Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (20P) When the single-index model is used, the variance of a security's return is expressed as: o = o +0 Derive the

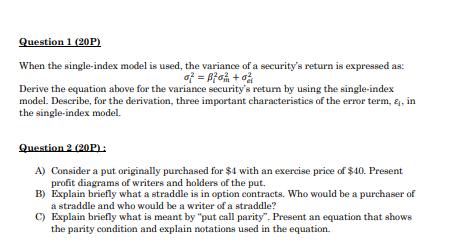

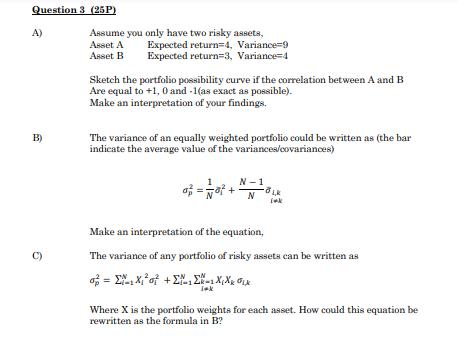

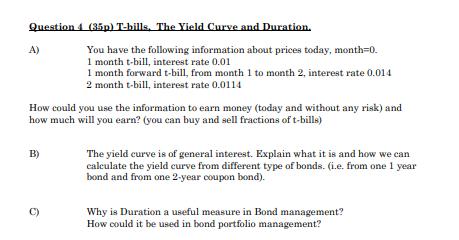

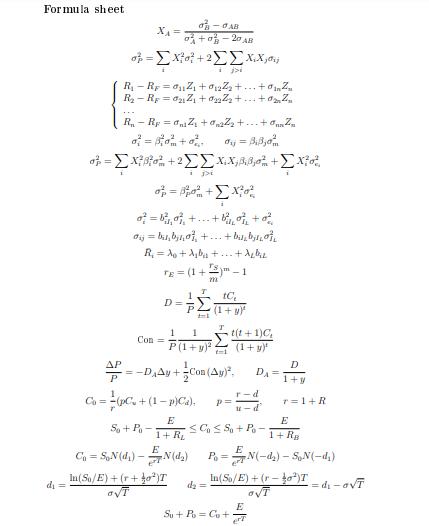

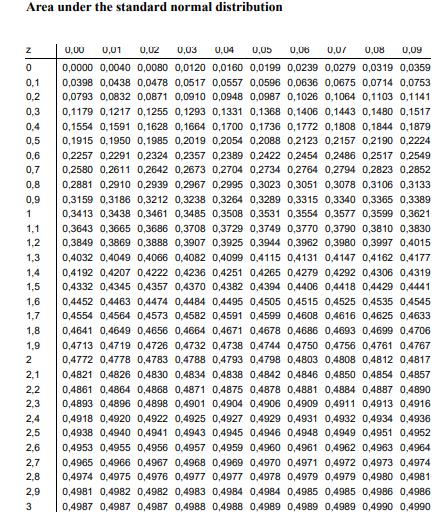

Question 1 (20P) When the single-index model is used, the variance of a security's return is expressed as: o = o +0 Derive the equation above for the variance security's return by using the single-index model. Describe, for the derivation, three important characteristics of the error term, &, in the single-index model. Question 2 (20P): A) Consider a put originally purchased for $4 with an exercise price of $40. Present profit diagrams of writers and holders of the put. B) Explain briefly what a straddle is in option contracts. Who would be a purchaser of a straddle and who would be a writer of a straddle? C) Explain briefly what is meant by "put call parity". Present an equation that shows the parity condition and explain notations used in the equation. Question 3 (25P) A) B) Assume you only have two risky assets, Asset A Expected return=4, Variance-9 Asset B Expected return=3, Variance 4 Sketch the portfolio possibility curve if the correlation between A and B Are equal to +1,0 and 1(as exact as possible). Make an interpretation of your findings. The variance of an equally weighted portfolio could be written as (the bar indicate the average value of the variances/covariances) 1 N-1 N -LK lak Make an interpretation of the equation, The variance of any portfolio of risky assets can be written as = x of +- Ex-XXx x lak Where X is the portfolio weights for each asset. How could this equation be rewritten as the formula in B? Question A) 4 (35p) T-bills. The Yield Curve and Duration. You have the following information about prices today, month=0. 1 month t-bill, interest rate 0.01 1 month forward t-bill, from month 1 to month 2, interest rate 0.014 2 month t-bill, interest rate 0.0114 How could you use the information to earn money (today and without any risk) and how much will you earn? (you can buy and sell fractions of t-bills) B) The yield curve is of general interest. Explain what it is and how we can calculate the yield curve from different type of bonds. (i.e. from one 1 year bond and from one 2-year coupon bond). Why is Duration a useful measure in Bond management? How could it be used in bond portfolio management? Formula sheet d = X = +0 o = [X0 + 2 XiXj R - R=Z + 022+...+0Z R-R=01Z +022 +...+0 R - Rp = aZ +0n2Z+...+0 Z 2=0 +0. dj = B3, o = [X +2XX; +[X i pi =+++0 TE= (1 + -AB aj = bub,0], +...+bb,0 R = A ++.+ debre D= Con= So + Po- 1 P -20 AB T In(S/E) + (r+)T OVT 222 i 1 1 P(1+y) d = tC (1 + y) T =-DAy+Con (Ay) DA= t=1 t(t+1)C (1+y) r-d u-d co So + Po- Co= (pCu + (1-P)Ca), P= E 1 + R C=SN () N(d) P = = N(-d) - SoN(-d) In(S/E)+(ro)T =d-ov OVT Su + Po=Cu+ D 1+y E 27 T=1+R E 1+ RB Area under the standard normal distribution 0,09 0,00 0,01 0,02 0,03 0,04 0,05 0,06 0,0/ 0,08 0,0000 0,0040 0,0080 0,0120 0,0160 0,0199 0,0239 0,0279 0,0319 0,0359 0,0398 0,0438 0,0478 0,0517 0,0557 0,0596 0,0636 0,0675 0,0714 0,0753 0,0793 0,0832 0,0871 0,0910 0,0948 0,0987 0,1026 0,1064 0,1103 0,1141 0,1179 0,1217 0,1255 0,1293 0,1331 0,1368 0,1406 0,1443 0,1480 0,1517 0,1554 0,1591 0,1628 0,1664 0,1700 0,1736 0,1772 0,1808 0,1844 0,1879 0,1915 0,1950 0,1985 0,2019 0,2054 0,2088 0,2123 0,2157 0,2190 0,2224 0,2257 0,2291 0,2324 0,2357 0,2389 0,2422 0,2454 0,2486 0,2517 0,2549 0,2580 0,2611 0,2642 0,2673 0,2704 0,2734 0,2764 0,2794 0,2823 0,2852 0,2881 0,2910 0,2939 0,2967 0,2995 0,3023 0,3051 0,3078 0,3106 0,3133 0,3159 0,3186 0,3212 0,3238 0,3264 0,3289 0,3315 0,3340 0,3365 0,3389 0,3413 0,3438 0,3461 0,3485 0,3508 0,3531 0,3554 0,3577 0,3599 0,3621 0,3643 0,3665 0,3686 0,3708 0,3729 0,3749 0,3770 0,3790 0,3810 0,3830 0,3849 0,3869 0,3888 0,3907 0,3925 0,3944 0,3962 0,3980 0,3997 0,4015 0,4032 0,4049 0,4066 0,4082 0,4099 0,4115 0,4131 0,4147 0,4162 0,4177 0,4192 0,4207 0,4222 0,4236 0,4251 0,4265 0,4279 0,4292 0,4306 0,4319 0,4332 0,4345 0,4357 0,4370 0,4382 0,4394 0,4406 0,4418 0,4429 0,4441 0,4452 0,4463 0,4474 0,4484 0,4495 0,4505 0,4515 0,4525 0,4535 0,4545 0,4554 0,4564 0,4573 0,4582 0,4591 0,4599 0,4608 0,4616 0,4625 0,4633 0,4641 0,4649 0,4656 0,4664 0,4671 0,4678 0,4686 0,4693 0,4699 0,4706 0,4713 0,4719 0,4726 0,4732 0,4738 0,4744 0,4750 0,4756 0,4761 0,4767 0,4772 0,4778 0,4783 0,4788 0,4793 0,4798 0,4803 0,4808 0,4812 0,4817 2,1 0,4821 0,4826 0,4830 0,4834 0,4838 0,4842 0,4846 0,4850 0,4854 0,4857 2,2 0,4861 0,4864 0,4868 0,4871 0,4875 0,4878 0,4881 0,4884 0,4887 0,4890 2,3 0,4893 0,4896 0,4898 0,4901 0,4904 0,4906 0,4909 0,4911 0,4913 0,4916 2,4 0,4918 0,4920 0,4922 0,4925 0,4927 0,4929 0,4931 0,4932 0,4934 0,4936 0,4938 0,4940 0,4941 0,4943 0,4945 0,4946 0,4948 0,4949 0,4951 0,4952 0,4953 0,4955 0,4956 0,4957 0,4959 0,4960 0,4961 0,4962 0,4963 0,4964 0,4965 0,4966 0,4967 0,4968 0,4969 0,4970 0,4971 0,4972 0,4973 0,4974 0,4974 0,4975 0,4976 0,4977 0,4977 0,4978 0,4979 0,4979 0,4980 0,4981 0,4981 0,4982 0,4982 0,4983 0,4984 0,4984 0,4985 0,4985 0,4986 0,4986 0,4987 0,4987 0,4987 0,4988 0,4988 0,4989 0,4989 0,4989 0,4990 0,4990 z 0 0,1 0,2 0,3 0,4 0,5 0,6 0,7 0,8 0,9 1 1,1 1,2 1,3 1,4 1,5 1,6 1,7 1,8 1,9 2 NO 2,5 2,6 2,7 2,8 2,9 3

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 In the singleindex model the variance of a securitys return can be expressed as VarRi i2 VarRm Vari where VarRi is the variance of the securitys return i is the beta coefficient of the secu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started