Answered step by step

Verified Expert Solution

Question

1 Approved Answer

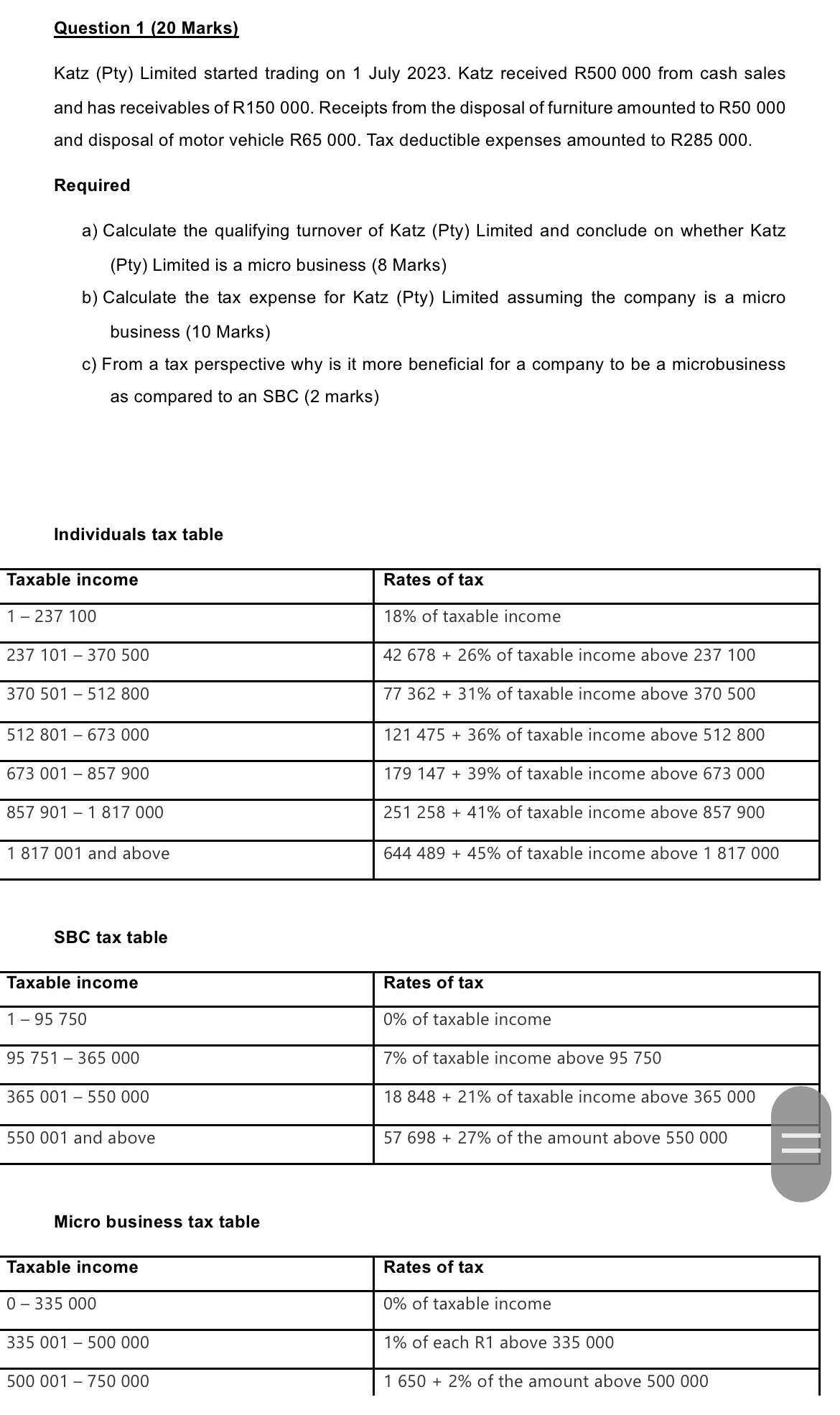

Question 1 ( 2 0 Marks ) Katz ( Pty ) Limited started trading on 1 July 2 0 2 3 . Katz received R

Question Marks

Katz Pty Limited started trading on July Katz received R from cash sales and has receivables of R Receipts from the disposal of furniture amounted to and disposal of motor vehicle R Tax deductible expenses amounted to R

Required

a Calculate the qualifying turnover of Katz Pty Limited and conclude on whether Katz Pty Limited is a micro business Marks

b Calculate the tax expense for Katz Pty Limited assuming the company is a micro business Marks

c From a tax perspective why is it more beneficial for a company to be a microbusiness as compared to an SBC marks

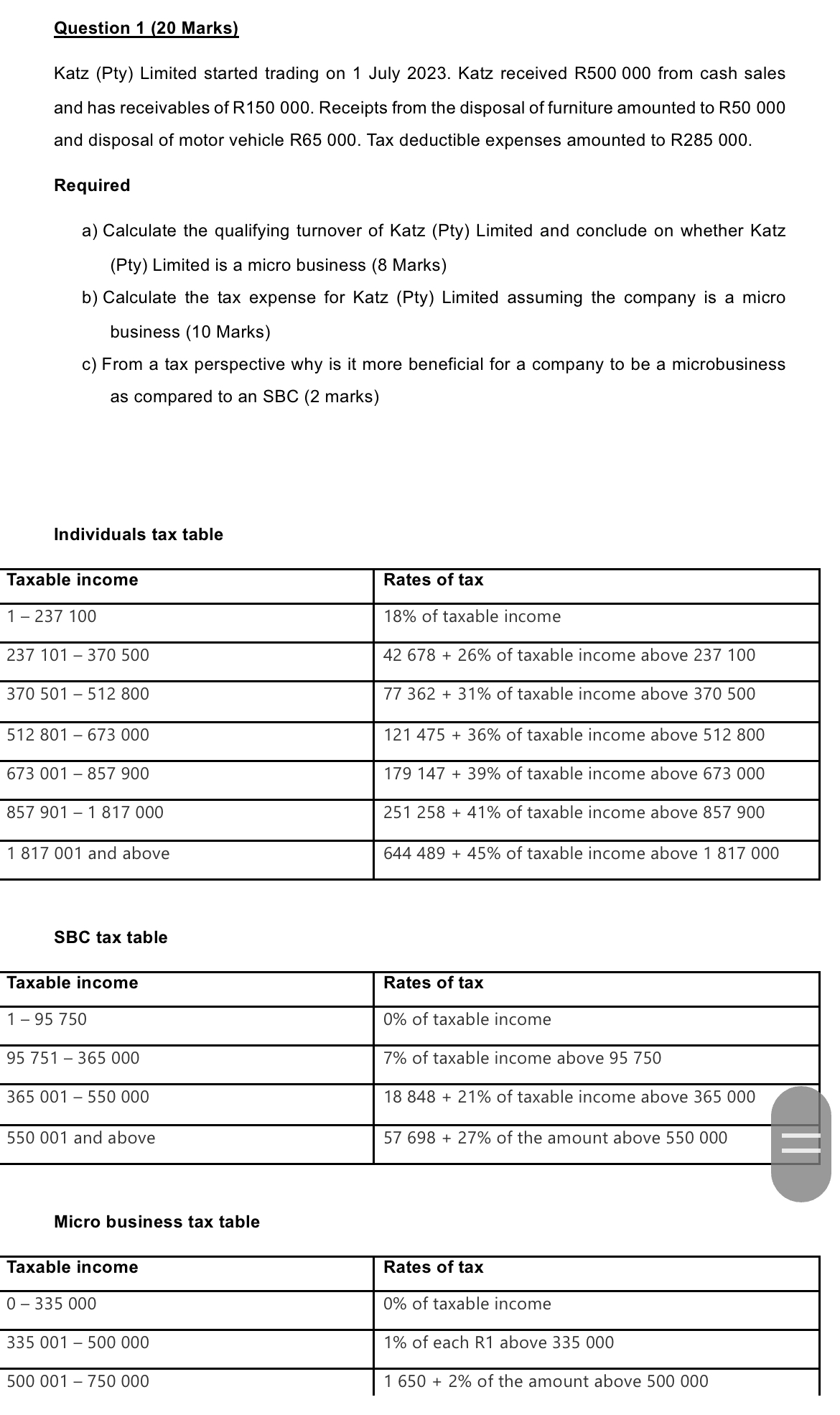

Individuals tax table

tableTaxable income,Rates of tax of taxable income of taxable income above of taxable income above of taxable income above of taxable income above of taxable income above and above, of taxable income above

SBC tax table

tableTaxable income,Rates of tax of taxable income of taxable income above of taxable income above and above, of the amount above

Micro business tax table

tableTaxable income,Rates of tax of taxable income of each R above of the amount above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started