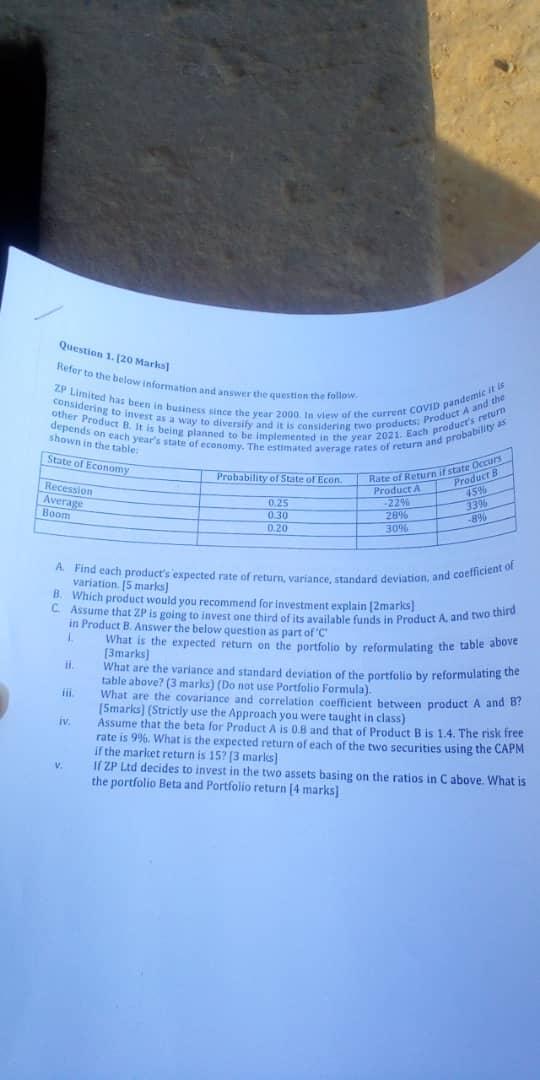

Question 1. [20 Marks Refer to the below information and answer the question the follow considering to invest as a way to diversity and it is considering two products Product A and the ZP Limited has been in business since the year 2000. In view of the current COVID pandemic it is other Product B. It is being planned to be implemented in the year 2021. Each products depends on each year's state of economy. The estimated average rates of return and retum shown in the table: State of Economy Probability of State of Econ Rute of Return it state Oecup Product B Recension Average Boom 0.25 030 0.20 Product -2298 2896 3096 4596 3396 -890 A Find each product's expected rate of return, variance, standard deviation, and coefficient of variation (5 maria) B. Which product would you recommend for investment explain 2marks] A, and two third in Product B. Answer the below question as part of What is the expected return on the portfolio by reformulating the table above [3marks) What are the variance and standard deviation of the portfolio by reformulating the table above? (3 marks) (Do not use Portfolio Formula). TIL What are the covariance and correlation coefficient between product A and B? (Smarles) (Strictly use the Approach you were taught in class) iv. Assume that the beta for Product A is 0.8 and that of Product B is 1.4. The risk free rate is 9%. What is the expected return of each of the two securities using the CAPM If the market return is 15? [3 marks) If ZP Ltd decides to invest in the two assets basing on the ratios in C above. What is the portfolio Beta and Portfolio return [4 marks) Question 1. [20 Marks Refer to the below information and answer the question the follow considering to invest as a way to diversity and it is considering two products Product A and the ZP Limited has been in business since the year 2000. In view of the current COVID pandemic it is other Product B. It is being planned to be implemented in the year 2021. Each products depends on each year's state of economy. The estimated average rates of return and retum shown in the table: State of Economy Probability of State of Econ Rute of Return it state Oecup Product B Recension Average Boom 0.25 030 0.20 Product -2298 2896 3096 4596 3396 -890 A Find each product's expected rate of return, variance, standard deviation, and coefficient of variation (5 maria) B. Which product would you recommend for investment explain 2marks] A, and two third in Product B. Answer the below question as part of What is the expected return on the portfolio by reformulating the table above [3marks) What are the variance and standard deviation of the portfolio by reformulating the table above? (3 marks) (Do not use Portfolio Formula). TIL What are the covariance and correlation coefficient between product A and B? (Smarles) (Strictly use the Approach you were taught in class) iv. Assume that the beta for Product A is 0.8 and that of Product B is 1.4. The risk free rate is 9%. What is the expected return of each of the two securities using the CAPM If the market return is 15? [3 marks) If ZP Ltd decides to invest in the two assets basing on the ratios in C above. What is the portfolio Beta and Portfolio return [4 marks)