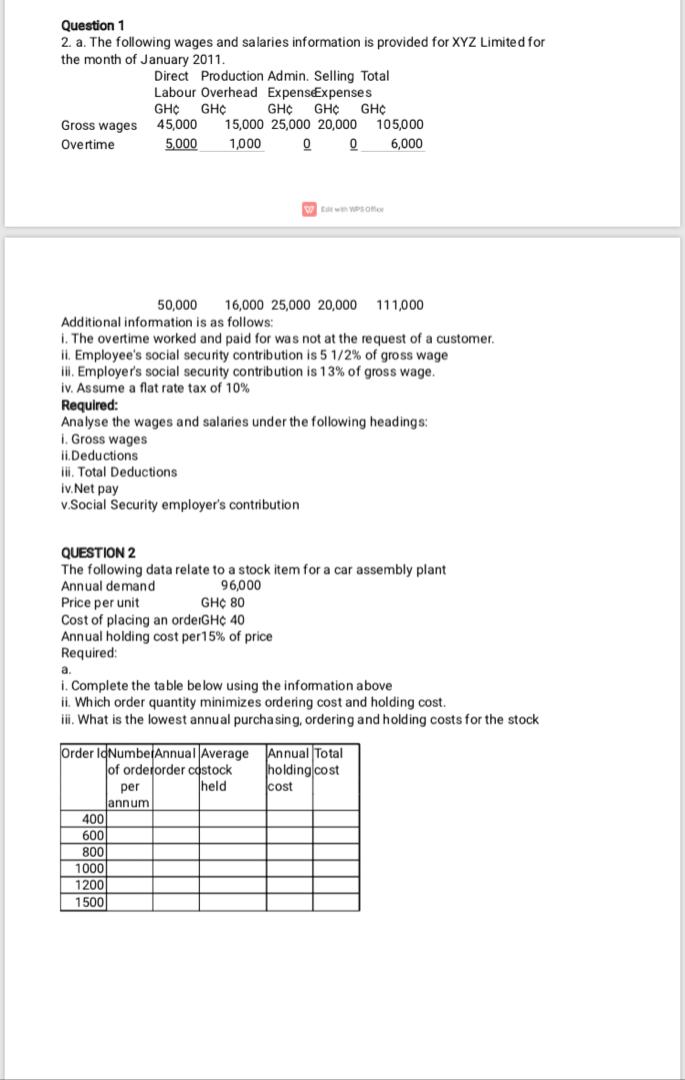

Question 1 2. a. The following wages and salaries information is provided for XYZ Limited for the month of January 2011. Gross wages Overtime

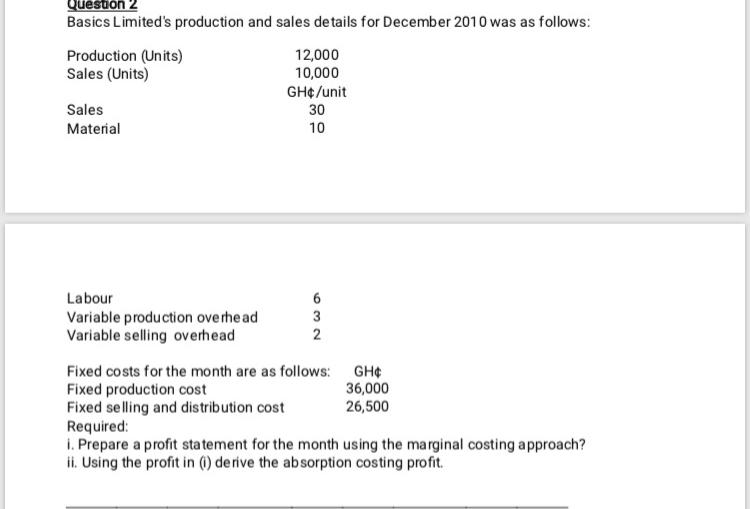

Question 1 2. a. The following wages and salaries information is provided for XYZ Limited for the month of January 2011. Gross wages Overtime Direct Production Admin. Selling Total Labour Overhead Expense Expenses GHC GHC GHC GHC GHC 45,000 15,000 25,000 20,000 5,000 1,000 105,000 0 0 6,000 With WPS Off 50,000 16,000 25,000 20,000 111,000 Additional information is as follows: i. The overtime worked and paid for was not at the request of a customer. ii. Employee's social security contribution is 5 1/2% of gross wage iii. Employer's social security contribution is 13% of gross wage. iv. Assume a flat rate tax of 10% Required: Analyse the wages and salaries under the following headings: i. Gross wages ii.Deductions iii. Total Deductions iv.Net pay v.Social Security employer's contribution QUESTION 2 The following data relate to a stock item for a car assembly plant Annual demand Price per unit 96,000 GHC 80 Cost of placing an orderGHC 40 Annual holding cost per 15% of price Required: a. i. Complete the table below using the information above ii. Which order quantity minimizes ordering cost and holding cost. iii. What is the lowest annual purchasing, ordering and holding costs for the stock Order loNumberAnnual Average Annual Total holding cost held cost of orderorder costock per Jannum 400 600 800 1000 1200 1500 Question 2 Basics Limited's production and sales details for December 2010 was as follows: Production (Units) Sales (Units) Sales Material 12,000 10,000 GH/unit 30 10 Labour Variable production overhead Variable selling overhead 632 3 2 Fixed costs for the month are as follows: GH Fixed production cost Fixed selling and distribution cost Required: 36,000 26,500 i. Prepare a profit statement for the month using the marginal costing approach? ii. Using the profit in (i) derive the absorption costing profit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started