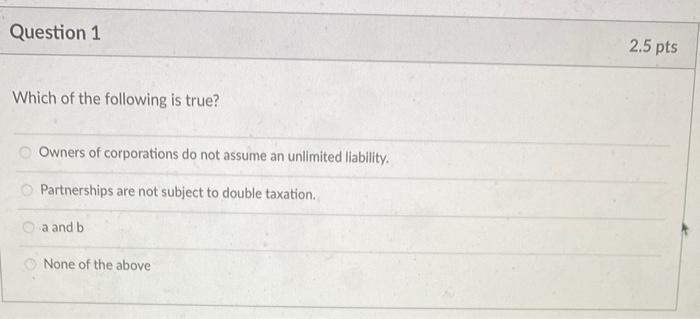

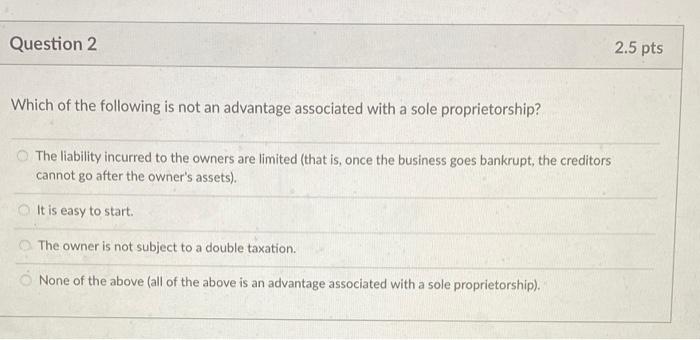

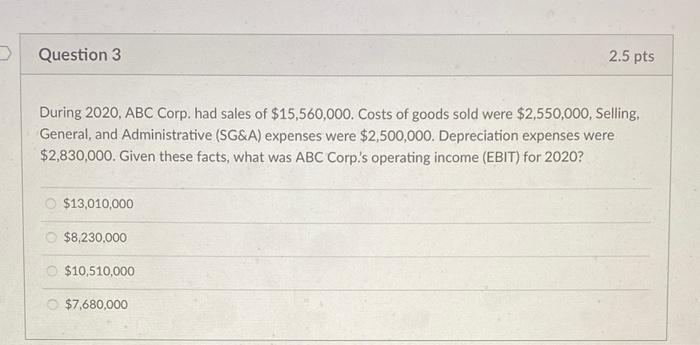

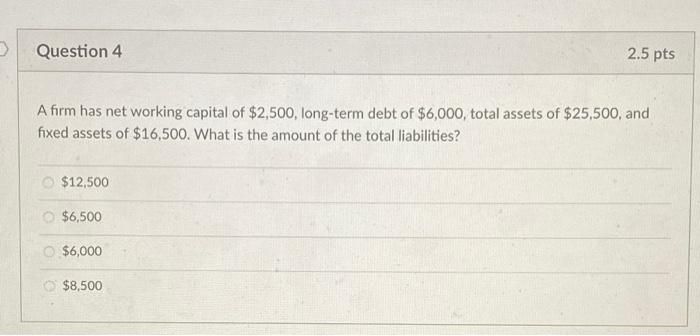

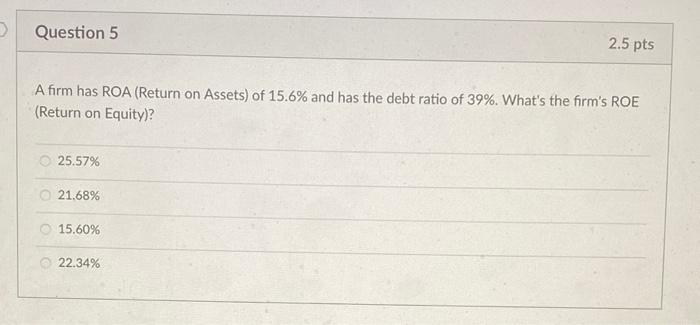

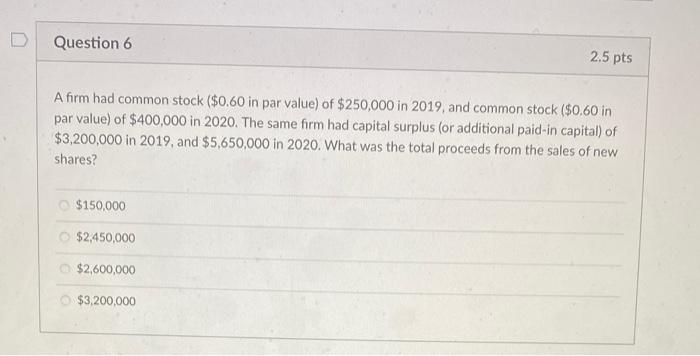

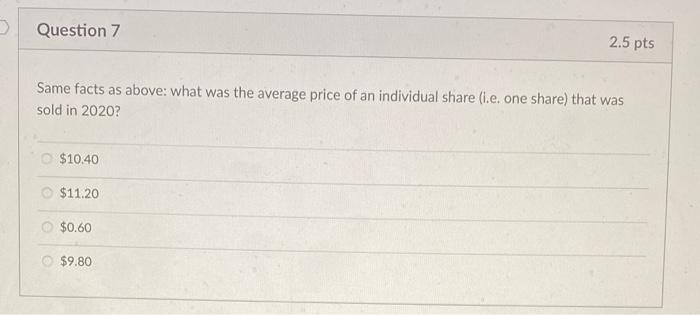

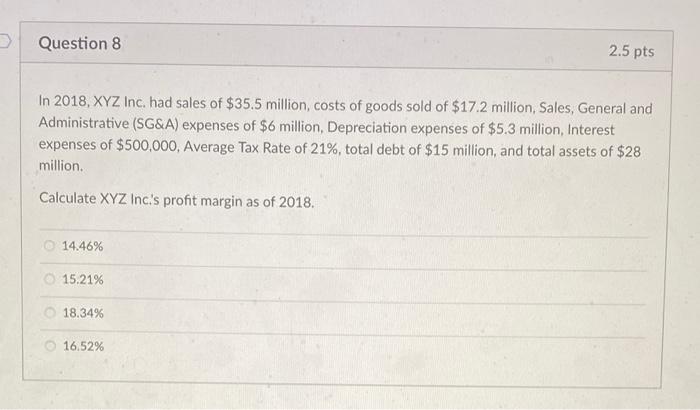

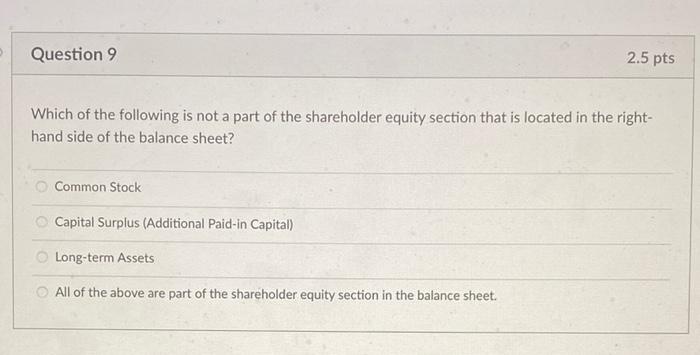

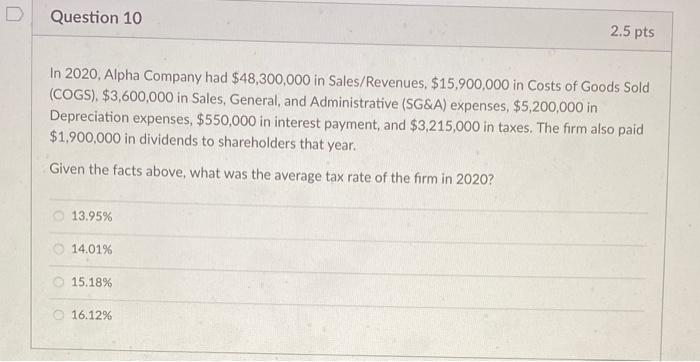

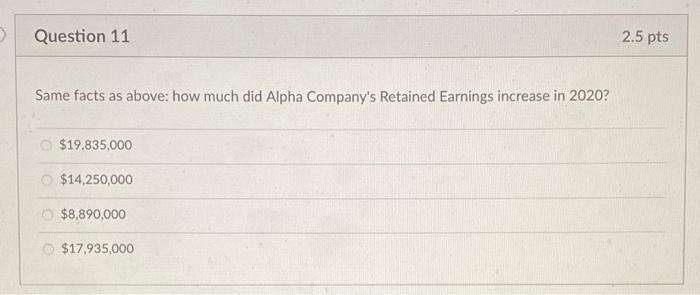

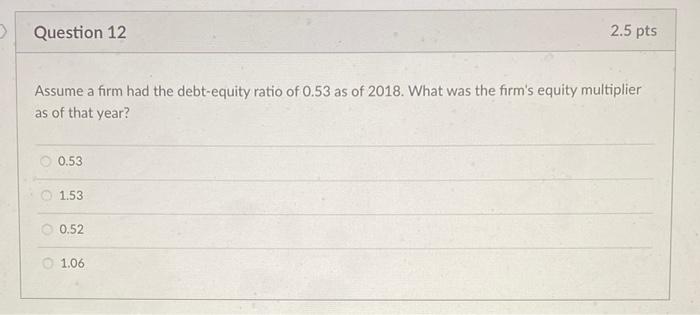

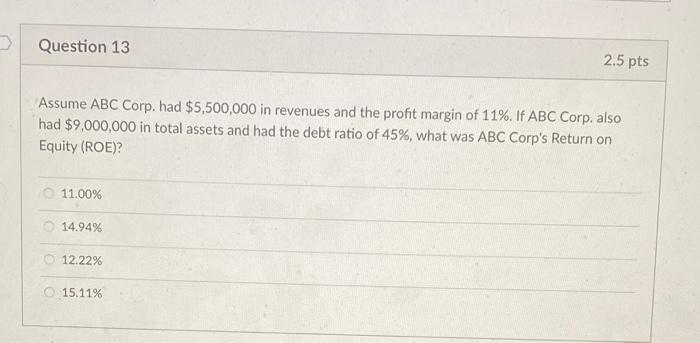

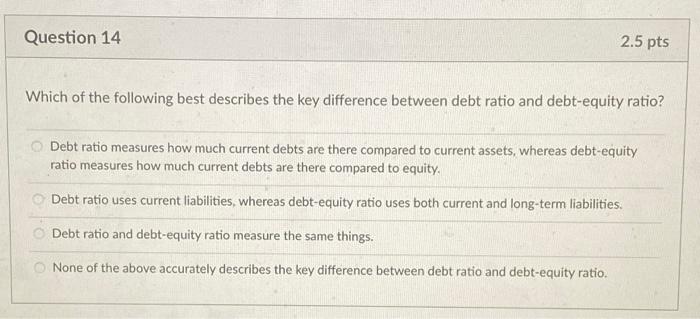

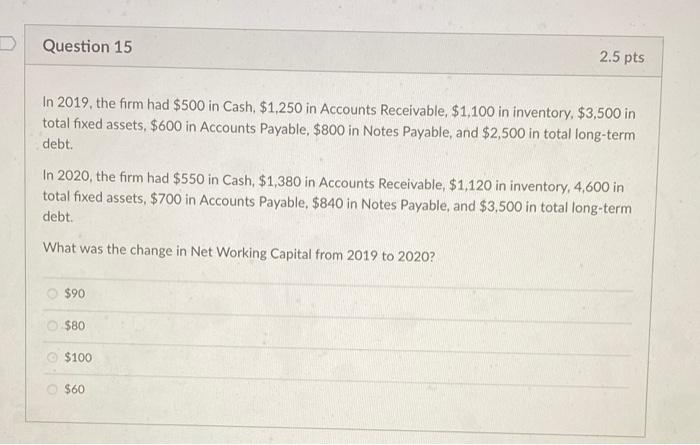

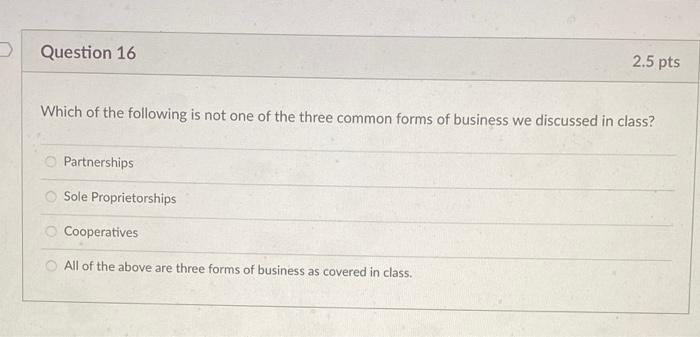

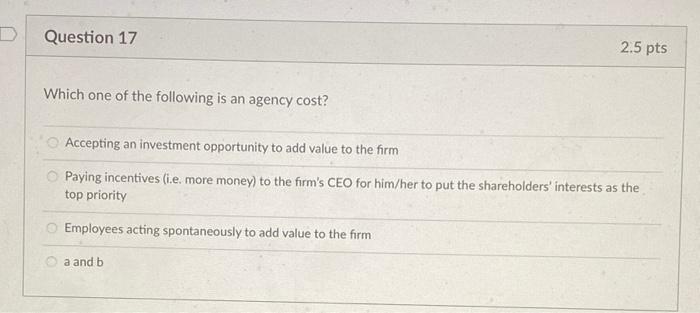

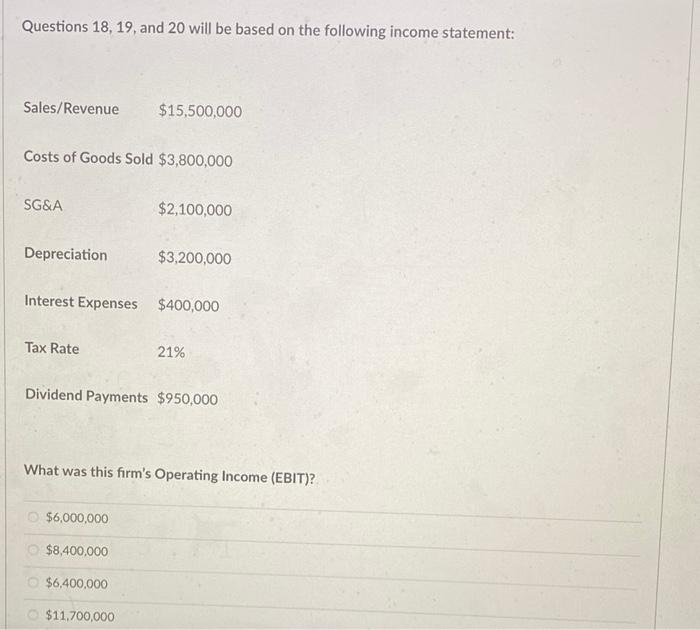

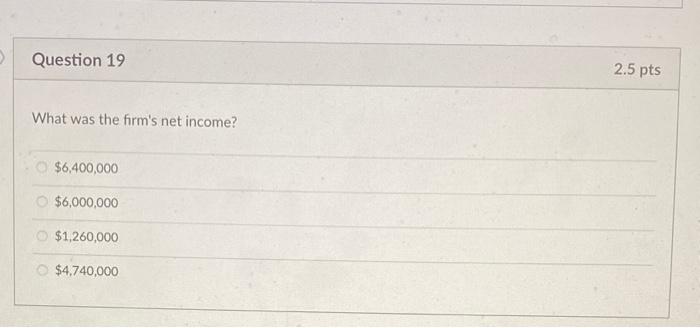

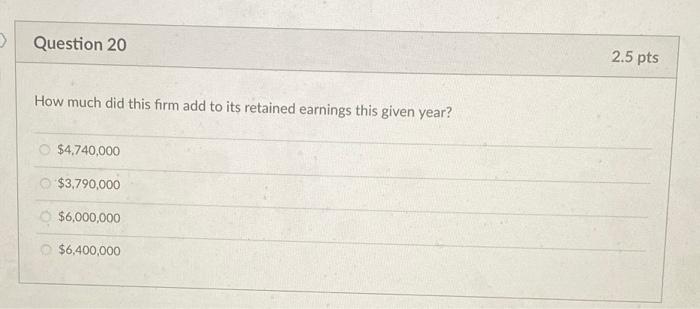

Question 1 2.5 pts Which of the following is true? Owners of corporations do not assume an unlimited liability. Partnerships are not subject to double taxation a and b None of the above Question 2 2.5 pts Which of the following is not an advantage associated with a sole proprietorship? The liability incurred to the owners are limited (that is, once the business goes bankrupt, the creditors cannot go after the owner's assets). It is easy to start The owner is not subject to a double taxation. None of the above (all of the above is an advantage associated with a sole proprietorship). Question 3 2.5 pts During 2020, ABC Corp. had sales of $15,560,000. Costs of goods sold were $2,550,000, Selling, General, and Administrative (SG&A) expenses were $2,500,000. Depreciation expenses were $2,830,000. Given these facts, what was ABC Corp.s operating income (EBIT) for 2020? $13,010,000 $8,230,000 $10,510,000 $7,680,000 Question 4 2.5 pts A firm has net working capital of $2,500, long-term debt of $6,000, total assets of $25,500, and fixed assets of $16,500. What is the amount of the total liabilities? $12,500 $6,500 $6,000 $8,500 Question 5 2.5 pts A firm has ROA (Return on Assets) of 15.6% and has the debt ratio of 39%. What's the firm's ROE (Return on Equity)? 25.57% 21.68% 15.60% 22.34% D Question 6 2.5 pts A firm had common stock ($0.60 in par value) of $250,000 in 2019, and common stock ($0.60 in par value) of $400,000 in 2020. The same firm had capital surplus (or additional paid-in capital) of $3,200,000 in 2019, and $5,650,000 in 2020. What was the total proceeds from the sales of new shares? $150,000 $2,450,000 $2,600,000 $3,200,000 Question 7 2.5 pts Same facts as above: what was the average price of an individual share (i.e. one share) that was sold in 2020? $10.40 $11.20 $0.60 $9.80 Question 8 2.5 pts In 2018, XYZ Inc. had sales of $35.5 million, costs of goods sold of $17.2 million, Sales, General and Administrative (SG&A) expenses of $6 million, Depreciation expenses of $5.3 million, Interest expenses of $500,000, Average Tax Rate of 21%, total debt of $15 million, and total assets of $28 million. Calculate XYZ Inc's profit margin as of 2018. 14.46% 15.21% 18.34% 16.52% Question 9 2.5 pts Which of the following is not a part of the shareholder equity section that is located in the right- hand side of the balance sheet? Common Stock Capital Surplus (Additional Paid-in Capital) Long-term Assets All of the above are part of the shareholder equity section in the balance sheet. D Question 10 2.5 pts In 2020, Alpha Company had $48,300,000 in Sales/Revenues, $15.900,000 in Costs of Goods Sold (COGS), $3,600,000 in Sales, General, and Administrative (SG&A) expenses, $5,200,000 in Depreciation expenses, $550,000 in interest payment, and $3,215,000 in taxes. The firm also paid $1,900,000 in dividends to shareholders that year. Given the facts above, what was the average tax rate of the firm in 2020? 13.95% 14.01% 15.18% 16.12% Question 11 2.5 pts Same facts as above: how much did Alpha Company's Retained Earnings increase in 2020? $19,835,000 $14,250,000 $8,890,000 $17,935,000 Question 12 2.5 pts Assume a firm had the debt-equity ratio of 0.53 as of 2018. What was the firm's equity multiplier as of that year? 0.53 1.53 0.52 1.06 Question 13 2.5 pts Assume ABC Corp. had $5,500,000 in revenues and the profit margin of 11%. If ABC Corp. also had $9,000,000 in total assets and had the debt ratio of 45%, what was ABC Corp's Return on Equity (ROE)? 11.0096 14.94% 12.22% 15.11% Question 14 2.5 pts Which of the following best describes the key difference between debt ratio and debt-equity ratio? Debt ratio measures how much current debts are there compared to current assets, whereas debt-equity ratio measures how much current debts are there compared to equity Debt ratio uses current liabilities, whereas debt-equity ratio uses both current and long-term liabilities. Debt ratio and debt-equity ratio measure the same things. None of the above accurately describes the key difference between debt ratio and debt-equity ratio. D Question 15 2.5 pts In 2019. the firm had $500 in Cash $1,250 in Accounts Receivable, $1,100 in inventory, $3,500 in total fixed assets, $600 in Accounts Payable, $800 in Notes Payable, and $2,500 in total long-term debt. In 2020, the firm had $550 in Cash, $1,380 in Accounts Receivable, $1,120 in inventory, 4,600 in total fixed assets, $700 in Accounts Payable, $840 in Notes Payable, and $3,500 in total long-term debt What was the change in Net Working Capital from 2019 to 2020? $90 $80 $100 $60 Question 16 2.5 pts Which of the following is not one of the three common forms of business we discussed in class? Partnerships Sole Proprietorships Cooperatives All of the above are three forms of business as covered in class. D Question 17 2.5 pts Which one of the following is an agency cost? Accepting an investment opportunity to add value to the form Paying incentives (i.e. more money) to the firm's CEO for him/her to put the shareholders' interests as the top priority Employees acting spontaneously to add value to the form a and b Questions 18, 19, and 20 will be based on the following income statement: Sales/Revenue $15,500,000 Costs of Goods Sold $3,800,000 SG&A $2,100,000 Depreciation $3,200,000 Interest Expenses $400,000 Tax Rate 21% Dividend Payments $950,000 What was this firm's Operating Income (EBIT)? $6,000,000 $8,400,000 $6,400,000 $11.700,000 Question 19 2.5 pts What was the firm's net income? $6,400,000 $6,000,000 $1,260,000 $4,740,000 Question 20 2.5 pts How much did this form add to its retained earnings this given year? $4,740,000 $3,790,000 $6,000,000 $6,400,000