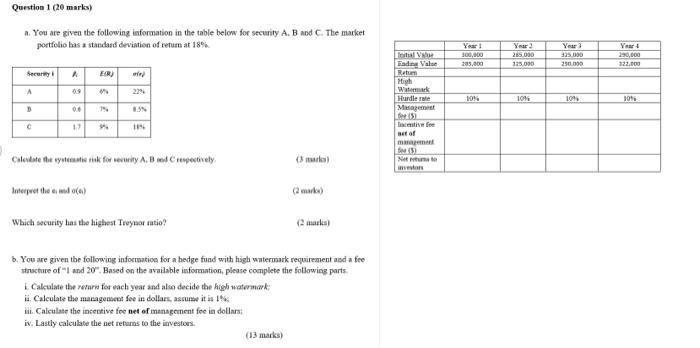

Question 1 (20 marks) a. You are given the following information in the table below for security A. B and C. The market portfolio has a standard deviation of return at 18% Security k ER) olej A 0.9 4% 22% D 8.3% C 17 35 18% Calestate the systematic risk for security A. B and C respectively. (3 marks) Interpret the end o(a) (2 marks) Which security has the highest Treynormatio? (2 marks) b. You are given the following information for a hedge fund with high watermark requirement and a fee structure of "I and 20". Based on the available information, please complete the following parts. i. Calculate the return for each year and also decide the high watermark ii. Calculate the management fee in dollars, assume it is 1% iii. Calculate the incentive fee net of management fee in dollars iv. Lastly calculate the net returns to the investors. (13 marks) Initial Value Ending Value Return High Watermark Hurdle rate Management fee (3) Incentive fee net of management fee (5) Netto investors Year 1 300,000 205,000 10% Year 2 285,000 125.000 10% Year 3 325.000 250.000 10% Year 4 290,000 122,000 10% Question 1 (20 marks) a. You are given the following information in the table below for security A. B and C. The market portfolio has a standard deviation of return at 18% Security k ER) olej A 0.9 4% 22% D 8.3% C 17 35 18% Calestate the systematic risk for security A. B and C respectively. (3 marks) Interpret the end o(a) (2 marks) Which security has the highest Treynormatio? (2 marks) b. You are given the following information for a hedge fund with high watermark requirement and a fee structure of "I and 20". Based on the available information, please complete the following parts. i. Calculate the return for each year and also decide the high watermark ii. Calculate the management fee in dollars, assume it is 1% iii. Calculate the incentive fee net of management fee in dollars iv. Lastly calculate the net returns to the investors. (13 marks) Initial Value Ending Value Return High Watermark Hurdle rate Management fee (3) Incentive fee net of management fee (5) Netto investors Year 1 300,000 205,000 10% Year 2 285,000 125.000 10% Year 3 325.000 250.000 10% Year 4 290,000 122,000 10%