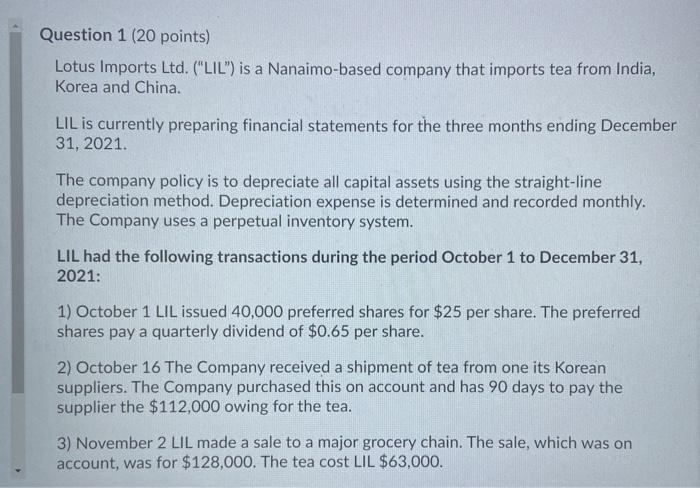

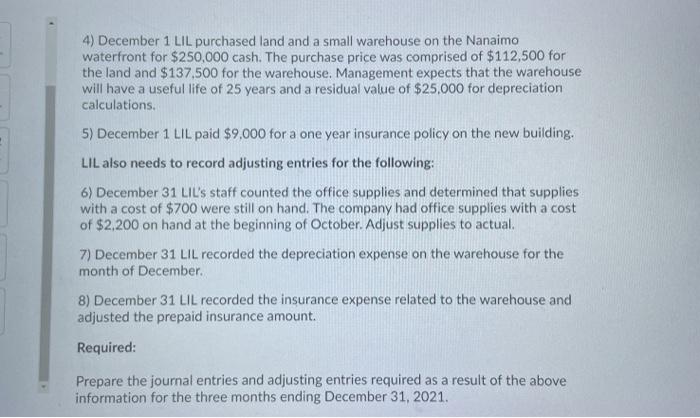

Question 1 (20 points) Lotus Imports Ltd. ("LIL") is a Nanaimo-based company that imports tea from India, Korea and China. LIL is currently preparing financial statements for the three months ending December 31, 2021 The company policy is to depreciate all capital assets using the straight-line depreciation method. Depreciation expense is determined and recorded monthly. The Company uses a perpetual inventory system. LIL had the following transactions during the period October 1 to December 31, 2021: 1) October 1 LIL issued 40,000 preferred shares for $25 per share. The preferred shares pay a quarterly dividend of $0.65 per share. 2) October 16 The Company received a shipment of tea from one its Korean suppliers. The Company purchased this on account and has 90 days to pay the supplier the $112,000 owing for the tea. 3) November 2 LIL made a sale to a major grocery chain. The sale, which was on account, was for $128,000. The tea cost LIL $63,000. 4) December 1 LIL purchased land and a small warehouse on the Nanaimo waterfront for $250,000 cash. The purchase price was comprised of $112,500 for the land and $137,500 for the warehouse. Management expects that the warehouse will have a useful life of 25 years and a residual value of $25.000 for depreciation calculations. 5) December 1 LIL paid $9,000 for a one year insurance policy on the new building, LIL also needs to record adjusting entries for the following: 6) December 31 LIL's staff counted the office supplies and determined that supplies with a cost of $700 were still on hand. The company had office supplies with a cost of $2,200 on hand at the beginning of October. Adjust supplies to actual. 7) December 31 LIL recorded the depreciation expense on the warehouse for the month of December 8) December 31 LIL recorded the insurance expense related to the warehouse and adjusted the prepaid insurance amount Required: Prepare the journal entries and adjusting entries required as a result of the above information for the three months ending December 31, 2021