Answered step by step

Verified Expert Solution

Question

1 Approved Answer

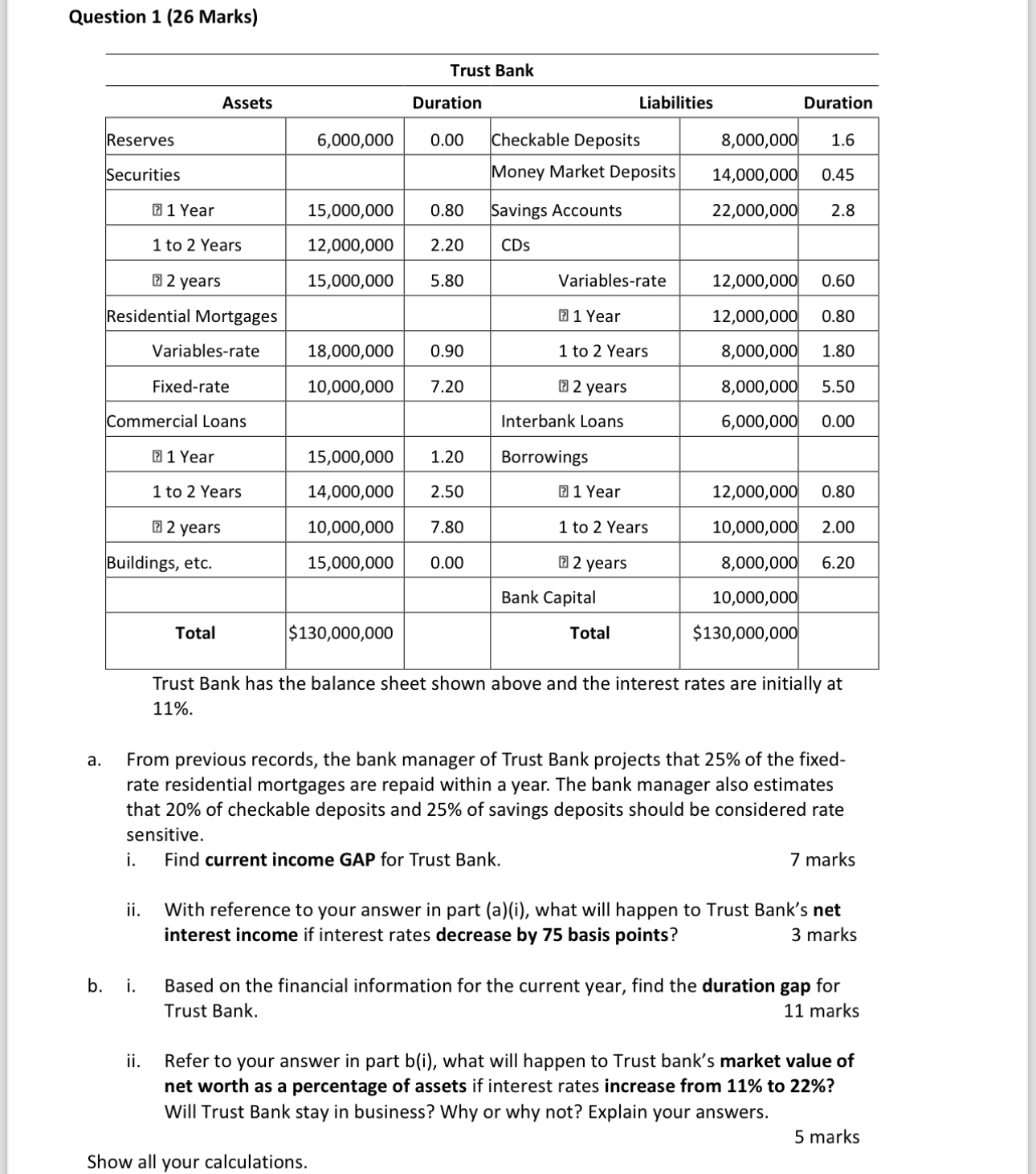

Question 1 (26 Marks) Trust Bank Assets Duration Liabilities Duration Reserves 6,000,000 0.00 Checkable Deposits 8,000,000 1.6 Securities Money Market Deposits 14,000,000 0.45 1

Question 1 (26 Marks) Trust Bank Assets Duration Liabilities Duration Reserves 6,000,000 0.00 Checkable Deposits 8,000,000 1.6 Securities Money Market Deposits 14,000,000 0.45 1 Year 15,000,000 0.80 Savings Accounts 22,000,000 2.8 1 to 2 Years 12,000,000 2.20 CDs 2 years 15,000,000 5.80 Variables-rate 12,000,000 0.60 Residential Mortgages ? 1 Year 12,000,000 0.80 Variables-rate 18,000,000 0.90 1 to 2 Years 8,000,000 1.80 Fixed-rate 10,000,000 7.20 2 years 8,000,000 5.50 Commercial Loans Interbank Loans 6,000,000 0.00 1 Year 1 to 2 Years 2 years Buildings, etc. 15,000,000 14,000,000 2.50 10,000,000 7.80 15,000,000 1.20 Borrowings 1 Year 12,000,000 0.80 1 to 2 Years 10,000,000 2.00 0.00 2 years 8,000,000 6.20 Bank Capital 10,000,000 Total $130,000,000 Total $130,000,000 a. Trust Bank has the balance sheet shown above and the interest rates are initially at 11%. From previous records, the bank manager of Trust Bank projects that 25% of the fixed- rate residential mortgages are repaid within a year. The bank manager also estimates that 20% of checkable deposits and 25% of savings deposits should be considered rate sensitive. i. Find current income GAP for Trust Bank. 7 marks ii. With reference to your answer in part (a)(i), what will happen to Trust Bank's net interest income if interest rates decrease by 75 basis points? 3 marks b. i. Based on the financial information for the current year, find the duration gap for Trust Bank. 11 marks ii. Refer to your answer in part b(i), what will happen to Trust bank's market value of net worth as a percentage of assets if interest rates increase from 11% to 22%? Will Trust Bank stay in business? Why or why not? Explain your answers. Show all your calculations. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current income GAP for Trust Bank we need to determine the ratesensitive assets RSA and ratesensitive liabilities RSL The GAP is the difference between RSA and RSL Ratesensitive asset...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started