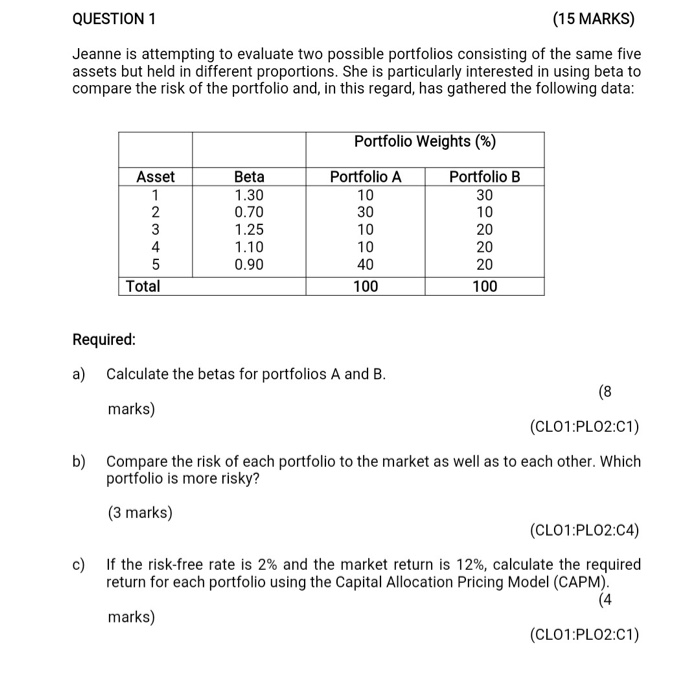

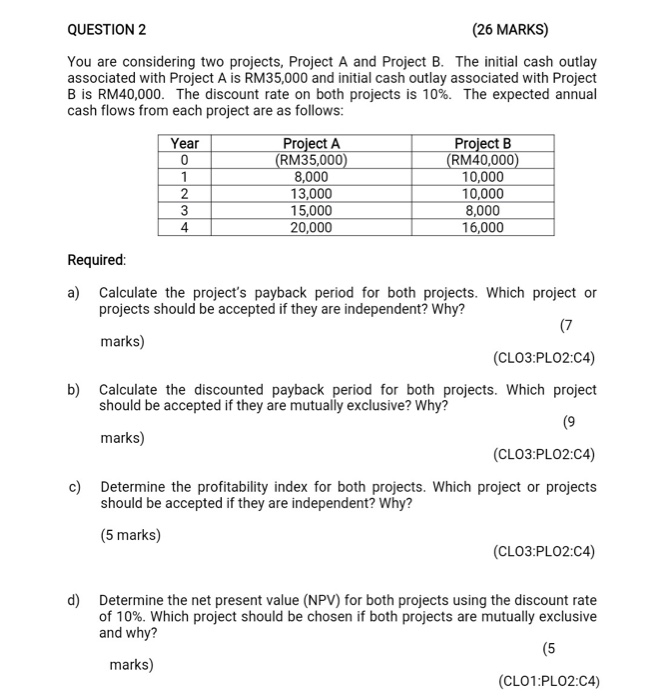

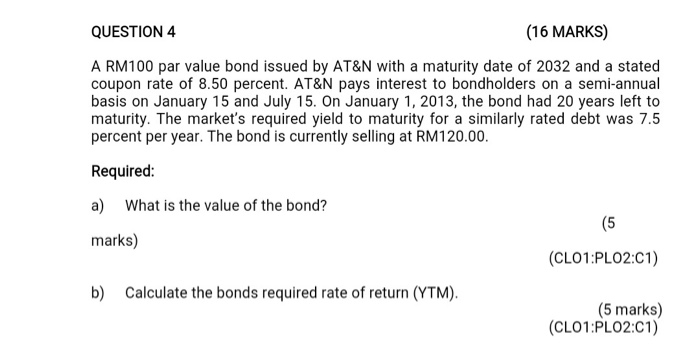

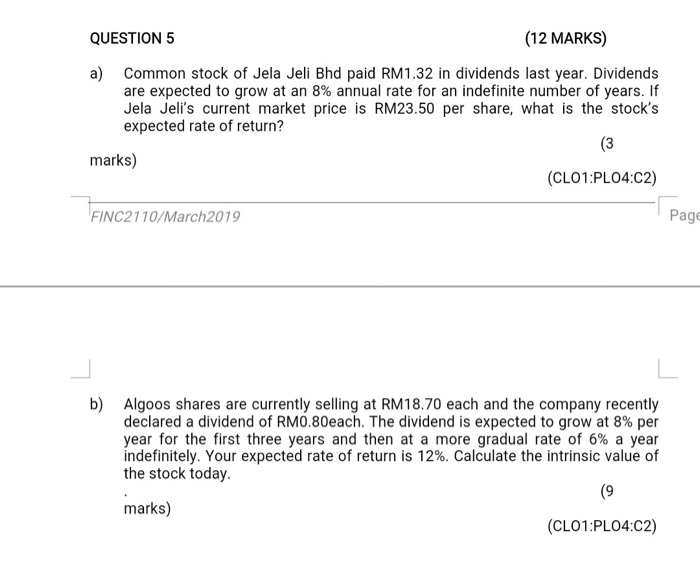

QUESTION 1 (15 MARKS) Jeanne is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. She is particularly interested in using beta to compare the risk of the portfolio and, in this regard, has gathered the following data: Portfolio Weights (%) Asset Beta Portfolio Portfolio B 1.30 0.70 1.25 1.10 0.90 20 NO 10 10 40 Total 100 100 Required: a) Calculate the betas for portfolios A and B. marks) (CL01:PLO2:01) Compare the risk of each portfolio to the market as well as to each other. Which portfolio is more risky? b) (3 marks) (CL01:PLO2:04) c) If the risk-free rate is 2% and the market return is 12%, calculate the required return for each portfolio using the Capital Allocation Pricing Model (CAPM). marks) (CLO1:PLO2:01) QUESTION 2 (26 MARKS) You are considering two projects, Project A and Project B. The initial cash outlay associated with Project A is RM35,000 and initial cash outlay associated with Project B is RM40,000. The discount rate on both projects is 10%. The expected annual cash flows from each project are as follows: Year 0 - Project A (RM35,000 8,000 13,000 15,000 20,000 Project B (RM40,000) 10,000 10,000 8,000 16,000 + Required: a) Calculate the project's payback period for both projects. Which project or projects should be accepted if they are independent? Why? marks) (CL03:PL02:04) b) Calculate the discounted payback period for both projects. Which project should be accepted if they are mutually exclusive? Why? marks) (CLO3:PLO2:04) c) Determine the profitability index for both projects. Which project or projects should be accepted if they are independent? Why? (5 marks) (CLO3:PLO2:04) d) Determine the net present value (NPV) for both projects using the discount rate of 10%. Which project should be chosen if both projects are mutually exclusive and why? (5 marks) (CL01:PLO2:C4) QUESTION 4 (16 MARKS) A RM100 par value bond issued by AT&N with a maturity date of 2032 and a stated coupon rate of 8.50 percent. AT&N pays interest to bondholders on a semi-annual basis on January 15 and July 15. On January 1, 2013, the bond had 20 years left to maturity. The market's required yield to maturity for a similarly rated debt was 7.5 percent per year. The bond is currently selling at RM120.00. Required: a) What is the value of the bond? marks) (CL01:PL02:01) b) Calculate the bonds required rate of return (YTM). (5 marks) (CLO1:PLO2:C1) QUESTION 5 (12 MARKS) a) Common stock of Jela Jeli Bhd paid RM1.32 in dividends last year. Dividends are expected to grow at an 8% annual rate for an indefinite number of years. If Jela Jeli's current market price is RM23.50 per share, what is the stock's expected rate of return? marks) (CLO1:PL04:02) FINC2110/March 2019 Page b) Algoos shares are currently selling at RM18.70 each and the company recently declared a dividend of RM0.80each. The dividend is expected to grow at 8% per year for the first three years and then at a more gradual rate of 6% a year indefinitely. Your expected rate of return is 12%. Calculate the intrinsic value of the stock today. marks) (CLO1:PL04:02)