Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 ( 2 7 marks ) Multiforce ( Pty ) Ltd is a manufacturer of various vitamins and supplements, and the company has a

QUESTION

marks

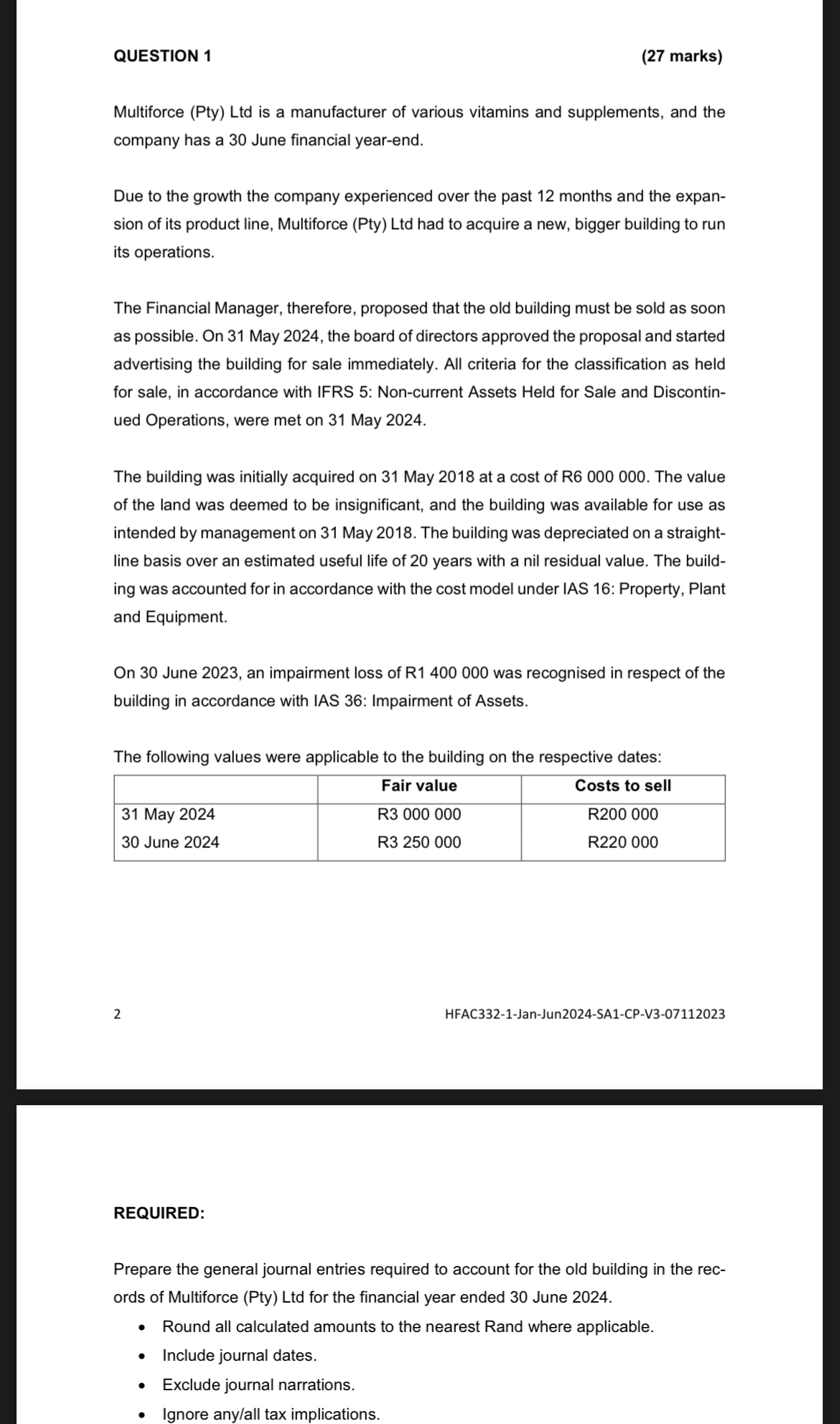

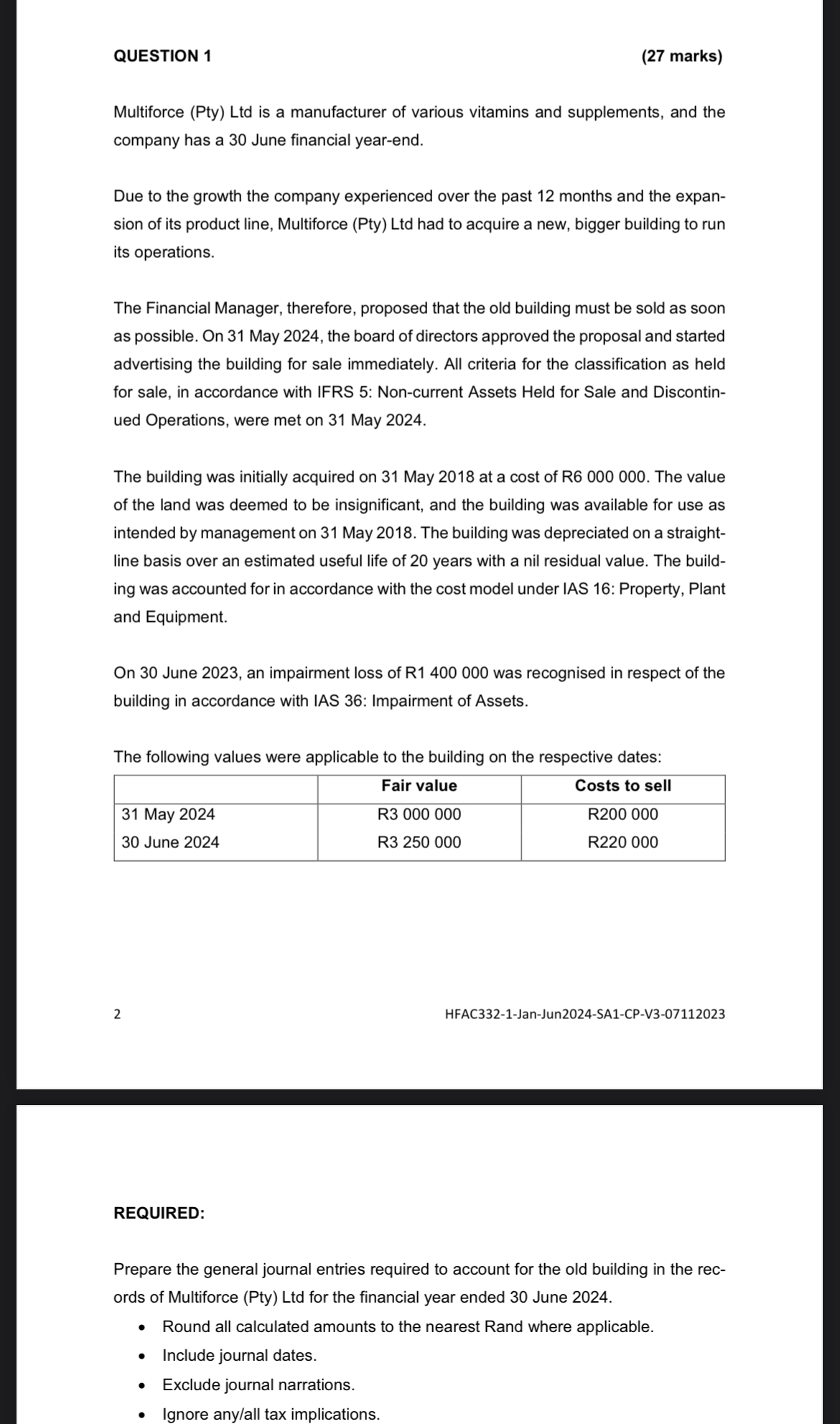

Multiforce Pty Ltd is a manufacturer of various vitamins and supplements, and the company has a June financial yearend.

Due to the growth the company experienced over the past months and the expansion of its product line, Multiforce Pty Ltd had to acquire a new, bigger building to run its operations.

The Financial Manager, therefore, proposed that the old building must be sold as soon as possible. On May the board of directors approved the proposal and started advertising the building for sale immediately. All criteria for the classification as held for sale, in accordance with IFRS : Noncurrent Assets Held for Sale and Discontinued Operations, were met on May

The building was initially acquired on May at a cost of The value of the land was deemed to be insignificant, and the building was available for use as intended by management on May The building was depreciated on a straightline basis over an estimated useful life of years with a nil residual value. The building was accounted for in accordance with the cost model under IAS : Property, Plant and Equipment.

On June an impairment loss of R was recognised in respect of the building in accordance with IAS : Impairment of Assets.

The following values were applicable to the building on the respective dates:

tableFair value,Costs to sell May RR June RR

REQUIRED:

Prepare the general journal entries required to account for the old building in the records of Multiforce Pty Ltd for the financial year ended June

Round all calculated amounts to the nearest Rand where applicable.

Include journal dates.

Exclude journal narrations.

Ignore anyall tax implications.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started