Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following financial information relates to Bunney Ltd. All sales and purchases of inventory at Bunney are on credit. There were no non-current asset

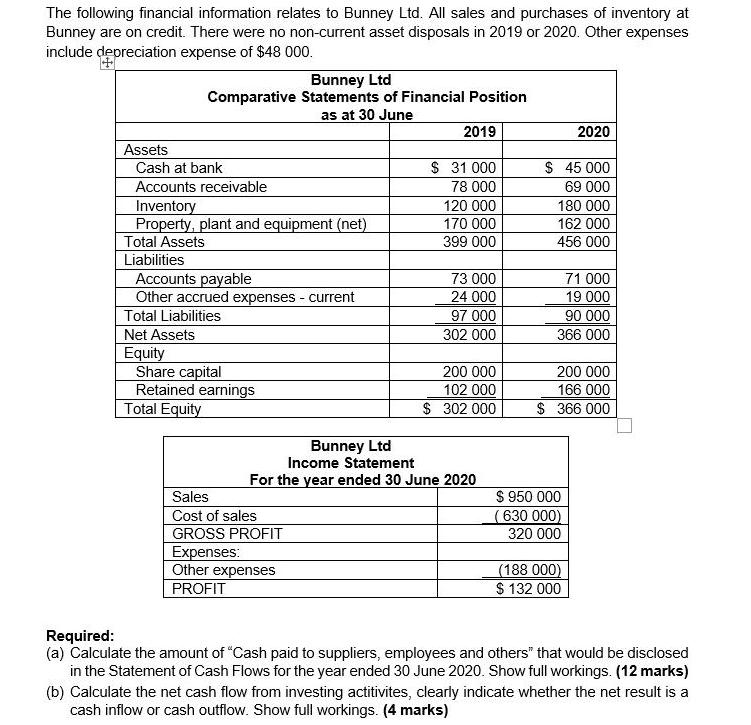

The following financial information relates to Bunney Ltd. All sales and purchases of inventory at Bunney are on credit. There were no non-current asset disposals in 2019 or 2020. Other expenses include depreciation expense of $48 000. Bunney Ltd Comparative Statements of Financial Position as at 30 June 2019 2020 Assets Cash at bank Accounts receivable Inventory Property, plant and equipment (net) Total Assets $ 31 000 $ 45 000 78 000 69 000 120 000 170 000 399 000 180 000 162 000 456 000 Liabilities Accounts payable Other accrued expenses - current Total Liabilities Net Assets Equity Share capital Retained earnings Total Equity 73 000 71 000 19 000 90 000 366 000 24 000 97 000 302 000 200 000 166 000 $ 366 000 200 000 102 000 $ 302 000 Bunney Ltd Income Statement For the year ended 30 June 2020 Sales Cost of sales GROSS PROFIT Expenses: Other expenses PROFIT $ 950 000 (630 000) 320 000 (188 000) $ 132 000 Required: (a) Calculate the amount of "Cash paid to suppliers, employees and others" that would be disclosed in the Statement of Cash Flows for the year ended 30 June 2020. Show full workings. (12 marks) (b) Calculate the net cash flow from investing actitivites, clearly indicate whether the net result is a cash inflow or cash outflow. Show full workings. (4 marks)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Req A Cash Paid to SupplierWN 2 Cash Paid for E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started