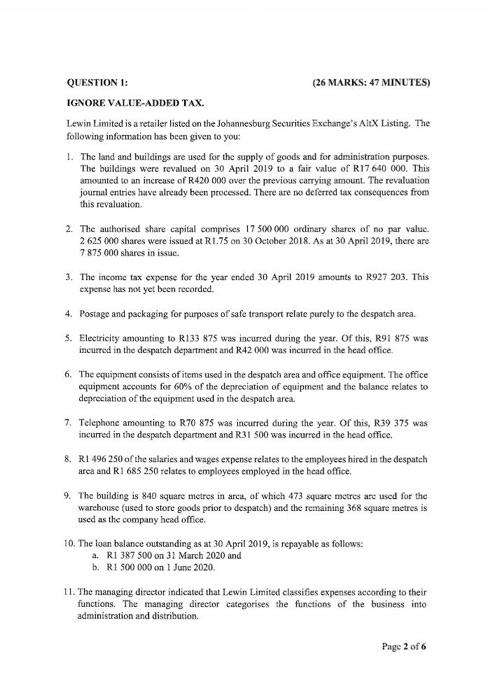

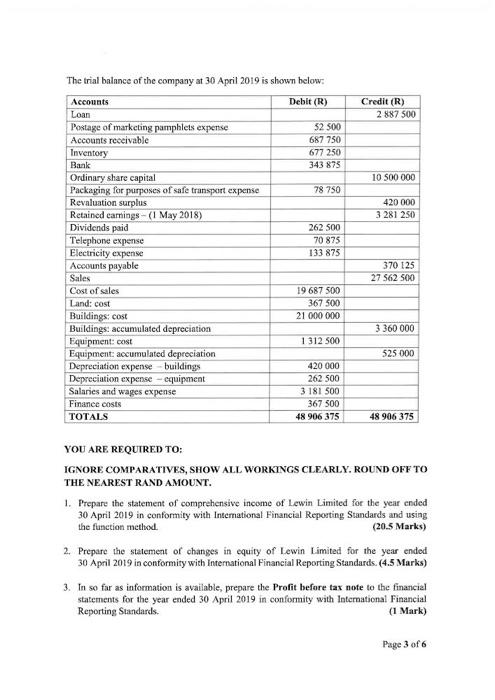

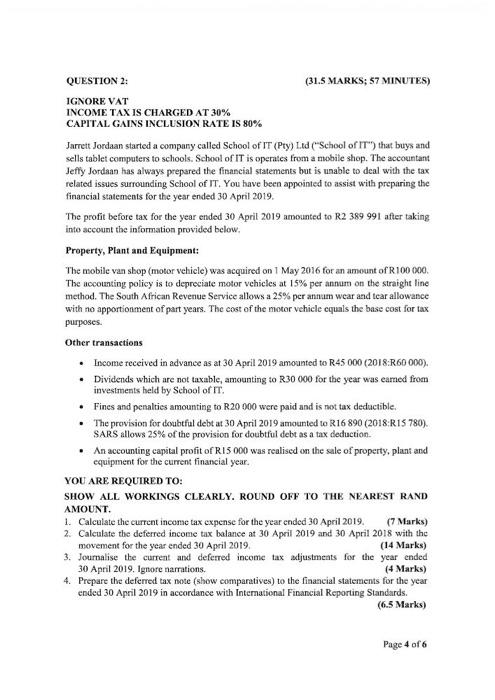

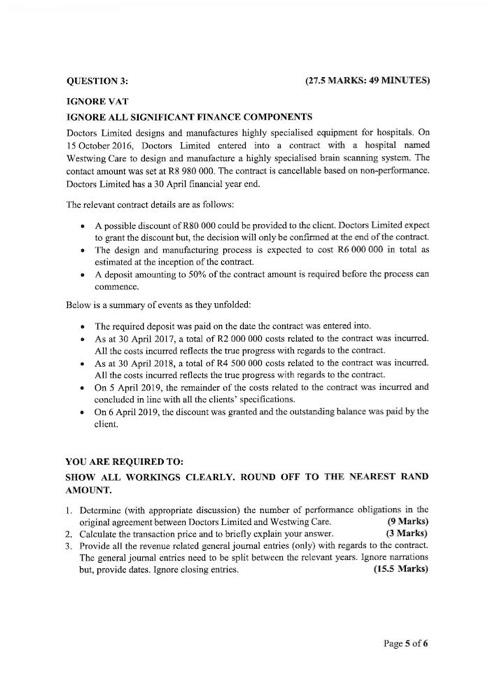

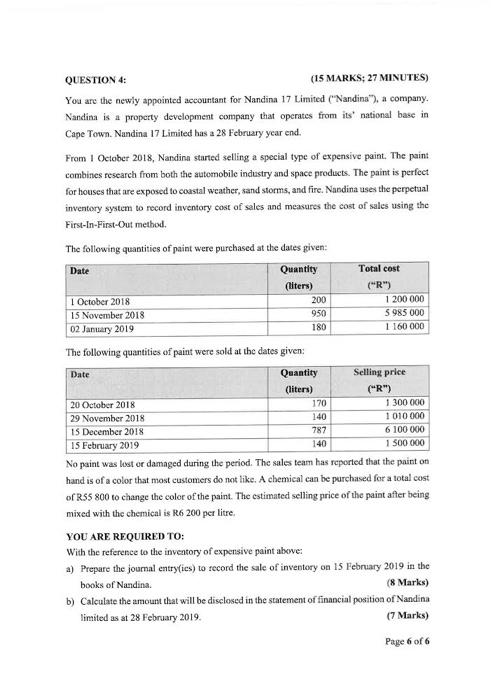

QUESTION 1: (26 MARKS: 47 MINUTES) IGNORE VALUE-ADDED TAX. Lewin Limited is a retailer listed on the Johannesburg Securities Exchange's AitX Listing. The following information has been given to you: 1. The land and buildings are used for the supply of goods and for administration purposes. The buildings were revalued on 30 April 2019 to a fair value of R17 640000 . This amounted to an increase of R420000 over the previous carrying amount. The revaluation journal entries have already been processed. There are no deferred tax consequences from this revaluation. 2. The authorised share capital comprises 17500000 ordinary shares of no par value. 2625000 shares were issued at R1.75 on 30 October 2018 . As at 30 April 2019 , there are 7875000 shares in issac. 3. The income tax expense for the year ended 30 April 2019 amounts to R927 203. This expense has not yet been recorded. 4. Postage and packaging for purposes of safe transport relate purely to the despatch area. 5. Electricity amounting to R133 875 was incurred during the year. Of this, R91 875 was incurred in the despatch department and R42000 was incurred in the head office. 6. The equipment consists of items used in the despatch area and office equipment. The oftice equipment accounts for 60% of the depreciation of equipment and the balance relates to depreciation of the equipment used in the despatch area. 7. Telephone amounting to R70 875 was incurred during the year. Of this, R39 375 was incurred in the despatch department and R31 500 was incurred in the head office. 8. R1 496250 of the salaries and wages expense relates to the employees hired in the despatch area and R1 685250 relates to employees employed in the bead office. 9. The building is 840 square metres in arca, of which 473 square metres are used for the warehouse (used to store goods prior to despatch) and the remaining 368 square metres is used as the company head office. 10. The loan bolance outstanding as at 30 April 2019 , is repayable as follows: a. R1 387500 on 31 March 2020 and b. R1 500000 on 1 June 2020 . 11. The managing director indicated that Lewin Limited classifies expenses according to their functions. The managing direetor categorises the functions of the business into administration and distribution. Page 2 of 6 The trial balnnee of the company at 30 April 2019 is shown below: YOU ARE REQUTRED TO: IGNORE COMPARATIVES, SHOW ALL WORKTNGS CLEARLY. ROUND OFF TO THE NEAREST RAND AMOUNT. 1. Prepare the statement of comprehensive income of Lewin Limited for the year ended 30 April 2019 in conformity with Intemational Financial Reporting Standards and using the function method. (20.5 Marks) 2. Prepare the statement of changes in equity of Lewin Limited for the year ended 30 April 2019 in conformity with International Financial Reporting Standards. (4.5 Marks) 3. In so far as information is available, prepare the Profit before tax note to the financial statements for the year ended 30 April 2019 in conformity with loternational Financial Reporting Standards. (1 Mark) Page 3 of 6 QUESTION 2: (31.5 MARKS; 57 MINUTES) IGNORE VAT INCOME TAX IS CHARGED AT 30% CAPITAL GAINS INCLUSION RATE IS 80% Jarrett Jordaan started a company called School of IT (Pty) Ltd (-School of T\%) that buys and sells tablet computers to schools. School of IT is operates from a mobile shop. The accountant Jeffy Jordaan has always prepared the financial statements but is unable to deal with the tax related issues surrounding School of IT. You have been appointed to assist with preparing the financial statements for the year ended 30 April 2019. The profit before tax for the year ended 30 April 2019 amounted to R2 389991 after taking into account the information provided below. Property, Plant and Equipment: The mobile van sbop (motor vehicle) was acquired on I May 2016 for an amount of 100000. The accounting policy is to depreciate motor vehicles at 15% per annum on the straight line method. The South African Revenue Service allows a 25\% per annam wear and tear allowance with no apportionment of part years. The cost of the motor vehicle equals the base cost for tax purposes. Other transactions - Income received in advance as at 30 April 2019 amounted to R45 000 (2018:R60 000). - Dividends which are not taxable, amounting to R30000 for the year was eamed from investments beld by School of T. - Fines and penalties amounting to R20 000 were paid and is not tax deductible. - The provision for doubtful debt at 30 April 2019 amounted to R16 890 (2018:R15 780). SARS allows 25% of the provision for doubtful debt as a tax deduction. - An accounting captal profit of R 15000 was realised on the sale of property, plant and equipment for the current financial year. YOU ARE REQUIRED TO: SHOW ALL WORKINGS CLEARLY. ROUND OFF TO THE NEAREST RAND AMOUNT. 1. Calculate the current inconse tax expense for the year ended 30 April 2019. (7 Marks) 2. Calculate the deferred income tax balance at 30 April 2019 and 30 April 2018 with the movement for the year ended 30 April 2019. (14 Marks) 3. Journalise the current and deferred income tax adjustmeats for the year ended 30 April 2019. Ignore narrations. (4 Marks) 4. Prepare the deferred tax note (show comparatives) to the financial statements for the year ended 30 April 2019 in accordance with Intemational Financial Reporting Standards. (6.5 Marks) Page 4 of 6 QUESTION 3: (27.5 MARKS: 49 MINUTES) IGNORE VAT IGNORE ALL SIGNIFICANT FINANCE COMPONENTS Doctors Limited designs and manufactures highly specialised equipment for hospitals, On 15 October 2016, Doctors Limited entered into a contract with a hospital named Westwing Care to design and mamufacture a highly specialised brain scanning system. The contact amount was set at R8 980000 . The contraet is cancellable based on non-performanee. Dectors Limited has a 30April financial year end. The relevant contract details are as follows: - A possible discount of R 80000 could be provided to the clicnt. Doctors Limited expect to grant the discount but, the decision will only be confirmed at the end of the contract. - The design and manufacturing process is expected to cost R6 000000 in total as estimated at the inception of the coatract. - A deposit amounting to 50% of the contract amount is required before the process can commence. Below is a summary of events as they unfolded: - The required deposit was paid on the date the contract was entered into. - As at 30 April 2017 , a total of R2000 000 costs related to the contract was incurred. All the costs incurred reflects the true progress with regards to the contract. - As at 30 April 2018, a total of R4 500000 costs related to the contract was incurred. All the costs incurred reflects the true progress with regards to the contract. - On 5 April 2019, the remainder of the costs related to the contract was incurred and concluded in line with all the elients' specifications. - On 6 April 2019, the discount was granted and the outstanding balance was paid by the client. YOU ARE REQUIRED TO: SHOW ALL WORKINGS CLEARLY. ROUND OFF TO THE NEAREST RAND AMOUNT. 1. Determine (with appropriate discussion) the number of performance obligations in the original agreement between Doctors Limited and Westwing Care. (9 Marks) 2. Calculate the transaction price and to briefly explain your answer. (3 Marks) 3. Provide all the revenue related general journal entries (only) with regards to the contract The general joumal entries need to be split between the relevant years. Ignore narrations but, provide dates. Ignore closing entries. (15.5 Marks) QUESTION 4: (15 MARKS; 27 MINUTES) You are the newly appointed accountant for Nandina 17 Limited ("Nandina"), a company. Nandina is a property development company that operates from its' national base in Cape Town. Nandina 17 Limited has a 28 February year end. From I Oetober 2018, Nandinn started selling a special type of expensive paint. The paint combines research from both the automobile industry and space products. The paint is perfect for houses that are exposed to coustal weather, sand storms, and fire. Nandina uses the perpetaal inventory system to record inventory cost of sales and measures the cost of sales using the First-In-First-Out method. The following quantitics of paint were purchased at the dates given: The following quantities of paint were sold at the dates given: No naint was lost or damaged during the period. The sales team has reported that the paint on hand is of a color that most customers do not like. A chemical can be parchased for a total cost of R55 800 to change the color of the paint. The estimated selling price of the paint after being mixed with the chemical is R6 200 per litre. YOU ARE REQUIRED TO: With the referenee to the inveatory of expensive paint above: a) Prepare the journal entry(ies) to fecord the sale of inventory on 15 February 2019 in the books of Nandina. (8 Marks) b) Calculate the amount that will be disclosed in the statement of financial positioa of Nandina limted as at 28 February 2019. (7 Marks) QUESTION 1: (26 MARKS: 47 MINUTES) IGNORE VALUE-ADDED TAX. Lewin Limited is a retailer listed on the Johannesburg Securities Exchange's AitX Listing. The following information has been given to you: 1. The land and buildings are used for the supply of goods and for administration purposes. The buildings were revalued on 30 April 2019 to a fair value of R17 640000 . This amounted to an increase of R420000 over the previous carrying amount. The revaluation journal entries have already been processed. There are no deferred tax consequences from this revaluation. 2. The authorised share capital comprises 17500000 ordinary shares of no par value. 2625000 shares were issued at R1.75 on 30 October 2018 . As at 30 April 2019 , there are 7875000 shares in issac. 3. The income tax expense for the year ended 30 April 2019 amounts to R927 203. This expense has not yet been recorded. 4. Postage and packaging for purposes of safe transport relate purely to the despatch area. 5. Electricity amounting to R133 875 was incurred during the year. Of this, R91 875 was incurred in the despatch department and R42000 was incurred in the head office. 6. The equipment consists of items used in the despatch area and office equipment. The oftice equipment accounts for 60% of the depreciation of equipment and the balance relates to depreciation of the equipment used in the despatch area. 7. Telephone amounting to R70 875 was incurred during the year. Of this, R39 375 was incurred in the despatch department and R31 500 was incurred in the head office. 8. R1 496250 of the salaries and wages expense relates to the employees hired in the despatch area and R1 685250 relates to employees employed in the bead office. 9. The building is 840 square metres in arca, of which 473 square metres are used for the warehouse (used to store goods prior to despatch) and the remaining 368 square metres is used as the company head office. 10. The loan bolance outstanding as at 30 April 2019 , is repayable as follows: a. R1 387500 on 31 March 2020 and b. R1 500000 on 1 June 2020 . 11. The managing director indicated that Lewin Limited classifies expenses according to their functions. The managing direetor categorises the functions of the business into administration and distribution. Page 2 of 6 The trial balnnee of the company at 30 April 2019 is shown below: YOU ARE REQUTRED TO: IGNORE COMPARATIVES, SHOW ALL WORKTNGS CLEARLY. ROUND OFF TO THE NEAREST RAND AMOUNT. 1. Prepare the statement of comprehensive income of Lewin Limited for the year ended 30 April 2019 in conformity with Intemational Financial Reporting Standards and using the function method. (20.5 Marks) 2. Prepare the statement of changes in equity of Lewin Limited for the year ended 30 April 2019 in conformity with International Financial Reporting Standards. (4.5 Marks) 3. In so far as information is available, prepare the Profit before tax note to the financial statements for the year ended 30 April 2019 in conformity with loternational Financial Reporting Standards. (1 Mark) Page 3 of 6 QUESTION 2: (31.5 MARKS; 57 MINUTES) IGNORE VAT INCOME TAX IS CHARGED AT 30% CAPITAL GAINS INCLUSION RATE IS 80% Jarrett Jordaan started a company called School of IT (Pty) Ltd (-School of T\%) that buys and sells tablet computers to schools. School of IT is operates from a mobile shop. The accountant Jeffy Jordaan has always prepared the financial statements but is unable to deal with the tax related issues surrounding School of IT. You have been appointed to assist with preparing the financial statements for the year ended 30 April 2019. The profit before tax for the year ended 30 April 2019 amounted to R2 389991 after taking into account the information provided below. Property, Plant and Equipment: The mobile van sbop (motor vehicle) was acquired on I May 2016 for an amount of 100000. The accounting policy is to depreciate motor vehicles at 15% per annum on the straight line method. The South African Revenue Service allows a 25\% per annam wear and tear allowance with no apportionment of part years. The cost of the motor vehicle equals the base cost for tax purposes. Other transactions - Income received in advance as at 30 April 2019 amounted to R45 000 (2018:R60 000). - Dividends which are not taxable, amounting to R30000 for the year was eamed from investments beld by School of T. - Fines and penalties amounting to R20 000 were paid and is not tax deductible. - The provision for doubtful debt at 30 April 2019 amounted to R16 890 (2018:R15 780). SARS allows 25% of the provision for doubtful debt as a tax deduction. - An accounting captal profit of R 15000 was realised on the sale of property, plant and equipment for the current financial year. YOU ARE REQUIRED TO: SHOW ALL WORKINGS CLEARLY. ROUND OFF TO THE NEAREST RAND AMOUNT. 1. Calculate the current inconse tax expense for the year ended 30 April 2019. (7 Marks) 2. Calculate the deferred income tax balance at 30 April 2019 and 30 April 2018 with the movement for the year ended 30 April 2019. (14 Marks) 3. Journalise the current and deferred income tax adjustmeats for the year ended 30 April 2019. Ignore narrations. (4 Marks) 4. Prepare the deferred tax note (show comparatives) to the financial statements for the year ended 30 April 2019 in accordance with Intemational Financial Reporting Standards. (6.5 Marks) Page 4 of 6 QUESTION 3: (27.5 MARKS: 49 MINUTES) IGNORE VAT IGNORE ALL SIGNIFICANT FINANCE COMPONENTS Doctors Limited designs and manufactures highly specialised equipment for hospitals, On 15 October 2016, Doctors Limited entered into a contract with a hospital named Westwing Care to design and mamufacture a highly specialised brain scanning system. The contact amount was set at R8 980000 . The contraet is cancellable based on non-performanee. Dectors Limited has a 30April financial year end. The relevant contract details are as follows: - A possible discount of R 80000 could be provided to the clicnt. Doctors Limited expect to grant the discount but, the decision will only be confirmed at the end of the contract. - The design and manufacturing process is expected to cost R6 000000 in total as estimated at the inception of the coatract. - A deposit amounting to 50% of the contract amount is required before the process can commence. Below is a summary of events as they unfolded: - The required deposit was paid on the date the contract was entered into. - As at 30 April 2017 , a total of R2000 000 costs related to the contract was incurred. All the costs incurred reflects the true progress with regards to the contract. - As at 30 April 2018, a total of R4 500000 costs related to the contract was incurred. All the costs incurred reflects the true progress with regards to the contract. - On 5 April 2019, the remainder of the costs related to the contract was incurred and concluded in line with all the elients' specifications. - On 6 April 2019, the discount was granted and the outstanding balance was paid by the client. YOU ARE REQUIRED TO: SHOW ALL WORKINGS CLEARLY. ROUND OFF TO THE NEAREST RAND AMOUNT. 1. Determine (with appropriate discussion) the number of performance obligations in the original agreement between Doctors Limited and Westwing Care. (9 Marks) 2. Calculate the transaction price and to briefly explain your answer. (3 Marks) 3. Provide all the revenue related general journal entries (only) with regards to the contract The general joumal entries need to be split between the relevant years. Ignore narrations but, provide dates. Ignore closing entries. (15.5 Marks) QUESTION 4: (15 MARKS; 27 MINUTES) You are the newly appointed accountant for Nandina 17 Limited ("Nandina"), a company. Nandina is a property development company that operates from its' national base in Cape Town. Nandina 17 Limited has a 28 February year end. From I Oetober 2018, Nandinn started selling a special type of expensive paint. The paint combines research from both the automobile industry and space products. The paint is perfect for houses that are exposed to coustal weather, sand storms, and fire. Nandina uses the perpetaal inventory system to record inventory cost of sales and measures the cost of sales using the First-In-First-Out method. The following quantitics of paint were purchased at the dates given: The following quantities of paint were sold at the dates given: No naint was lost or damaged during the period. The sales team has reported that the paint on hand is of a color that most customers do not like. A chemical can be parchased for a total cost of R55 800 to change the color of the paint. The estimated selling price of the paint after being mixed with the chemical is R6 200 per litre. YOU ARE REQUIRED TO: With the referenee to the inveatory of expensive paint above: a) Prepare the journal entry(ies) to fecord the sale of inventory on 15 February 2019 in the books of Nandina. (8 Marks) b) Calculate the amount that will be disclosed in the statement of financial positioa of Nandina limted as at 28 February 2019. (7 Marks)