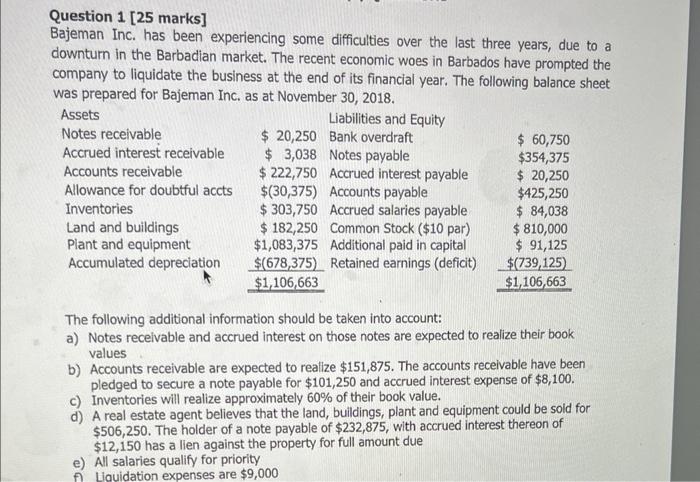

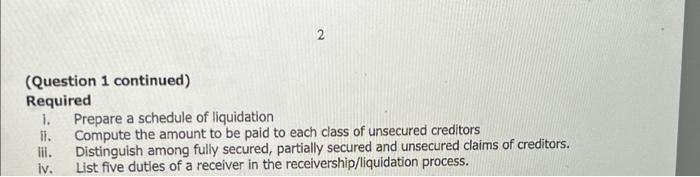

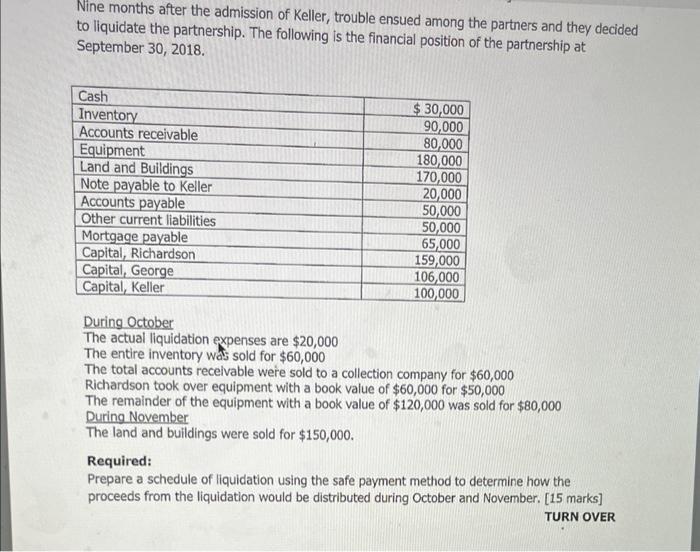

Question 1 [25 marks] Bajeman Inc. has been experiencing some difficulties over the last three years, due to a downturn in the Barbadian market. The recent economic woes in Barbados have prompted the company to liquidate the business at the end of its financial year. The following balance sheet was prepared for Bajeman Inc. as at November 30, 2018. The following additional information should be taken into account: a) Notes recelvable and accrued interest on those notes are expected to realize their book values b) Accounts receivable are expected to realize $151,875. The accounts receivable have been pledged to secure a note payable for $101,250 and accrued interest expense of $8,100. c) Inventories will realize approximately 60% of their book value. d) A real estate agent believes that the land, buildings, plant and equipment could be soid for $506,250. The holder of a note payable of $232,875, with accrued interest thereon of $12,150 has a lien against the property for full amount due e) All salaries qualify for priority f Liquidation expenses are $9,000 (Question 1 continued) Required i. Prepare a schedule of liquidation ii. Compute the amount to be paid to each class of unsecured creditors iii. Distinguish among fully secured, partially secured and unsecured claims of creditors. Iv. List five dutles of a receiver in the receivership/liquidation process. Nine months after the admission of Keller, trouble ensued among the partners and they decided to liquidate the partnership. The following is the financial position of the partnership at September 30, 2018. During October The actual liquidation expenses are $20,000 The entire inventory was sold for $60,000 The total accounts recelvable were sold to a collection company for $60,000 Richardson took over equipment with a book value of $60,000 for $50,000 The remainder of the equipment with a book value of $120,000 was sold for $80,000 During November The land and buildings were sold for $150,000. Required: Prepare a schedule of liquidation using the safe payment method to determine how the proceeds from the liquidation would be distributed during October and November. [15 marks] TURN OVER