Question

Question 1 (25) Natural perils are those hazards or pure risks generally arising from natural causes as opposed to losses brought about by human actions

Question 1 (25)

Natural perils are those hazards or pure risks generally arising from natural causes as opposed to losses brought about by human actions Valsamakis, A.C. et al (2022)

The definition for force majeure (French) or vis major (Latin), is basically the superior force, or a chance occurrence, unavoidable accident Ward, M. (2021)

Discuss this main form of Eskoms COVID-19 force majeure as per the case study. 1.1. Briefly discuss the impact of covid on Eskom. (7)

1.2. What are the related risk control and techniques applied by Eskom in this force majeure? (18)

Question 2 (20)

2.1. Valsamakis (2022) states that risk control entails all activities mainly aimed at reducing the severity as well as the frequency of occurrence within an organisation.

Discuss the risk-financing function identified in the Eskom case study when considering the pursuit of minimizing the total cost of risk within the natural peril. Referring to Question 1, identifying the risks within Eskoms objectives, present the final adaptation of the risk management model. (Please include a discussion)

Question 3 (15)

Identify some practical steps in implementing a retention programme for Eskom.

Question 4 (20)

4.1. Discuss deductibles as part of the insured losses and insured retains for Eskoms own account. (10)

4.2. Discuss Eskoms evaluation of retention funding under the assumption of transaction costs commanded by alternative sources of finance. (10)

.

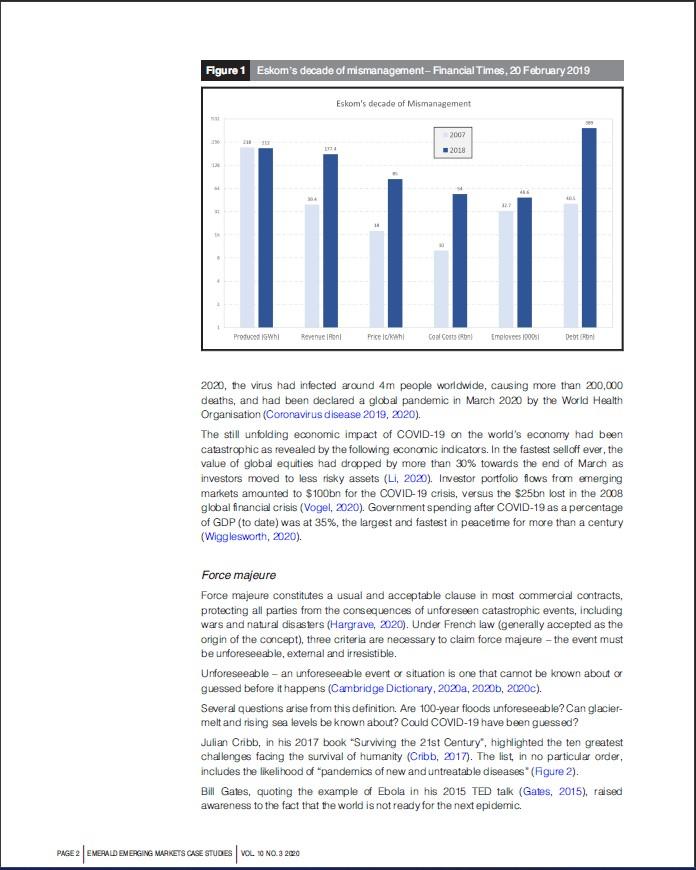

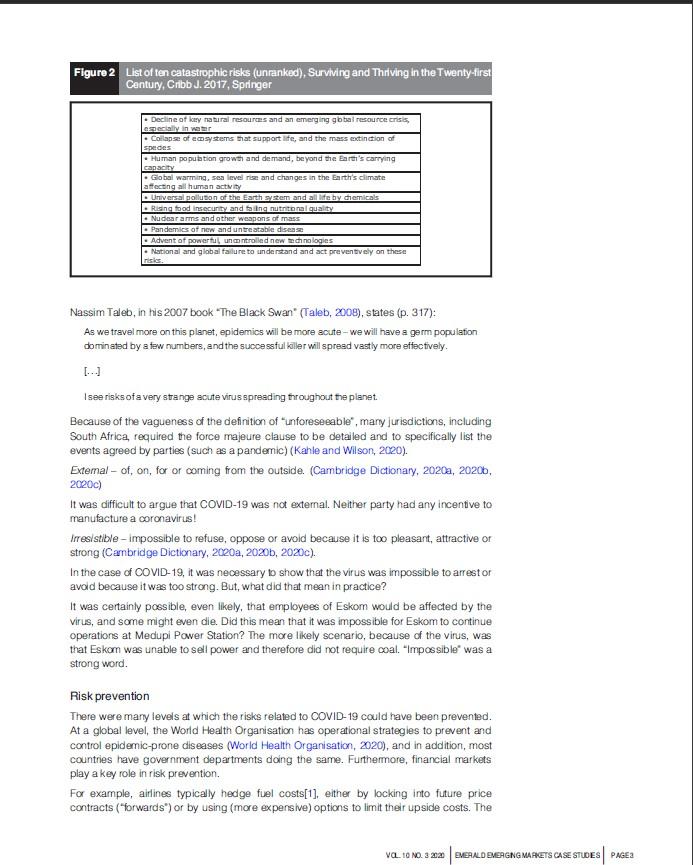

Eskom's COVID-19 force majeure Michael Ward Eskom - South Africa's pariah Following SA's 1994 democratic election, Eskom, with generating capacity of 33,000MW, embarked on a massive electrification scheme in townships and rural areas, connecting more than 300,000 households each year and forcing down the price of electricity. In its 1995 annual report John Maree, chairperson of the board, noted that Eskom was "admired internationally" and a "pillar" of economic growth (Eskom Communications, 1995). In 2001 at the Global Energy awards ceremony in New York, Eskom was named the "Financial Times Power Company of the Year". It was described as "providing the world's lowest-cost electricity", using "superior technology", "increasing transmission rellably" and using "efficient and safe methods for combustion of low-grade coal" (Tdit, 2019). In the 25 years that followed, bad management and corr uption had reduced the company to pariah status. Eskom, with capacity of over 45,000MW, could only generate 27,000MW and had, once again, reverted to "rolling blackouts". In 2019 , Pravin Gordhan, Minister of Public Enterprises, observed that Eskom was suffering from "systernic corruption, malfeasance, fraud and state capture" that had "compromised the credibility of the organisation and eroded ifvestor confidence:. Figure 1 summarises the most recent decade of mismanagement. On 26 March 2020, President Pamaposa declared COVID-19 a national disaster and implemented stringent "lockdown" rules across South Africa. A month later Eskom reported that it was expecting to "bleed up to R2.5bn a month in revenue because of reduced electricity demand" (Khumalo, 2020). Shortly after this, Eskom sent precautionary force majeure notices to its coal suppliers (Cronje, 2020). Devainer. This caseis wrthen 2020 , the virus had infected around 4m people worldwide, causing more than 200,000 deaths, and had been declared a global pandemic in March 2020 by the World Health Organisation (Coronavirus disease 2019, 2020). The still unfolding economic impact of COVID-19 on the world's economy had been catastrophic as revealed by the following economic indicators. In the fastest selloff ever, the value of global equities had dropped by more than 30% towards the end of March as investors moved to less risky assets ( Li, 2020). Irvestor portfolio flows from ernerging markets amounted to $100 bn for the COVID-19 crisis, versus the $25 bn lost in the 2008 global financial crisis (Vogel, 2020). Government spending after COVID-19 as a percentage of GDP ( to date) was at 35%, the largest and fastest in peacetime for more than a century (Wigglesworth, 2020). Force majeure Force majeure constitutes a usual and acceptable clause in most commercial contracts, protecting all parties from the consequences of unforeseen catastrophic events, including wars and natural disasters (Hargrave, 2020). Under French law (generally accepted as the origin of the concept), three criteria are necessary to claim force majeure - the event must be unforeseeable, extemal and ifresistible. Unforeseeable - an unforeseeable event or situation is one that cannot be known about or guessed before it happens (Cambridge Dictionary, 2020a, 2020b, 2020c). Several questions arise from this definition. Are 100-year floods unforeseeable? Can glaciermelt and rising sea levels be known about? Could COVID-19 have been guessed? Jullan Cribb, in his 2017 book "Surviving the 21st Century", highlighted the ten greatest. challenges facing the survival of humanity (Cribb, 2017). The list, in no particular order, includes the likelihood of "pandemics of new and untreatable diseases" (Figure 2). Bill Gates, quoting the example of Ebola in his 2015 TED talk (Gates, 2015), raised awareness to the fact that the world is not ready for the next epidemic. Figure 2 List of ten catastrophic risks (unranked), Surviving and Thriving in the Twenty first Cantury, CribbJ. 2017, Springer Nassim Taleb, in his 2007 book "The Black Swan" (Taleb, 2008), states (p. 317): As we travel more on this plenet, epidemics will be more acute - we will have a germ population dominated by a few numbers, and the successful killer will spread vastly more effectively. [] I see risks of a very stange acute virus spreading fhroughout the planet. Because of the vagueness of the definition of "unforeseeable", mary jurisdictions, including South Africa, required the force majeure clause to be detailed and to specifically list the events agreed by parties (such as a pandemic) (Kahle and Wilson, 2020). Extemal - of, on, for or coming from the outside. (Cambridge Dictionary, 2020a, 2020b, 2020c) It was difficult to argue that COVID-19 was not extemal. Neither party had any incentive to manufacture a coronavirus! Iresistible-impossible to refuse, oppose or avoid because it is too pleasant, attractive of strong (Cambridge Dictionary, 2020a, 2020b, 2020c). In the case of COVID-19, it was necessary to show that the virus was impossible to arrest or avold because it was too strong. But, what did that mean in practice? It was certainly possible, even likely, that employees of Eskom would be affected by the virus, and some might even die. Did this mean that it was impossible for Eskom to continue operations at Medupi Power Station? The more likely scenario, because of the virus, was that Eskom was unable to sell power and therefore did not require coal. "Impossible" was a strong word. Risk prevention There were marry levels at which the risks related to COVID-19 could have been prevented. At a global level, the World Health Organisation has operational strategies to prevent and control epidemic-prone diseases (World Health Organisation, 2020), and in addition, most countries have government departments doing the same. Furthemore, financial markets play a key role in risk prevention. For example, airlines typically hedge fuel costs[1], either by locking into future price contracts ("forwards") or by using (more expensive) options to limit their upside costs. The recent collapse of the ol price had impacted airlines differently, depending on their method and extent of hedging (Asquith, 2020). While airlines cannot fly, there is of course a natural fuel hedge - they are not buying fuel [...] In the same way, Eskom (or Exaro) could have hedged the coal-price risk in financial markets. However, Eskom's force majeure claim was an altempt to use a natural coaldernand hedge. Eskom had reduced capacity at Medupi because it was unable to sell electricity, but for Exxaro, this had reduced revenues accordingly, but not costs, as these were largely fixed. A take or pay" provision in the contract would have mitigated this risk for Exxaro, and forced Eskom to elther take an agreed minimum supply of coal, or pay not to. The issue It was clear that force majeure favoured Eskom at Exxaro's expense. Exxaro's Grootegeluk mine had lost its source of revenue, but still needed to incur maintenance costs to protect the mine and pay wages or retrench staff. However, several questions were evident: Is Eskom using force majeure to mask their own mismanagement, re-focus on pressing maintenance issues or cut costs? As Eskom is still producing power, was the force majeure even valid? Should Exxaro extend the force majeure to their own suppliers? If taken to conclusion, how would such actions impact the entire economy? - decline of key natural resources and an emerging global resource crisis, especially in water; - collapse of ecosystems that support life, and the mass extinction of species; - human population growth and dernand, beyond the Earth's carrying capacity; - global waming, sea level rise and changes in the Earth's climate affecting all human activity; - universal pollution of the Earth system and all Ife by chemicals; - rising food insecurity and failing nutritional quality; Keywords: Disaster riskmanagement failure, - nuclear ams and other weapons of mass; Insurance, Hedging - pandemics of new and untreatable disease; - advent of powerful, uncontrolled new technologies; and - national and global failure to understand and act preventively on these risks. Note 1. Fuel costs represent about 25% of costs for airlines. References Asquth, J. (2020), "The oil price collapse will do very little to help strugg ling airlines",. Forbes, 10 March, Retrieved from: ww. forbes. com/sites/jemesasquift/20zap3/10/the-oil-price-collapse-will-do-very-littleto-help-strugging-airlines-suffer ing-from-a-corongvirus-demand-stumplit 120038216 a a 3 Cambridge Dictionary (2020)), External, Cambridge Dictionary, 20 April, retrieved froms https:/l dictionary. cambridge.org/dictionaryleng lish/externa?q=External Cambridge Dictionary, (2020b), Irresisfblele, Cambridge Dicfionary, 20 April retrieved from https:/l dictionary. cambridge.org/dictionary/eng lish/irresistible Cambridge Dictionary, (2020c), Unforeseesble, Cambridge Dictionary, 20 April, Retrieved from: https: /f dicfionary. cambridge.org/dictionarylenglish/unforeseseable Eskom's COVID-19 force majeure Michael Ward Eskom - South Africa's pariah Following SA's 1994 democratic election, Eskom, with generating capacity of 33,000MW, embarked on a massive electrification scheme in townships and rural areas, connecting more than 300,000 households each year and forcing down the price of electricity. In its 1995 annual report John Maree, chairperson of the board, noted that Eskom was "admired internationally" and a "pillar" of economic growth (Eskom Communications, 1995). In 2001 at the Global Energy awards ceremony in New York, Eskom was named the "Financial Times Power Company of the Year". It was described as "providing the world's lowest-cost electricity", using "superior technology", "increasing transmission rellably" and using "efficient and safe methods for combustion of low-grade coal" (Tdit, 2019). In the 25 years that followed, bad management and corr uption had reduced the company to pariah status. Eskom, with capacity of over 45,000MW, could only generate 27,000MW and had, once again, reverted to "rolling blackouts". In 2019 , Pravin Gordhan, Minister of Public Enterprises, observed that Eskom was suffering from "systernic corruption, malfeasance, fraud and state capture" that had "compromised the credibility of the organisation and eroded ifvestor confidence:. Figure 1 summarises the most recent decade of mismanagement. On 26 March 2020, President Pamaposa declared COVID-19 a national disaster and implemented stringent "lockdown" rules across South Africa. A month later Eskom reported that it was expecting to "bleed up to R2.5bn a month in revenue because of reduced electricity demand" (Khumalo, 2020). Shortly after this, Eskom sent precautionary force majeure notices to its coal suppliers (Cronje, 2020). Devainer. This caseis wrthen 2020 , the virus had infected around 4m people worldwide, causing more than 200,000 deaths, and had been declared a global pandemic in March 2020 by the World Health Organisation (Coronavirus disease 2019, 2020). The still unfolding economic impact of COVID-19 on the world's economy had been catastrophic as revealed by the following economic indicators. In the fastest selloff ever, the value of global equities had dropped by more than 30% towards the end of March as investors moved to less risky assets ( Li, 2020). Irvestor portfolio flows from ernerging markets amounted to $100 bn for the COVID-19 crisis, versus the $25 bn lost in the 2008 global financial crisis (Vogel, 2020). Government spending after COVID-19 as a percentage of GDP ( to date) was at 35%, the largest and fastest in peacetime for more than a century (Wigglesworth, 2020). Force majeure Force majeure constitutes a usual and acceptable clause in most commercial contracts, protecting all parties from the consequences of unforeseen catastrophic events, including wars and natural disasters (Hargrave, 2020). Under French law (generally accepted as the origin of the concept), three criteria are necessary to claim force majeure - the event must be unforeseeable, extemal and ifresistible. Unforeseeable - an unforeseeable event or situation is one that cannot be known about or guessed before it happens (Cambridge Dictionary, 2020a, 2020b, 2020c). Several questions arise from this definition. Are 100-year floods unforeseeable? Can glaciermelt and rising sea levels be known about? Could COVID-19 have been guessed? Jullan Cribb, in his 2017 book "Surviving the 21st Century", highlighted the ten greatest. challenges facing the survival of humanity (Cribb, 2017). The list, in no particular order, includes the likelihood of "pandemics of new and untreatable diseases" (Figure 2). Bill Gates, quoting the example of Ebola in his 2015 TED talk (Gates, 2015), raised awareness to the fact that the world is not ready for the next epidemic. Figure 2 List of ten catastrophic risks (unranked), Surviving and Thriving in the Twenty first Cantury, CribbJ. 2017, Springer Nassim Taleb, in his 2007 book "The Black Swan" (Taleb, 2008), states (p. 317): As we travel more on this plenet, epidemics will be more acute - we will have a germ population dominated by a few numbers, and the successful killer will spread vastly more effectively. [] I see risks of a very stange acute virus spreading fhroughout the planet. Because of the vagueness of the definition of "unforeseeable", mary jurisdictions, including South Africa, required the force majeure clause to be detailed and to specifically list the events agreed by parties (such as a pandemic) (Kahle and Wilson, 2020). Extemal - of, on, for or coming from the outside. (Cambridge Dictionary, 2020a, 2020b, 2020c) It was difficult to argue that COVID-19 was not extemal. Neither party had any incentive to manufacture a coronavirus! Iresistible-impossible to refuse, oppose or avoid because it is too pleasant, attractive of strong (Cambridge Dictionary, 2020a, 2020b, 2020c). In the case of COVID-19, it was necessary to show that the virus was impossible to arrest or avold because it was too strong. But, what did that mean in practice? It was certainly possible, even likely, that employees of Eskom would be affected by the virus, and some might even die. Did this mean that it was impossible for Eskom to continue operations at Medupi Power Station? The more likely scenario, because of the virus, was that Eskom was unable to sell power and therefore did not require coal. "Impossible" was a strong word. Risk prevention There were marry levels at which the risks related to COVID-19 could have been prevented. At a global level, the World Health Organisation has operational strategies to prevent and control epidemic-prone diseases (World Health Organisation, 2020), and in addition, most countries have government departments doing the same. Furthemore, financial markets play a key role in risk prevention. For example, airlines typically hedge fuel costs[1], either by locking into future price contracts ("forwards") or by using (more expensive) options to limit their upside costs. The recent collapse of the ol price had impacted airlines differently, depending on their method and extent of hedging (Asquith, 2020). While airlines cannot fly, there is of course a natural fuel hedge - they are not buying fuel [...] In the same way, Eskom (or Exaro) could have hedged the coal-price risk in financial markets. However, Eskom's force majeure claim was an altempt to use a natural coaldernand hedge. Eskom had reduced capacity at Medupi because it was unable to sell electricity, but for Exxaro, this had reduced revenues accordingly, but not costs, as these were largely fixed. A take or pay" provision in the contract would have mitigated this risk for Exxaro, and forced Eskom to elther take an agreed minimum supply of coal, or pay not to. The issue It was clear that force majeure favoured Eskom at Exxaro's expense. Exxaro's Grootegeluk mine had lost its source of revenue, but still needed to incur maintenance costs to protect the mine and pay wages or retrench staff. However, several questions were evident: Is Eskom using force majeure to mask their own mismanagement, re-focus on pressing maintenance issues or cut costs? As Eskom is still producing power, was the force majeure even valid? Should Exxaro extend the force majeure to their own suppliers? If taken to conclusion, how would such actions impact the entire economy? - decline of key natural resources and an emerging global resource crisis, especially in water; - collapse of ecosystems that support life, and the mass extinction of species; - human population growth and dernand, beyond the Earth's carrying capacity; - global waming, sea level rise and changes in the Earth's climate affecting all human activity; - universal pollution of the Earth system and all Ife by chemicals; - rising food insecurity and failing nutritional quality; Keywords: Disaster riskmanagement failure, - nuclear ams and other weapons of mass; Insurance, Hedging - pandemics of new and untreatable disease; - advent of powerful, uncontrolled new technologies; and - national and global failure to understand and act preventively on these risks. Note 1. Fuel costs represent about 25% of costs for airlines. References Asquth, J. (2020), "The oil price collapse will do very little to help strugg ling airlines",. Forbes, 10 March, Retrieved from: ww. forbes. com/sites/jemesasquift/20zap3/10/the-oil-price-collapse-will-do-very-littleto-help-strugging-airlines-suffer ing-from-a-corongvirus-demand-stumplit 120038216 a a 3 Cambridge Dictionary (2020)), External, Cambridge Dictionary, 20 April, retrieved froms https:/l dictionary. cambridge.org/dictionaryleng lish/externa?q=External Cambridge Dictionary, (2020b), Irresisfblele, Cambridge Dicfionary, 20 April retrieved from https:/l dictionary. cambridge.org/dictionary/eng lish/irresistible Cambridge Dictionary, (2020c), Unforeseesble, Cambridge Dictionary, 20 April, Retrieved from: https: /f dicfionary. cambridge.org/dictionarylenglish/unforeseseableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started