Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (25 marks) Read the case study below and answer the questions that follow: Bio Technologies Africa (BTA) Ltd, is a rapidly growing

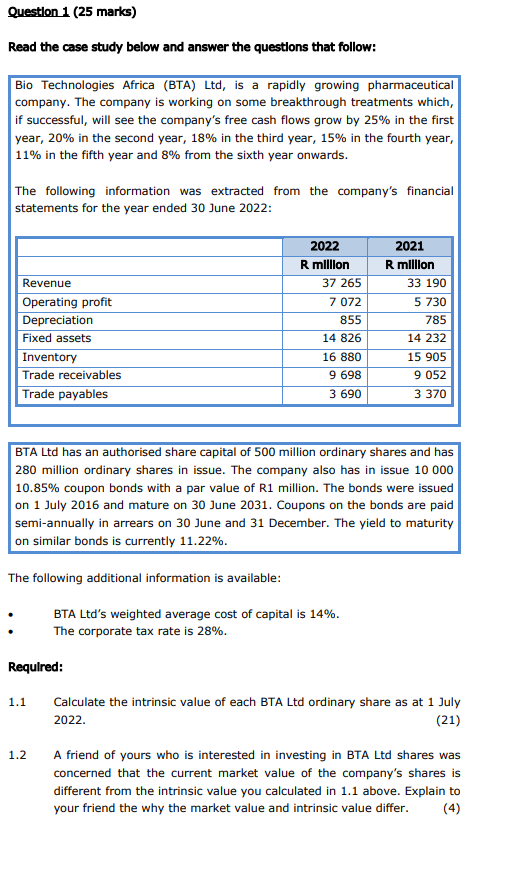

Question 1 (25 marks) Read the case study below and answer the questions that follow: Bio Technologies Africa (BTA) Ltd, is a rapidly growing pharmaceutical company. The company is working on some breakthrough treatments which, if successful, will see the company's free cash flows grow by 25% in the first year, 20% in the second year, 18% in the third year, 15% in the fourth year, 11% in the fifth year and 8% from the sixth year onwards. The following information was extracted from the company's financial statements for the year ended 30 June 2022: Revenue Operating profit Depreciation Fixed assets Inventory Trade receivables Trade payables 2022 R million 2021 R million 37 265 33 190 7 072 5 730 855 14 826 785 14 232 16 880 15 905 9 698 9 052 3 690 3 370 BTA Ltd has an authorised share capital of 500 million ordinary shares and has 280 million ordinary shares in issue. The company also has in issue 10 000 10.85% coupon bonds with a par value of R1 million. The bonds were issued on 1 July 2016 and mature on 30 June 2031. Coupons on the bonds are paid semi-annually in arrears on 30 June and 31 December. The yield to maturity on similar bonds is currently 11.22%. The following additional information is available: BTA Ltd's weighted average cost of capital is 14%. The corporate tax rate is 28%. Required: 1.1 1.2 Calculate the intrinsic value of each BTA Ltd ordinary share as at 1 July 2022. (21) A friend of yours who is interested in investing in BTA Ltd shares was concerned that the current market value of the company's shares is different from the intrinsic value you calculated in 1.1 above. Explain to your friend the why the market value and intrinsic value differ. (4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started