Answered step by step

Verified Expert Solution

Question

1 Approved Answer

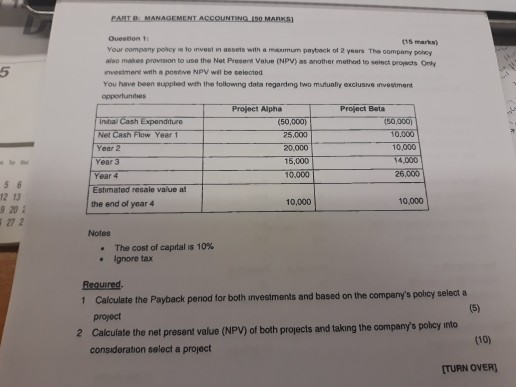

Question 1 (15 marks) Your company poloy to invest sn assets with a marmun payback 012 years Tho company poley aiso makes provision to use

Question 1 (15 marks) Your company poloy to invest sn assets with a marmun payback 012 years Tho company poley aiso makes provision to use the Net Present Value (NPV) as another method to salech proyects Only 5 nvestment with a postve NPV will be seleoted You heve been suppled wth the followng data regarding two mutualy oxclusve investment opportunses Project Alpha Project Beta inhal Cash Expenditure (50,0001 (50,000) Net Cash Flow Year 1 25,000 10,000 Year 2 10,000 20,000 14,000 Year 3 16,000 26,000 10,000 Year 4 Estmated resale value at 12 13 10,000 10,000 the end of year 4 9 20 2 27 2 Notes The cost of capital is 10% Ignore tax . . Reguired. 1 Calculate the Payback penod tor both investments and based on the company's polcy select a project 2 Calculate the net present value (NPV) of both projects and taking the company's polcy into (10) consideration select a project TURN OVER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started