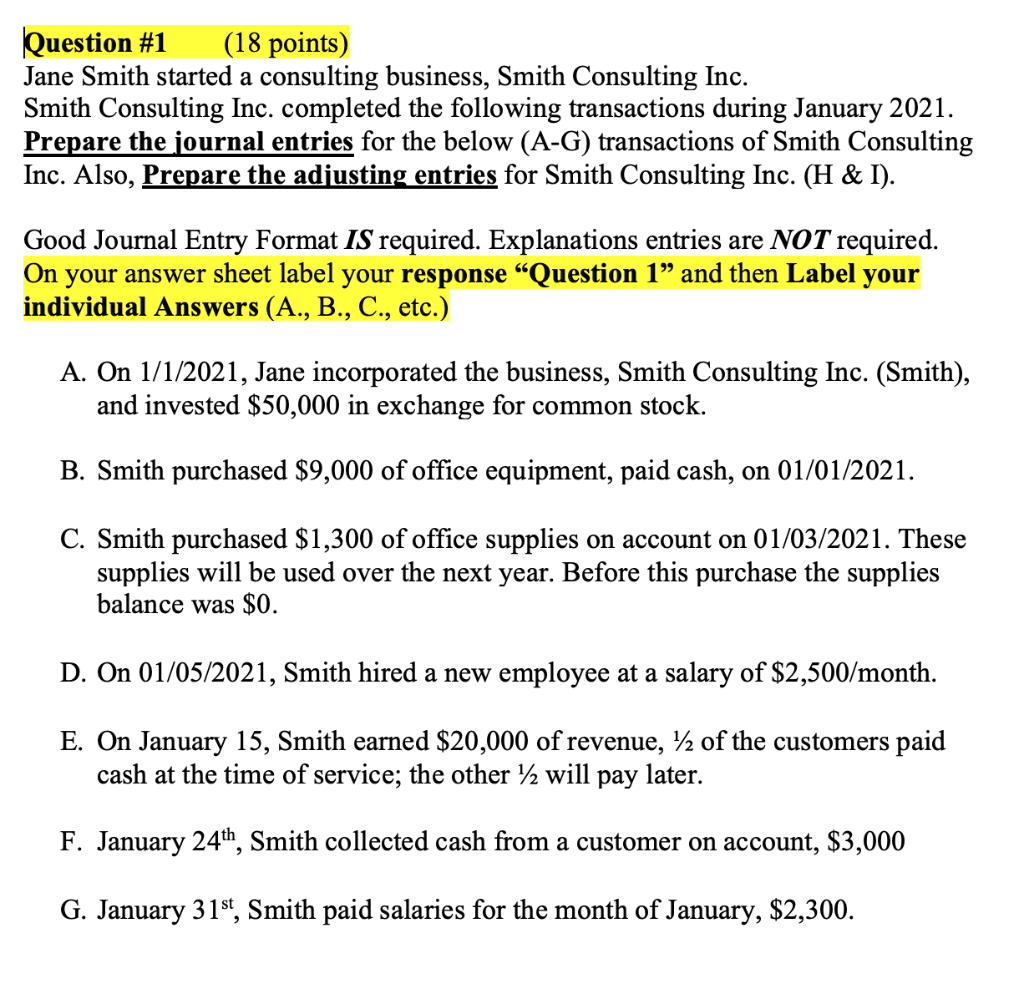

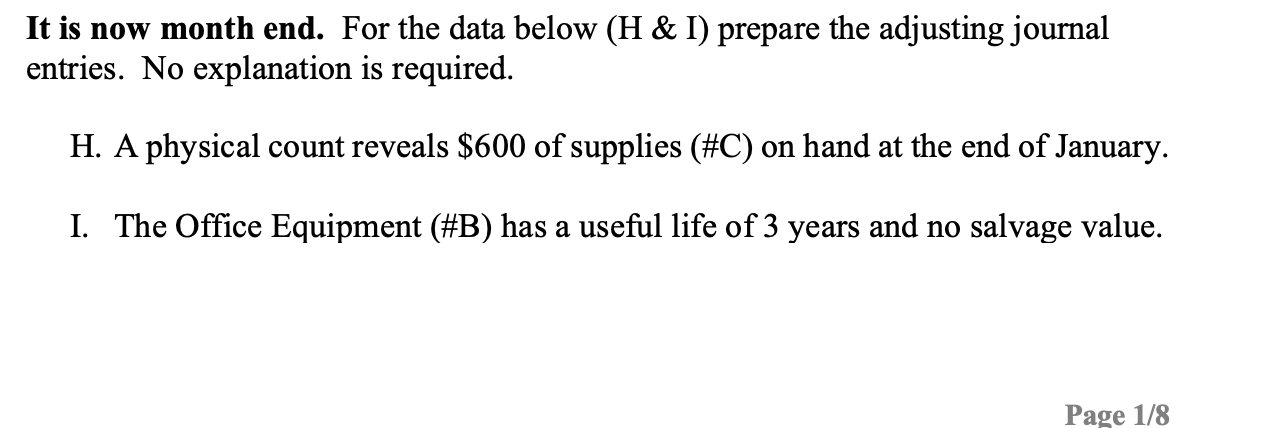

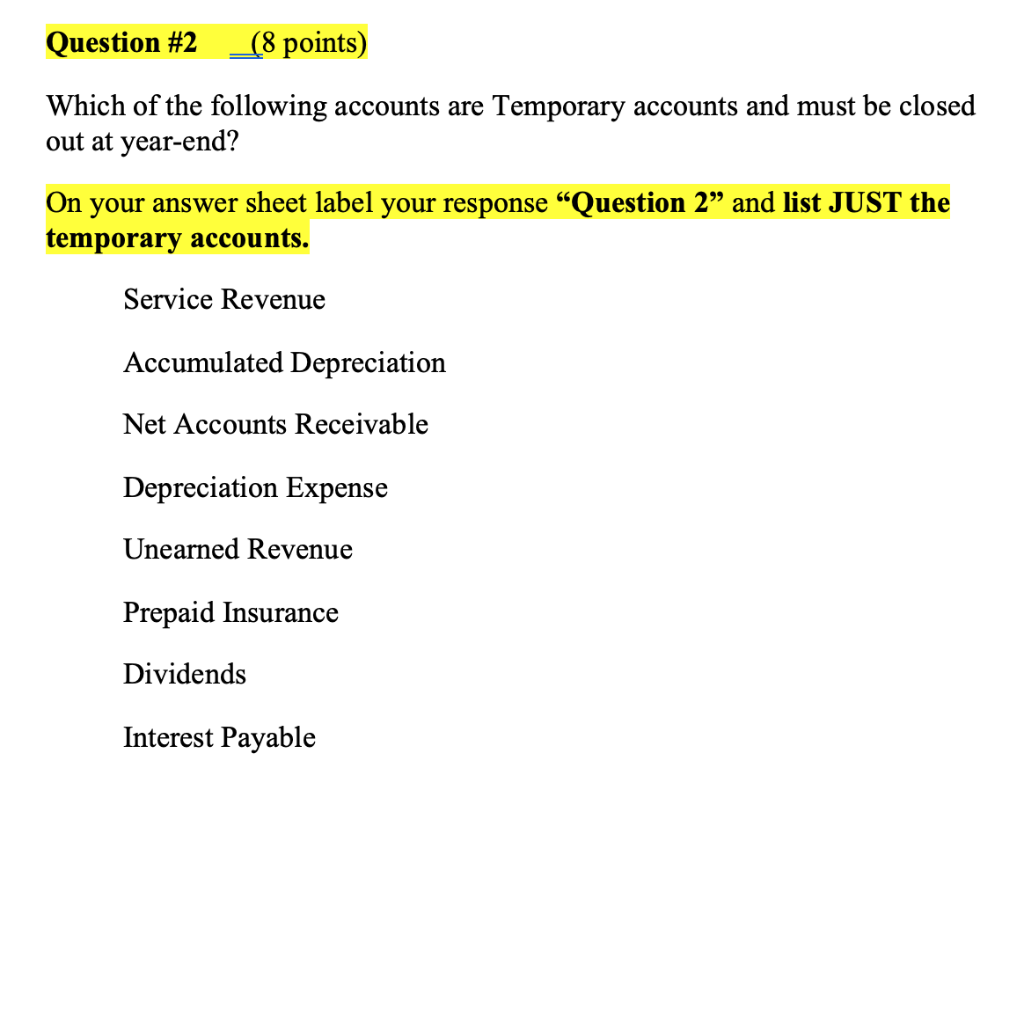

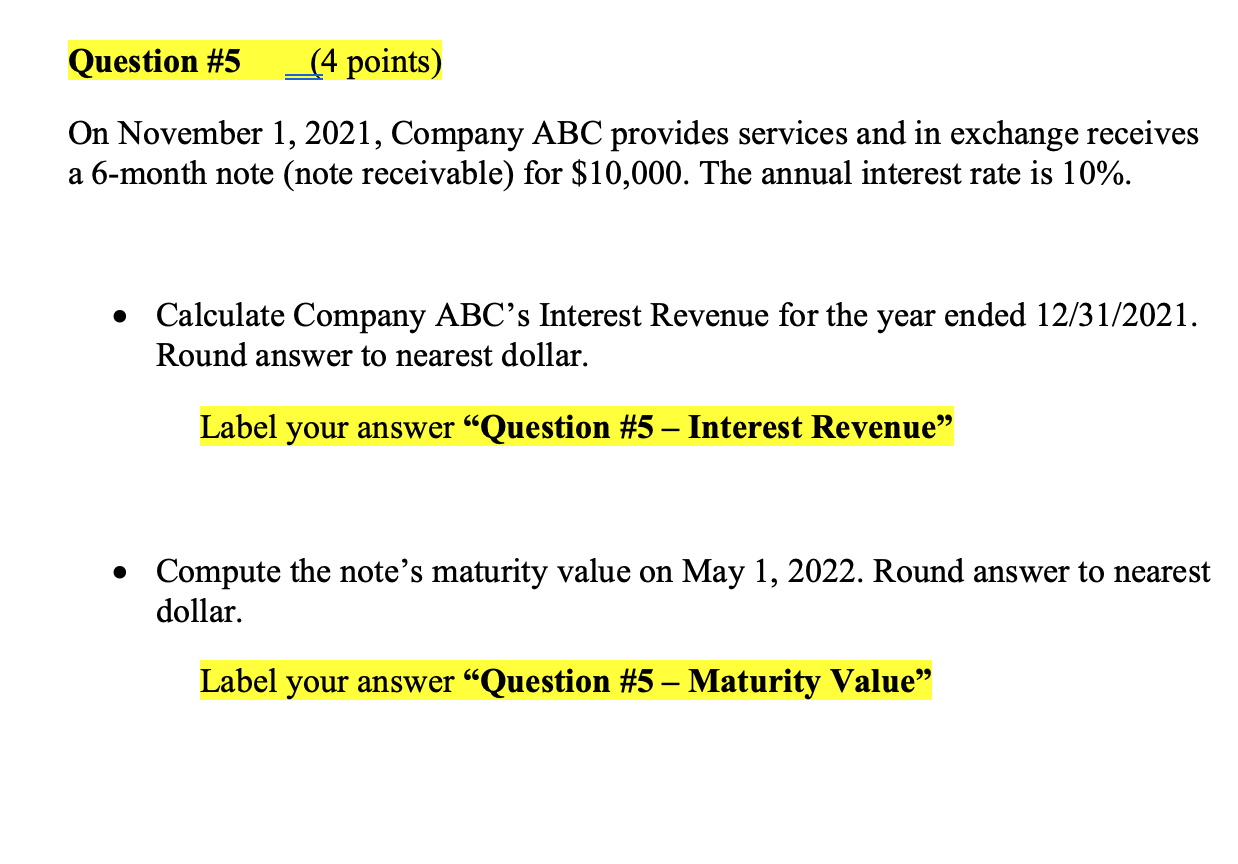

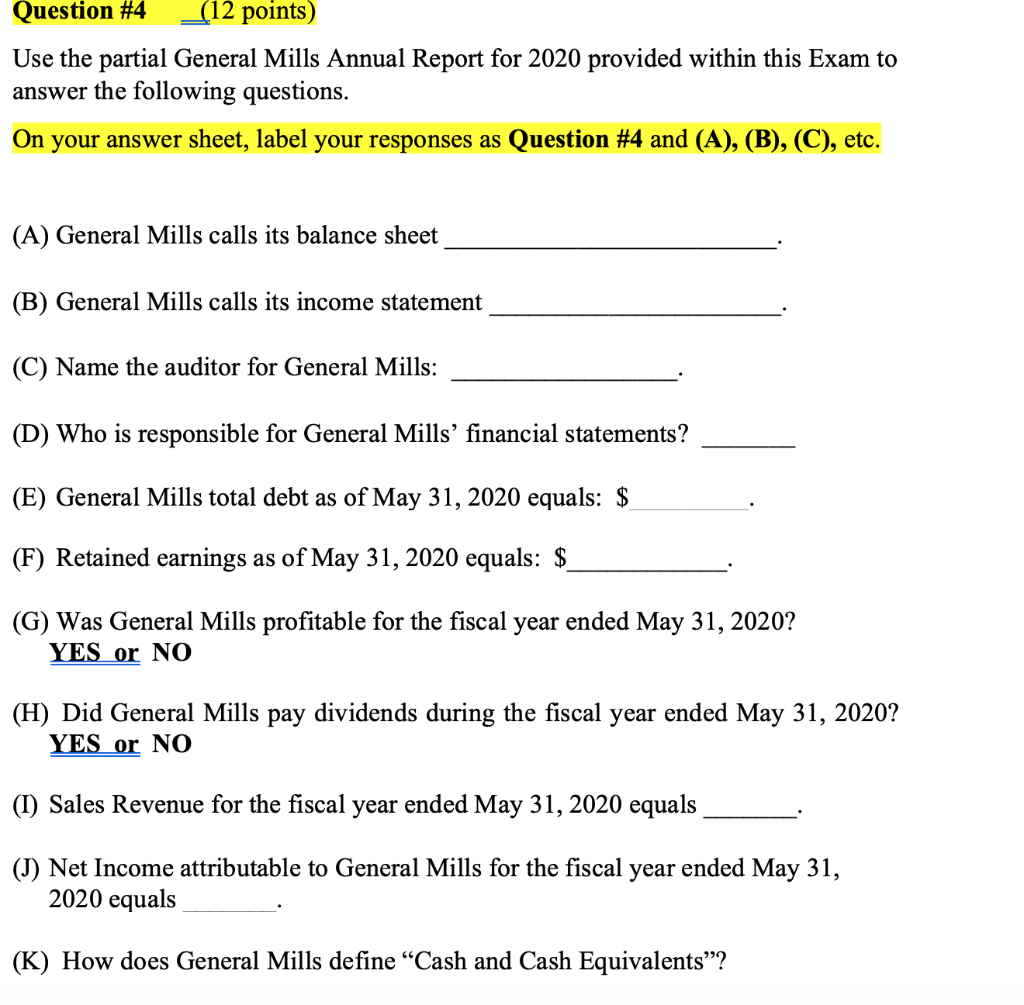

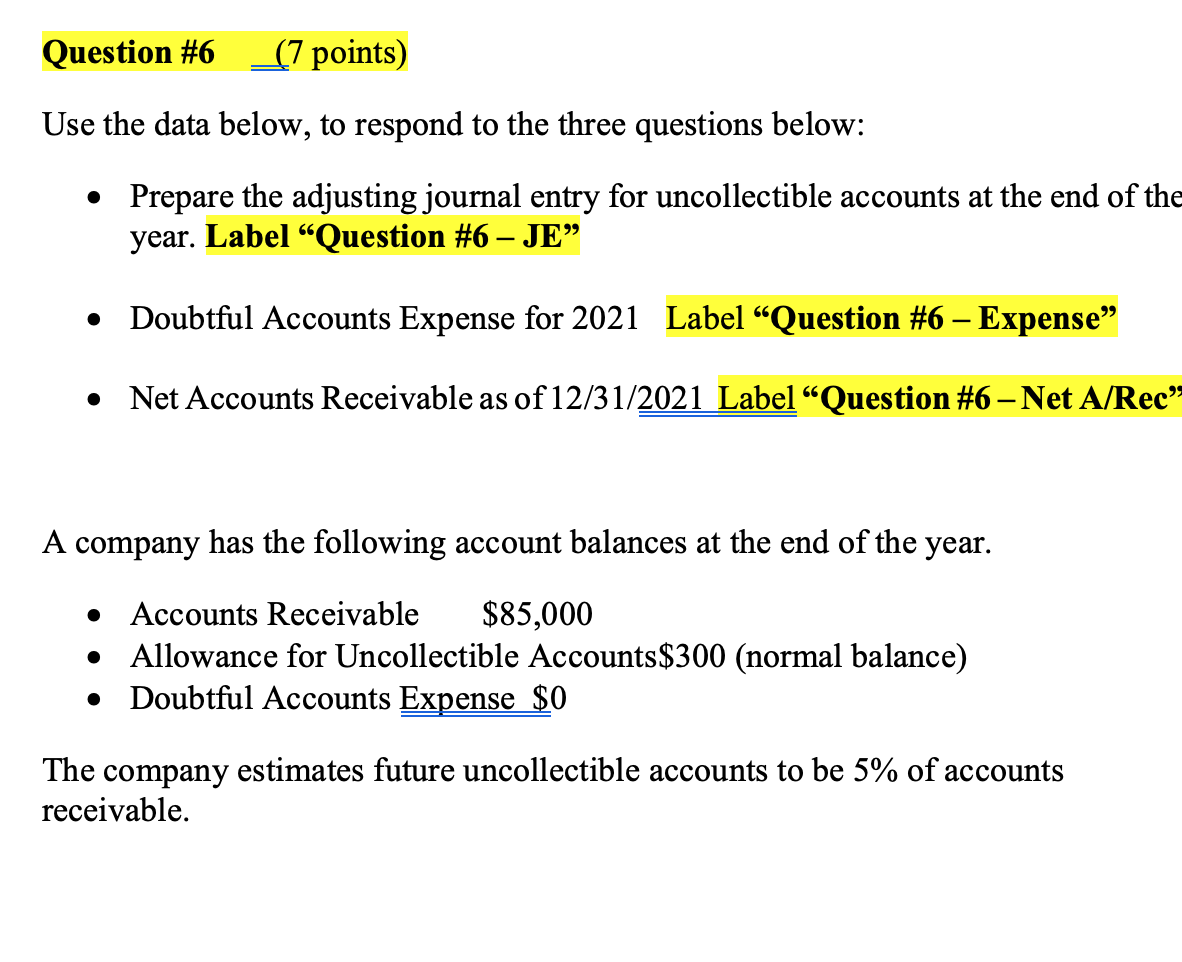

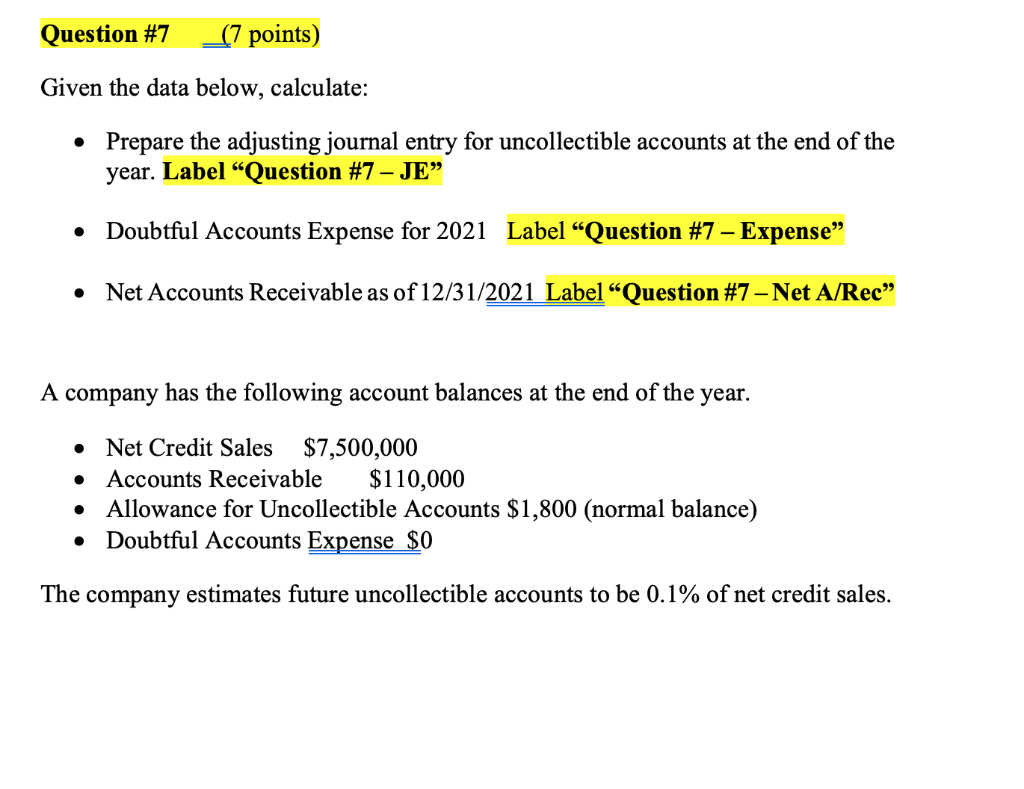

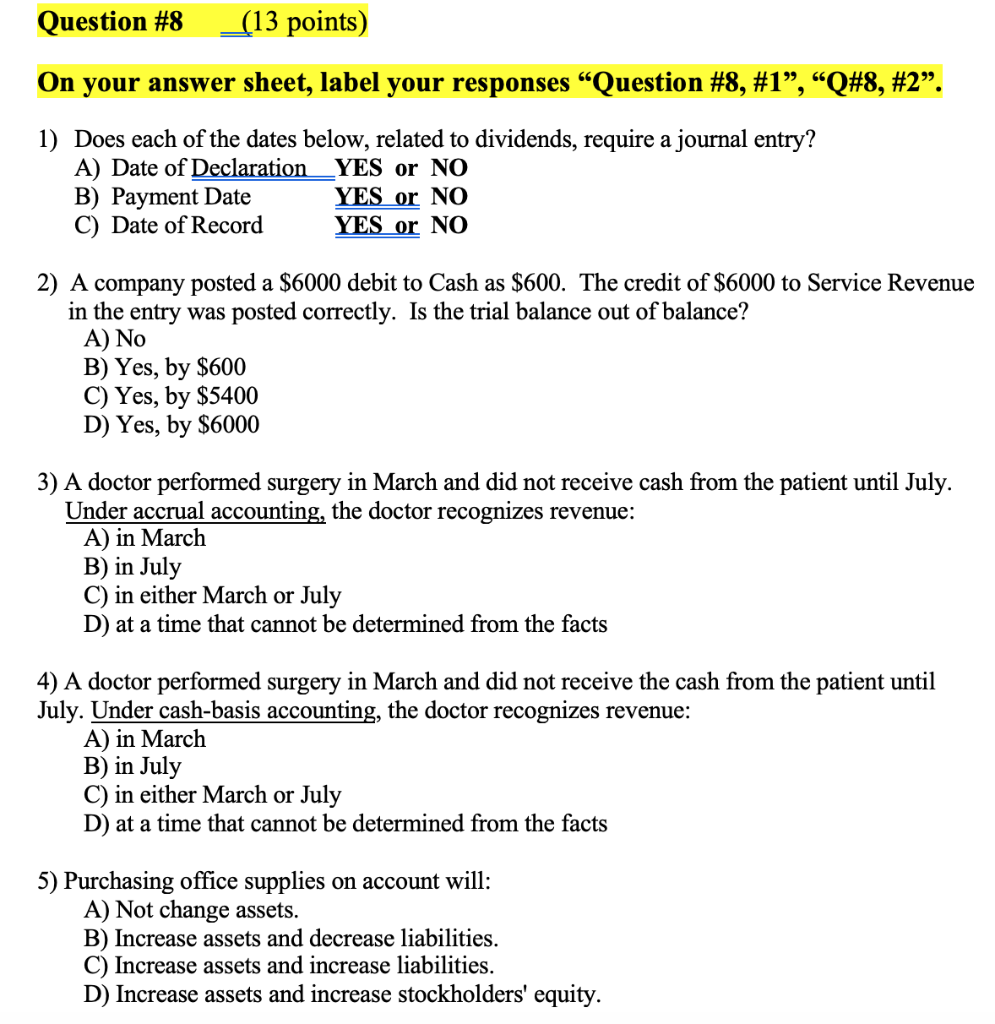

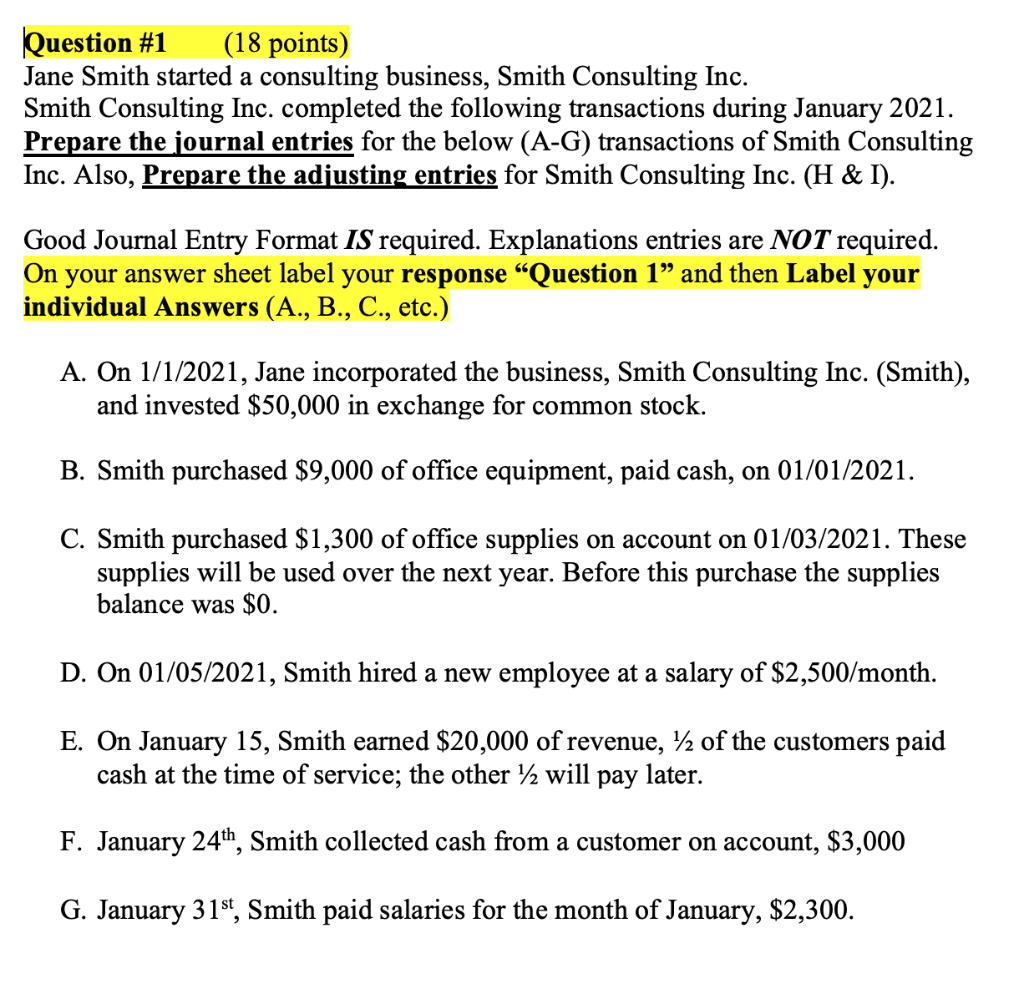

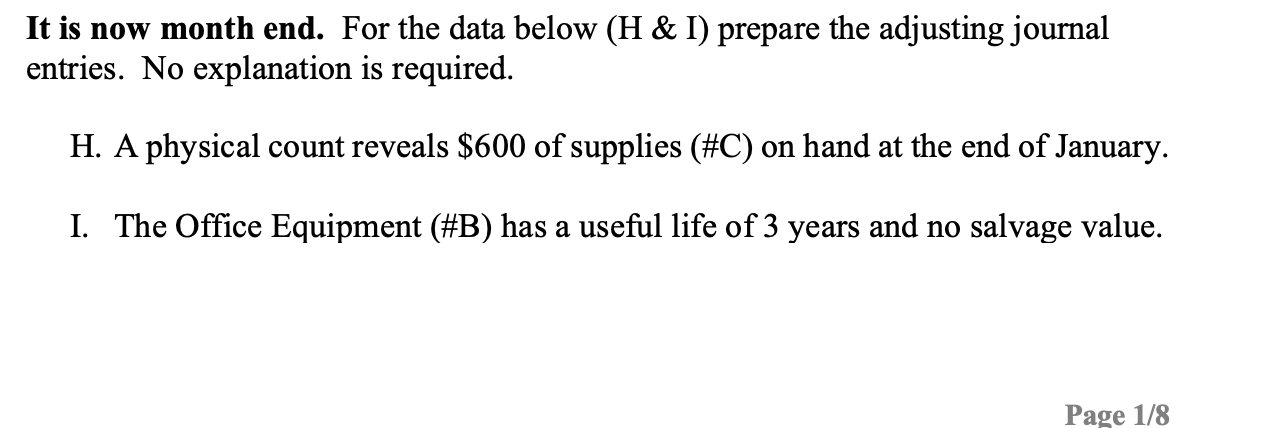

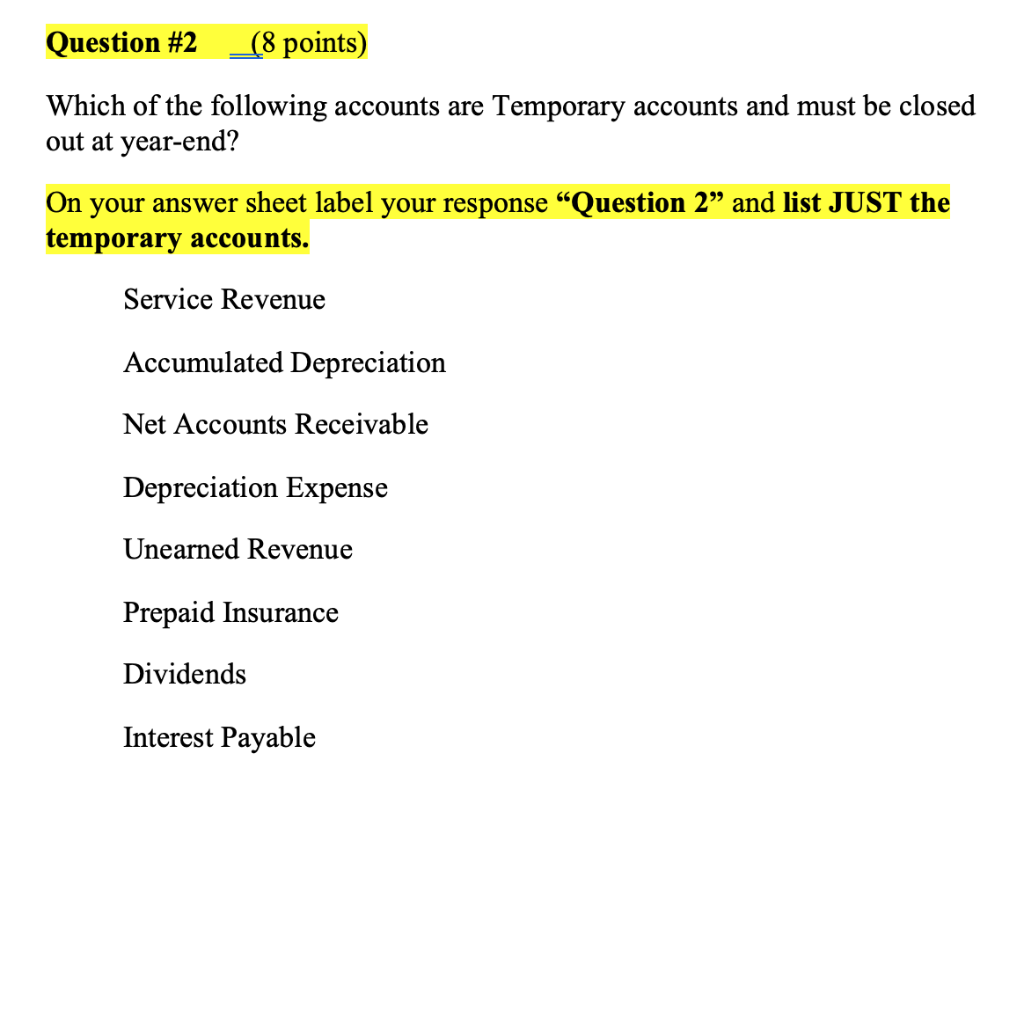

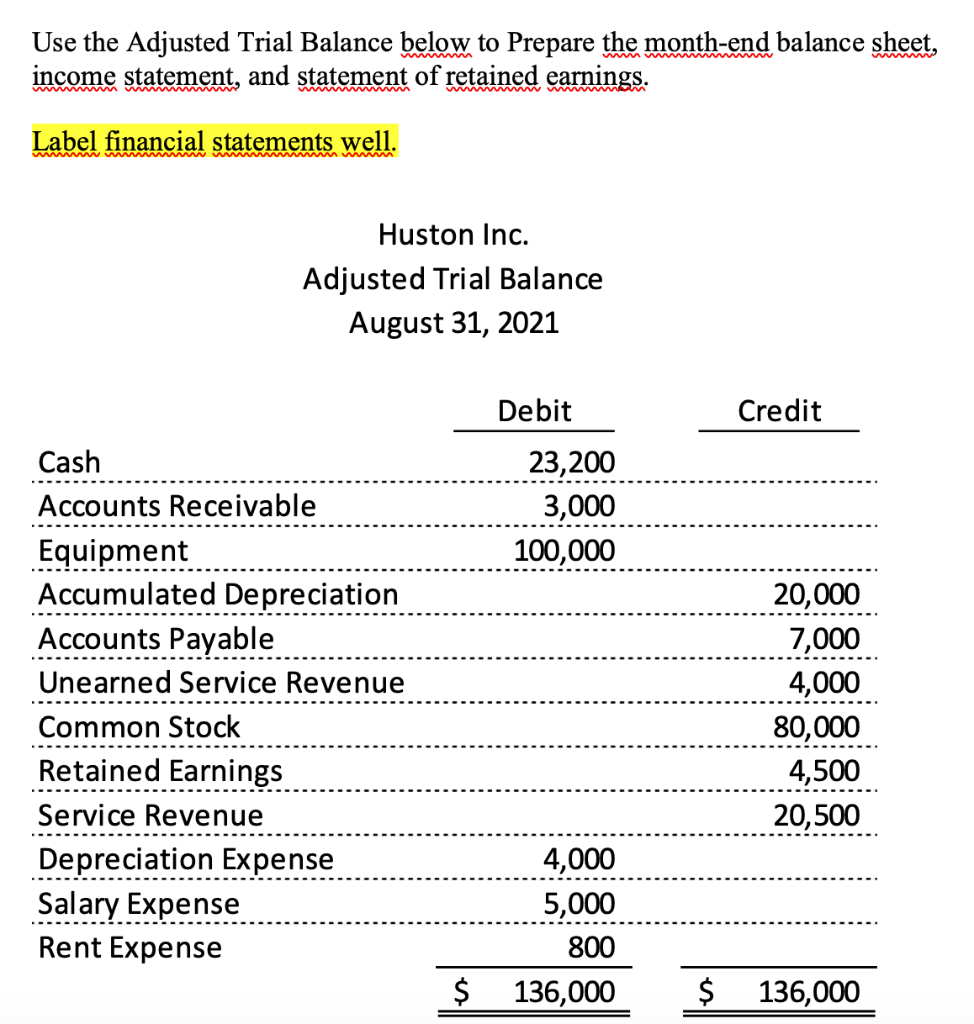

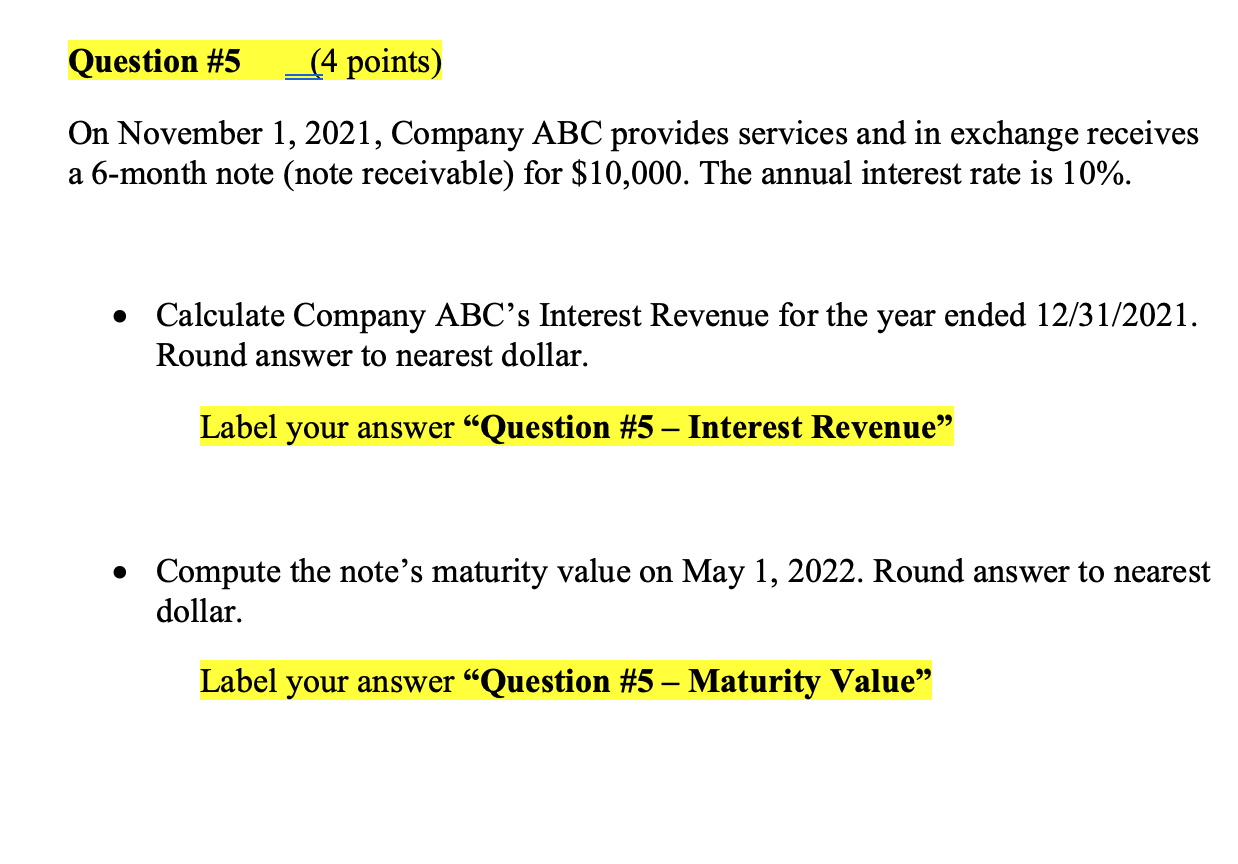

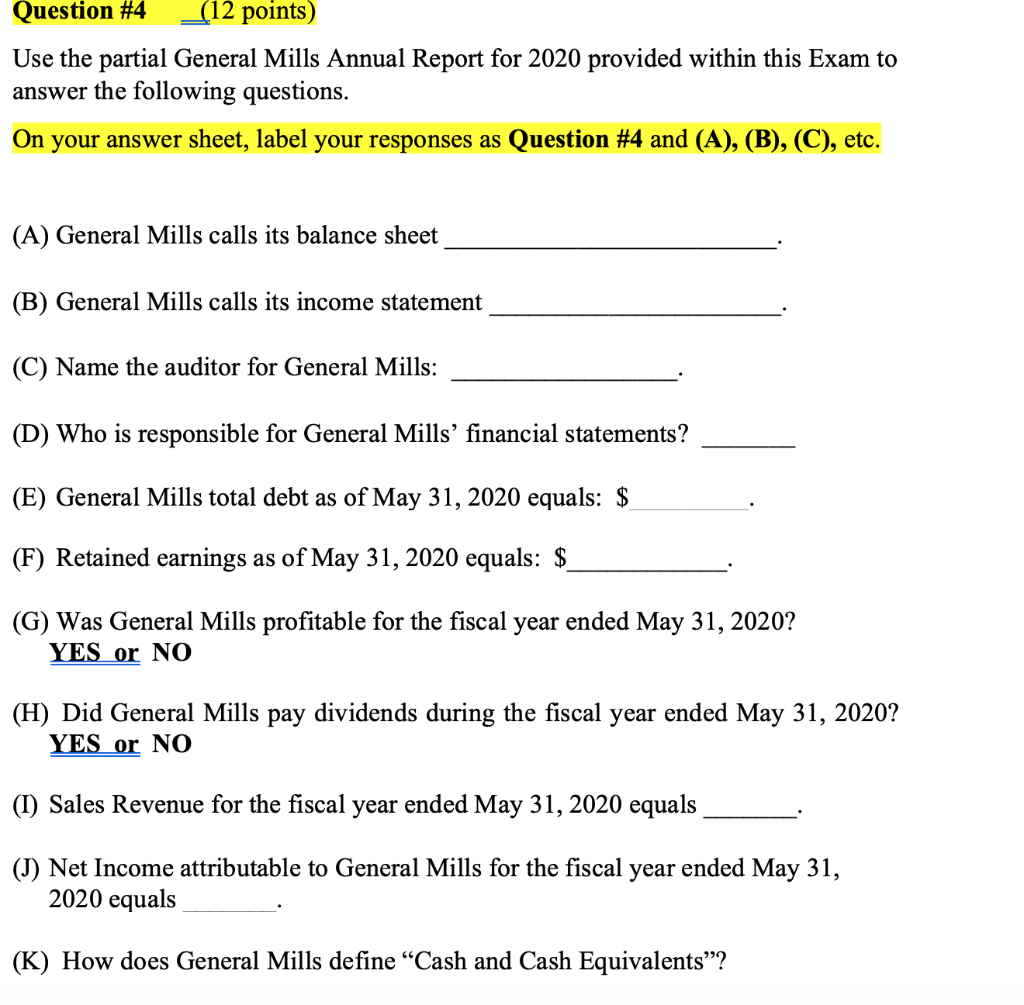

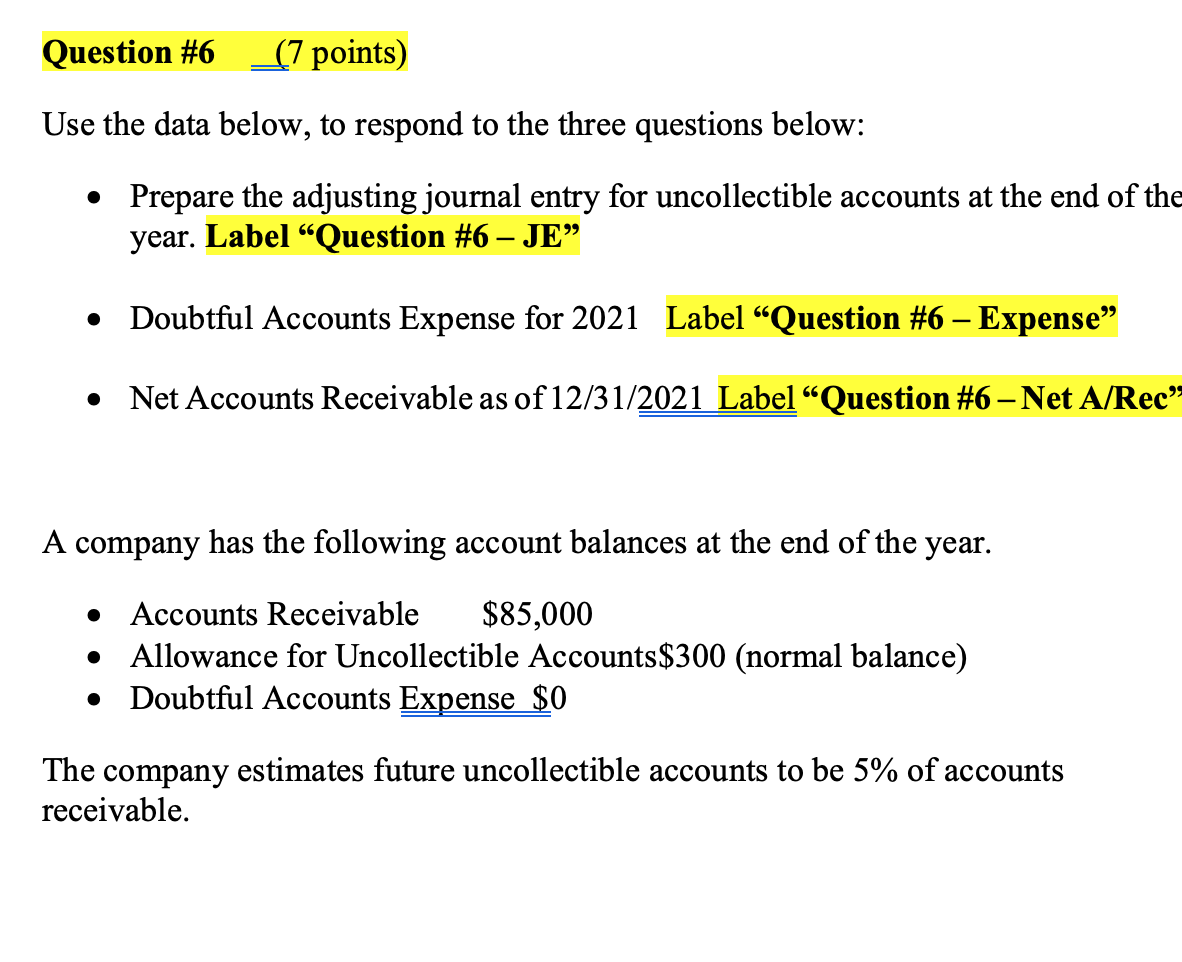

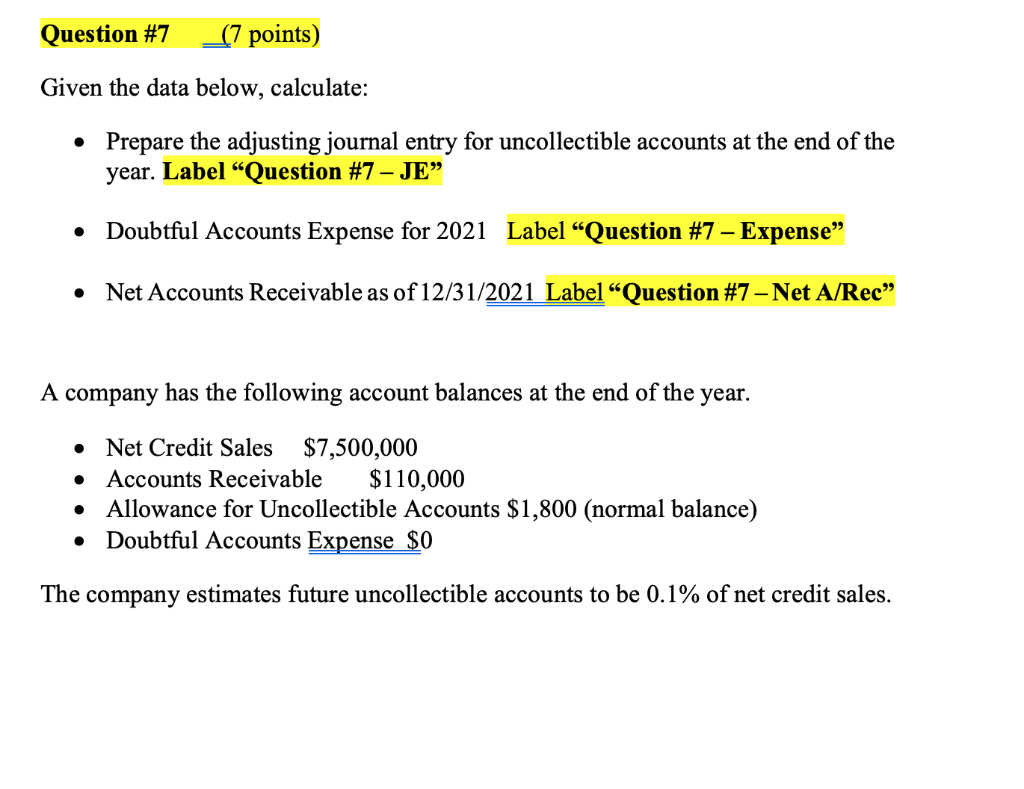

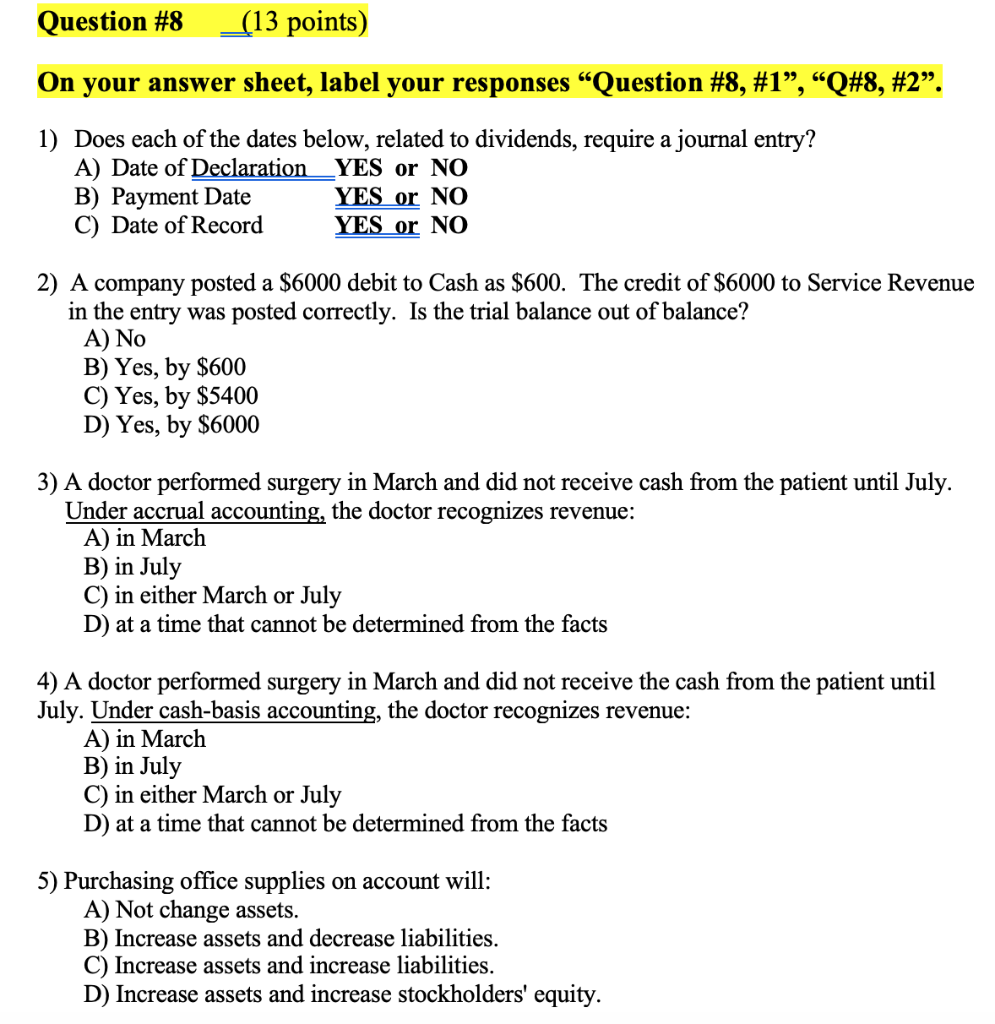

Question #1 (18 points) Jane Smith started a consulting business, Smith Consulting Inc. Smith Consulting Inc. completed the following transactions during January 2021. Prepare the journal entries for the below (A-G) transactions of Smith Consulting Inc. Also, Prepare the adjusting entries for Smith Consulting Inc. (H & I). Good Journal Entry Format IS required. Explanations entries are NOT required. On your answer sheet label your response Question 1 and then Label your individual Answers (A., B., C., etc.) A. On 1/1/2021, Jane incorporated the business, Smith Consulting Inc. (Smith), and invested $50,000 in exchange for common stock. B. Smith purchased $9,000 of office equipment, paid cash, on 01/01/2021. C. Smith purchased $1,300 of office supplies on account on 01/03/2021. These supplies will be used over the next year. Before this purchase the supplies balance was $0. D. On 01/05/2021, Smith hired a new employee at a salary of $2,500/month. E. On January 15, Smith earned $20,000 of revenue, 12 of the customers paid cash at the time of service; the other 12 will pay later. F. January 24th, Smith collected cash from a customer on account, $3,000 G. January 31st, Smith paid salaries for the month of January, $2,300. It is now month end. For the data below (H & I) prepare the adjusting journal entries. No explanation is required. H. A physical count reveals $600 of supplies (#C) on hand at the end of January. I. The Office Equipment (#B) has a useful life of 3 years and no salvage value. Page 1/8 Question #2 (8 points) Which of the following accounts are Temporary accounts and must be closed out at year-end? On your answer sheet label your response Question 2 and list JUST the temporary accounts. Service Revenue Accumulated Depreciation Net Accounts Receivable Depreciation Expense Unearned Revenue Prepaid Insurance Dividends Interest Payable Use the Adjusted Trial Balance below to Prepare the month-end balance sheet, income statement, and statement of retained earnings. Label financial statements well. WWW Huston Inc. Adjusted Trial Balance August 31, 2021 Debit Credit 23,200 3,000 100,000 Cash Accounts Receivable Equipment Accumulated Depreciation Accounts Payable Unearned Service Revenue Common Stock Retained Earnings Service Revenue Depreciation Expense Salary Expense Rent Expense 20,000 7,000 4,000 80,000 4,500 20,500 4,000 5,000 800 136,000 $ $ 136,000 Question #5 (4 points) On November 1, 2021, Company ABC provides services and in exchange receives a 6-month note (note receivable) for $10,000. The annual interest rate is 10%. Calculate Company ABC's Interest Revenue for the year ended 12/31/2021. Round answer to nearest dollar. Label your answer Question #5 Interest Revenue . Compute the note's maturity value on May 1, 2022. Round answer to nearest dollar. Label your answer Question #5 Maturity Value Question #4 _(12 points) Use the partial General Mills Annual Report for 2020 provided within this Exam to answer the following questions. On your answer sheet, label your responses as Question #4 and (A), (B), (C), etc. (A) General Mills calls its balance sheet (B) General Mills calls its income statement (C) Name the auditor for General Mills: (D) Who is responsible for General Mills' financial statements ? (E) General Mills total debt as of May 31, 2020 equals: $ (F) Retained earnings as of May 31, 2020 equals: $ (G) Was General Mills profitable for the fiscal year ended May 31, 2020? YES or NO (H) Did General Mills pay dividends during the fiscal year ended May 31, 2020? YES or NO (1) Sales Revenue for the fiscal year ended May 31, 2020 equals (J) Net Income attributable to General Mills for the fiscal year ended May 31, 2020 equals (K) How does General Mills define Cash and Cash Equivalents? Question #6 (7 points) Use the data below, to respond to the three questions below: Prepare the adjusting journal entry for uncollectible accounts at the end of the year. Label Question #6 JE . Doubtful Accounts Expense for 2021 Label Question #6 Expense . Net Accounts Receivable as of 12/31/2021 Label Question #6 Net A/Rec" A company has the following account balances at the end of the year. . . Accounts Receivable $85,000 Allowance for Uncollectible Accounts$300 (normal balance) Doubtful Accounts Expense $0 . The company estimates future uncollectible accounts to be 5% of accounts receivable. Question #7 _(7 points) Given the data below, calculate: Prepare the adjusting journal entry for uncollectible accounts at the end of the year. Label Question #7 JE . Doubtful Accounts Expense for 2021 Label Question #7 Expense . Net Accounts Receivable as of 12/31/2021 Label Question #7 Net A/Rec A company has the following account balances at the end of the year. Net Credit Sales $7,500,000 Accounts Receivable $110,000 Allowance for Uncollectible Accounts $1,800 (normal balance) Doubtful Accounts Expense $0 The company estimates future uncollectible accounts to be 0.1% of net credit sales. Question #8 _(13 points) On your answer sheet, label your responses Question #8, #1, Q#8, #2. 1) Does each of the dates below, related to dividends, require a journal entry? A) Date of Declaration YES or NO B) Payment Date YES or NO C) Date of Record YES or NO 2) A company posted a $6000 debit to Cash as $600. The credit of $6000 to Service Revenue in the entry was posted correctly. Is the trial balance out of balance? A) No B) Yes, by $600 C) Yes, by $5400 D) Yes, by $6000 3) A doctor performed surgery in March and did not receive cash from the patient until July. Under accrual accounting, the doctor recognizes revenue: A) in March B) in July C) in either March or July D) at a time that cannot be determined from the facts 4) A doctor performed surgery in March and did not receive the cash from the patient until July. Under cash-basis accounting, the doctor recognizes revenue: A) in March B) in July C) in either March or July D) at a time that cannot be determined from the facts 5) Purchasing office supplies on account will: A) Not change assets. B) Increase assets and decrease liabilities. C) Increase assets and increase liabilities. D) Increase assets and increase stockholders' equity. Question #1 (18 points) Jane Smith started a consulting business, Smith Consulting Inc. Smith Consulting Inc. completed the following transactions during January 2021. Prepare the journal entries for the below (A-G) transactions of Smith Consulting Inc. Also, Prepare the adjusting entries for Smith Consulting Inc. (H & I). Good Journal Entry Format IS required. Explanations entries are NOT required. On your answer sheet label your response Question 1 and then Label your individual Answers (A., B., C., etc.) A. On 1/1/2021, Jane incorporated the business, Smith Consulting Inc. (Smith), and invested $50,000 in exchange for common stock. B. Smith purchased $9,000 of office equipment, paid cash, on 01/01/2021. C. Smith purchased $1,300 of office supplies on account on 01/03/2021. These supplies will be used over the next year. Before this purchase the supplies balance was $0. D. On 01/05/2021, Smith hired a new employee at a salary of $2,500/month. E. On January 15, Smith earned $20,000 of revenue, 12 of the customers paid cash at the time of service; the other 12 will pay later. F. January 24th, Smith collected cash from a customer on account, $3,000 G. January 31st, Smith paid salaries for the month of January, $2,300. It is now month end. For the data below (H & I) prepare the adjusting journal entries. No explanation is required. H. A physical count reveals $600 of supplies (#C) on hand at the end of January. I. The Office Equipment (#B) has a useful life of 3 years and no salvage value. Page 1/8 Question #2 (8 points) Which of the following accounts are Temporary accounts and must be closed out at year-end? On your answer sheet label your response Question 2 and list JUST the temporary accounts. Service Revenue Accumulated Depreciation Net Accounts Receivable Depreciation Expense Unearned Revenue Prepaid Insurance Dividends Interest Payable Use the Adjusted Trial Balance below to Prepare the month-end balance sheet, income statement, and statement of retained earnings. Label financial statements well. WWW Huston Inc. Adjusted Trial Balance August 31, 2021 Debit Credit 23,200 3,000 100,000 Cash Accounts Receivable Equipment Accumulated Depreciation Accounts Payable Unearned Service Revenue Common Stock Retained Earnings Service Revenue Depreciation Expense Salary Expense Rent Expense 20,000 7,000 4,000 80,000 4,500 20,500 4,000 5,000 800 136,000 $ $ 136,000 Question #5 (4 points) On November 1, 2021, Company ABC provides services and in exchange receives a 6-month note (note receivable) for $10,000. The annual interest rate is 10%. Calculate Company ABC's Interest Revenue for the year ended 12/31/2021. Round answer to nearest dollar. Label your answer Question #5 Interest Revenue . Compute the note's maturity value on May 1, 2022. Round answer to nearest dollar. Label your answer Question #5 Maturity Value Question #4 _(12 points) Use the partial General Mills Annual Report for 2020 provided within this Exam to answer the following questions. On your answer sheet, label your responses as Question #4 and (A), (B), (C), etc. (A) General Mills calls its balance sheet (B) General Mills calls its income statement (C) Name the auditor for General Mills: (D) Who is responsible for General Mills' financial statements ? (E) General Mills total debt as of May 31, 2020 equals: $ (F) Retained earnings as of May 31, 2020 equals: $ (G) Was General Mills profitable for the fiscal year ended May 31, 2020? YES or NO (H) Did General Mills pay dividends during the fiscal year ended May 31, 2020? YES or NO (1) Sales Revenue for the fiscal year ended May 31, 2020 equals (J) Net Income attributable to General Mills for the fiscal year ended May 31, 2020 equals (K) How does General Mills define Cash and Cash Equivalents? Question #6 (7 points) Use the data below, to respond to the three questions below: Prepare the adjusting journal entry for uncollectible accounts at the end of the year. Label Question #6 JE . Doubtful Accounts Expense for 2021 Label Question #6 Expense . Net Accounts Receivable as of 12/31/2021 Label Question #6 Net A/Rec" A company has the following account balances at the end of the year. . . Accounts Receivable $85,000 Allowance for Uncollectible Accounts$300 (normal balance) Doubtful Accounts Expense $0 . The company estimates future uncollectible accounts to be 5% of accounts receivable. Question #7 _(7 points) Given the data below, calculate: Prepare the adjusting journal entry for uncollectible accounts at the end of the year. Label Question #7 JE . Doubtful Accounts Expense for 2021 Label Question #7 Expense . Net Accounts Receivable as of 12/31/2021 Label Question #7 Net A/Rec A company has the following account balances at the end of the year. Net Credit Sales $7,500,000 Accounts Receivable $110,000 Allowance for Uncollectible Accounts $1,800 (normal balance) Doubtful Accounts Expense $0 The company estimates future uncollectible accounts to be 0.1% of net credit sales. Question #8 _(13 points) On your answer sheet, label your responses Question #8, #1, Q#8, #2. 1) Does each of the dates below, related to dividends, require a journal entry? A) Date of Declaration YES or NO B) Payment Date YES or NO C) Date of Record YES or NO 2) A company posted a $6000 debit to Cash as $600. The credit of $6000 to Service Revenue in the entry was posted correctly. Is the trial balance out of balance? A) No B) Yes, by $600 C) Yes, by $5400 D) Yes, by $6000 3) A doctor performed surgery in March and did not receive cash from the patient until July. Under accrual accounting, the doctor recognizes revenue: A) in March B) in July C) in either March or July D) at a time that cannot be determined from the facts 4) A doctor performed surgery in March and did not receive the cash from the patient until July. Under cash-basis accounting, the doctor recognizes revenue: A) in March B) in July C) in either March or July D) at a time that cannot be determined from the facts 5) Purchasing office supplies on account will: A) Not change assets. B) Increase assets and decrease liabilities. C) Increase assets and increase liabilities. D) Increase assets and increase stockholders' equity