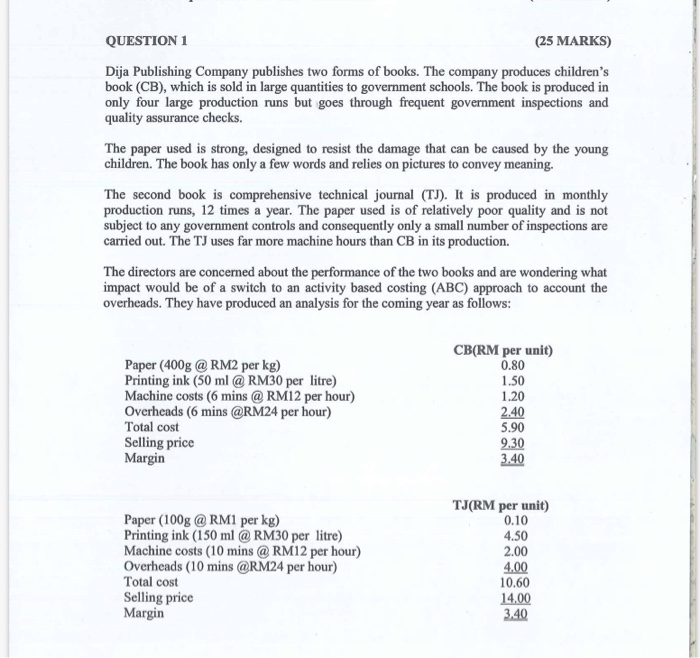

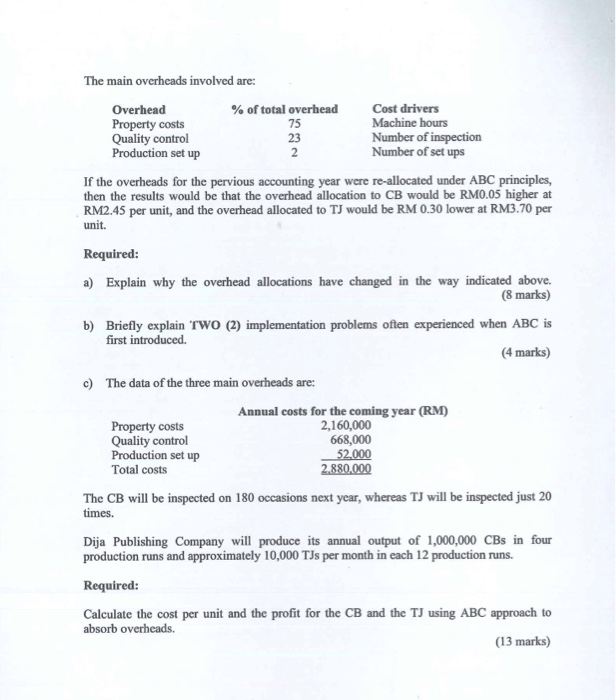

QUESTION 1 (25 MARKS) Dija Publishing Company publishes two forms of books. The company produces children's book (CB), which is sold in large quantities to government schools. The book is produced in only four large production runs but goes through frequent government inspections and quality assurance checks. The paper used is strong, designed to resist the damage that can be caused by the young children. The book has only a few words and relies on pictures to convey meaning. The second book is comprehensive technical journal (TJ). It is produced in monthly production runs, 12 times a year. The paper used is of relatively poor quality and is not subject to any government controls and consequently only a small number of inspections are carried out. The TJ uses far more machine hours than CB in its production. The directors are concerned about the performance of the two books and are wondering what impact would be of a switch to an activity based costing (ABC) approach to account the overheads. They have produced an analysis for the coming year as follows: Paper (400g @ RM2 per kg) Printing ink (50 ml @ RM30 per litre) Machine costs (6 mins @ RM12 per hour) Overheads (6 mins @RM24 per hour) Total cost Selling price Margin CB(RM per unit) 0.80 1.50 1.20 2.40 5.90 9.30 3.40 Paper (100g @ RM1 per kg) Printing ink (150 ml @ RM30 per litre) Machine costs (10 mins @ RM12 per hour) Overheads (10 mins @RM24 per hour) Total cost Selling price Margin TJ(RM per unit) 0.10 4.50 2.00 4.00 10.60 14.00 3.40 The main overheads involved are: Overhead % of total overhead Cost drivers Property costs Machine hours Quality control Number of inspection Production set up Number of set ups If the overheads for the pervious accounting year were re-allocated under ABC principles, then the results would be that the overhead allocation to CB would be RM RM2.45 per unit, and the overhead allocated to TJ would be RM 0.30 lower at RM3.70 per unit. Required: a) Explain why the overhead allocations have changed in the way indicated above. (8 marks) b) Briefly explain TWO (2) implementation problems often experienced when ABC is first introduced. (4 marks) c) The data of the three main overheads are: Annual costs for the coming year (RM) Property costs 2,160,000 Quality control 668,000 Production set up 52.000 Total costs 2.880.000 The CB will be inspected on 180 occasions next year, whereas TJ will be inspected just 20 times. Dija Publishing Company will produce its annual output of 1,000,000 CBs in four production runs and approximately 10,000 TJs per month in cach 12 production runs. Required: Calculate the cost per unit and the profit for the CB and the TJ using ABC approach to absorb overheads. (13 marks)