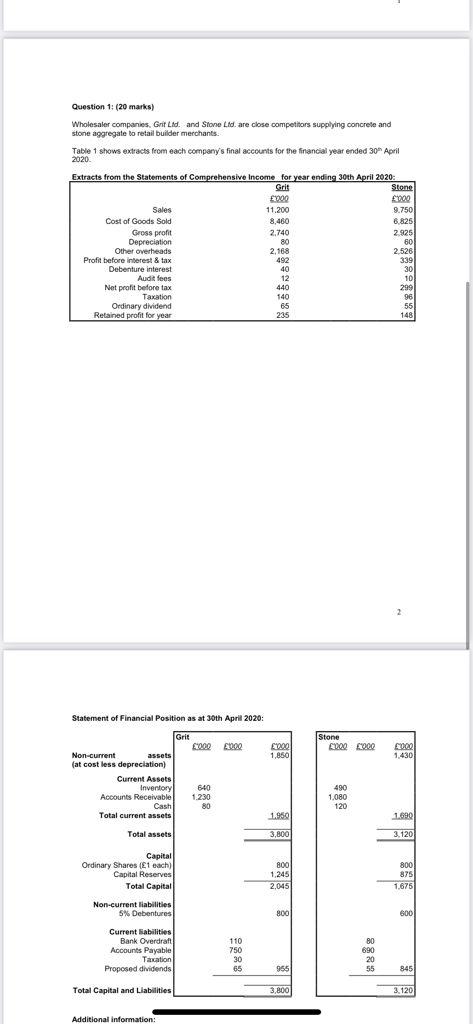

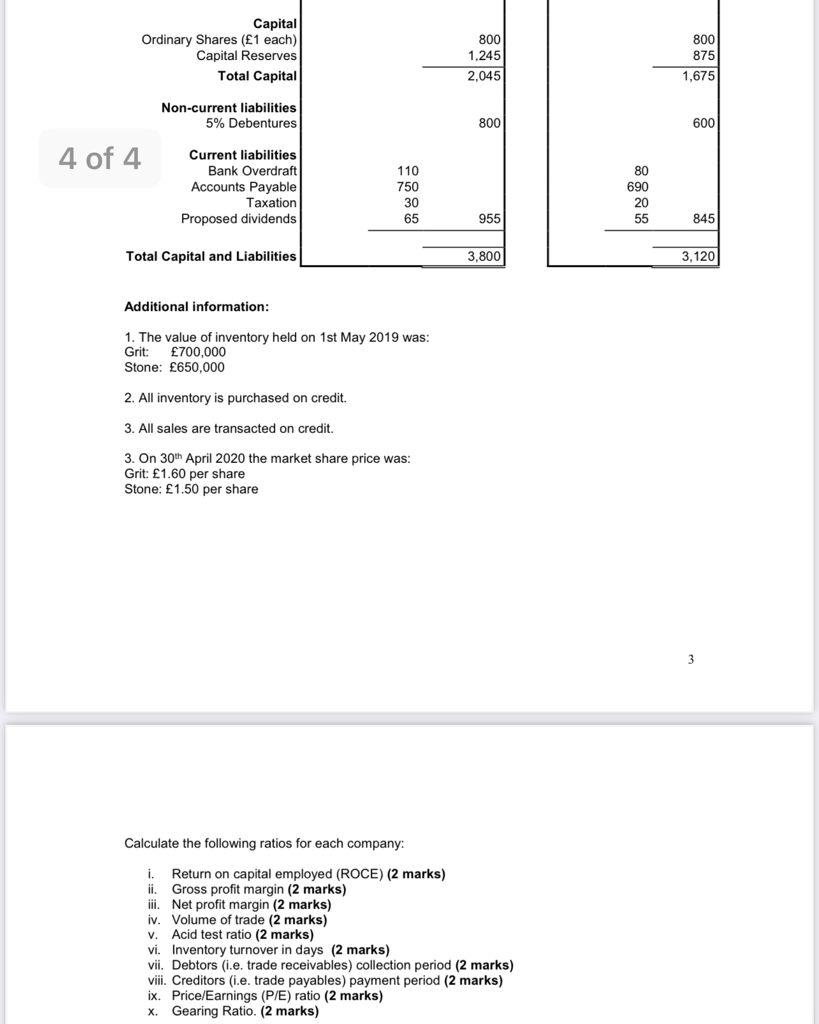

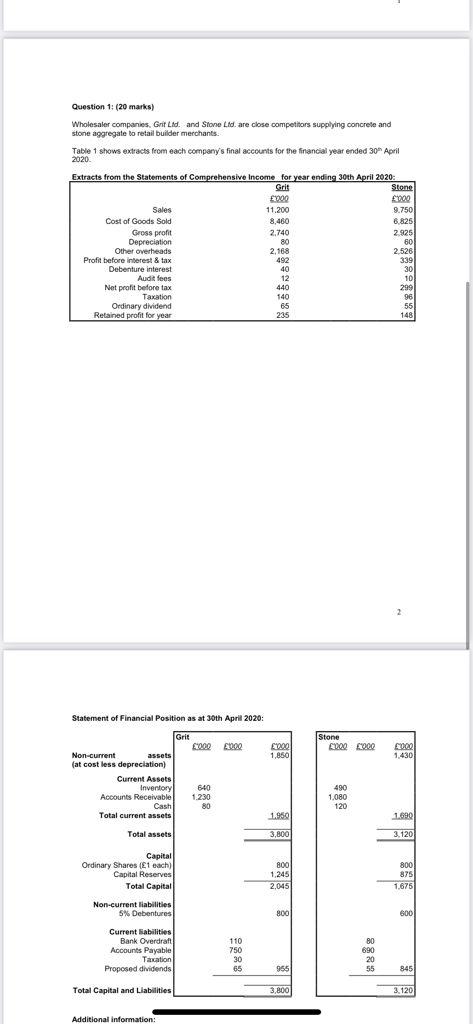

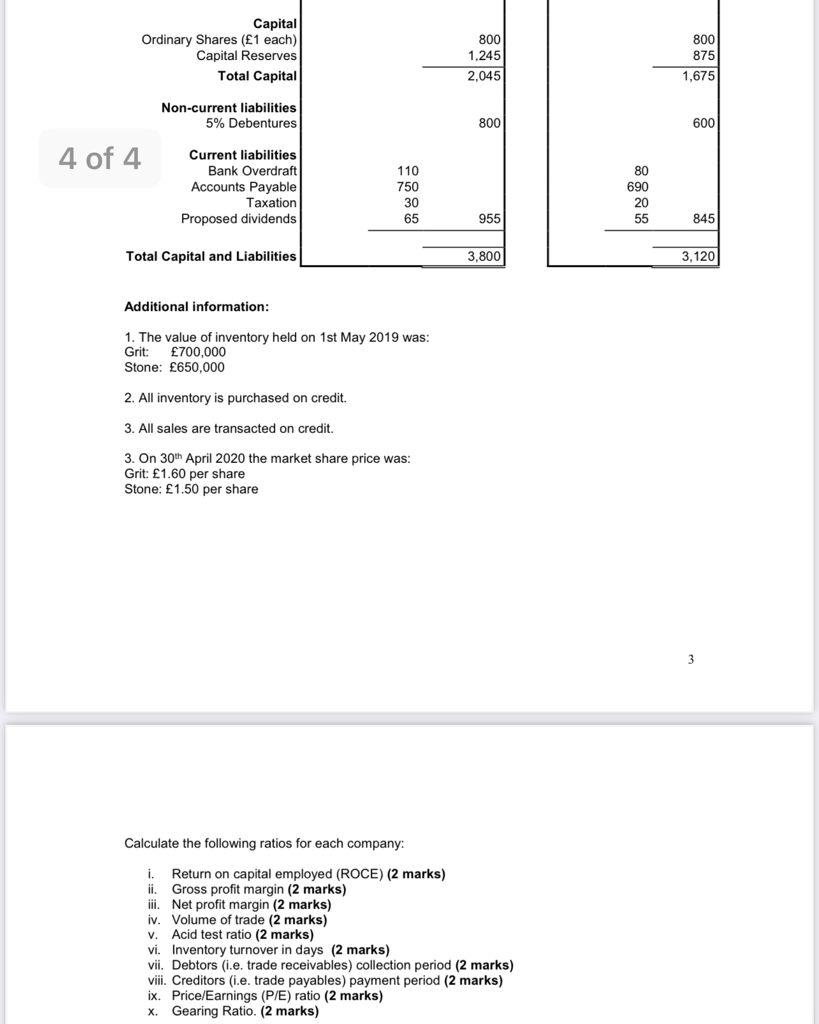

Question 1: (20 marks) Wholesaler companies. Grit Lid. and Stone Lid. are close competitors supplying concrete and stone aggregate to retail builder merchants Table 1 shows extracts from each company's final accounts for the financial year ended 30 April 1 Extracts from the Statements of Comprehensive Income for year ending 30th April 2020: Grit Stone 1000 200 Sales 11.200 9.750 Cost of Goods Sold 8,460 6.825 Gross profit 2.740 2.925 Depreciation 80 60 Other Overheads 2,168 2,526 Profit before interest & tax 492 339 Debenture interest 40 30 Audit fees 12 10 Net profit before tax 440 299 Taxation 140 96 Ordinary dividend 65 55 Retained profit for year 285 148 Statement of Financial Position as at 30th April 2020: : Grie 2000 2000 Stone 21000 2000 200 1,850 10 1.430 Non-current assets (at cost less depreciation) Current Assets Inventory Accounts Receivable Cash Total current assets 640 1.230 80 490 1.080 120 1.950 1.690 Total assets 3,800 3.120 Capital Ordinary Shares (1 each) Capital Reserves Total Capital 800 1.245 2.045 800 875 1.675 Non-current liabilities 5% Debentures 800 600 Current liabilities Bank Overdraft Accounts Payable Taxation Proposed dividends 110 750 30 65 80 690 20 55 955 845 Total Capital and Liabilities 3.800 3.120 Additional information: Capital Ordinary Shares (1 each) Capital Reserves Total Capital 800 1.245 800 875 2.045 1,675 Non-current liabilities 5% Debentures 800 600 4 of 4 Current liabilities Bank Overdraft Accounts Payable Taxation Proposed dividends 110 750 30 65 80 690 20 55 955 845 Total Capital and Liabilities 3,800 3,120 Additional information: 1. The value of inventory held on 1st May 2019 was: Grit: 700,000 Stone: 650,000 2. All inventory is purchased on credit. 3. All sales are transacted on credit. 3. On 30th April 2020 the market share price was: Grit: 1.60 per share Stone: 1.50 per share 3 Calculate the following ratios for each company: V. i. Return on employed (ROCE) (2 marks ii. Gross profit margin (2 marks) iii. Net profit margin marks) iv. Volume of trade (2 marks) Acid test ratio (2 marks) vi. Inventory turnover in days (2 marks) vii. Debtors (i.e. trade receivables) collection period (2 marks) viii. Creditors (i.e. trade payables) payment period (2 marks) ix. Price/Earnings (P/E) ratio (2 marks) X. Gearing Ratio. (2 marks)