Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (25 Marks) Study the information given below and answer the following questions: begin{tabular}{|l|l|l|l|l|l|l|l|} hline & INFORMATION & & & & hline end{tabular}

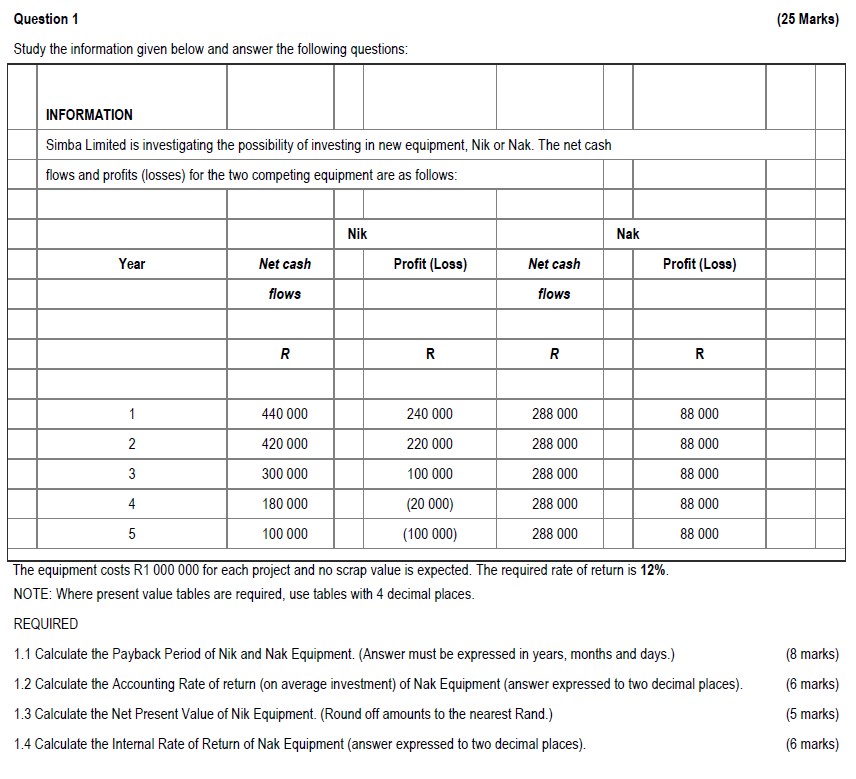

Question 1 (25 Marks) Study the information given below and answer the following questions: \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & INFORMATION & & & & \\ \hline \end{tabular} The equipment costs R1 000000 for each project and no scrap value is expected. The required rate of return is 12%. NOTE: Where present value tables are required, use tables with 4 decimal places. REQUIRED 1.1 Calculate the Payback Period of Nik and Nak Equipment. (Answer must be expressed in years, months and days.) (8 marks) 1.2 Calculate the Accounting Rate of return (on average investment) of Nak Equipment (answer expressed to two decimal places). (6 marks) 1.3 Calculate the Net Present Value of Nik Equipment. (Round off amounts to the nearest Rand.) (5 marks) 1.4 Calculate the Internal Rate of Return of Nak Equipment (answer expressed to two decimal places). (6 marks) Question 1 (25 Marks) Study the information given below and answer the following questions: \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & INFORMATION & & & & \\ \hline \end{tabular} The equipment costs R1 000000 for each project and no scrap value is expected. The required rate of return is 12%. NOTE: Where present value tables are required, use tables with 4 decimal places. REQUIRED 1.1 Calculate the Payback Period of Nik and Nak Equipment. (Answer must be expressed in years, months and days.) (8 marks) 1.2 Calculate the Accounting Rate of return (on average investment) of Nak Equipment (answer expressed to two decimal places). (6 marks) 1.3 Calculate the Net Present Value of Nik Equipment. (Round off amounts to the nearest Rand.) (5 marks) 1.4 Calculate the Internal Rate of Return of Nak Equipment (answer expressed to two decimal places). (6 marks)

Question 1 (25 Marks) Study the information given below and answer the following questions: \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & INFORMATION & & & & \\ \hline \end{tabular} The equipment costs R1 000000 for each project and no scrap value is expected. The required rate of return is 12%. NOTE: Where present value tables are required, use tables with 4 decimal places. REQUIRED 1.1 Calculate the Payback Period of Nik and Nak Equipment. (Answer must be expressed in years, months and days.) (8 marks) 1.2 Calculate the Accounting Rate of return (on average investment) of Nak Equipment (answer expressed to two decimal places). (6 marks) 1.3 Calculate the Net Present Value of Nik Equipment. (Round off amounts to the nearest Rand.) (5 marks) 1.4 Calculate the Internal Rate of Return of Nak Equipment (answer expressed to two decimal places). (6 marks) Question 1 (25 Marks) Study the information given below and answer the following questions: \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & INFORMATION & & & & \\ \hline \end{tabular} The equipment costs R1 000000 for each project and no scrap value is expected. The required rate of return is 12%. NOTE: Where present value tables are required, use tables with 4 decimal places. REQUIRED 1.1 Calculate the Payback Period of Nik and Nak Equipment. (Answer must be expressed in years, months and days.) (8 marks) 1.2 Calculate the Accounting Rate of return (on average investment) of Nak Equipment (answer expressed to two decimal places). (6 marks) 1.3 Calculate the Net Present Value of Nik Equipment. (Round off amounts to the nearest Rand.) (5 marks) 1.4 Calculate the Internal Rate of Return of Nak Equipment (answer expressed to two decimal places). (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started