Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 2 Sea - Trefoil is a multinational bank with a strong presence in the bond and equity markets. The bank is currently active

Question

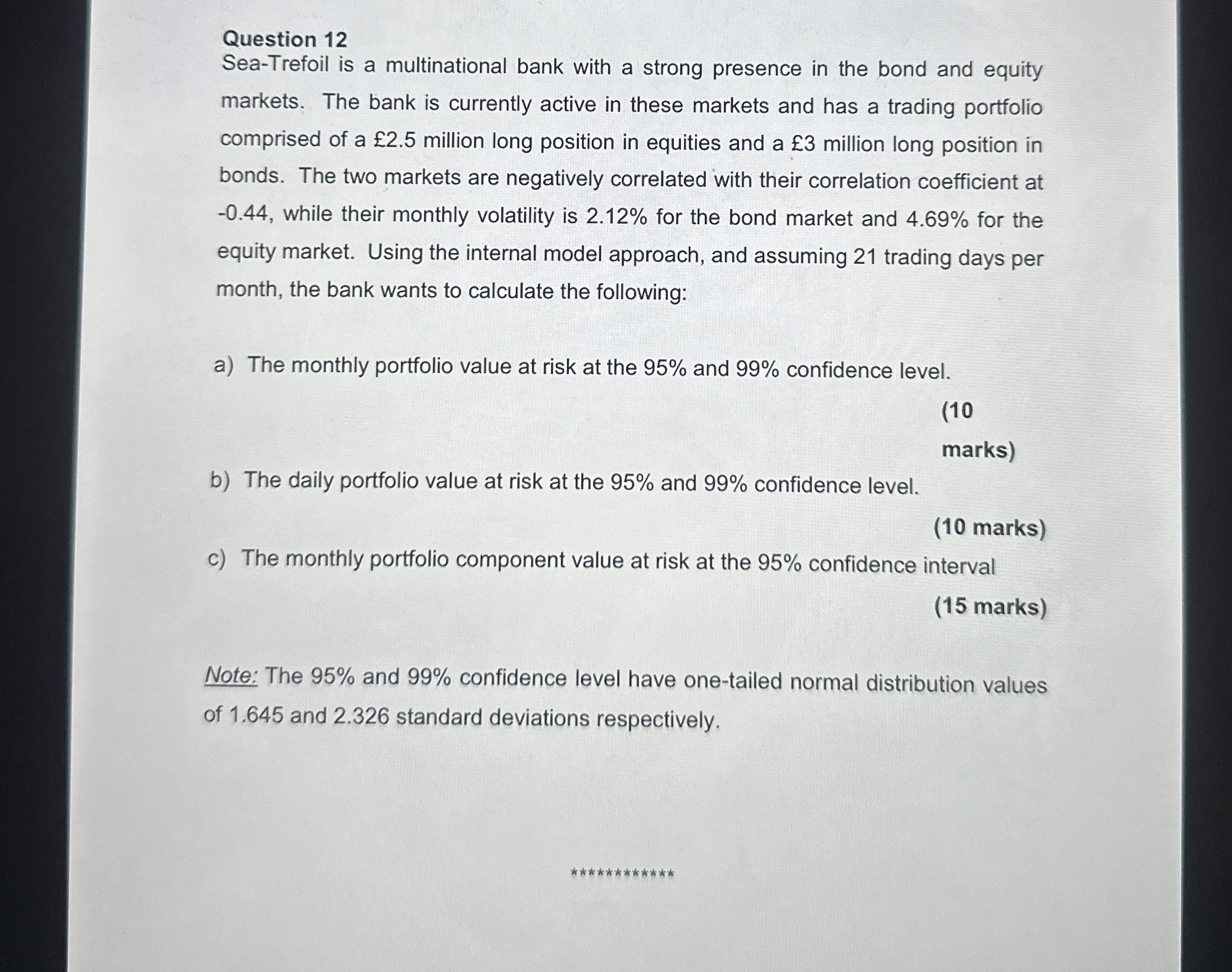

SeaTrefoil is a multinational bank with a strong presence in the bond and equity markets. The bank is currently active in these markets and has a trading portfolio comprised of a million long position in equities and a million long position in bonds. The two markets are negatively correlated with their correlation coefficient at while their monthly volatility is for the bond market and for the equity market. Using the internal model approach, and assuming trading days per month, the bank wants to calculate the following:

a The monthly portfolio value at risk at the and confidence level.

marks

b The daily portfolio value at risk at the and confidence level.

marks

c The monthly portfolio component value at risk at the confidence interval marks

Note: The and confidence level have onetailed normal distribution values of and standard deviations respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started