salvage value. Assume no taxes and a stable exchange rate of USD 0.0225 - INRI over the sea three (3) years. All cash flows are repatriated to the parent. What is the break-even salvage value in USD and in INR? Show all calculations and working, clearly and explicitly. 110 Marka