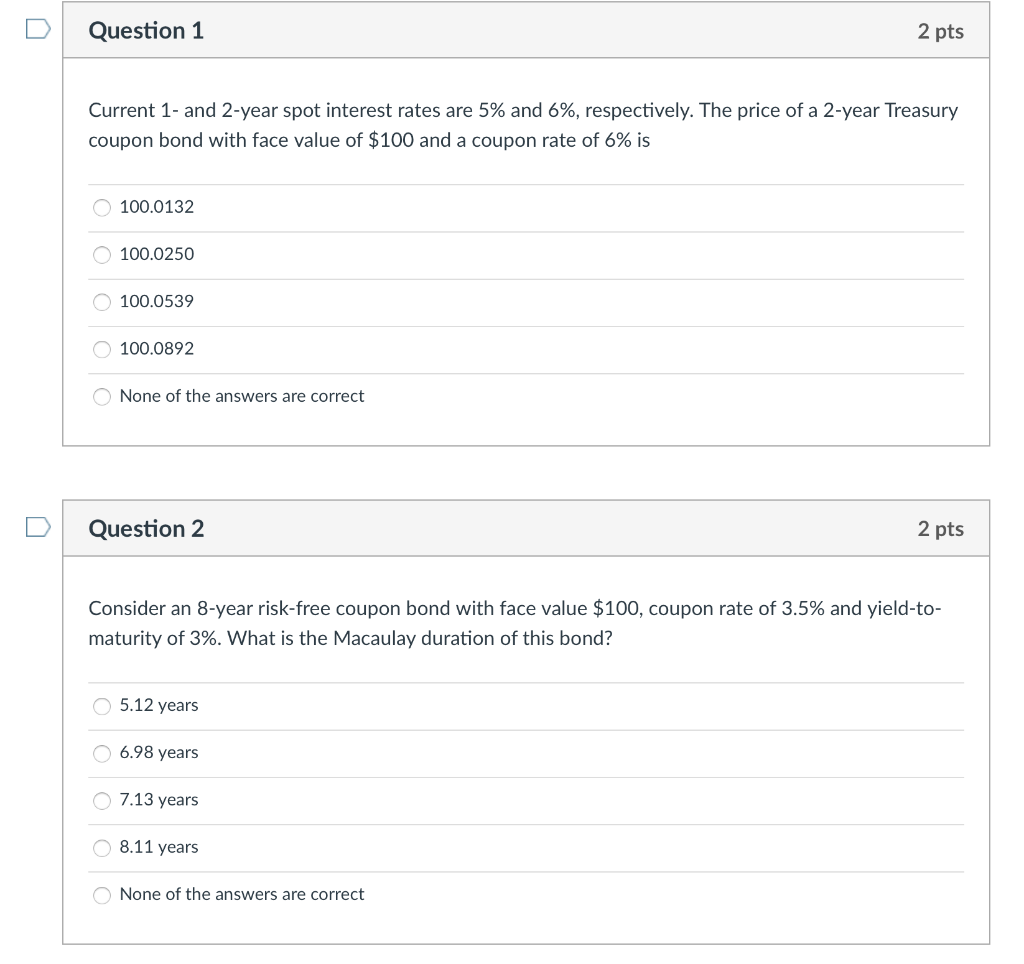

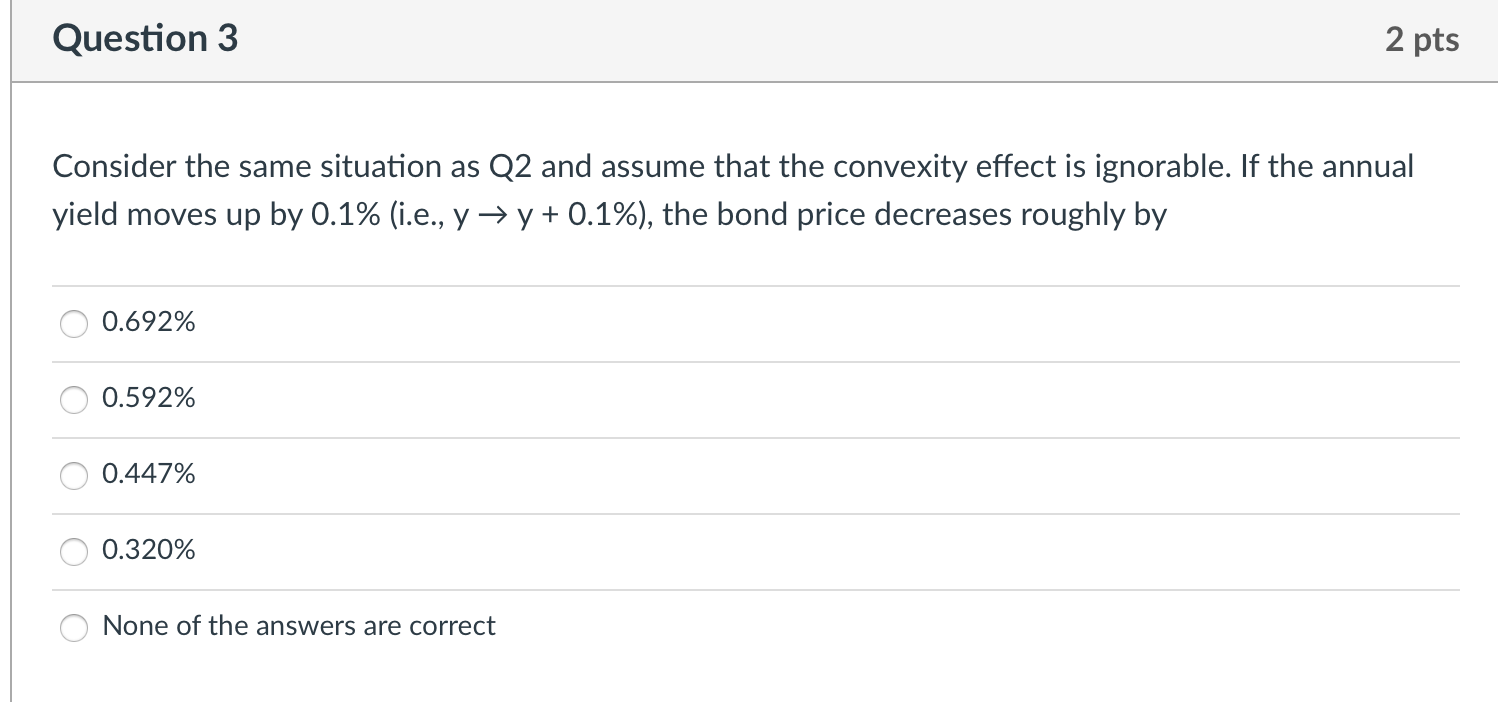

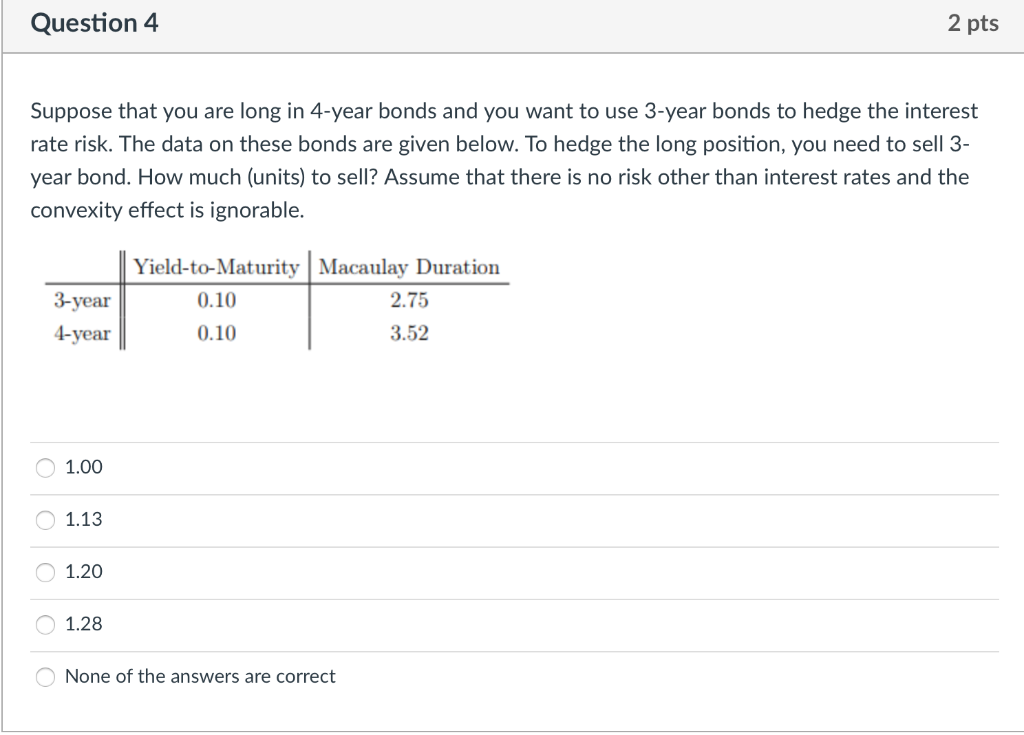

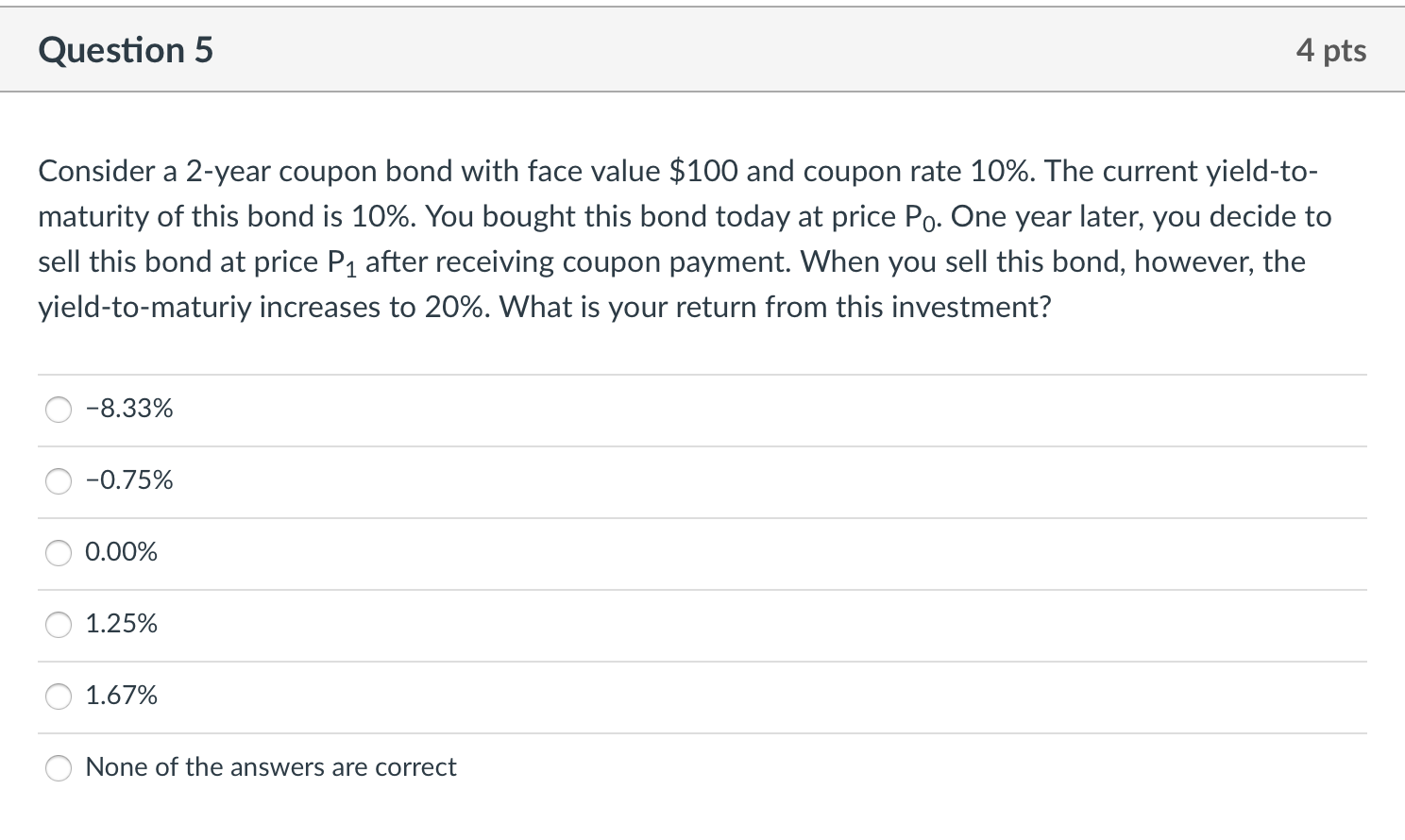

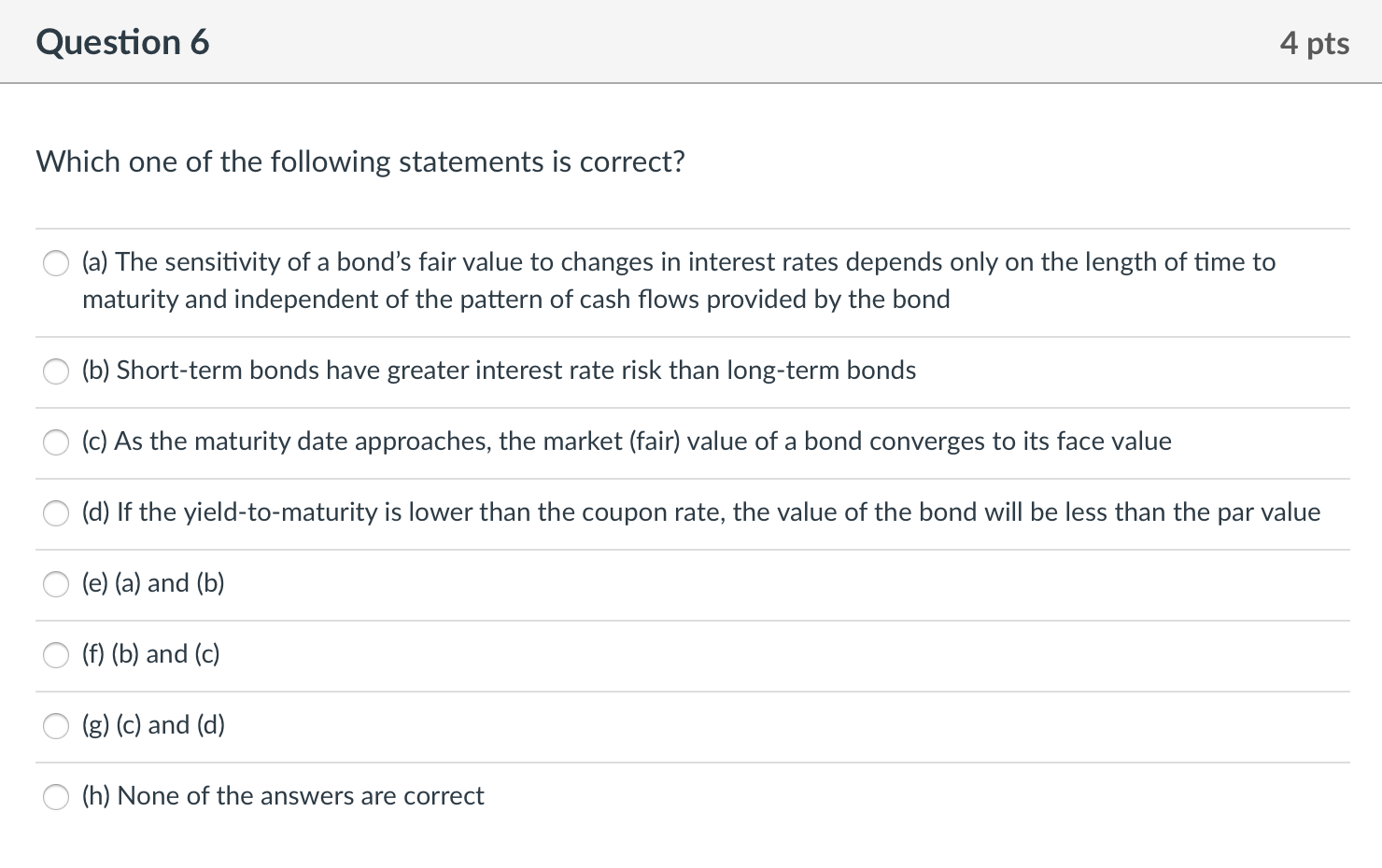

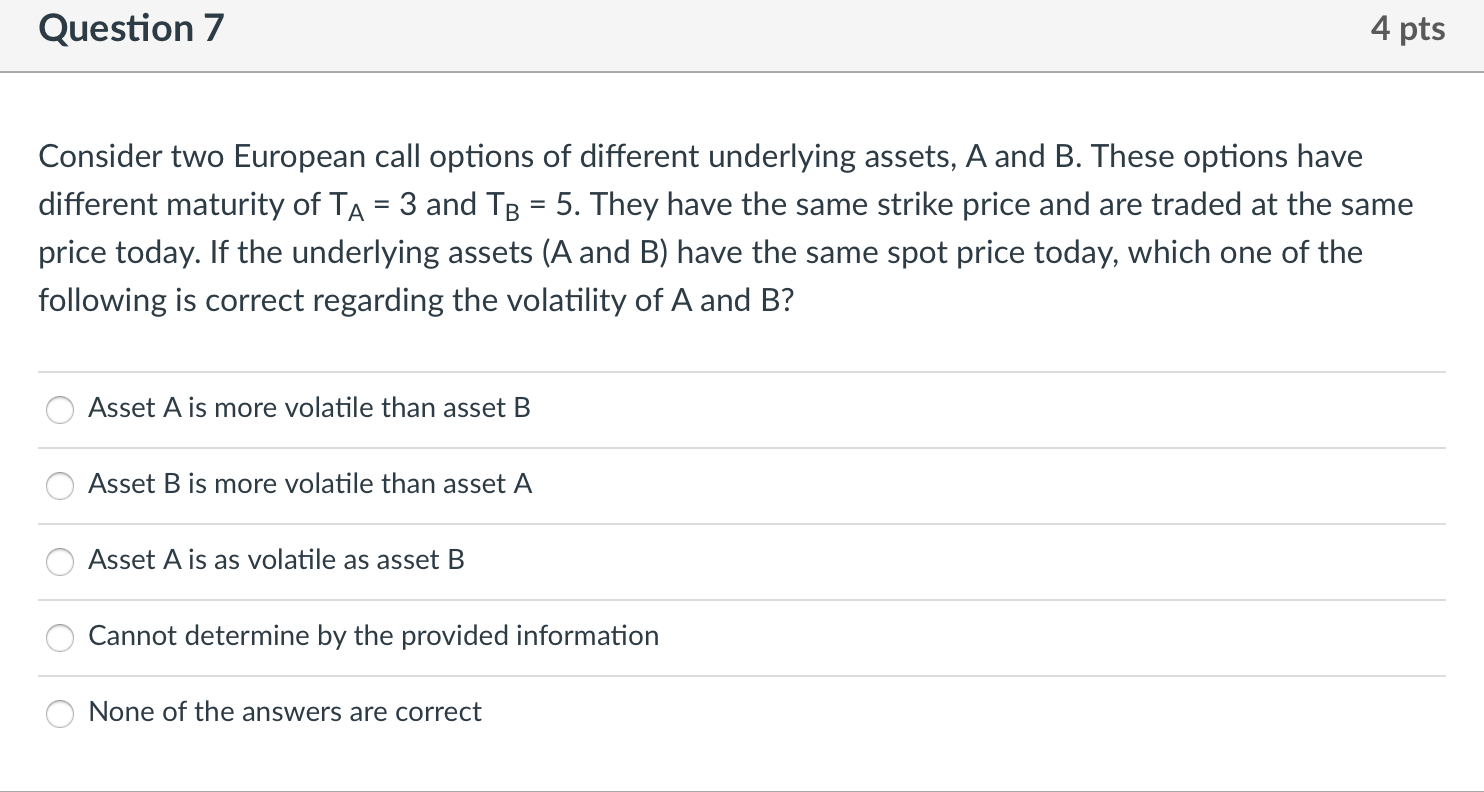

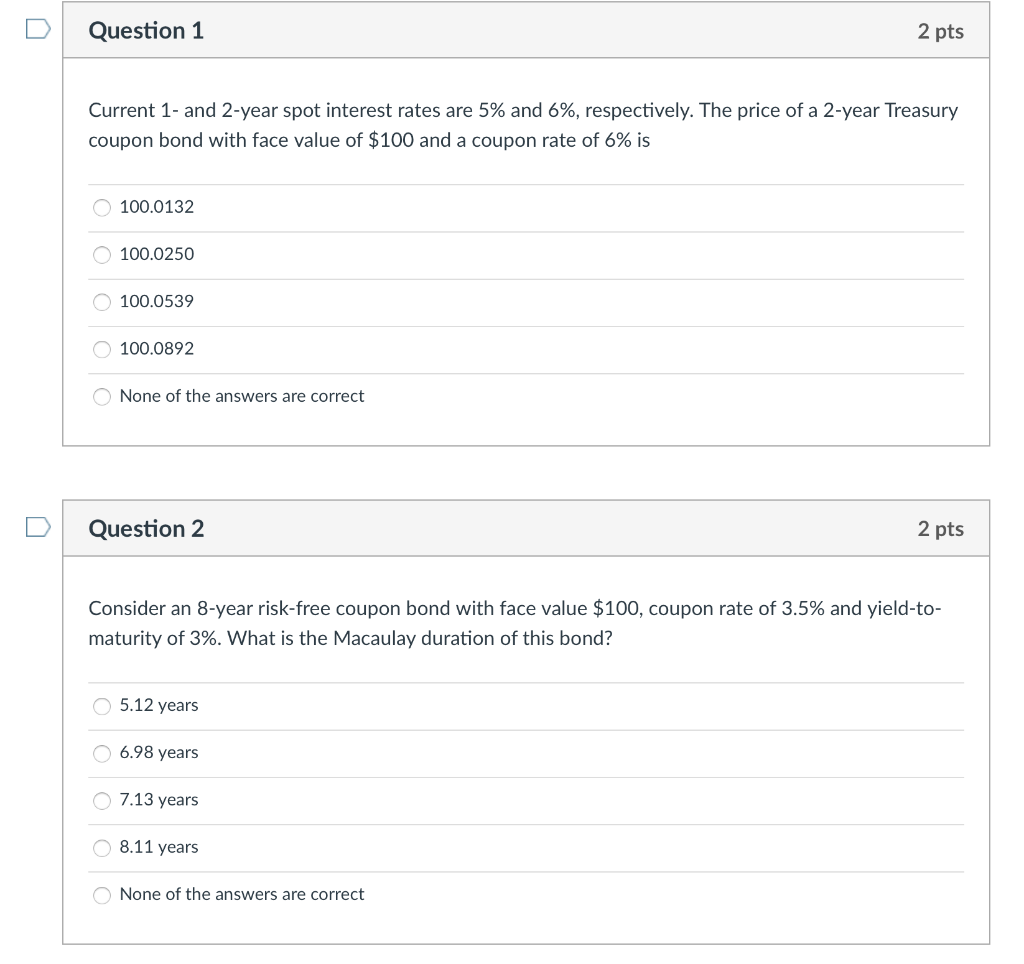

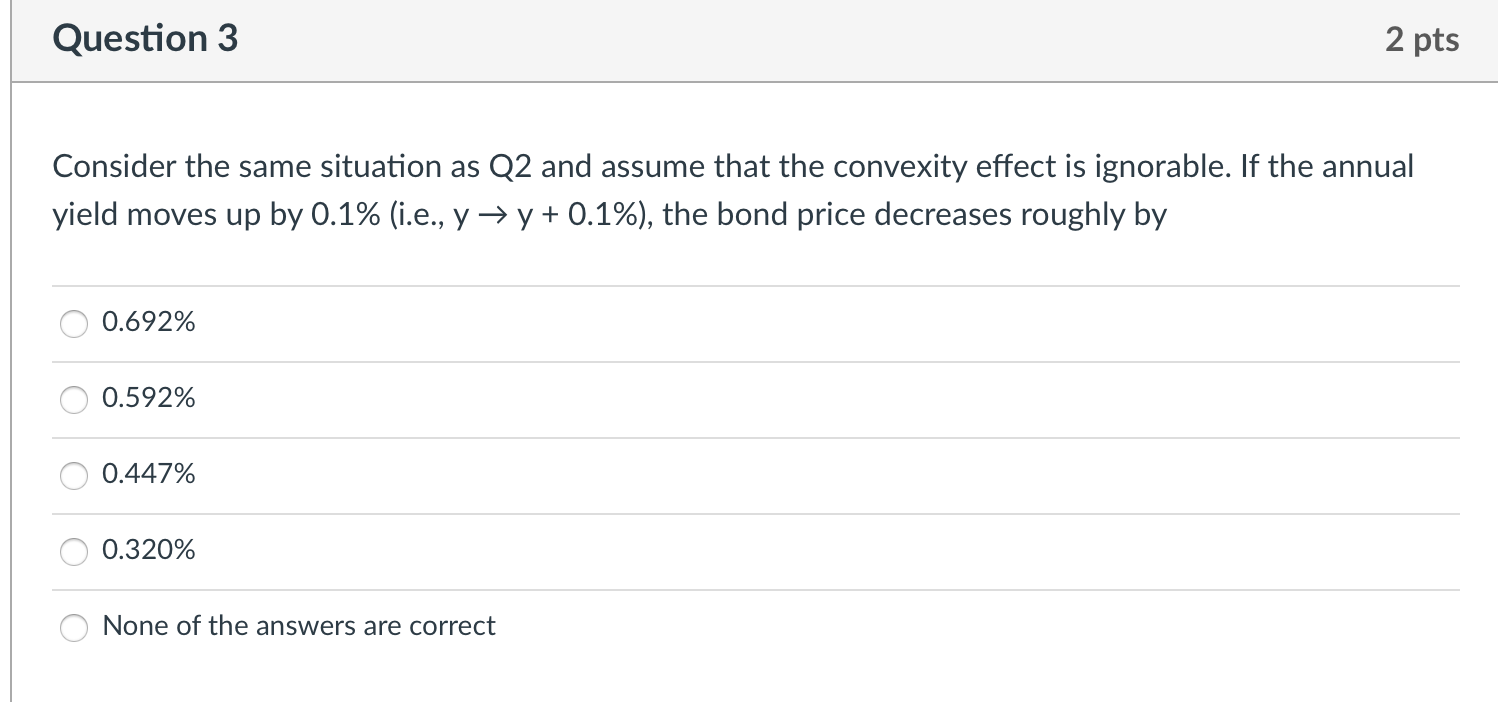

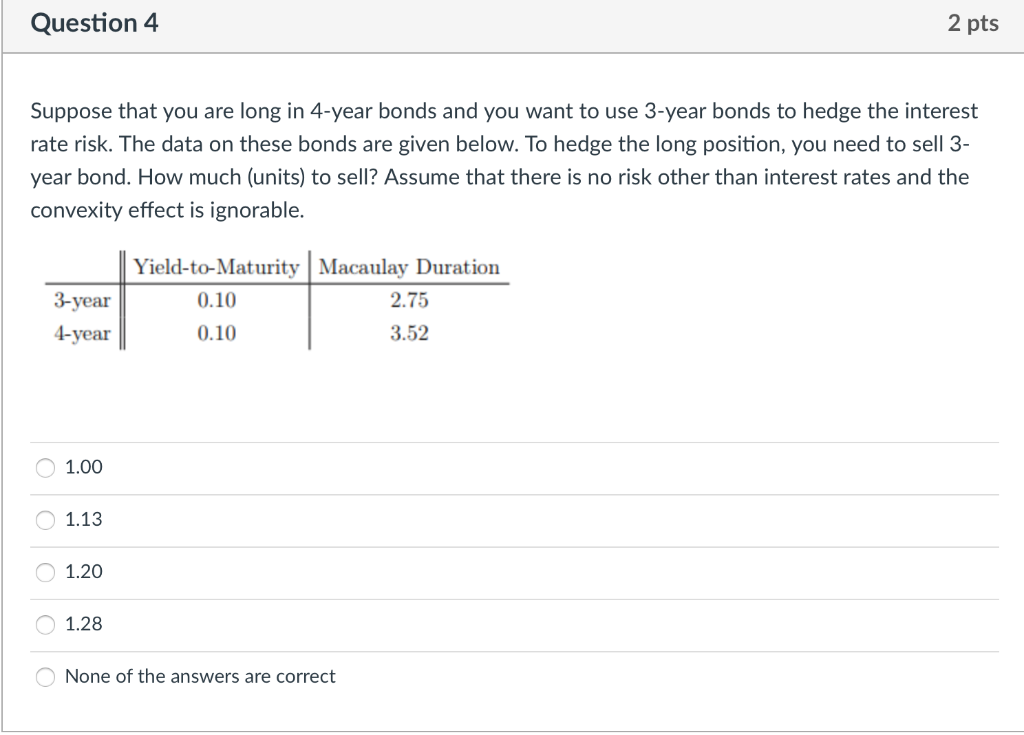

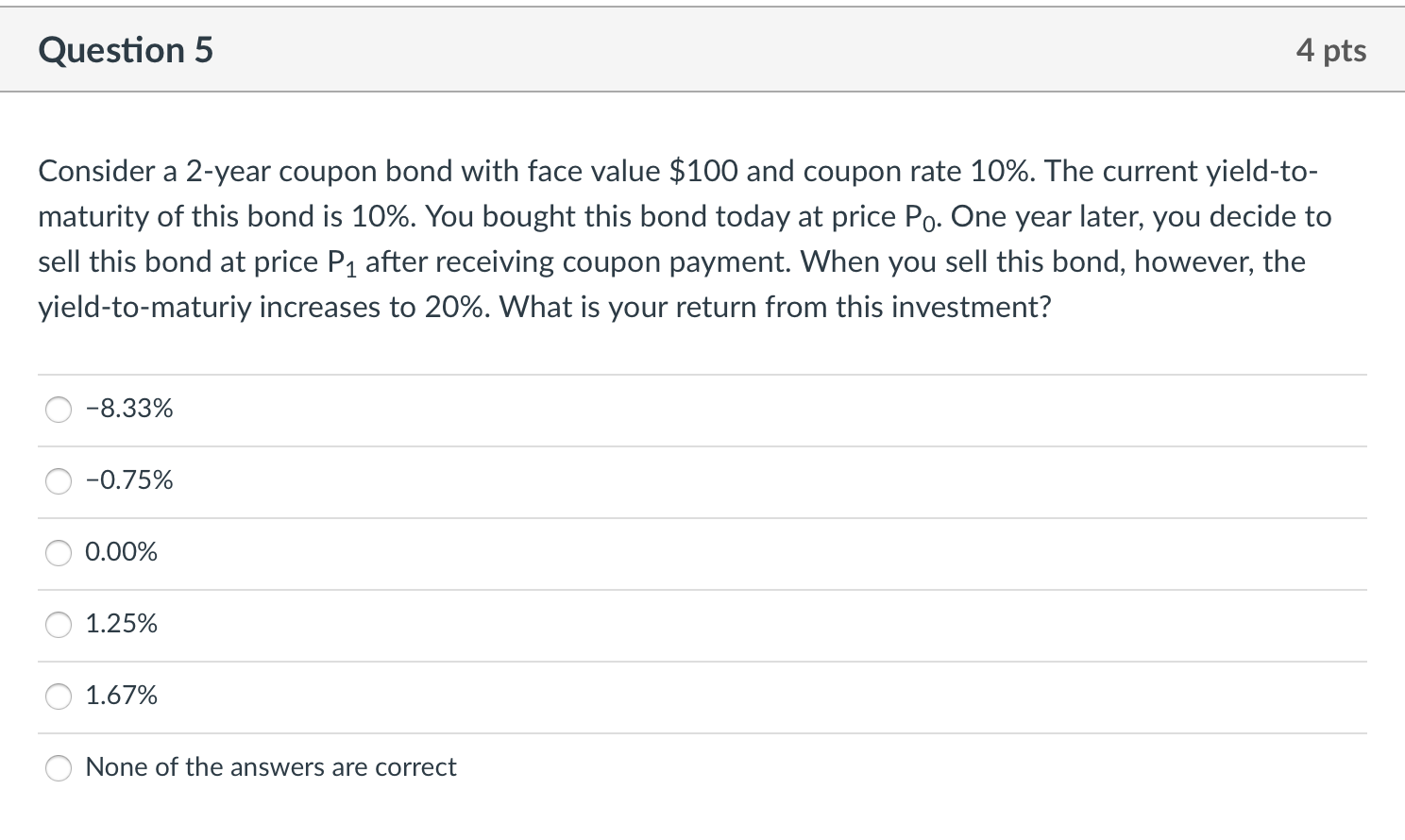

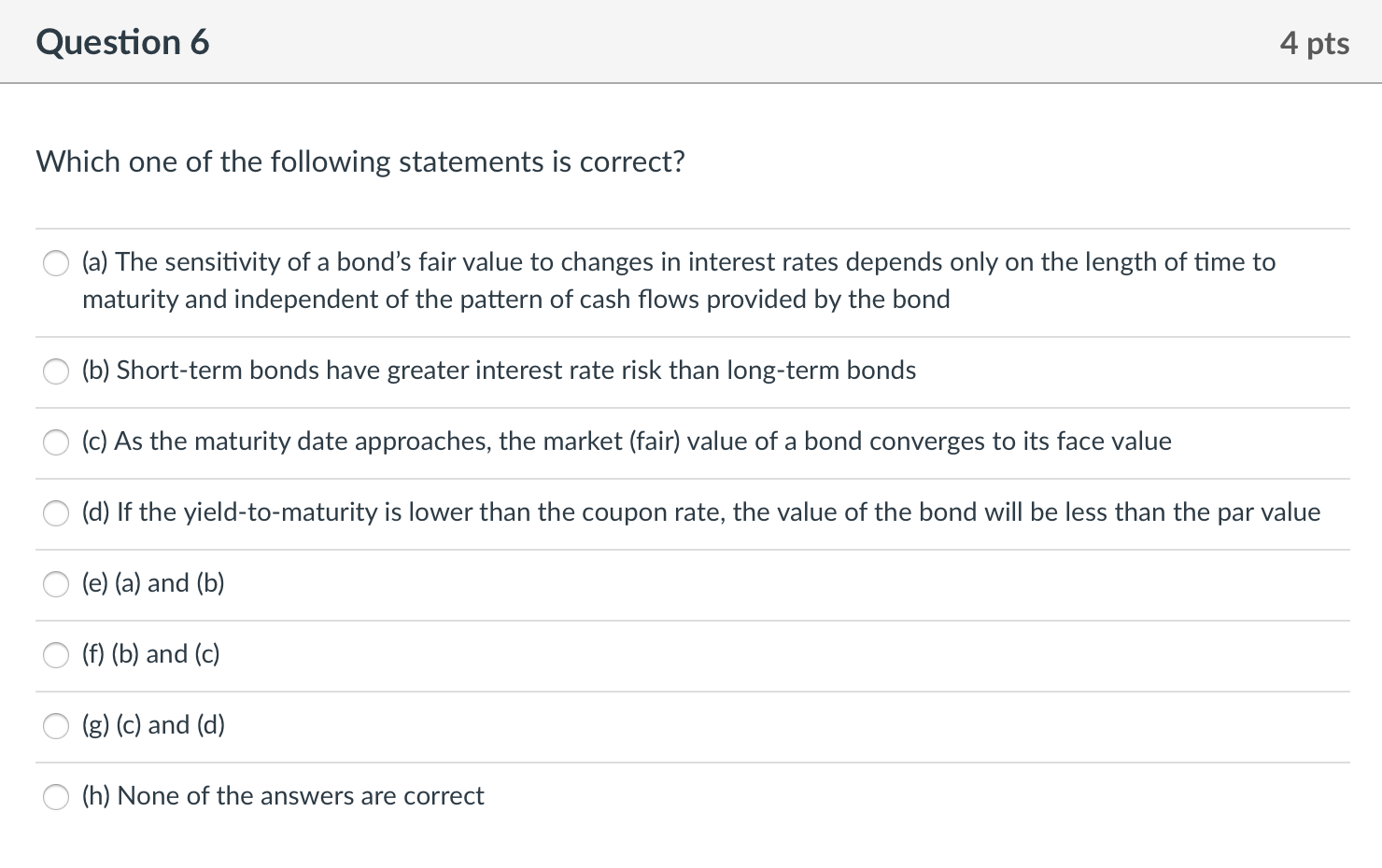

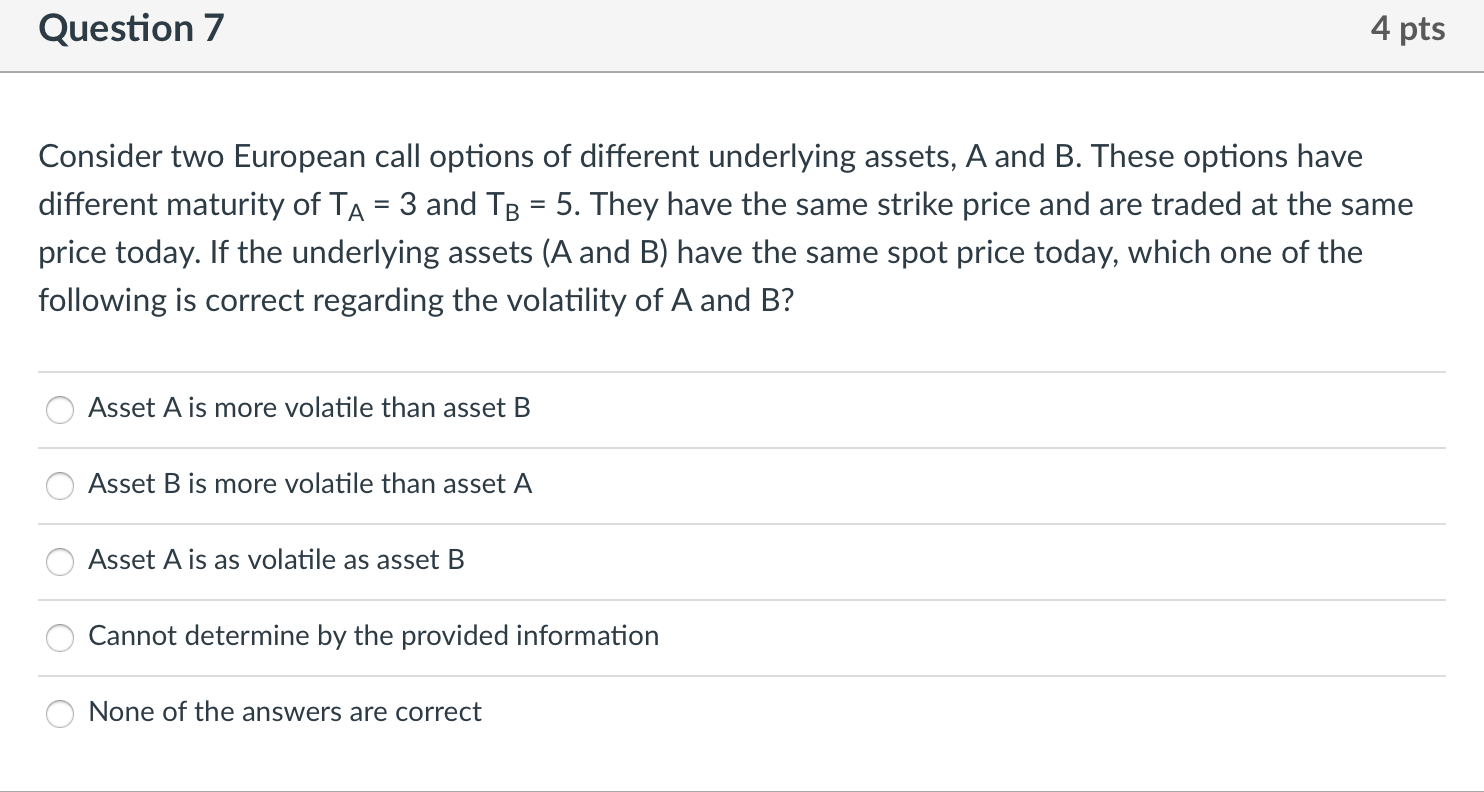

Question 1 2 pts Current 1- and 2-year spot interest rates are 5% and 6%, respectively. The price of a 2-year Treasury coupon bond with face value of $100 and a coupon rate of 6% is 100.0132 100.0250 100.0539 100.0892 None of the answers are correct Question 2 2 pts Consider an 8-year risk-free coupon bond with face value $100, coupon rate of 3.5% and yield-to- maturity of 3%. What is the Macaulay duration of this bond? 5.12 years 6.98 years 7.13 years 8.11 years None of the answers are correct Question 3 2 pts Consider the same situation as Q2 and assume that the convexity effect is ignorable. If the annual yield moves up by 0.1% (i.e., y + y + 0.1%), the bond price decreases roughly by 0.692% 0.592% 0.447% 0.320% None of the answers are correct Question 4 2 pts Suppose that you are long in 4-year bonds and you want to use 3-year bonds to hedge the interest rate risk. The data on these bonds are given below. To hedge the long position, you need to sell 3- year bond. How much (units) to sell? Assume that there is no risk other than interest rates and the convexity effect is ignorable. 3-year 4-year Yield-to-Maturity Macaulay Duration 0.10 2.75 0.10 3.52 1.00 1.13 OO 1.20 1.28 None of the answers are correct Question 5 4 pts Consider a 2-year coupon bond with face value $100 and coupon rate 10%. The current yield-to- maturity of this bond is 10%. You bought this bond today at price Po. One year later, you decide to sell this bond at price P1 after receiving coupon payment. When you sell this bond, however, the yield-to-maturiy increases to 20%. What is your return from this investment? -8.33% -0.75% 0.00% 1.25% 1.67% None of the answers are correct Question 6 4 pts Which one of the following statements is correct? (a) The sensitivity of a bond's fair value to changes in interest rates depends only on the length of time to maturity and independent of the pattern of cash flows provided by the bond (b) Short-term bonds have greater interest rate risk than long-term bonds (c) As the maturity date approaches, the market (fair) value of a bond converges to its face value (d) If the yield-to-maturity is lower than the coupon rate, the value of the bond will be less than the par value (e) (a) and (b) (f) (b) and (c) (g) (c) and (d) (h) None of the answers are correct Question 7 4 pts = Consider two European call options of different underlying assets, A and B. These options have different maturity of TA = 3 and TB = 5. They have the same strike price and are traded at the same price today. If the underlying assets (A and B) have the same spot price today, which one of the following is correct regarding the volatility of A and B? Asset A is more volatile than asset B Asset B is more volatile than asset A Asset A is as volatile as asset B Cannot determine by the provided information None of the answers are correct