Answered step by step

Verified Expert Solution

Question

1 Approved Answer

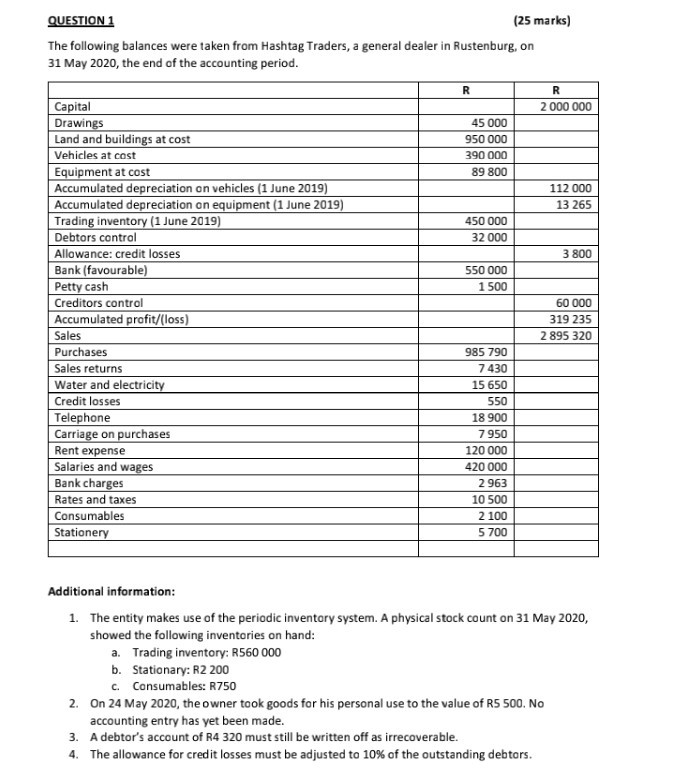

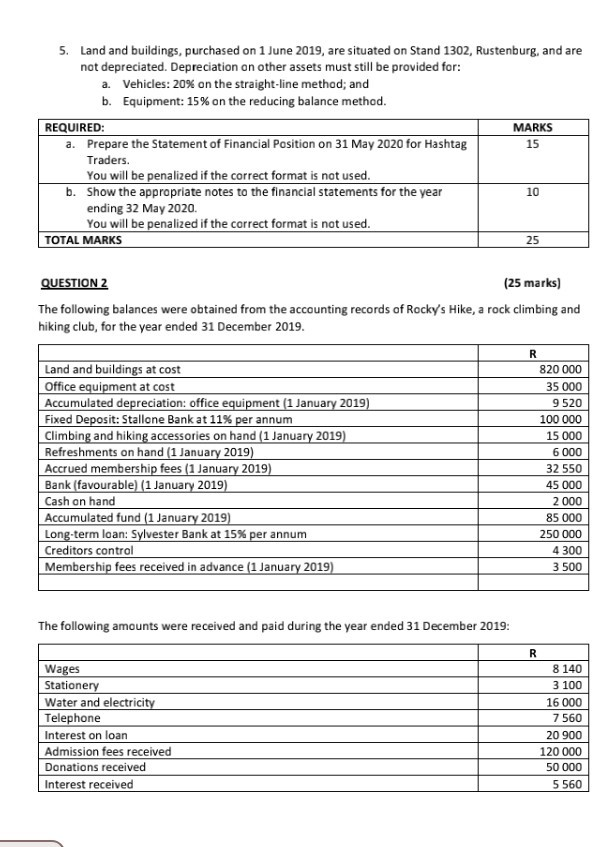

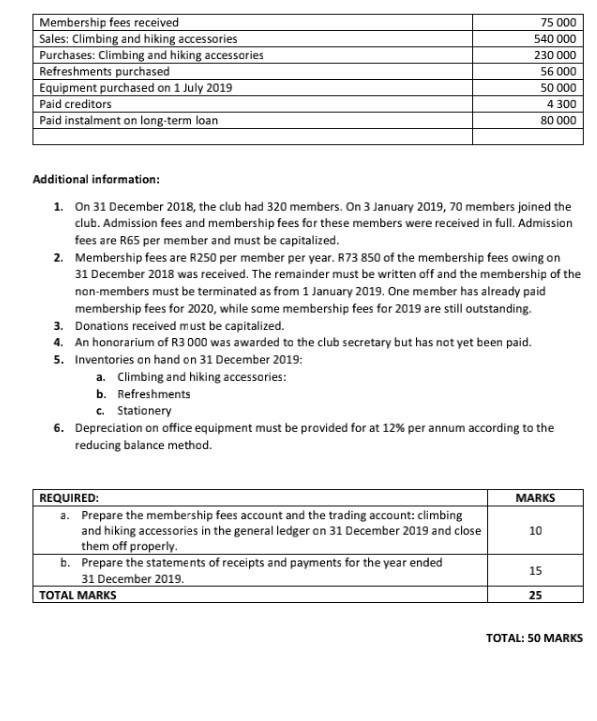

QUESTION 1 (25 marks) The following balances were taken from Hashtag Traders, a general dealer in Rustenburg, on 31 May 2020, the end of the

QUESTION 1 (25 marks) The following balances were taken from Hashtag Traders, a general dealer in Rustenburg, on 31 May 2020, the end of the accounting period. R R 2 000 000 45 000 950 000 390 000 89 800 112 000 13 265 450 000 32 000 3 800 550 000 1 500 Capital Drawings Land and buildings at cost Vehicles at cost Equipment at cost Accumulated depreciation on vehicles (1 June 2019) Accumulated depreciation on equipment (1 June 2019) Trading inventory (1 June 2019) Debtors control Allowance: credit losses Bank (favourable) Petty cash Creditors control Accumulated profit/(loss) Sales Purchases Sales returns Water and electricity Credit losses Telephone Carriage on purchases Rent expense Salaries and wages Bank charges Rates and taxes Consumables Stationery 60 000 319 235 2 895 320 985 790 7430 15 650 550 18 900 7950 120 000 420 000 2963 10 500 2 100 5700 Additional information: 1. The entity makes use of the periodic inventory system. A physical stock count on 31 May 2020, showed the following inventories on hand: a. Trading inventory: R560 000 b. Stationary: R2 200 c. Consumables: R750 2. On 24 May 2020, the owner took goods for his personal use to the value of Rs 500. No accounting entry has yet been made. 3. A debtor's account of R4 320 must still be written off as irrecoverable. 4. The allowance for credit losses must be adjusted to 10% of the outstanding debtors. 5. Land and buildings, purchased on 1 June 2019, are situated on Stand 1302, Rustenburg, and are not depreciated. Depreciation on other assets must still be provided for: a. Vehicles: 20% on the straight-line method; and b. Equipment: 15% on the reducing balance method. REQUIRED: a. Prepare the Statement of Financial Position on 31 May 2020 for Hashtag Traders. You will be penalized if the correct format is not used. b. Show the appropriate notes to the financial statements for the year ending 32 May 2020 You will be penalized if the correct format is not used. TOTAL MARKS MARKS 15 10 25 QUESTION 2 (25 marks) The following balances were obtained from the accounting records of Rocky's Hike, a rock climbing and hiking club, for the year ended 31 December 2019. Land and buildings at cost Office equipment at cost Accumulated depreciation office equipment (1 January 2019) Fixed Deposit: Stallone Bank at 11% per annum Climbing and hiking accessories on hand (1 January 2019) Refreshments on hand (1 January 2019) Accrued membership fees (1 January 2019) Bank (favourable) (1 January 2019) Cash on hand Accumulated fund (1 January 2019) Long-term loan: Sylvester Bank at 15% per annum Creditors control Membership fees received in advance (1 January 2019) R 820 000 35 000 9520 100 000 15 000 6 000 32 550 45 000 2 000 85 000 250 000 4 300 3 500 The following amounts were received and paid during the year ended 31 December 2019: Wages Stationery Water and electricity Telephone Interest on loan Admission fees received Donations received Interest received R 8 140 3 100 16 000 7560 20 900 120 000 50 000 5 560 Membership fees received Sales: Climbing and hiking accessories Purchases: Climbing and hiking accessories Refreshments purchased Equipment purchased on 1 July 2019 Paid creditors Paid instalment on long-term loan 75 000 540 000 230 000 56 000 50 000 4 300 80 000 Additional information: 1. On 31 December 2018, the club had 320 members. On 3 January 2019, 70 members joined the club. Admission fees and membership fees for these members were received in full. Admission fees are R65 per member and must be capitalized. 2. Membership fees are R250 per member per year. R73 850 of the membership fees owing on 31 December 2018 was received. The remainder must be written off and the membership of the non-members must be terminated as from 1 January 2019. One member has already paid membership fees for 2020, while some membership fees for 2019 are still outstanding. 3. Donations received must be capitalized. 4. An honorarium of R3 000 was awarded to the club secretary but has not yet been paid. 5. Inventories on hand on 31 December 2019: a. Climbing and hiking accessories: b. Refreshments c. Stationery 6. Depreciation on office equipment must be provided for at 12% per annum according to the reducing balance method. MARKS 10 REQUIRED: a. Prepare the membership fees account and the trading account: climbing and hiking accessories in the general ledger on 31 December 2019 and close them off properly. b. Prepare the statements of receipts and payments for the year ended 31 December 2019. TOTAL MARKS 15 25 TOTAL: 50 MARKS QUESTION 1 (25 marks) The following balances were taken from Hashtag Traders, a general dealer in Rustenburg, on 31 May 2020, the end of the accounting period. R R 2 000 000 45 000 950 000 390 000 89 800 112 000 13 265 450 000 32 000 3 800 550 000 1 500 Capital Drawings Land and buildings at cost Vehicles at cost Equipment at cost Accumulated depreciation on vehicles (1 June 2019) Accumulated depreciation on equipment (1 June 2019) Trading inventory (1 June 2019) Debtors control Allowance: credit losses Bank (favourable) Petty cash Creditors control Accumulated profit/(loss) Sales Purchases Sales returns Water and electricity Credit losses Telephone Carriage on purchases Rent expense Salaries and wages Bank charges Rates and taxes Consumables Stationery 60 000 319 235 2 895 320 985 790 7430 15 650 550 18 900 7950 120 000 420 000 2963 10 500 2 100 5700 Additional information: 1. The entity makes use of the periodic inventory system. A physical stock count on 31 May 2020, showed the following inventories on hand: a. Trading inventory: R560 000 b. Stationary: R2 200 c. Consumables: R750 2. On 24 May 2020, the owner took goods for his personal use to the value of Rs 500. No accounting entry has yet been made. 3. A debtor's account of R4 320 must still be written off as irrecoverable. 4. The allowance for credit losses must be adjusted to 10% of the outstanding debtors. 5. Land and buildings, purchased on 1 June 2019, are situated on Stand 1302, Rustenburg, and are not depreciated. Depreciation on other assets must still be provided for: a. Vehicles: 20% on the straight-line method; and b. Equipment: 15% on the reducing balance method. REQUIRED: a. Prepare the Statement of Financial Position on 31 May 2020 for Hashtag Traders. You will be penalized if the correct format is not used. b. Show the appropriate notes to the financial statements for the year ending 32 May 2020 You will be penalized if the correct format is not used. TOTAL MARKS MARKS 15 10 25 QUESTION 2 (25 marks) The following balances were obtained from the accounting records of Rocky's Hike, a rock climbing and hiking club, for the year ended 31 December 2019. Land and buildings at cost Office equipment at cost Accumulated depreciation office equipment (1 January 2019) Fixed Deposit: Stallone Bank at 11% per annum Climbing and hiking accessories on hand (1 January 2019) Refreshments on hand (1 January 2019) Accrued membership fees (1 January 2019) Bank (favourable) (1 January 2019) Cash on hand Accumulated fund (1 January 2019) Long-term loan: Sylvester Bank at 15% per annum Creditors control Membership fees received in advance (1 January 2019) R 820 000 35 000 9520 100 000 15 000 6 000 32 550 45 000 2 000 85 000 250 000 4 300 3 500 The following amounts were received and paid during the year ended 31 December 2019: Wages Stationery Water and electricity Telephone Interest on loan Admission fees received Donations received Interest received R 8 140 3 100 16 000 7560 20 900 120 000 50 000 5 560 Membership fees received Sales: Climbing and hiking accessories Purchases: Climbing and hiking accessories Refreshments purchased Equipment purchased on 1 July 2019 Paid creditors Paid instalment on long-term loan 75 000 540 000 230 000 56 000 50 000 4 300 80 000 Additional information: 1. On 31 December 2018, the club had 320 members. On 3 January 2019, 70 members joined the club. Admission fees and membership fees for these members were received in full. Admission fees are R65 per member and must be capitalized. 2. Membership fees are R250 per member per year. R73 850 of the membership fees owing on 31 December 2018 was received. The remainder must be written off and the membership of the non-members must be terminated as from 1 January 2019. One member has already paid membership fees for 2020, while some membership fees for 2019 are still outstanding. 3. Donations received must be capitalized. 4. An honorarium of R3 000 was awarded to the club secretary but has not yet been paid. 5. Inventories on hand on 31 December 2019: a. Climbing and hiking accessories: b. Refreshments c. Stationery 6. Depreciation on office equipment must be provided for at 12% per annum according to the reducing balance method. MARKS 10 REQUIRED: a. Prepare the membership fees account and the trading account: climbing and hiking accessories in the general ledger on 31 December 2019 and close them off properly. b. Prepare the statements of receipts and payments for the year ended 31 December 2019. TOTAL MARKS 15 25 TOTAL: 50 MARKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started