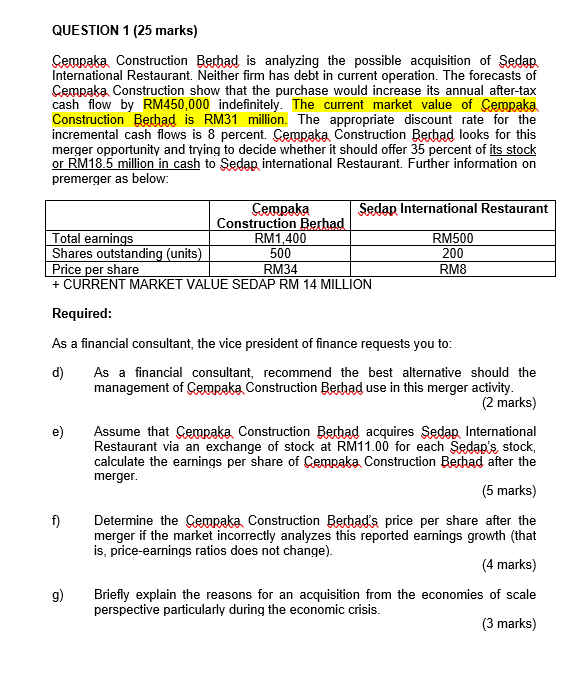

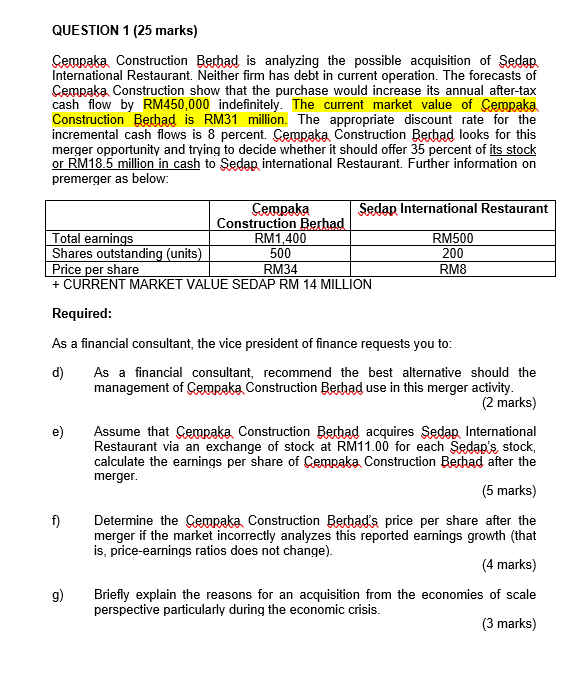

QUESTION 1 (25 marks) Cempaka Construction Berhad is analyzing the possible acquisition of Sedap International Restaurant. Neither firm has debt in current operation. The forecasts of Cempaka, Construction show that the purchase would increase its annual after-tax cash flow by RM450,000 indefinitely. The current market value of Cempaka Construction Berhad is RM31 million. The appropriate discount rate for the incremental cash flows is 8 percent. Cempaka Construction Berhad looks for this merger opportunity and trying to decide whether it should offer 35 percent of its stock or RM18.5 million in cash to Sedap international Restaurant. Further information on premerger as below: Cempaka Sedap International Restaurant Construction Berhad Total earnings RM1,400 Shares outstanding (units) 500 Price per share RM34 + CURRENT MARKET VALUE SEDAP RM 14 MILLION RM500 200 RM8 Required: As a financial consultant, the vice president of finance requests you to: d) As a financial consultant, recommend the best alternative should the management of Cempaka Construction Berhad use in this merger activity. (2 marks) e) Assume that Cempaka Construction Berhad acquires Sedap International Restaurant via an exchange of stock at RM11.00 for each Sedap's stock, calculate the earnings per share of Cempaka Construction Berhad after the merger. (5 marks) f) Determine the Cempaka Construction Berhad's price per share after the merger if the market incorrectly analyzes this reported earnings growth (that is, price-earnings ratios does not change). (4 marks) g) Briefly explain the reasons for an acquisition from the economies of scale perspective particularly during the economic crisis. (3 marks) QUESTION 1 (25 marks) Cempaka Construction Berhad is analyzing the possible acquisition of Sedap International Restaurant. Neither firm has debt in current operation. The forecasts of Cempaka, Construction show that the purchase would increase its annual after-tax cash flow by RM450,000 indefinitely. The current market value of Cempaka Construction Berhad is RM31 million. The appropriate discount rate for the incremental cash flows is 8 percent. Cempaka Construction Berhad looks for this merger opportunity and trying to decide whether it should offer 35 percent of its stock or RM18.5 million in cash to Sedap international Restaurant. Further information on premerger as below: Cempaka Sedap International Restaurant Construction Berhad Total earnings RM1,400 Shares outstanding (units) 500 Price per share RM34 + CURRENT MARKET VALUE SEDAP RM 14 MILLION RM500 200 RM8 Required: As a financial consultant, the vice president of finance requests you to: d) As a financial consultant, recommend the best alternative should the management of Cempaka Construction Berhad use in this merger activity. (2 marks) e) Assume that Cempaka Construction Berhad acquires Sedap International Restaurant via an exchange of stock at RM11.00 for each Sedap's stock, calculate the earnings per share of Cempaka Construction Berhad after the merger. (5 marks) f) Determine the Cempaka Construction Berhad's price per share after the merger if the market incorrectly analyzes this reported earnings growth (that is, price-earnings ratios does not change). (4 marks) g) Briefly explain the reasons for an acquisition from the economies of scale perspective particularly during the economic crisis