Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 (25 Marks) 1.1 Barney Limited has the choice of purchasing one of two machines viz. Machine A and Machine B. Both machines have

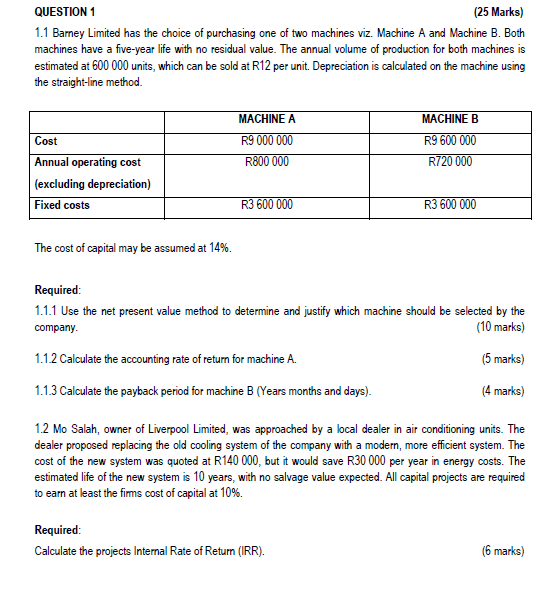

QUESTION 1 (25 Marks) 1.1 Barney Limited has the choice of purchasing one of two machines viz. Machine A and Machine B. Both machines have a five-year life with no residual value. The annual volume of production for both machines is estimated at 600000 units, which can be sold at R12 per unit. Depreciation is calculated on the machine using the straight-line method. The cost of capital may be assumed at 14%. Required: 1.1.1 Use the net present value method to determine and justify which machine should be selected by the company. (10 marks) 1.1.2 Calculate the accounting rate of return for machine A. (5 marks) 1.1.3 Calculate the payback period for machine B (Years months and days). (4 marks) 1.2 Mo Salah, owner of Liverpool Limited, was approached by a local dealer in air conditioning units. The dealer proposed replacing the old cooling system of the company with a modern, more efficient system. The cost of the new system was quoted at R140 000, but it would save R30 000 per year in energy costs. The estimated life of the new system is 10 years, with no salvage value expected. All capital projects are required to earn at least the firms cost of capital at 10%. Required: Calculate the projects Internal Rate of Return (IRR). (6 marks)

QUESTION 1 (25 Marks) 1.1 Barney Limited has the choice of purchasing one of two machines viz. Machine A and Machine B. Both machines have a five-year life with no residual value. The annual volume of production for both machines is estimated at 600000 units, which can be sold at R12 per unit. Depreciation is calculated on the machine using the straight-line method. The cost of capital may be assumed at 14%. Required: 1.1.1 Use the net present value method to determine and justify which machine should be selected by the company. (10 marks) 1.1.2 Calculate the accounting rate of return for machine A. (5 marks) 1.1.3 Calculate the payback period for machine B (Years months and days). (4 marks) 1.2 Mo Salah, owner of Liverpool Limited, was approached by a local dealer in air conditioning units. The dealer proposed replacing the old cooling system of the company with a modern, more efficient system. The cost of the new system was quoted at R140 000, but it would save R30 000 per year in energy costs. The estimated life of the new system is 10 years, with no salvage value expected. All capital projects are required to earn at least the firms cost of capital at 10%. Required: Calculate the projects Internal Rate of Return (IRR). (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started