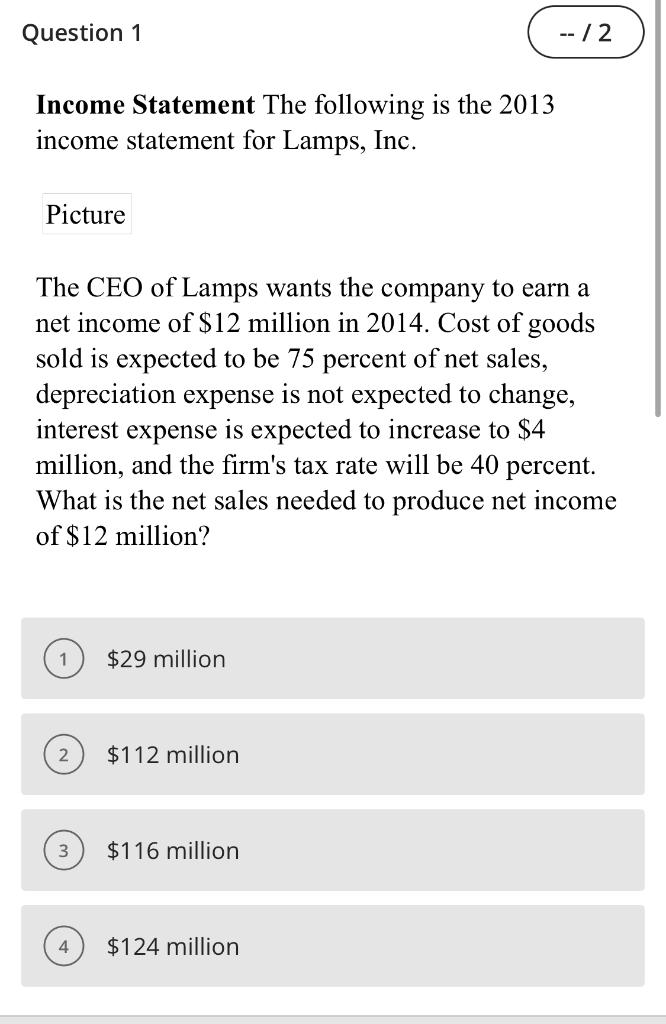

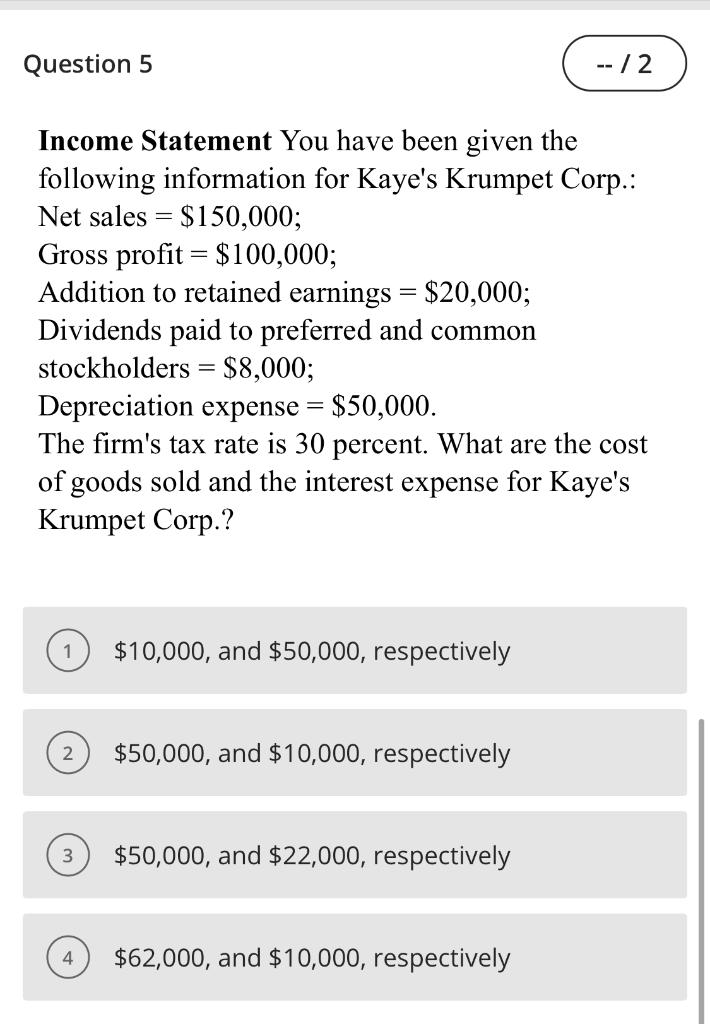

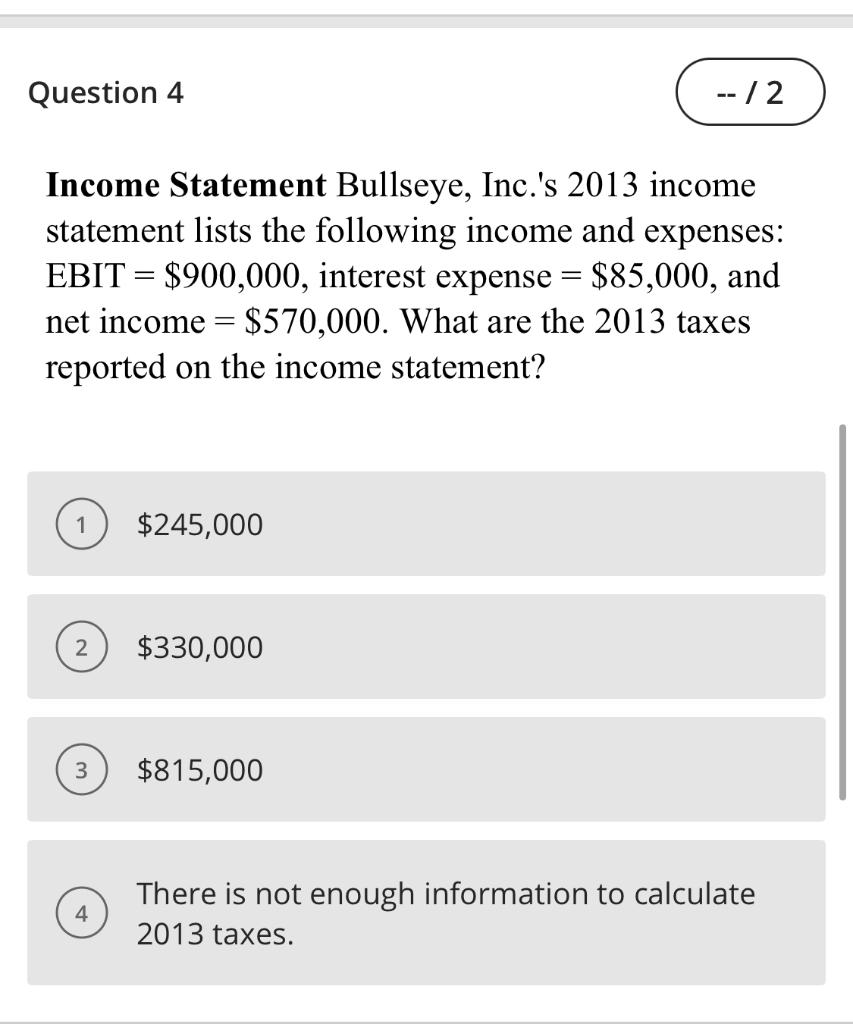

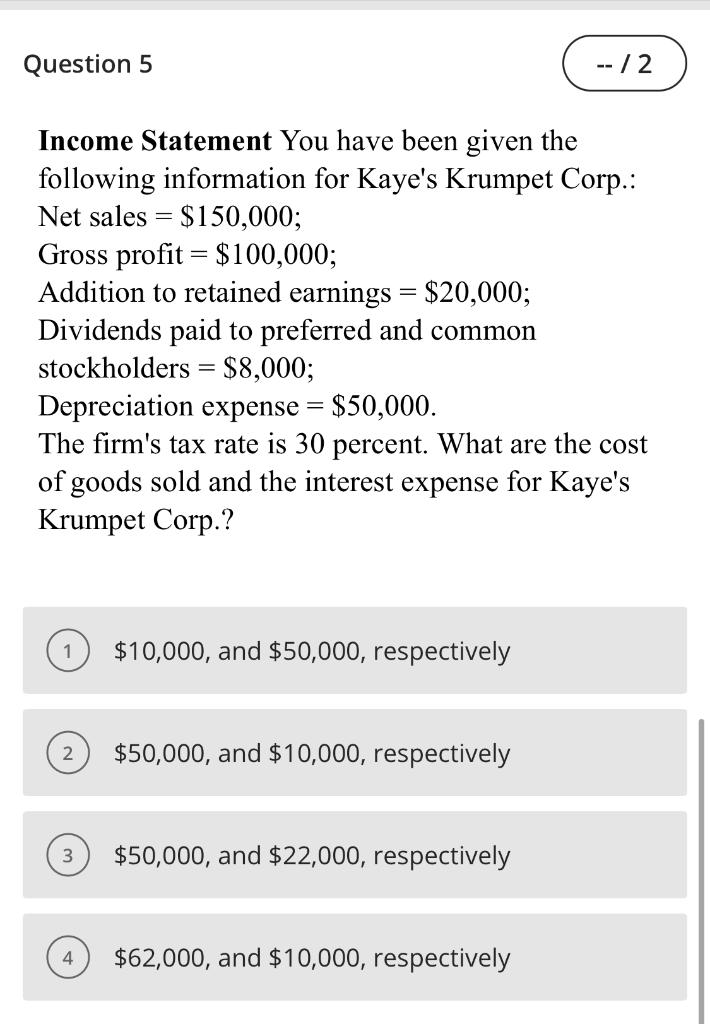

Question 1 -- /2 Income Statement The following is the 2013 income statement for Lamps, Inc. Picture The CEO of Lamps wants the company to earn a net income of $12 million in 2014. Cost of goods sold is expected to be 75 percent of net sales, depreciation expense is not expected to change, interest expense is expected to increase to $4 million, and the firm's tax rate will be 40 percent. What is the net sales needed to produce net income of $12 million? $29 million 2 $112 million 3 $116 million 4 $124 million Question 2 -- 12 Income Statement You have been given the following information for Ross's Rocket Corp.: Net sales = $1,000,000; Gross profit = $400,000; Addition to retained earnings = $60,000; Dividends paid to preferred and common stockholders = $90,000; Depreciation expense = $50,000. The firm's tax rate is 40 percent. What are the cost of goods sold and the interest expense for Ross's Rocket Corp.? 1 $100,000, and $600,000, respectively 2 $600,000, and $100,000, respectively 3 $600,000, and $200,000, respectively 4 $700,000, and $100,000, respectively Question 3 -- / 2 Reed's Birdie Shot, Inc.'s 2013 income statement lists the following income and expenses: EBIT $550,000, interest expense = $43,000, and net income = $300,000. Calculate the 2013 taxes reported on the income statement. 1 $85,000 $107,000 3 $309,000 4 $207,000 Question 4 -- /2 Income Statement Bullseye, Inc.'s 2013 income statement lists the following income and expenses: EBIT = $900,000, interest expense = $85,000, and net income = $570,000. What are the 2013 taxes reported on the income statement? $245,000 2 $330,000 3 $815,000 4 There is not enough information to calculate 2013 taxes. Question 5 -- 12 Income Statement You have been given the following information for Kaye's Krumpet Corp.: Net sales = $150,000; Gross profit = $100,000; Addition to retained earnings = $20,000; Dividends paid to preferred and common stockholders = $8,000; Depreciation expense = $50,000. The firm's tax rate is 30 percent. What are the cost of goods sold and the interest expense for Kaye's Krumpet Corp.? $10,000, and $50,000, respectively 2 $50,000, and $10,000, respectively 3 $50,000, and $22,000, respectively 4 $62,000, and $10,000, respectively